Retiring with $1 million used to be the dream, but with rising inflation and healthcare costs, it's becoming harder to live comfortably on this amount. However, with careful planning and smart investments, it is still possible to retire with $1 million. The key is to start saving early, have an emergency fund, and make the most of employer matches and tax advantages. The earlier you start, the less you'll need to save each month to reach $1 million by retirement age. It's also important to consider your lifestyle choices, healthcare costs, and longevity when planning for retirement. While $1 million may be enough for some, others may need to save more or plan for additional income streams.

| Characteristics | Values |

|---|---|

| How much is needed for retirement? | $1 million is a common target sum for retirement savings. |

| How much to save per month | Depends on age and desired retirement age. For example, a 20-year-old would need to save $116 per month to retire at 65 with $1 million, whereas a 50-year-old would need to save $2,623 per month. |

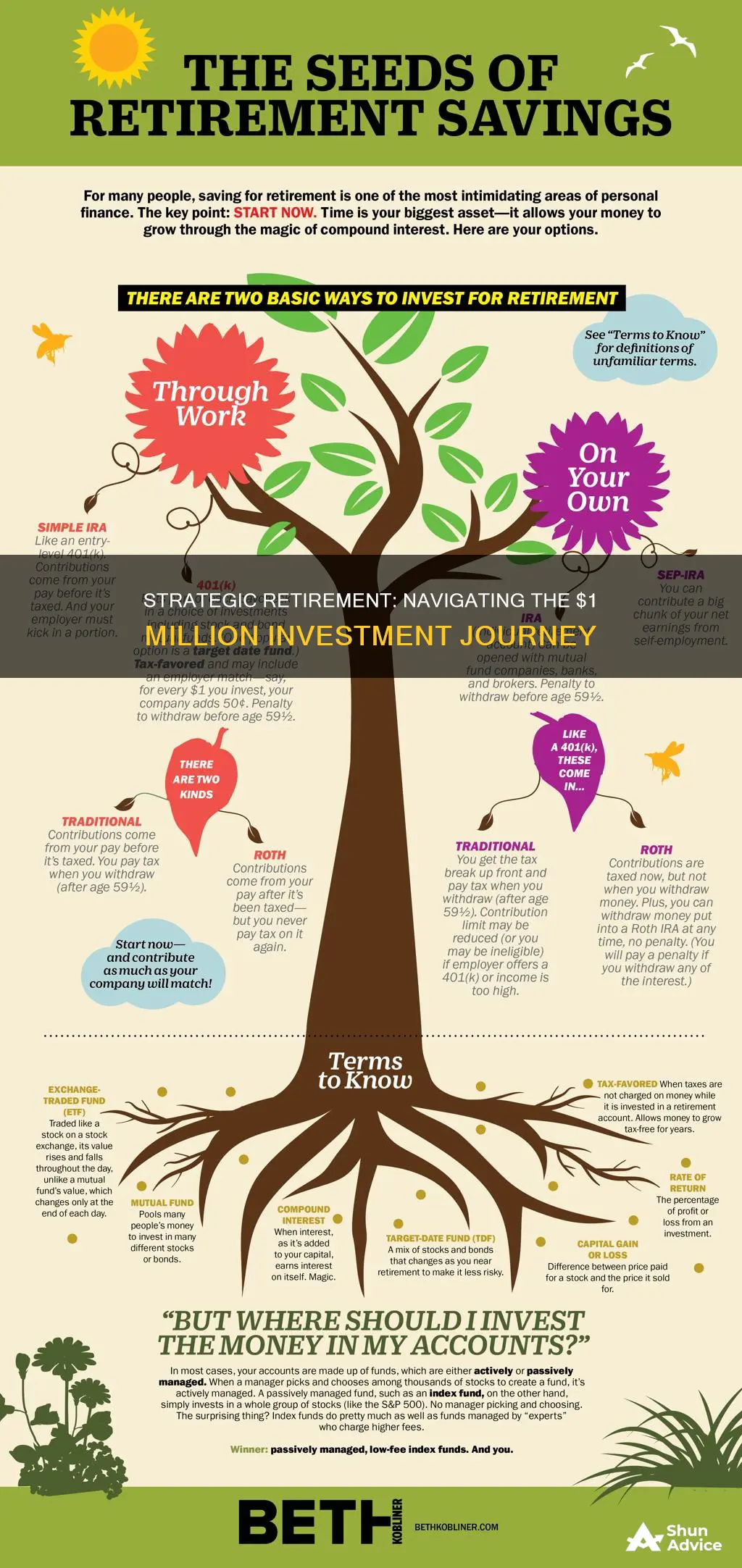

| Retirement account types | Individual retirement accounts (IRAs), 401(k)s, Roth IRAs, brokerage accounts, and annuities are all options for retirement savings. |

| Taxes | Taxes vary depending on the type of retirement account. For example, 401(k) contributions are tax-deferred, while Roth IRAs are taxed as normal income but have tax-free withdrawals. |

| Emergency funds | It is recommended to have an emergency fund that can cover at least three months' worth of expenses to avoid dipping into retirement savings. |

| Risk | Taking some risks with investments is necessary to maximize returns, but it is important to balance this with more conservative investments to manage risk exposure. |

| Fees | Retirement accounts often come with fees, such as expense ratios, which can reduce the value of the account over time. |

| Lifestyle choices | The desired lifestyle in retirement will impact how much money is needed. For example, those who want to travel will need more savings than those who plan to stay local. |

| Cost of living | The cost of living in different areas varies, and this will impact how much money is needed for retirement. |

| Longevity | The expected lifespan will impact how much money is needed for retirement. Those who live longer may need more savings. |

| Healthcare costs | Healthcare costs, especially for long-term care, can be significant in retirement and should be factored into savings plans. |

What You'll Learn

Diversifying investments to reduce risk

Diversifying your investments is a crucial strategy to reduce risk and ensure a more secure retirement. Here are some ways to achieve diversification:

Diversification Across Asset Classes

One of the primary methods of diversification is to spread your investments across different asset classes. The three main asset classes are stocks, bonds, and cash or cash equivalents. By blending these dissimilar assets, you reduce your exposure to any single class. For example, stocks offer higher long-term gains but are volatile, while bonds provide more stable income with modest returns. Additionally, you can explore alternative asset classes like real estate, commodities, and cryptocurrency.

Diversification Within Asset Classes

You can further diversify by breaking down asset classes into subcategories. For instance, within stocks, you can invest in companies of different sizes, from large-cap to small-cap, and consider both growth stocks and value stocks. In the case of bonds, you can diversify by investing in bonds with different creditworthiness, term lengths, and bond issuers.

Diversification Across Industries and Sectors

Investing in various industries and sectors helps reduce sector-specific risks. For example, investing in both travel and digital streaming entertainment can hedge against the impact of future pandemics. Similarly, investing in both consumer discretionary and consumer staples can balance your portfolio, as consumer discretionary is more sensitive to economic cycles, while consumer staples are considered defensive.

Diversification Across Geographical Locations

Including international investments in your portfolio can provide further diversification. Investing in foreign securities, such as stocks from other developed or emerging markets, can offer protection against risks specific to your domestic economy. For instance, investing in Japanese equities can provide a cushion against downturns in the US economy.

Diversification Across Time Frames

When diversifying, consider the time horizon of your investments. Short-term investments, like short-term bonds, are more liquid and yield lower returns, while long-term investments, like long-term bonds, carry higher inherent risk but often deliver higher returns.

Diversification Across Risk Profiles

Different investments offer varying risk profiles. For instance, fixed-income securities, such as bonds, allow you to choose between the safety of government bonds and the higher risk and potential returns of private company bonds. Similarly, within the real estate asset class, you can opt for the higher upside of real estate development projects or the lower risk of established operating properties.

While diversifying your investments is essential, it's also important to remember that diversification may reduce your overall returns. Diversification aims to reduce risk rather than maximize returns. Therefore, finding the right balance between risk and return is crucial when planning for retirement.

ELSS: Right Time to Invest?

You may want to see also

Evaluating inflation to protect purchasing power

Inflation is a gradual loss of purchasing power, reflected in a broad rise in prices for goods and services over time. It erodes the value of a currency over time, reducing the number of goods or services that can be bought with a unit of money.

To protect your purchasing power from inflation, you can:

- Invest in asset classes that outperform the market during inflationary times, such as commodities like grain, beef, oil, electricity, and natural gas.

- Invest in real estate, as landlords can increase rent to keep pace with rising prices.

- Purchase Treasury Inflation-Protected Securities (TIPS), a type of security indexed to inflation to protect against declines in purchasing power.

- Opt for inflation-hedged asset classes, such as gold, commodities, and real estate investment trusts (REITs).

- Invest in stocks, as the rise in stock prices includes the effects of inflation.

- Consider special financial instruments like Treasury Inflation-Protected Securities (TIPS), which are low-risk treasury securities indexed to inflation.

- Buy Series I savings bonds, which are designed to protect consumers' purchasing power against inflation.

Additionally, when investing $1 million for retirement, it is important to evaluate inflation to protect your purchasing power. Diversifying your investments can help reduce risk. Some strategies to consider are purchasing an annuity, choosing dividend stocks, buying fixed-income securities, investing in real estate, or building a portfolio.

The Debt Dilemma: Navigating the Investment vs. Loan Repayment Conundrum

You may want to see also

Purchasing an annuity

Annuities are a type of insurance product that provides a series of payments over a set period. They are often used for retirement as they offer a steady income stream for the duration of the contract. Annuities can be purchased with a lump sum or through a series of payments. In exchange, you will receive monthly payouts for a fixed number of years or for life, depending on the type of annuity.

The amount you receive from an annuity depends on several factors, including the age at which you buy or start paying for it, the return rate, and the length of the contract. As of July 2024, a $1 million annuity could offer monthly payments of up to $11,000. However, it is important to note that annuities typically offer lower returns compared to other investments.

There are two main types of annuities: immediate annuities and traditional portfolios. Immediate annuities provide a fixed income stream guaranteed for life, which can be appealing to those who worry about running out of money. Traditional portfolios, on the other hand, offer more financial flexibility, allowing you to withdraw a set percentage each year, adjusted for inflation.

When considering an annuity, it is important to keep in mind the disadvantages, such as tax treatment and illiquidity. Annuity payments are taxed as ordinary income, which may be higher than long-term capital gain rates. Additionally, accessing a large sum of money from the annuity for emergencies or major purchases may incur penalties.

Before purchasing an annuity, it is advisable to consult a financial advisor to determine if it aligns with your retirement goals and to understand the specific terms and conditions of the contract.

Public Utilities: Worth the Investment?

You may want to see also

Choosing dividend stocks

Dividend stocks can be a valuable component of a retirement portfolio due to their potential to generate consistent income. They are stocks of companies that regularly distribute a portion of their earnings to shareholders. For retirees seeking a reliable income stream, dividend-paying stocks can be beneficial as they provide a source of passive income.

When choosing dividend stocks, it is important to look beyond a stock's yield and instead opt for stocks with durable dividends, buying them when they are undervalued. It is also crucial to be selective and avoid dividend traps—companies with unsustainable yields.

- Dividend durability and reliability: Look for companies with a history of consistently increasing dividends over a long period, indicating financial stability and strong management.

- Management support: Select companies with management teams that are supportive of their dividend strategies.

- Competitive advantage: Choose companies with competitive advantages or economic moats, which can help protect their market position and maintain dividends.

- Undervalued stocks: Consider buying dividend stocks when they are trading below their fair value or when the market is underestimating their potential.

- Free cash flow: Assess the company's ability to generate free cash flow, as this indicates their capacity to cover dividend payments and support growth.

- Company performance: Evaluate the overall performance of the company, including revenue, earnings, and growth prospects.

- Exxon Mobil: A dividend aristocrat with a history of raising dividends and a diverse revenue base.

- Johnson & Johnson: Another dividend aristocrat with a solid pipeline, exceptional cash flow, and a commitment to dividends and share repurchases.

- Verizon Communications: Offers a high dividend yield and robust wireless revenue growth.

- Altria: The leading tobacco maker in the US with a multipronged approach to cigarette substitutes and a commitment to consistent dividend growth.

- Comcast: Demonstrates strong pricing power and has consistently increased its dividend payouts since instituting them in 2008.

- Medtronic: The largest pure-play medical device maker, Medtronic has raised its dividend for 46 consecutive years and targets returning a significant portion of its annual free cash flow to shareholders.

- Duke Energy: One of the largest regulated utilities in the US, Duke Energy has a strong balance sheet and an appropriate dividend policy, paying out 65-75% of earnings.

- Flowers Foods: An American leading producer and marketer of bakery products with a 21-year streak of raising dividends and a dividend yield of 4.30%.

- Texas Instruments: A global semiconductor company with a 12-year dividend growth streak and a dividend yield of 3.39%.

- International Business Machines Corporation: This multinational tech company has been rewarding shareholders with growing dividends for 28 years and currently offers a dividend yield of 4.28%.

Remember, investing in stocks, including dividend stocks, carries risks. It is always advisable to consult a financial professional before making any investment decisions.

Investing: Inspired by Future Security

You may want to see also

Buying fixed-income securities

Fixed-income securities are a popular choice for retirees as they provide a guaranteed, stable return on investments. They are ideal for those who don't want exposure to risk and instead want secure returns with additional yields.

Fixed-income securities are debt instruments that pay a fixed rate of interest. The interest is typically paid at set intervals and the principal amount is returned to the investor at maturity. The interest payments from these securities can help investors stabilise the risk-return on their investment portfolios.

The most common types of fixed-income securities are government and corporate bonds. Bonds are assigned credit ratings based on the financial viability of the issuer. Bonds with higher credit ratings tend to pay lower coupon rates.

Treasury bonds are fixed-interest U.S. government securities with a maturity of over a decade. They are considered low-risk investments. Treasury bills are short-term U.S. government debt obligations with a maturity of one year or less.

Municipal bonds are another type of fixed-income security. They are issued by states, cities, and counties to fund capital projects such as roads, schools, and hospitals. The interest earned on these bonds is usually exempt from federal income tax.

Certificates of Deposit (CDs) are offered by financial institutions and have maturities of five years or less, although some can be for longer. They typically pay higher rates than traditional savings accounts and are insured by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000 per individual.

Other types of fixed-income securities include exchange-traded funds, money market instruments, and corporate bonds.

When investing in fixed-income securities, it is important to consider the risks involved, such as credit and default risk, interest rate risk, and inflation risk.

Is it wise to invest now?

You may want to see also

Frequently asked questions

Understand your financial goals, timeline, and risk tolerance. Define your goals, calculate the annual return needed to achieve them, and consider your current age and desired timeline for spending returns. The longer your time horizon, the more you can allocate to equities, while shorter timelines should focus on low-risk fixed-income assets.

Costs vary significantly across the country, so where you live will determine how far your $1 million goes. U.S. News identified the most affordable places in the U.S. where your money will stretch further for housing and living costs.

Your spending habits and lifestyle choices will greatly impact your retirement planning. Those who choose an expensive lifestyle will need a larger nest egg. This includes factors such as dining out frequently, travelling, and other discretionary spending.

Stocks are the foundation of every investment portfolio, but the allocation depends on your goals, time horizon, and risk appetite. You can invest in individual stocks, equity mutual funds, or exchange-traded funds (ETFs). Bonds are also a key component for diversification and cash flow. Real estate investment trusts (REITs) are a less risky option than direct property investment.

A common rule of thumb is to withdraw 4% from your retirement funds each year. This would provide $40,000 per year from a $1 million savings balance. However, in high inflation years or years with a lower stock market, you may need to make adjustments and spend less.