Investment management is the process of building a portfolio of stocks, bonds, and other assets to help achieve your financial goals. It can be done independently or with the help of an investment manager.

There are several steps to investing successfully. First, you need to set clear investment goals and determine how much you can afford to invest. Next, you need to assess your risk tolerance and choose an investment account that aligns with your goals and preferences. Once you've opened your account, you can start investing in a diverse range of assets, such as stocks, bonds, mutual funds, or exchange-traded funds (ETFs).

It's important to monitor your investments regularly and make adjustments as needed to ensure they align with your goals and risk tolerance. You can do this yourself or seek the help of a financial advisor or robo-advisor.

By following these steps and staying informed about the market and your investments, you can effectively grow your investments and increase your profits over time.

| Characteristics | Values |

|---|---|

| Investment goals | Clear, short-term and long-term |

| Investment amount | Emergency fund, high-interest debts paid off, budgeted |

| Risk tolerance | High, moderate, low |

| Investment account | Brokerage, retirement, managed, dividend reinvestment, education savings, health savings |

| Investment types | Stocks, bonds, mutual funds, ETFs, index funds, robo-advisors |

| Investment strategy | Buy-and-hold, diversification, dollar-cost averaging, CAN SLIM |

| Investment sectors | Technology, healthcare, construction, small-cap stocks |

What You'll Learn

Set clear investment goals

Setting clear investment goals is the first step in investing in stocks. Clear goals will guide your investment decisions and help you stay focused. Here are some tips to help you set clear investment goals:

- Be precise about your objectives: Instead of vague goals like “save for retirement,” aim for specific targets like “accumulate $500,000 in my retirement fund by age 50.” Clear and precise investment goals will help you navigate the stock market with confidence and purpose.

- Determine your investment horizon: Assess how long you have to achieve each goal. Longer time horizons often allow for more aggressive investment strategies, while shorter ones may require more conservative approaches. The longer you give yourself, the less conservative you'll need to be early on.

- Evaluate your finances: Be realistic about how much you can put toward your investment goals, considering your savings, regular income, and any other financial resources.

- Rank your goals: Most people balance several goals at once, so it's important to prioritize them based on urgency and importance. For example, saving for a down payment on a house might take precedence over planning a vacation.

- Adapt as life changes: Financial planning is an ongoing process that should evolve with your needs and aspirations. Regularly review and adjust your goals as your life circumstances change.

Once you've set your investment goals, you can move on to the next steps, which include determining how much you can afford to invest, choosing the right investment account, and picking the right stocks or other investments that align with your goals and risk tolerance.

Understanding Personal Investment Portfolios: Your Financial Journey

You may want to see also

Determine how much you can afford to invest

Before you start investing, it's important to determine how much you can afford to invest. This involves assessing your financial situation, including your income, expenses, debt, savings, and financial goals. Here are some key considerations to help you figure out how much you can comfortably invest:

Review your income sources:

Start by listing all your sources of income, such as your salary, investments, or any other streams of revenue. This will give you an understanding of how much money you have available to work with.

Establish an emergency fund:

Before investing, it's crucial to have a solid financial foundation. Set aside an emergency fund to cover unexpected expenses, such as a job loss, medical needs, or car repairs. This fund should ideally cover at least a few months' worth of essential living expenses.

Pay off high-interest debts:

High-interest debt, such as credit card balances, can hinder your financial stability. It's generally recommended to prioritize paying off these debts before investing. Calculate the interest you're paying on your debts and weigh it against the potential returns from investing.

Create a budget:

Based on your income and expenses, create a budget that outlines how much money you can comfortably allocate towards investments. Ensure that your essential expenses, such as housing, utilities, and groceries, and debt payments, are covered first. Don't forget to include some discretionary spending in your budget as well.

Set clear investment goals:

Determine your short-term and long-term investment goals. Are you saving for a house, retirement, or your child's education? Setting clear goals will help you stay focused and guide your investment strategy.

Choose the right investment account:

Select an investment account that aligns with your goals and risk tolerance. Consider the different types of accounts, such as brokerage accounts, retirement accounts (IRAs, 401(k)s), and managed accounts. Evaluate the tax implications, fees, and minimum requirements of each account type.

Start small and increase gradually:

You don't need a large sum of money to start investing. Many online brokers have eliminated account minimums, making it easier for beginners to get started. You can start with a smaller amount and gradually increase your investments as your financial situation improves.

Remember, investing should be done responsibly and with a long-term perspective. It's crucial to assess your financial situation and ensure that you don't endanger your financial stability.

MFS Investment Management: Paying Primary Beneficiaries

You may want to see also

Understand your risk tolerance and investing style

Understanding your risk tolerance and investing style is a cornerstone of investing. It helps you align your comfort level with the inherent uncertainties of the stock market and your financial goals.

Tips for Assessing Your Risk Tolerance:

- Self-assessment: Reflect on your comfort level with the ups and downs of the stock market. Are you willing to accept higher risks for potentially greater returns, or do you prefer stability even if that means potentially less in the end?

- Consider your time horizon: Your risk tolerance often depends on your investment timeline. Longer horizons allow for more risk since you have time to recover from potential losses. Shorter timelines typically require a more conservative approach.

- Gauge your financial cushion: Assess your finances, including your savings, emergency fund, and other investments. A solid financial cushion can help you take on more risk.

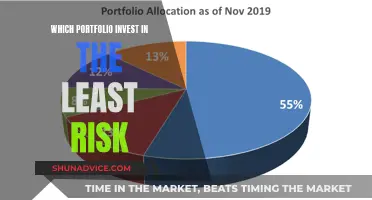

Based on how much risk you can tolerate, investors are typically classified as aggressive, moderate, or conservative. Aggressive investors are willing to lose money to get potentially better results. They tend to be market-savvy and follow strategies for achieving higher-than-average returns. Their investments emphasize capital appreciation rather than income preservation. A conservative investor, on the other hand, commonly has a lower risk tolerance and seeks investments with guaranteed returns. They are willing to accept little to no volatility in their investment portfolios.

Tips for Identifying Your Investing Style:

- DIY investing: If you understand how stocks work and are confident in your knowledge, you can manage the trades yourself. Even here, you can take an active or passive approach.

- Active: You use your brokerage account to access various investments and trade as you wish. You set your goals and choose when to buy and sell.

- Passive: You use your brokerage account to buy shares in index ETFs and mutual funds. You control which funds you purchase, but fund managers do the trading for you.

- Professional guidance: For a more personal approach, an experienced broker or financial advisor can offer tailored advice based on your life experiences and goals. They can help you monitor your portfolio and collaborate with you on adjustments.

Adjusting Your Risk Tolerance Over Time:

It's important to remember that your risk tolerance may change over time. It can be influenced by market and economic conditions, life events, and other factors. As your finances and goals evolve, regularly reassess your risk tolerance and adjust your investment strategy accordingly.

Investment Banking vs Asset Management: Who Earns More?

You may want to see also

Choose an investment account

There are several types of investment accounts, each with its own purpose, features, benefits, and drawbacks. The type of account you choose will depend on your savings goals, eligibility, and ownership preferences. Here is an overview of some common types of investment accounts:

- Standard Brokerage Account: A standard brokerage account, also known as a taxable brokerage account or non-retirement account, offers access to a wide range of investments, including stocks, mutual funds, bonds, and exchange-traded funds. Any interest, dividends, or gains on investments are subject to taxes in the year they are received. You can choose between an individual or joint taxable brokerage account. A cash account is generally recommended for most investors, while a margin account is riskier and suited for advanced traders who want to borrow to buy investments. There are no contribution limits, and money can be withdrawn at any time, although taxes may apply if the investments have increased in value.

- Retirement Accounts: Retirement accounts, such as Individual Retirement Accounts (IRAs), are similar to standard brokerage accounts in terms of investment options. However, they offer tax advantages. Traditional IRAs allow you to contribute pre-tax money, reducing your taxable income for the year, while Roth IRAs, another type of IRA, allow you to invest income that has already been taxed. Withdrawals from Roth IRAs in retirement are tax-free. It is important to note that IRAs have contribution limits and early withdrawal penalties.

- Investment Accounts for Kids: Custodial brokerage accounts, such as Uniform Gift to Minors Act (UGMA) and Uniform Transfers to Minors Act (UTMA) accounts, are investment accounts set up for minors with money gifted to them. The custodian maintains control of the account and transfers assets to the child when they reach the age of majority (18 or 21, depending on state laws). UGMA accounts hold typical investments like cash, stocks, and bonds, while UTMAs can also hold real estate. Money in these accounts can be used for any purpose. Another option for kids with earned income is a Roth or traditional IRA, which can be set up and maintained by an adult until the child turns 18 or 21.

- Education Accounts: These accounts are designed to save for education expenses. Examples include 529 savings plans, Coverdell Education Savings Accounts (ESAs), and ABLE accounts for individuals with disabilities. Contributions to these accounts are typically not tax-deductible, but qualified distributions are generally tax-free.

- Brokerage Accounts for Beginners: If you are new to investing, consider opening an account with an online broker that caters to beginner investors. These brokers provide educational resources and tools to help you get started.

- Robo-Advisors: Robo-advisors offer an automated, low-cost solution for investors. They use algorithms to determine the ideal investment mix based on your goals and risk tolerance. Robo-advisors are less expensive than traditional investment managers and often have low or no account minimums.

Inflation's Impact: Protecting Your Investment Portfolio

You may want to see also

Pick your investments

Picking your investments is a crucial part of growing your wealth through investment management. Here are some detailed guidelines and tips to help you make informed decisions about which investments to choose:

Set Clear Investment Goals:

Begin by defining your financial objectives. Are you saving for a house, retirement, or your child's education? Clear goals will guide your investment strategy and help you stay focused and motivated. Be as specific as possible, for example, instead of saying "save for retirement," set a target like "accumulate $500,000 in my retirement fund by age 50."

Determine Your Risk Tolerance:

Understanding your risk tolerance is essential for aligning your investments with your comfort level. Are you willing to take on higher risks for potentially greater returns, or do you prefer stability? Your risk tolerance often depends on your investment timeline, with longer horizons allowing for more risk-taking.

Choose Your Investment Style:

Decide on your preferred investment style, whether you want a hands-on approach (DIY investing) or a more passive strategy (professional guidance). If you choose DIY investing, you can either take an active role by accessing various investments through your brokerage account or a passive approach by investing in index ETFs and mutual funds.

Pick Your Stocks or Other Investments:

When selecting individual stocks, look for stability, a strong track record, and potential for steady growth. Here are some types of stocks that are generally considered solid choices for beginners:

- Blue-chip stocks: Shares of large, well-established companies with a history of reliable performance, such as those listed in the Dow Jones Industrial Average or the S&P 500.

- Dividend stocks: Companies that pay regular dividends provide a steady income, which can be reinvested to buy more stock.

- Growth stocks: Target industries with long-term potential, such as technology or healthcare, for greater growth chances.

- Defensive stocks: Invest in industries that tend to perform well during economic downturns, such as utilities, healthcare, and consumer goods.

- ETFs: Traded like stocks, ETFs offer instant diversification by tracking market indexes like the S&P 500, reducing the risk associated with individual stocks.

Additionally, you can consider investing in mutual funds or exchange-traded funds (ETFs) based on specific sectors like healthcare and technology, which have historically produced above-average returns.

Monitor and Review:

Stay informed about the global economy, industry trends, and the companies you invest in. Regularly review your investment goals and adjust your strategy as needed. Utilize resources like reputable financial news sites, stock simulators, and books on investment strategies to make informed decisions.

Maximizing Your Savings: Safe Investment Strategies for Beginners

You may want to see also

Frequently asked questions

Investment management is the process of building a portfolio of stocks, bonds and other investments based on your goals. You can either manage your portfolio independently or with the help of an investment manager.

When choosing an investment manager, it's important to consider their qualifications, experience and registration status. Investment managers typically have a bachelor's degree and may hold a master's degree or financial certifications. They should be registered with the relevant state authorities or the U.S. Securities and Exchange Commission, depending on the assets under management.

Investment managers provide personalised advice and tailor their strategies to your life experiences and goals. They can help you consolidate multiple investment accounts, make investing decisions, and monitor and rebalance your portfolio as needed.

There are several strategies to consider, including buying and holding investments for the long term, diversifying your portfolio across different asset classes, and investing in growth sectors such as technology and healthcare.

Growth sectors are typically characterised by "hot" industries that are producing above-average returns. To identify specific growth stocks, investors often use financial metrics such as the price-to-earnings (P/E) ratio and the price-to-book (P/B) ratio.

Diversification is a key risk management strategy. By investing in different types and classes of assets, you can reduce the impact of any single investment on your portfolio. Additionally, consider your risk tolerance and investment horizon when making investment decisions.

Yes, investment management can be a lucrative and growing field. According to the U.S. Bureau of Labor Statistics, the median salary for financial advisors was $94,170 in 2021, and the industry is expected to grow by 5% between 2020 and 2030.

Investment managers typically have a bachelor's degree and may benefit from a master's degree or financial certifications, such as the Certified Financial Planner (CFP) designation.

One challenge is that investment management is not an exact science, and predicting market performance can be difficult. As a result, investment managers may face criticism or anger from clients during periods of financial turmoil or portfolio losses.