401(k)s are a common form of retirement benefit that grow with the market and you usually choose a general level of investment from conservative to aggressive. Dividing retirement accounts can be complicated if there are loans or investments associated with the account. If you and your former spouse have agreed to divide a 401k account, the process will vary depending on the type of retirement plan.

| Characteristics | Values |

|---|---|

| Diversify investments | Between four types of mutual funds |

| Mutual funds | Growth and income, growth, aggressive growth, international |

| Look for funds | With a long track record of strong returns |

| 401k accounts | Investment accounts |

| Investment selection | Curated by your plan provider and your employer |

| Retirement accounts | Complicated if there are loans or investments associated with the account |

| Lump sum distribution | Fully taxable in the year they are withdrawn |

What You'll Learn

Diversify investments between growth, income, aggressive growth, and international funds

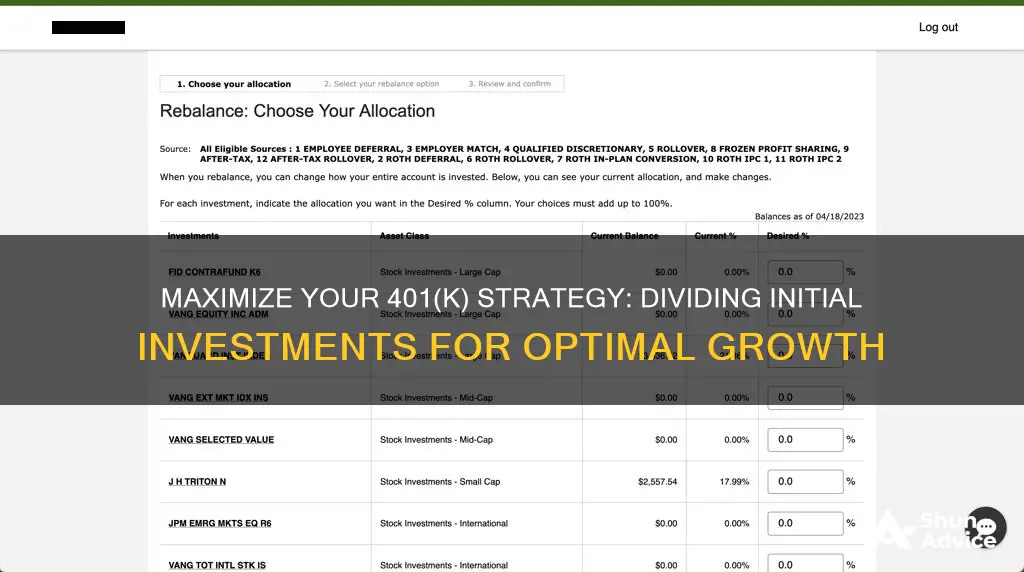

When dividing 401k investments, it is important to diversify your investments between four types of mutual funds: growth and income, growth, aggressive growth, and international. Look for funds with a long track record of strong returns.

When you are choosing your 401(k) investments, you are essentially choosing a general level of investment from conservative to aggressive. However, some 401(k) plans may allow you to choose specific companies. 401(k)s tend to have a small investment selection that’s curated by your plan provider and your employer. You’re not selecting individual stocks and bonds, but mutual funds — ideally ETFs or index funds — that pool your money along with that of other investors to buy small pieces of many related securities. Stock funds are divided into categories.

When filling out your 401(k) beneficiary form, contact your 401(k) plan manager to make sure those funds end up where you want them. You should also make sure that you do not pay taxes on the money you invest into the account.

When it comes to dividing an IRA or health savings account (HSA), financial institutions generally require the parties to send a "transfer incident to divorce" form as well as a copy of the divorce decree. When it comes to taxable investments, you may be able to sell the investments and divvy up the proceeds or you can otherwise divide the investment holdings.

Healthcare Investment: Strategies for Success in a Dynamic Sector

You may want to see also

Select mutual funds or ETFs to pool your money

When it comes to dividing 401k investments, it's important to diversify your investments between four types of mutual funds: growth and income, growth, aggressive growth, and international. Look for funds with a long track record of strong returns.

401k accounts are the most common form of retirement benefit. They are essentially an investment account that you contribute to, which grows with the market. You usually choose a general level of investment from conservative to aggressive, but some plans may allow you to choose specific companies.

K)s tend to have a small investment selection that’s curated by your plan provider and your employer. You’re not selecting individual stocks and bonds (whew!), but mutual funds — ideally ETFs or index funds — that pool your money along with that of other investors to buy small pieces of many related securities. Stock funds are divided into categories.

When picking your 401(k) investments, try to diversify your investments between four types of mutual funds: growth and income, growth, aggressive growth, and international. Look for funds with a long track record of strong returns.

If it’s been a while since you filled out your 401(k) beneficiary form, contact your 401(k) plan manager to make sure those funds end up where you want them.

Understanding Investment Risk Reserve: Protecting Your Portfolio

You may want to see also

Avoid individual stocks and bonds

When filling out your 401(k) beneficiary form, it's important to remember that you should not select individual stocks and bonds. Instead, you should choose mutual funds, ideally ETFs or index funds. These funds pool your money with that of other investors to buy small pieces of many related securities. This approach helps to diversify your investments and reduce risk.

When selecting mutual funds, it's recommended to diversify your investments between four types of funds: growth and income, growth, aggressive growth, and international. Look for funds with a long track record of strong returns. This will help ensure that your investments are well-diversified and have the potential to perform well over the long term.

It's also important to review your 401(k) investments regularly to ensure that they are still aligned with your financial goals and risk tolerance. If you're unsure about how to proceed, it's a good idea to consult with a financial advisor who can provide guidance on how to best manage your 401(k) investments.

Additionally, if you've recently filled out your 401(k) beneficiary form, it's a good idea to double-check that the funds are in the correct place. You can do this by contacting your 401(k) plan manager and reviewing the beneficiary form to ensure that the funds are allocated as you intended.

Smart Investing Strategies for High Earners

You may want to see also

Be aware of tax implications when taking a lump sum distribution

When you take a lump sum distribution from your 401(k) account, you will be subject to tax on the entire amount. This is because 401(k) accounts are tax-deferred, meaning that you do not pay taxes on the money you invest into the account, but once you start taking distributions, you will be taxed on the entire balance.

The tax implications of taking a lump sum distribution can be significant. You will be taxed on the entire amount, which can result in a large tax bill. Additionally, you will be subject to penalties if you take a lump sum distribution before you reach the age of 59½.

It is important to plan ahead and consider the tax implications of taking a lump sum distribution. You may want to consult with a financial advisor to determine the best course of action for your situation.

When you take a lump sum distribution, you will be taxed on the entire amount, which can result in a large tax bill. Additionally, you will be subject to penalties if you take a lump sum distribution before you reach the age of 59½.

It is important to plan ahead and consider the tax implications of taking a lump sum distribution. You may want to consult with a financial advisor to determine the best course of action for your situation.

Factors Influencing Investor Choices and Decisions

You may want to see also

Consult a financial planner for divorce-related 401k division

When you are divorcing and dividing retirement assets, it is important to consult a financial planner to ensure that you are making the best decisions for your financial future. If you and your former spouse have agreed to divide a 401k account, the process will vary depending on the type of retirement plan.

401k accounts are the most common form of retirement benefit. They are investment accounts that you contribute to, which grow with the market. You usually choose a general level of investment from conservative to aggressive, but some plans may allow you to choose specific companies.

When dividing retirement accounts, it is important to be aware that these funds are fully taxable in the year they are withdrawn. This could affect your overall financial plan and should be discussed with a financial planner beforehand.

If you choose to take a lump sum distribution, it is essential to be aware that these funds are fully taxable in the year they are withdrawn. This could affect your overall financial plan and should be discussed with a financial planner beforehand.

It is important to diversify your investments between four types of mutual funds: growth and income, growth, aggressive growth, and international. Look for funds with a long track record of strong returns.

Invest Wisely for a Comfortable Retirement

You may want to see also

Frequently asked questions

401k accounts are the most common form of retirement benefit. You usually choose a general level of investment from conservative to aggressive, but some plans may allow you to choose specific companies.

401(k)s tend to have a small investment selection that’s curated by your plan provider and your employer. You’re not selecting individual stocks and bonds, but mutual funds — ideally ETFs or index funds — that pool your money along with that of other investors to buy small pieces of many related securities. Stock funds are divided into categories.

When picking your 401(k) investments, try to diversify your investments between four types of mutual funds: growth and income, growth, aggressive growth, and international. Look for funds with a long track record of strong returns. If it’s been a while since you filled out your 401(k) beneficiary form, contact your 401(k) plan manager to make sure those funds end up where you want them.