Investing is a great way to grow your wealth and turning a small amount of money into a substantial sum is possible with the right knowledge, strategy and discipline. There are many ways to invest $1,000 and make $10,000, from investing in stocks, bonds and real estate to starting a business or buying and reselling items. While it may seem challenging, it is achievable with the right plans and creativity.

| Characteristics | Values |

|---|---|

| Time | Turning $1,000 into $10,000 will take time, and is unlikely to happen overnight or in a few weeks. |

| Risk | High-risk investments tend to offer higher potential returns, but they also come with a greater chance of loss. |

| Diversification | Diversifying your investment portfolio means spreading your investments across different asset classes, such as stocks, bonds, real estate, and commodities. |

| Time Horizon | The longer your time horizon, the more risk you can afford to take on. |

| Education | It is important to stay informed and keep up with market trends and economic news. |

| Strategy | Choose the right investment strategy that aligns with your financial goals and risk tolerance. |

| Discipline | Setting realistic financial goals is the first step towards achieving success. |

What You'll Learn

Flipping items for profit

Source your inventory

Start by looking for items around your house that you no longer use and could sell. You might be surprised at how much money you can make from selling things like old phones, laptops, clothing, furniture, and appliances.

Once you've exhausted your personal inventory, you can begin sourcing items from second-hand stores, thrift shops, flea markets, yard sales, and even the curb. Look for items that are undervalued or in need of minor repairs that you can fix yourself.

Choose the right platforms

When it comes to selling your items, there are several online platforms to choose from, each with its own advantages. Facebook Marketplace, Craigslist, and eBay are great for larger items like furniture and appliances due to easy local pickups. eBay and Depop are good choices for clothing, especially if they are branded. Worthy is a great platform for selling jewellery.

If you have a lot of items to sell, consider hosting a yard sale to quickly make money. You might get less money per item, but it adds up!

Increase exposure

To increase the chances of your items selling, use keywords in your titles, descriptions, and tags. Offer shipping if possible, as this will increase your reach. Share your listings on relevant Facebook groups and use the "Insights" feature on Facebook Marketplace to see what keywords people are searching for.

Re-visit sitting inventory

If some items aren't selling, consider lowering the price to attract buyers. You can also renew the listing or try listing it on a different platform.

Follow other resellers

Following other resellers on social media platforms like Instagram (#resellercommunity) can help you normalise this line of work and give you ideas for what items are selling well.

Focus on profitable items

Some of the best items to flip for profit include:

- Exercise equipment

- Household appliances

- Books

- Designer bags

- Vintage jewellery

- Furniture

- Sneakers

- Video games

- DVDs and Blu-Ray discs

- Baby gear

- Musical instruments

- Power tools and yard equipment

Computer Robo-Investor: Strategies for Automating Your Portfolio

You may want to see also

Online business

Investing $1,000 in an online business can be a great way to build wealth and achieve your financial goals. Here are some options for online businesses that you can start with $1,000 or less:

- ECommerce business: With the rise of online shopping, starting an eCommerce business is a viable option. Invest in inventory and create a website to showcase your products. You can also use social media to build a community of potential buyers.

- Digital marketing agency: If you have experience in digital marketing, you can offer services such as social media management, content creation, graphic design, and paid advertising. Choose a niche to focus on and start building a client base.

- Social media management: You can manage social media accounts for businesses and brands. Create engaging content, respond to comments and messages, and grow their online presence.

- Content creation: Choose a niche and create valuable content on social media platforms. Build a following and partner with brands for sponsorships or collaborations.

- Online translating: If you are fluent in multiple languages, you can offer translation services online. Create a website showcasing your language skills and work samples.

- Dropshipping: Choose a product from a wholesale vendor and market it on social media. When you receive an order, ship it directly from the supplier to the customer.

- Domain flipping: Buy domain names at a low price and resell them for a profit. This can be a risky business, but it has the potential for high returns.

- Personal shopping: Use personal shopping apps to connect with clients and shop for them. You can charge around $30 per hour for this service.

- Consulting business: Start a consulting business in an area where you have expertise, such as software, accounting, marketing, or business operations. Network with potential clients and showcase your knowledge and experience.

When starting an online business, it is important to have a plan and conduct thorough research. Consider your investment goals, timeline, and risk tolerance. You may also want to consult a financial advisor to make informed decisions about allocating your $1,000 investment.

A Guide to Investing in Ripple Currency in India

You may want to see also

Real estate investing

Real estate has traditionally been one of the most sought-after investment vehicles, offering passive income potential, appreciation, positive cash flow, and tax-reducing deductions. However, it is also viewed as one of the more challenging investments to start due to the high risk and high upfront costs.

If you are looking to invest $1000 in real estate, here are some options to consider:

- Real Estate Crowdfunding Platforms: These platforms allow investors to pool their funds and collectively invest in various real estate projects, including residential, commercial, or industrial properties. With a minimum investment, individuals can participate in larger projects with a limited budget. Examples of such platforms include Fundrise, DiversyFund, and RealtyMogul.

- Real Estate Investment Trusts (REITs): REITs are companies that own, operate, and finance income-generating properties or mortgages on these properties. By purchasing shares in a REIT, investors gain access to a diversified portfolio of income-generating properties. REITs have historically been one of the highest-performing asset classes, offering high returns and portfolio diversification.

- Real Estate Syndication: Syndication is a form of passive real estate investing where a group of investors pool their money to buy large commercial assets. The syndicator scouts, purchases, and manages the property, while the investors provide funding and take on a passive role. Each investor owns a percentage of the property, and the rent earned is shared among the partners.

- Fractional Real Estate Investing: This approach allows individuals to invest in a fraction of a property, sharing ownership with other investors. Platforms facilitating fractional real estate ownership have lowered the barrier to entry into the market, enabling individuals with limited capital to benefit from property appreciation and rental income.

- Real Estate Limited Partnerships (RELPs): RELPs involve a partnership between general partners, who manage the investment, and limited partners, who contribute capital. This structure allows investors to participate in larger projects while minimizing their hands-on responsibilities.

- Real Estate Wholesaling: Wholesaling involves identifying distressed properties, securing them under contract, and then assigning the contract to another buyer for a fee. With $10,000, one can focus on finding lucrative deals and building relationships with investors.

- Fix-and-Flip Strategy: For those with a knack for renovations, this strategy involves identifying undervalued properties, renovating them, and selling them at a higher price.

- Real Estate Exchange-Traded Funds (ETFs): Real estate ETFs track the performance of real estate indices, providing diversification and liquidity. This option is suitable for those who prefer a hands-off approach to real estate investing.

- Real Estate Individual Retirement Accounts (IRAs): These accounts allow investors to use their retirement savings to invest in real estate, potentially offering tax advantages while building a real estate portfolio.

- Real Estate Tax Liens: When a homeowner fails to pay property taxes, investors can buy the tax lien on the property. Investors make arrangements with the property owner for repayment, with interest rates ranging from 5% to 35%. While rare, if the owner does not pay, the investor can foreclose on the property.

Crafting a Cover Letter for Investment Management Roles

You may want to see also

Peer-to-peer lending

There are several platforms that facilitate peer-to-peer lending, including Funding Circle, Kiva, LendingClub, Prosper, and Upstart. These platforms connect borrowers directly to lenders, with each platform setting its own rates and terms. Most sites offer a range of interest rates based on the creditworthiness of the applicant.

The process typically involves an investor opening an account and depositing funds, while loan applicants post a financial profile and are assigned a risk category that determines their interest rate. The investor can then choose to lend to borrowers manually or use the platform's automated investing feature.

For example, Prosper.com allows investors to lend as little as $25 to multiple borrowers, who together fund a larger loan. The investor essentially becomes the bank, earning interest on the loan.

It is important to note that peer-to-peer lending comes with risks. The default rates for P2P loans can be higher than those of traditional lending institutions, and investors should be aware of transaction fees imposed by the platforms. Diversifying loans and carefully researching borrowers can help mitigate these risks.

Some popular P2P platforms outside the US include Mintos, Iuvo Group, Envestio, and Crowdestor, which offer high-interest loans with buyback guarantees.

Foxconn's India Investment: Where and Why?

You may want to see also

Stock investing

Firstly, it's important to diversify your portfolio. Don't put all your eggs in one basket. Spread your $1000 across a variety of stocks in different sectors to minimize risk. Look for companies with a strong track record of growth and a bright future. Biotech, tech startups, and renewable energy companies often offer high growth potential, but they can be volatile, so do your research and understand the risks.

Another strategy is to invest in established companies that pay dividends. Dividend stocks can provide a steady income stream, and if you reinvest those dividends, you can benefit from compound growth over time. Many companies offer dividend reinvestment plans (DRIPs) that allow you to automatically use your dividends to purchase more shares. This can be a great way to grow your $1000 investment over time.

Consider using a dollar-cost averaging strategy. This involves investing a fixed amount regularly, say $100 per month, regardless of the share price. When prices are high, you'll buy fewer shares, and when prices drop, you'll purchase more. This smooths out the impact of market volatility and ensures you don't invest a large sum right before a market dip.

Finally, remember that investing $1000 and turning it into $10,000 will take time and patience. It's unlikely to happen overnight, and you should be prepared to hold your investments for the long term, through market ups and downs. By regularly reviewing your portfolio, staying informed about the companies you invest in, and keeping an eye on broader market trends, you can increase your chances of achieving your $10,000 goal.

Remember, investing always carries risks, and past performance is never a guarantee of future results. Do your own research and, if necessary, consult a financial advisor to help you make informed decisions about your money.

Creating Casting Sand: A Guide to Investment Casting

You may want to see also

Frequently asked questions

To turn $1,000 into $10,000 through investing, you can consider various options such as investing in stocks, bonds, real estate, or cryptocurrencies. It's important to assess your risk tolerance and diversify your investment portfolio to reduce potential losses.

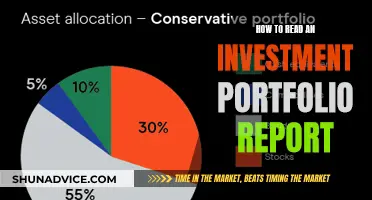

One strategy is to allocate your funds across different asset classes. For example, you could invest 60% in stocks, 20% in bonds, 10% in commodities, and 10% in gold and bitcoin through exchange-traded funds (ETFs). Additionally, consider investing in index funds or using a robo-advisor for a more hands-off approach.

Yes, there are alternative ways to turn $1,000 into $10,000 that don't involve traditional investing. You could start a business, such as an online store or a service-based business like freelance writing or lawn care. Another option is to buy and resell items for a profit. This could include flipping furniture, electronics, clothing, or other items.