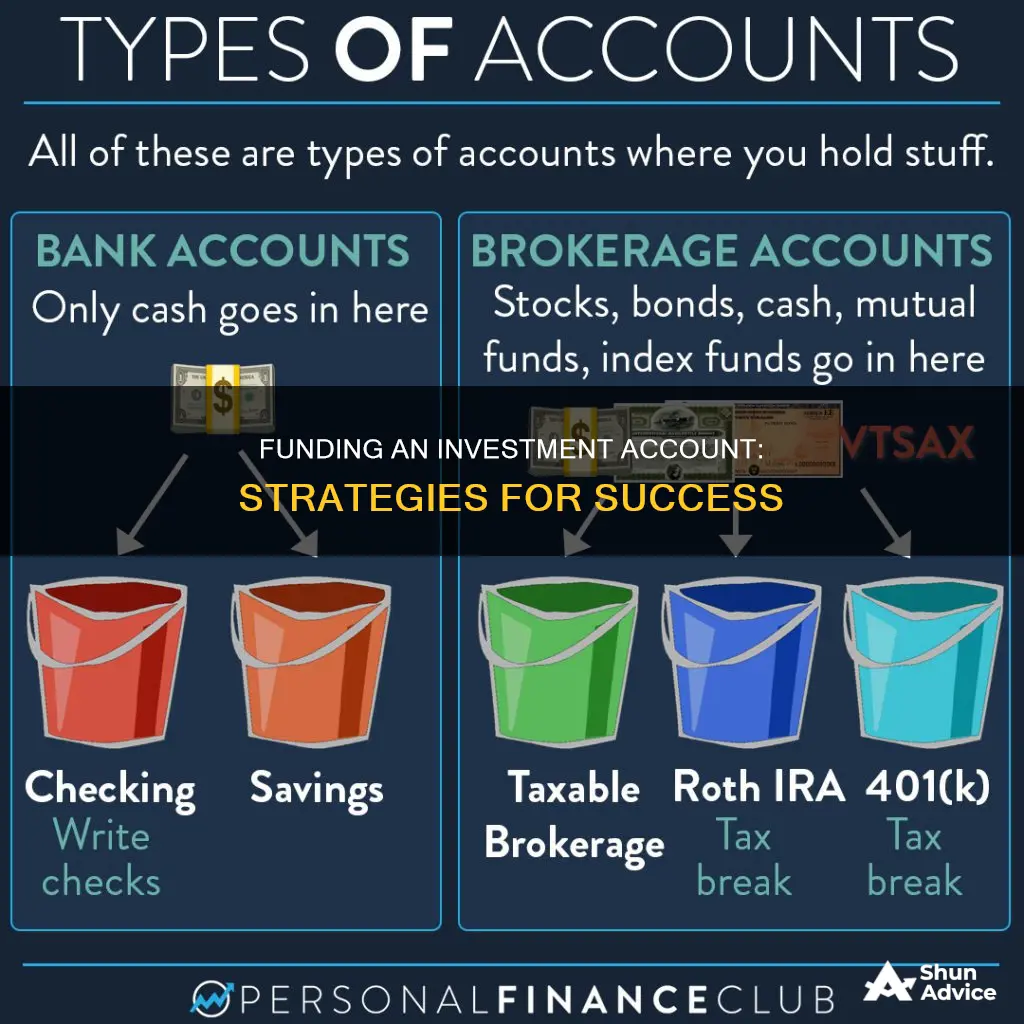

Funding an investment account is a crucial step towards achieving financial security and meeting long-term goals. There are several ways to fund an investment or brokerage account, including transferring funds from a bank account or another brokerage account, or rolling over retirement assets. When choosing a brokerage firm, it is essential to consider factors such as costs, incentives, services offered, and convenience. It is also important to determine the type of brokerage account that aligns with your investment objectives, such as a taxable brokerage account or a retirement account like an IRA. Once the account is opened, it is crucial to understand the various investment options available, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs), and to create a well-diversified portfolio that matches your goals and risk tolerance.

| Characteristics | Values |

|---|---|

| Account type | Brokerage account, IRA, 401(k) |

| Investment types | Stocks, bonds, mutual funds, ETFs, index funds, cash management accounts, low-risk investment portfolios |

| Account minimums | Often zero, but can be as little as $25 per month |

| Investment minimums | Often $1,000 or more, but low- or no-minimum funds are available |

| Fees | Some accounts have no fees, but fees may apply for certain types of trades or transactions |

| Accessibility | Online or in-person at branch locations |

| Age restrictions | Must be 18 or older in most states |

| Tax implications | Brokerage accounts are taxable, while IRAs and 401(k)s offer tax advantages |

What You'll Learn

Choose the type of account

When choosing the type of account for your investment, you should consider your financial situation, investment goals, and timeline. Here are some options to consider:

Taxable Brokerage Account

A taxable brokerage account is suitable if you don't have a specific timeline for your investments. This type of account offers flexibility as there are no withdrawal restrictions, and you can invest as much as you want. However, it does not provide tax advantages. You will typically owe taxes annually on dividends, interest, or realised gains. Examples of taxable brokerage accounts include regular brokerage accounts and cash accounts.

Individual Retirement Account (IRA)

If you are specifically investing for retirement, an Individual Retirement Account (IRA) is a good option. There are two main types: Traditional IRAs and Roth IRAs. With a Traditional IRA, you can get tax deductions when you contribute, but you won't be able to access your money until you reach the age of 59 1/2. On the other hand, Roth IRAs do not provide an immediate tax benefit, but qualified withdrawals during retirement are tax-free. Additionally, you can withdraw your contributions from a Roth IRA at any time without tax consequences.

Managed Brokerage Account

If you prefer to have investment management support, you can opt for a managed brokerage account. This can be through a human investment advisor or a robo-advisor, which uses computer programs to manage your investments based on your goals. A robo-advisor is a low-cost alternative to a human advisor and is a good option if you want a more hands-off approach to your investments.

Retirement Brokerage Account

If you are saving for retirement and don't have access to an employer-sponsored retirement account, you can consider opening a retirement brokerage account such as an IRA. This will allow you to take advantage of tax benefits designed to encourage retirement savings.

Best SBI Mutual Fund Schemes for Investors

You may want to see also

Transfer from bank accounts

Transferring funds from a bank account to an investment account is a straightforward process. Here is a step-by-step guide:

Choose the Type of Account:

Before transferring funds, decide on the type of investment account you want to open. The two main options are a regular brokerage account or an Individual Retirement Account (IRA). A regular brokerage account offers flexibility with few restrictions, while an IRA provides tax advantages for retirement savings.

Select an Online Brokerage Firm:

Choose a reputable online brokerage firm that suits your needs. Examples include E*Trade, Fidelity, Schwab, TD Ameritrade, or Webull. These firms typically offer a range of investment options, such as stocks, mutual funds, and ETFs, with no minimum investment requirements.

Fund the Investment Account:

To fund the investment account, you will need to link it to your bank account. Here are the steps:

- Decide on the checking or savings account you want to use for transferring funds.

- Obtain your bank's routing number and your checking or savings account number.

- Ensure you have online access to your banking information, such as balances, deposits, and withdrawals.

- Establish a link between your brokerage account and bank account. This is usually done through the brokerage account dashboard by looking for options like "move money," "transfer money," or "enroll account."

- Initiate a transfer from your bank to the brokerage firm. This typically involves entering the routing and account numbers and verifying the transaction.

Transfer Timing and Availability:

The timing of fund transfers can vary. Internal transfers between accounts in the same financial institution are often instant, especially if done before the daily cutoff time (e.g., before 4:30 pm ET for J.P. Morgan). Transfers from external accounts usually take 1-3 business days but can take up to 5 business days or longer, depending on the institutions and the type of transfer.

Transfer Fees:

When transferring funds, be mindful of potential fees. While the receiving brokerage firm typically does not charge a fee for incoming transfers, your bank or the external financial institution might. Always verify any fees before initiating a transfer request.

Managing Repeating Transfers:

If you plan to set up repeating transfers, most brokerage platforms allow you to view, edit, pause, or cancel these recurring transactions through their website or mobile app.

Actively Managed Funds: Why They're Worth Your Investment

You may want to see also

Move cash

Moving cash is one of the ways to fund an investment or brokerage account. Here's a detailed, step-by-step guide on how to do it:

Decide on the source account:

Firstly, you need to decide which account you want to transfer the funds from. This could be your checking or savings account, or even another brokerage or investment account. If you're transferring from a bank account, you'll need the bank's routing number and your account number. It's also helpful to have online access to your banking information, such as balances, deposits, and withdrawals.

Choose the destination account:

You'll need to select the investment or brokerage account where you want the funds to be deposited. This could be your own personal account or an external account. If you're transferring to an external account, be sure to verify any fees that your bank may charge for the transfer.

Establish a link between the accounts:

You'll need to set up a connection between the source and destination accounts. This is typically done through the dashboard of your brokerage account. Look for options like "move money", "transfer money", or "enroll account". You'll then be prompted to enter the routing and account numbers of your bank account.

Verify the trial deposits:

Once the connection is established, your brokerage firm will make trial deposits into your bank account. These are usually small amounts, such as $0.22 or $0.34. You'll need to check your bank account online to find these deposits and then enter them on the broker's website. This step verifies that you are the owner of the bank account and authorises transactions between the two accounts.

Initiate the transfer:

After the link has been set up and verified, you can initiate the transfer from your bank account to the brokerage firm to fund your investment account. Depending on the type of transfer, the funds will be available instantly or within a few business days. For example, an internal transfer between accounts at the same financial institution is usually instant, while an external transfer may take 1 to 3 business days.

Manage your transfers:

Once the transfer is complete, you can manage your investment account by deciding what you want to buy. Make sure you have enough funds to cover the purchase of your selected investment, including any transaction charges. You can then execute the transaction by finding the listing of the investment and following the prompts to buy or trade.

Monitor your transfers:

It's important to keep track of your transfers and their status. You can usually do this through your brokerage account's dashboard or by checking your email for notifications from the brokerage firm. Additionally, you can view the status of your transfers by going to your "Brokerage transfer activity" and checking the transaction status.

The Future of Investing: Funds to Focus On

You may want to see also

Select an online brokerage firm

There are a lot of great online brokerage firms to choose from. For example, you might open an account with E*Trade, Fidelity, Schwab, TD Ameritrade, or upstart Webull. These firms allow you to invest in a variety of stocks, mutual funds, and ETFs for free with no minimum.

You could also consider opening an investment account with a company that is not a discount, online brokerage firm. For example, if you bank with Wells Fargo, you could open an investment account with WellsTrade.

You might also consider newer, innovative firms such as Betterment, each with unique advantages and drawbacks.

At Betterment, you choose a type of account and set a financial goal. The firm makes a recommendation in the form of a selection of ETFs for a diversified portfolio; you can accept or modify the recommendation to be more conservative or aggressive. In general, account funding is similar to these firms. However, depending on how you set up your accounts, Betterment is designed to immediately purchase shares. Most firms require you to fund your account and then initiate a purchase of a specific investment in a separate action.

When choosing an online brokerage firm, it's important to evaluate their compatibility with your investing profile and objectives, the level of customer support you prefer, and the promotions and bonuses they offer.

Who Should Invest in Mutual Funds?

You may want to see also

Make regular contributions

Making regular contributions to your investment account is a great way to build wealth over time. Here are some tips to help you make regular contributions effectively:

Determine How Much You Can Contribute

Before you start investing, it's important to assess your financial situation and determine how much you can comfortably contribute to your investment account on a regular basis. Consider your income, expenses, and savings goals when making this decision. Even small contributions can add up over time, so don't be discouraged if you can't invest a large amount right away.

Set Up Automatic Contributions

Automating your investments is a great way to ensure that you consistently contribute to your account without having to remember to initiate a transfer each time. Most investment platforms allow you to set up recurring contributions from your bank account. By automating your investments, you can take advantage of dollar-cost averaging, which helps to reduce the impact of market volatility on your portfolio.

Choose the Right Investment Vehicles

When making regular contributions, consider investing in mutual funds, exchange-traded funds (ETFs), or stocks that align with your risk tolerance and investment goals. These investment options typically have lower minimum investment requirements, making them more accessible for smaller contributions. Diversifying your portfolio can also help to mitigate risk and maximize the potential for long-term growth.

Stay Disciplined and Consistent

Consistency is key when it comes to making regular contributions. Try to maintain your contribution schedule and avoid skipping investments, even during periods of market volatility. Staying disciplined will help you take advantage of compound growth and increase your chances of reaching your financial goals.

Consider Increasing Your Contributions Over Time

As your financial situation improves, consider increasing the amount you contribute to your investment account. This could be done through periodic adjustments or by taking advantage of windfalls, such as bonuses or tax refunds. Increasing your contributions over time can help accelerate your progress towards your investment goals.

Take Advantage of Tax-Advantaged Accounts

If possible, contribute to tax-advantaged retirement accounts, such as Individual Retirement Accounts (IRAs) or employer-sponsored plans like 401(k)s. These accounts offer tax benefits that can help your investments grow faster. For example, contributions to a traditional IRA may be tax-deductible, while earnings in a Roth IRA can grow tax-free.

Bond of America: State Investment Destinations

You may want to see also

Frequently asked questions

You can open a brokerage account online. Many brokerage firms allow you to open an account with no upfront deposit, but you will need to fund the account before you buy investments. You can move money from your checking or savings account or another brokerage account.

There are two main types of brokerage accounts: taxable brokerage accounts and tax-advantaged accounts like an IRA. Taxable brokerage accounts have no limits on how much you can contribute or what you can do with the money, but you won't get the tax benefits found in retirement accounts. With an IRA, you get tax advantages for contributing, either through a tax deduction when you contribute or tax-free withdrawals in retirement.

You can fund your brokerage account by transferring money from a linked checking or savings account. You can also use electronic funds transfer, wire transfer, or deposit checks or stock certificates by mail.