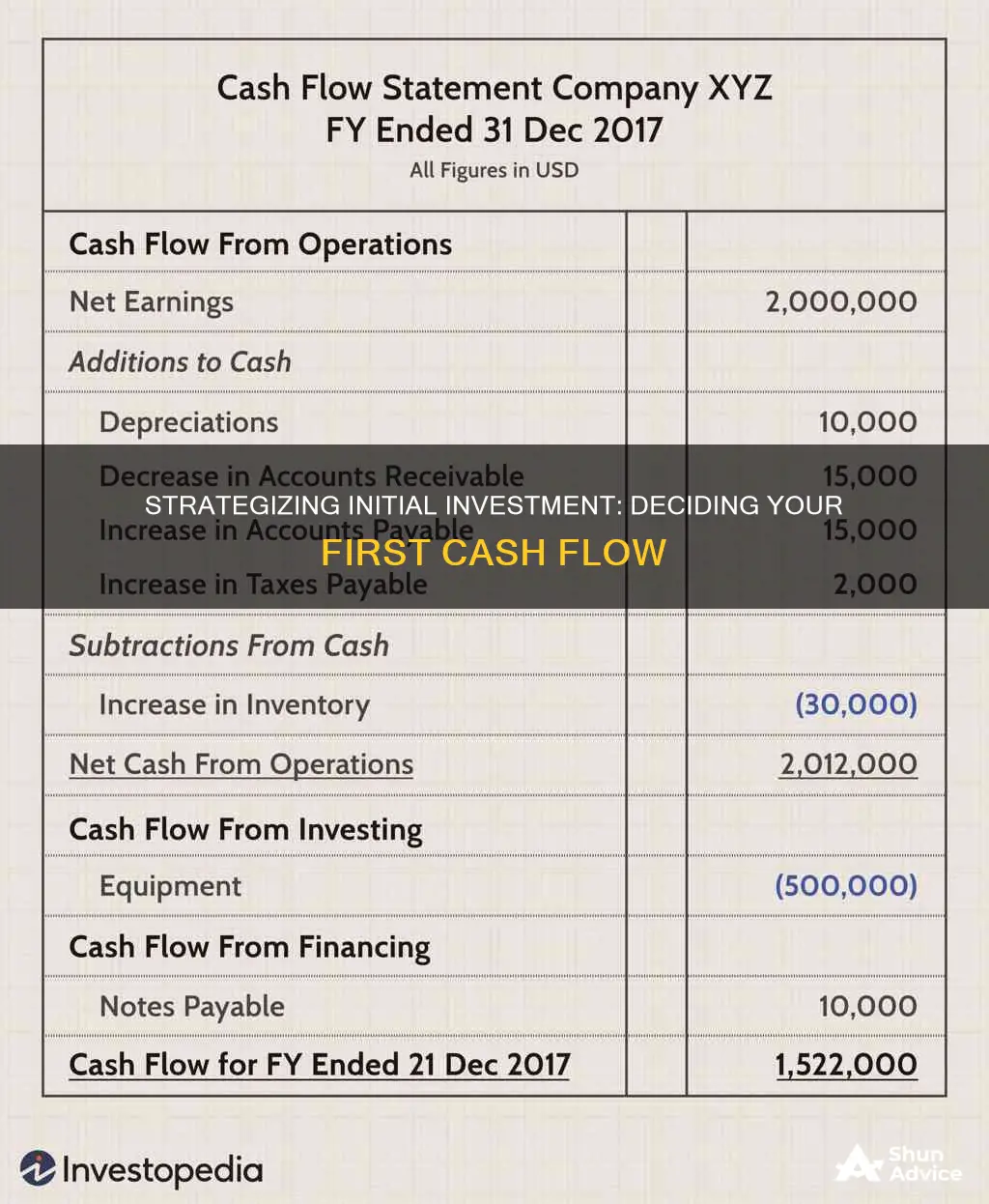

Deciding on the initial cash flow for an investment is a critical aspect of financial planning for any business or project. Initial cash flow refers to the total money available when a venture is in its planning stages, encompassing fixed capital, working capital, and expected returns. It is usually a negative figure, as launching a business or project requires capital investment. This initial investment outlay is crucial for evaluating the feasibility of a project, and involves careful consideration of capital expenditures, working capital requirements, and potential returns. Positive cash flow indicates a business's ability to cover obligations, reinvest, and buffer against future challenges. Various methods, such as direct and indirect calculations, are employed to determine initial cash flow, and it is essential for financial decision-making and strategic planning.

| Characteristics | Values |

|---|---|

| Definition | The total money available when a project or business is in the planning stages |

| Synonyms | Initial investment outlay |

| Figure Inclusion | All operating and equipment costs for the planning stage |

| Figure Exclusion | Sunk costs |

| Figure Calculation | Fixed capital + working capital – salvage value + (salvage value – book value) * tax rate |

| Figure Status | Usually a negative figure |

What You'll Learn

Fixed capital, working capital, salvage value, tax rate, and book value

Fixed Capital

Fixed capital investment refers to the funds required to establish a You may want to see also Capital expenditures (CapEx) refer to the funds used to acquire, upgrade, and maintain physical assets such as property, plants, buildings, technology, or equipment. CapEx is often associated with new projects or investments, and companies make these expenditures to expand their operations or gain future economic benefits. Examples of CapEx include purchasing land, vehicles, buildings, or heavy machinery. These expenditures are recorded on the company's balance sheet and are expected to provide long-term value. Working capital, on the other hand, is a short-term financial analysis tool that provides insight into a company's health. It is calculated by subtracting current liabilities from current assets. Making capital expenditures will impact a company's working capital, depending on the nature of the transaction and the types of assets involved. For instance, if a company uses cash to pay for a capital expenditure, there will be no change in working capital if the acquired asset is a current asset. However, if the asset is a long-term asset, there will be a decrease in working capital. Additionally, the disposal of assets can also influence a company's initial cash flow. When a company sells or disposes of an asset, it may generate proceeds that can offset the initial cash flow outlay. This is often considered in the context of salvage proceeds from discontinued ventures or the sale of old equipment. Understanding the interplay between capital expenditures, working capital, and asset disposal is essential for effective financial management and investment decision-making. These factors collectively shape a company's financial health, liquidity, and ability to pursue new projects or investments. You may want to see also Positive cash flow is essential for a business to survive, prosper, and sustain long-term growth. It indicates that a company's liquid assets are increasing, enabling it to cover its obligations, reinvest in its business, return money to shareholders, and pay expenses. Positive cash flow also provides a buffer against future financial challenges, allowing businesses to fare better during economic downturns by avoiding the costs of financial distress. To achieve and maintain positive cash flow, businesses should consider the following strategies: It is important to note that positive cash flow does not always indicate profitability. Sometimes, a business can be cash flow positive but not profitable, such as when it borrows money or sells assets to raise capital. Therefore, it is crucial to consider other financial metrics and indicators when assessing a company's overall financial health and performance. You may want to see also The indirect method starts with net income from the income statement and makes adjustments to "undo" the impact of the accruals made during the reporting period. Some common adjustments include depreciation and amortization. Both methods are accepted by Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). CFO includes cash received from sales, cash expenses paid for direct costs, and payments for funding working capital. It reflects the changes in cash, accounts receivables, inventory, depreciation, and accounts payable. A positive CFO indicates that a company's liquid assets are increasing, enabling it to cover obligations and reinvest in its business. To calculate cash flow from operations, one must calculate cash generated from customers and cash paid to suppliers. The difference between the two reflects the cash generated from operations. The formula for calculating CFO using the direct method is: CFO = Cash Receipts - Cash Payments - Cash Expenses - Cash Interest - Cash Taxes The formula for calculating CFO using the indirect method is: CFO = Net Income + Gains & Losses from financing & investments + Non-cash charges + changes in operating accounts You may want to see also Cash flow is the movement of money into and out of a company over a certain period of time. A positive cash flow indicates that a company's liquid assets are increasing, which is beneficial for covering obligations, reinvesting in the business, and providing a buffer against future financial challenges. Conversely, a negative cash flow indicates that a company is spending more than it is earning. Cash flow can be categorised into three types: cash flow from operations, from investing, and from financing. Cash flow from investing (CFI) or investing cash flow refers to the money generated or spent on various investment-related activities over a specific period. This includes purchases of speculative assets, investments in securities, or sales of securities or assets. Negative cash flow in this category could be due to significant investments in the company, such as research and development, and is not always detrimental. Cash flow from financing (CFF) or financing cash flow, on the other hand, reflects the net flows of cash used to fund the company and its capital structure. This includes transactions related to debt or equity, such as issuing debt or equity and paying dividends. Positive cash flow in this category during the startup phase is typical, as the company obtains financing cash to initiate operations and make future investments. Both cash flow from investing and financing activities are crucial components of a company's financial statements. They provide insights into the company's financial health, growth, and management of its capital structure. Analysing these cash flows helps investors and analysts make informed decisions and recommendations regarding the company's performance and potential. You may want to see also Initial cash flow is the total money available when a project or business is in the planning stages. It includes all operating and equipment costs, as well as any loans or investments made in the project. The initial cash flow can be calculated using the following formula: Initial cash flows = FC+WC-S + (S-B) * T, where FC = fixed capital, WC = working capital, S = Salvage value, B = Book value, and T = Tax rate. When deciding on the initial cash flow for an investment, it is important to carefully estimate the initial investment outlay and future cash flows of the project. Factors to consider include capital expenditures, working capital requirements, and after-tax proceeds from disposed-off assets. It is also crucial to evaluate the profitability of the project and its strategic purpose.Extra Cash: Where to Invest for Maximum Returns

Capital expenditures, working capital, and disposal of assets

Operating vs Investing: Where Do Customers Fit in Cash Flow?

Positive cash flow and business growth

Cashing Out Your Fidelity Investments: A Step-by-Step Guide

Cash flow from operations

Cash Investments: What Are They?

Cash flow from investing and financing

Understanding Net Cash Flow: Does It Include Investments?

Frequently asked questions