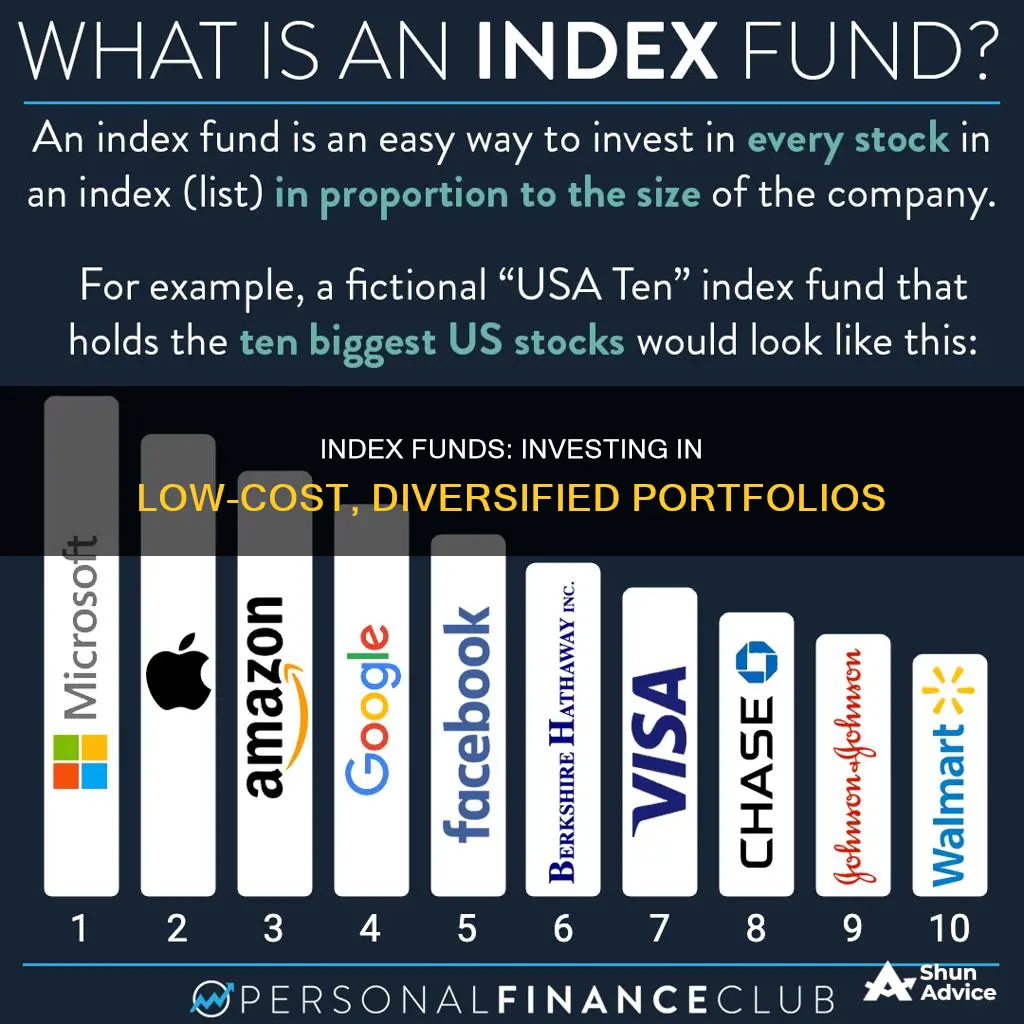

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. They are a low-cost way to build a diversified investment portfolio and are suitable for both new and experienced investors. Index funds are passively managed, meaning they aim to replicate the performance of an underlying index, and are therefore cheaper than actively managed funds. When investing in index funds, it is important to consider factors such as the fund's expenses, taxes, investment minimums, and trading costs.

| Characteristics | Values |

|---|---|

| Type of investment fund | Exchange-traded fund (ETF) or mutual fund |

| Investment type | Stocks, bonds, commodities, or other assets |

| Investment strategy | Passive |

| Risk | Lower than individual stocks |

| Returns | Attractive |

| Costs | Low expense ratio |

| Diversification | High |

| Taxes | Tax-efficient |

What You'll Learn

Understand the basics of index fund investing

Index funds are a passive investment strategy that tracks a specific collection of assets called an index. The index can include stocks, bonds, and other assets, including commodities such as gold. The fund manager's goal is to replicate the index's performance without actively investing in the market. Instead, they hold the same assets in the same proportions.

Index funds are available as either exchange-traded funds (ETFs) or mutual funds. ETFs are typically associated with stock index funds, while mutual funds are used for bond index funds. ETFs are generally available at all brokers that allow stock trading, but mutual funds may have more limited availability.

When investing in index funds, it's essential to consider the index's long-term returns and the cost of owning the fund. The S&P 500, for example, has returned about 10% annually over the long term. The fund's expense ratio is a critical factor, as it represents the fee you pay to the fund company as a percentage of your investment. Lower expense ratios are preferable, as they result in higher returns.

Some popular indexes that index funds track include:

- S&P 500: Tracks around 500 of the largest US companies

- Dow Jones Industrial Average: Tracks 30 of the largest US companies

- Nasdaq Composite: Measures the performance of over 3,000 companies listed on the Nasdaq stock market, with a focus on technology

- Russell 2000: Tracks the performance of about 2,000 of the smallest publicly traded US companies

When choosing an index fund, you can consider the following categories:

- Total US stock market funds: Track indexes that include all publicly traded US companies

- S&P 500 index funds: Offer diversified exposure to the largest US companies

- Index funds by market segment: Focus on large-cap, mid-cap, or small-cap companies to tailor your portfolio to your risk tolerance

- Sector-specific funds: Invest in a particular stock market sector, such as technology

- Style-specific funds: Invest in a particular type of stock, such as value, growth, or dividend stocks

It's also important to research and analyze the index funds you're considering, understand their expenses, taxes, and investment minimums, and decide which index fund best fits your portfolio and investment goals.

Investment Fund Balance Stagnation: Why It Happens

You may want to see also

Choose an index fund with the lowest costs and closest index tracking

Index funds are a great investment for building wealth over the long term. They are a group of stocks that mirror the performance of an existing stock market index, such as the Standard & Poor's 500 index.

When choosing an index fund with the lowest costs and closest index tracking, here are some key factors to consider:

- Investment Objective: Determine your investment goals, such as long-term wealth building, income generation, or portfolio diversification, and choose an index fund that aligns with those objectives.

- Risk Tolerance: Assess your risk appetite and select an index fund that matches your risk profile. Large-cap index funds are generally considered less risky than mid-cap or small-cap funds.

- Expense Ratio: Compare the expense ratios of different index funds, as lower fees can significantly impact long-term profits. Exchange-traded funds (ETFs) typically have lower expense ratios compared to standard index funds.

- Tracking Error: Evaluate the fund's ability to closely track the performance of the underlying index by analysing its tracking error, which measures the deviation from the index's returns.

- Fund Manager and Fund House: Consider the reputation and track record of the fund manager and the fund house, as well as their investment philosophy and management style.

- Taxation: Understand the tax implications of investing in different types of index funds, as the tax treatment may vary depending on the fund structure (e.g., mutual fund or ETF).

- Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX): Tracks the CRSP US Total Market Index, with a low 2.2% turnover rate and a 0.04% expense ratio.

- Fidelity ZERO Large Cap Index: Doesn't officially track the S&P 500 but follows the Fidelity US Large Cap Index. It has a 0% expense ratio, meaning no fees for investors.

- Vanguard 500 Index Fund Admiral Shares (VFIAX): Tracks the S&P 500 with a 0.04% expense ratio.

- Vanguard Total International Stock Index Fund Admiral Shares (VTIAX): Tracks the FTSE Global All Cap ex US Index with a competitively low 3.9% turnover rate and a 0.12% expense ratio.

- Vanguard Total World Stock Index Fund Admiral Shares (VTWAX): Tracks the FTSE Global All Cap Index, keeping portfolio turnover low at 4.3% and expense ratios reasonable at 0.1%.

- Vanguard Value Index Fund Admiral Shares (VVIAX): Tracks the CRSP US Large Cap Value Index with a 0.05% expense ratio and a decently low 10.3% portfolio turnover rate.

- Vanguard Wellington Fund Investor Shares (VWELX): A fund with a long track record that allocates two-thirds of its assets to large- and mid-cap stocks with high dividends and low valuations, and one-third to investment-grade corporate bonds. It has a 0.26% expense ratio and pays a 2.3% 30-day SEC yield.

- Vanguard Target Retirement 2070 Fund (VSVNX): A target-date fund that gradually adjusts its asset allocation to become more conservative over time, making it suitable for investors planning to retire around 2070.

Arbitrage Funds: A Smart Investment Move for Europeans

You may want to see also

Decide how to buy index fund shares

You can purchase an index fund share directly from a mutual fund company or a brokerage. The same goes for exchange-traded funds (ETFs). These are like mini mutual funds that trade like stocks throughout the day. When deciding where to buy an index fund, consider the following:

- Fund selection: Do you want to purchase index funds from various fund families? The big mutual fund companies carry some of their competitors' funds, but the selection may be more limited than what's available from a discount broker.

- Convenience: Find a single provider who can accommodate all your needs. For example, if you're just going to invest in mutual funds (or even a mix of funds and stocks), a mutual fund company may be able to serve as your investment hub. But if you require sophisticated stock research and screening tools, a discount broker that also sells the index funds you want may be better.

- Trading costs: If the commission or transaction fee isn't waived, consider how much a broker or fund company charges to buy or sell the index fund. Mutual fund commissions are higher than stock trading ones (about $20 or more). Compare that with less than $10 a trade for stocks and ETFs.

- Impact investing: Want your investment to make a difference outside your portfolio? Some funds target companies with a focus on environmental or social justice causes.

- Commission-free options: Do they offer no-transaction-fee mutual funds or commission-free ETFs?

To purchase shares of an index fund, you'll need to open an investment account. A brokerage account, individual retirement account (IRA), or Roth IRA will all work. You can then buy the fund in the account. When you go to purchase the fund, you may be able to select a fixed dollar amount to spend or choose a number of shares. The share price of the index fund and your investing budget will likely determine how much you're willing to spend.

Example:

If you have $1,000 you'd like to invest in an index fund, and the fund you're looking at is selling for $100 a share, you'd be able to purchase 10 shares.

TSP Funds: Where to Invest for Maximum Returns

You may want to see also

Research and analyse index funds

Researching and analysing index funds is a crucial step in the investment process. Here are some key considerations to keep in mind:

Understanding the Index Fund Landscape:

- Index funds are investment funds, typically offered as mutual funds or exchange-traded funds (ETFs), that aim to replicate the performance of a specific market index. Examples of popular indexes include the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite.

- Index funds are passively managed, meaning they aim to mirror the composition and performance of the underlying index without actively selecting securities. This passive approach results in lower fees compared to actively managed funds.

- Index funds provide instant diversification across various sectors and asset classes, reducing the risk associated with individual stocks.

Identifying Investment Objectives:

Determine your investment goals and risk tolerance. Are you investing for retirement, long-term growth, or a specific financial goal? This will help you choose the right index funds that align with your objectives.

Evaluating Different Index Funds:

- When analysing index funds, consider factors such as the geographic location of the investments, the business sector or industry focus, and the market opportunity presented by the fund.

- Compare the expense ratios of different funds tracking the same index. Lower expense ratios mean lower fees, resulting in higher returns over time.

- Assess the long-term performance of the index fund to gauge its potential for future returns. While past performance doesn't guarantee future results, it provides valuable insight.

- Consider the fund's trading costs, investment minimums, and tax implications. Some brokers offer commission-free trading for certain index funds, while mutual funds may have minimum investment requirements.

Selecting a Brokerage or Fund Provider:

- Decide whether to purchase index funds directly from a mutual fund company or through a brokerage. Consider factors such as fund selection, convenience, trading costs, and impact investing options.

- Compare the fees and features offered by different brokers or fund providers to make an informed decision.

Remember, it's essential to conduct thorough research and due diligence before investing in index funds. Consult with financial advisors or professionals if needed to ensure your investment decisions align with your financial goals and risk tolerance.

U.S. Investment Fund Transition to Schwab: What, When, Why?

You may want to see also

Compare the performance of actively managed funds with specific benchmarks

When comparing the performance of actively managed funds with specific benchmarks, it's important to understand the differences between these two types of investment funds.

Index funds, including mutual funds and exchange-traded funds (ETFs), are designed to mirror the performance of a specific market index or benchmark. They aim to keep pace with market returns by investing in all or a representative sample of the stocks or bonds in the index they are tracking. Index funds are passively managed, meaning there is no portfolio manager making buying and selling decisions, which results in lower fees for investors.

On the other hand, actively managed funds try to beat market returns by having professional money managers hand-pick investments. These funds aim to outperform their benchmark and involve more frequent trading, which can lead to higher taxable capital gains. The added expertise and research that goes into actively managed funds also come with higher costs.

When comparing the performance of actively managed funds with specific benchmarks, it's essential to consider the level of risk and potential returns associated with each. Actively managed funds introduce the risk that the portfolio manager may underperform the benchmark, whereas index funds closely follow the performance of their benchmark, for better or worse.

According to a study by S&P Dow Jones Indices, no actively managed stock or bond funds outperformed their respective markets convincingly and consistently over a five-year period. This highlights the challenge of trying to beat the market and the potential benefits of investing in low-cost index funds that mirror the overall market.

When making investment decisions, it's crucial to assess your investment goals, risk tolerance, and time horizon. While actively managed funds offer the potential for higher returns, they also come with higher costs and the risk of underperforming the market. On the other hand, index funds provide broad market exposure, low fees, and long-term growth potential, making them a popular choice for investors seeking a more passive investment strategy.

Mutual Funds Backing AMD: Who's Investing in the Tech Giant?

You may want to see also

Frequently asked questions

Low-cost index funds are a type of pooled investment vehicle that follows a benchmark, such as the S&P 500 or the Dow Jones Industrial Average. They are designed to replicate the performance of an underlying index, as people cannot invest directly in an index. Index funds are passively managed, which keeps costs low.

When choosing a low-cost index fund, consider the exposure you want (e.g., large-cap stocks, international stocks, or bonds). Look for a liquid fund, which is typically measured by trading volume, and consider the fund's structure. Compare expense ratios, as lower fees can significantly impact long-term profits.

The pros of low-cost index funds include their low cost and the diversification they offer. There are various fund types and styles available, and they may offer long-term investors more consistency. However, a con of index funds is that they seek to replicate an index's performance, so the fund's return will be similar to the index and not higher.

You can invest in low-cost index funds by opening and funding a brokerage account. Most brokers allow you to buy shares of ETFs on the open market, and some also let you invest directly in mutual funds. You can also open an account directly with a mutual fund company that offers an index fund you're interested in.