Investing for the long term in India can be a rewarding strategy, offering the potential for significant wealth accumulation over time. This guide will explore key considerations and strategies for building a robust investment portfolio in India, focusing on long-term growth. We'll delve into various investment options, such as stocks, bonds, mutual funds, and real estate, highlighting the benefits and risks associated with each. Additionally, we'll discuss the importance of diversification, risk management, and the role of financial advisors in helping investors navigate the complexities of the Indian market. By the end of this guide, readers will have a comprehensive understanding of how to build a sustainable investment strategy tailored to their financial goals and risk tolerance.

What You'll Learn

- Diversify: Spread investments across asset classes like stocks, bonds, and real estate

- Research: Study market trends, company fundamentals, and economic indicators for informed decisions

- Risk Management: Understand risk tolerance and employ strategies like stop-loss orders

- Long-Term Perspective: Focus on consistent growth over time, avoiding short-term market volatility

- Consult Professionals: Seek advice from financial advisors for tailored investment strategies

Diversify: Spread investments across asset classes like stocks, bonds, and real estate

When it comes to long-term investing in India, diversification is a key strategy to manage risk and optimize returns. This involves allocating your investments across different asset classes to ensure a balanced approach. Here's a detailed guide on how to diversify your portfolio:

Stocks: Investing in the stock market is a popular choice for long-term growth. Indian stocks offer the potential for significant capital appreciation over time. Research and identify companies with strong fundamentals, a history of growth, and a competitive advantage in their industry. Diversify your stock picks by considering various sectors such as technology, healthcare, banking, and consumer goods. You can invest directly in individual stocks or opt for mutual funds and exchange-traded funds (ETFs) that provide instant diversification across multiple companies.

Bonds: Bond investments are essential for adding stability and income to your portfolio. Government bonds and corporate bonds are common choices. Bonds offer a steady stream of interest income and are generally considered less risky than stocks. Diversify by investing in bonds with different maturity dates and credit ratings. Longer-term bonds provide higher yields but come with increased interest rate risk, while shorter-term bonds offer lower yields but less volatility.

Real Estate: Including real estate in your investment portfolio can be a powerful way to diversify. This asset class provides exposure to the property market, which has historically shown steady long-term growth. You can invest in physical real estate by purchasing properties, which can be a significant commitment. Alternatively, consider real estate investment trusts (REITs), which are companies that own and operate income-generating properties. REITs offer the advantage of liquidity and diversification across multiple properties without the need for direct property management.

To diversify effectively, allocate a portion of your investment capital to each asset class. A common approach is to use the 60/30/10 rule, where 60% is allocated to stocks, 30% to bonds, and 10% to real estate. However, this allocation can be adjusted based on your risk tolerance, financial goals, and market conditions. Regularly review and rebalance your portfolio to maintain your desired asset class distribution.

Remember, diversification is a long-term strategy, and it's essential to hold your investments for extended periods to benefit from compound growth. Stay informed about market trends, economic factors, and the performance of your chosen asset classes to make informed decisions and adjust your portfolio as needed.

Are NFTs a Long-Term Investment? Exploring the Future of Digital Art

You may want to see also

Research: Study market trends, company fundamentals, and economic indicators for informed decisions

When considering long-term investments in India, thorough research is essential to make informed decisions. Here's a breakdown of the key areas to focus on:

Market Trends:

- Analyze Historical Performance: Study historical stock market performance in India over various economic cycles. Identify trends, patterns, and potential areas of growth. Look at long-term averages, volatility, and key milestones.

- Identify Sectoral Strengths and Weaknesses: India's economy is diverse, with sectors like technology, manufacturing, healthcare, and financial services playing significant roles. Research which sectors are expected to grow and why. Understand the impact of global trends and geopolitical factors on these sectors.

- Stay Updated on Regulatory Changes: Keep track of changes in government policies, tax regulations, and industry-specific laws. These can significantly influence market dynamics and individual company performance.

Company Fundamentals:

- Financial Statements: Carefully analyze a company's financial health by examining its income statements, balance sheets, and cash flow statements. Look for consistent revenue growth, strong profit margins, healthy debt levels, and a robust balance sheet.

- Management Team: Assess the experience, track record, and vision of the company's management team. A competent and visionary leadership is crucial for long-term success.

- Competitive Advantage: Understand what sets the company apart from its competitors. Is it a strong brand, innovative products, cost leadership, or a unique market position?

- Growth Prospects: Evaluate the company's growth prospects. Does it have a strong pipeline of new products or services? Is it expanding into new markets?

Economic Indicators:

- GDP Growth: Monitor India's GDP growth rate, as it reflects the overall health of the economy. Strong GDP growth often correlates with favorable investment opportunities.

- Inflation: High inflation can erode the value of your investments over time. Track inflation rates and understand how they might impact your investment returns.

- Interest Rates: Changes in interest rates can affect bond prices and the cost of borrowing. Keep an eye on monetary policy decisions made by the Reserve Bank of India.

- Foreign Investment Flows: Monitor foreign direct investment (FDI) inflows into India. Increased FDI often signifies confidence in the economy and can create opportunities for investors.

Additional Research Considerations:

- Risk Assessment: Understand your risk tolerance and diversify your investments accordingly. Consider factors like market volatility, sector-specific risks, and geopolitical risks.

- Long-Term Outlook: Remember that long-term investments require a patient approach. Don't be swayed by short-term market fluctuations.

- Consultation: Consider seeking advice from financial advisors who can provide personalized guidance based on your financial goals and risk profile.

By conducting thorough research on market trends, company fundamentals, and economic indicators, you can make more informed investment decisions and increase your chances of achieving long-term financial success in India.

George Soros' Short-Term Investing Strategy: Unlocking Market Secrets

You may want to see also

Risk Management: Understand risk tolerance and employ strategies like stop-loss orders

When it comes to long-term investing in India, understanding and managing risk is crucial for building wealth over time. Risk tolerance is a fundamental concept that investors should grasp, as it determines their ability to withstand market fluctuations and volatility. Each investor has a unique risk tolerance level, which is influenced by factors such as age, financial goals, and investment horizon. For long-term investors, it's essential to recognize that markets can be unpredictable, and short-term price movements can be significant.

To manage risk effectively, investors should first assess their risk tolerance. This involves evaluating your financial situation, investment goals, and the time you can commit to monitoring your investments. Younger investors with a longer investment horizon might be more inclined to take on higher risks, as they have more time to recover from potential losses. In contrast, older investors with retirement goals in the near future may prefer a more conservative approach. Understanding your risk tolerance will help you make informed decisions about the types of investments you choose.

One powerful strategy to manage risk is implementing stop-loss orders. A stop-loss order is an instruction to sell an asset when it reaches a certain price, which is designed to limit potential losses. For example, if you purchase shares of a company and set a stop-loss price at 10% below your purchase price, the order will trigger a sell if the stock price drops to that level. This strategy is particularly useful for long-term investors who want to protect their capital from significant downturns. By setting a stop-loss, you create a safety net that automatically sells your position if the market moves against your expectations, ensuring that you don't incur substantial losses.

Additionally, stop-loss orders can be customized to fit individual risk preferences. Investors can choose the percentage drop or price movement that triggers the order, allowing for a more personalized risk management approach. It's important to note that stop-loss orders don't guarantee a profit or protect against market losses, but they provide a disciplined way to manage risk and can help investors stay committed to their long-term investment strategy.

In summary, long-term investors in India should focus on understanding their risk tolerance and employ risk management techniques like stop-loss orders to safeguard their investments. By assessing individual risk profiles and implementing appropriate strategies, investors can make informed decisions, protect their capital, and stay on track to achieve their financial goals over the long term. Remember, risk management is an essential component of a successful investment journey.

Mastering Long-Term Investing: Strategies for Building Wealth Over Time

You may want to see also

Long-Term Perspective: Focus on consistent growth over time, avoiding short-term market volatility

When it comes to investing for the long term in India, a strategic approach is essential to navigate the country's dynamic and evolving markets. The primary goal is to focus on consistent growth and avoid the pitfalls of short-term market volatility. Here's a comprehensive guide to help you achieve this:

Understand Your Investment Horizon: Long-term investing is a commitment that requires a patient mindset. It involves a longer-term view of financial goals, typically spanning several years or even decades. This approach is particularly beneficial for young investors who have a substantial time horizon to build wealth. By understanding the time you can invest, you can make more informed decisions about asset allocation and risk management.

Diversify Your Portfolio: Diversification is a key strategy to manage risk and ensure consistent growth. Instead of putting all your money into a single investment, distribute your portfolio across various asset classes. In the Indian context, this could include a mix of equity, debt, and alternative investments. For instance, you might allocate a significant portion to the stock market, which historically has provided higher returns over the long term, but also consider debt instruments like government bonds for stability. Diversification helps reduce the impact of any single investment's performance on your overall portfolio.

Embrace Index Funds and ETFs: Index funds and Exchange-Traded Funds (ETFs) are excellent tools for long-term investors. These funds track a specific market index, such as the Nifty 50 or BSE Sensex, and offer broad exposure to the market. By investing in these funds, you gain access to a diverse range of companies, reducing the risk associated with individual stocks. Over time, this strategy has proven to be highly effective, as it captures the overall market growth while minimizing the impact of market volatility.

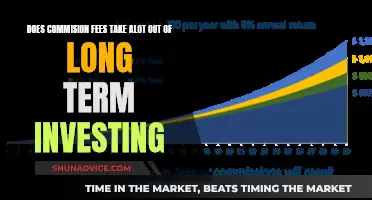

Stay Invested and Avoid Timing the Market: One of the most challenging aspects of investing is trying to time the market, which often leads to poor long-term outcomes. Market volatility is inevitable, and attempting to predict the bottom or top can be risky. Instead, maintain a disciplined investment approach by staying invested in your well-researched and diversified portfolio. Historical data shows that markets tend to recover and grow over the long term, and by avoiding frequent trading, you can benefit from compound interest and the power of long-term growth.

Regularly Review and Rebalance: Long-term investing requires periodic reviews to ensure your portfolio aligns with your goals and risk tolerance. Review your investments at least once a year, or more frequently if you prefer a more active approach. Rebalance your portfolio by adjusting the allocation of assets to maintain your desired risk level. For example, if the stock market has outperformed your debt investments, you might reallocate some funds to bring the portfolio back to its original target allocation. This process helps manage risk and ensures your investments stay on track.

In summary, investing for the long term in India requires a strategic approach that emphasizes consistency, diversification, and a long-term perspective. By avoiding short-term market fluctuations and focusing on your investment goals, you can build a robust financial portfolio. Remember, long-term investing is a journey, and staying committed to your strategy will ultimately lead to significant wealth accumulation.

Unveiling the Tricks: How Short-Term Investments Are Manipulated

You may want to see also

Consult Professionals: Seek advice from financial advisors for tailored investment strategies

When it comes to long-term investing in India, consulting professionals is a crucial step to ensure you make informed and strategic decisions. Financial advisors are experts who can provide valuable insights and guidance tailored to your specific goals and risk tolerance. Here's why seeking their advice is essential:

Personalized Financial Planning: Investment strategies should be unique to each individual. A financial advisor will assess your current financial situation, including your income, expenses, assets, and liabilities. They will then create a comprehensive financial plan that aligns with your long-term objectives. This plan might include retirement planning, wealth creation, or even tax-efficient strategies. By understanding your personal circumstances, advisors can offer customized advice, ensuring your investments are well-suited to your needs.

Market Knowledge and Expertise: The Indian market can be complex and dynamic, with various investment options available. Financial advisors possess extensive knowledge of the market, including its historical performance, current trends, and potential risks. They stay updated on economic policies, industry-specific news, and global market movements that could impact your investments. This expertise allows them to provide insights on the best investment avenues, such as stocks, bonds, mutual funds, or real estate, and help you navigate the ever-changing investment landscape.

Risk Management and Diversification: Long-term investing requires a well-thought-out risk management strategy. Advisors can assist in identifying and mitigating potential risks associated with different investment options. They will recommend a diversified portfolio to ensure your investments are spread across various asset classes, sectors, and geographic regions. Diversification is a key principle to minimize risks and maximize returns over the long term. By allocating your investments wisely, advisors can help protect your capital and optimize growth potential.

Regular Review and Adjustments: Investment strategies should not be set-and-forget plans. Financial advisors provide ongoing support by regularly reviewing your portfolio's performance and making necessary adjustments. Market conditions and personal circumstances can change over time, and advisors ensure your investment strategy remains aligned with your goals. They can rebalance your portfolio, reallocate assets, or suggest alternative investments to adapt to market shifts and help you stay on track.

Tax Efficiency and Legal Compliance: Navigating the tax implications of investments can be challenging. Financial advisors can offer strategies to minimize tax liabilities and ensure compliance with Indian tax laws. They can also provide guidance on legal aspects, such as choosing the right investment vehicles, understanding the tax benefits of different schemes, and optimizing your investment returns.

In summary, consulting financial advisors is a vital step towards successful long-term investing in India. Their expertise, personalized approach, and ability to provide tailored strategies can help you make informed decisions, manage risks, and grow your wealth over time. Remember, investing is a journey, and having a professional guide can make it a more rewarding and secure experience.

Maximizing Revenue: Understanding Short-Term Investments and Revenue Recognition

You may want to see also

Frequently asked questions

Long-term investing in India can be a lucrative strategy, and there are several ways to approach it. One popular method is to invest in the stock market through index funds or equity mutual funds. These funds track a specific market index, such as the NIFTY 50 or BSE SENSEX, and offer diversification across multiple companies. Over time, this approach can provide solid returns as the Indian economy grows and companies expand.

Beginning your long-term investment journey in India can be as simple as opening a demat account and a trading account with a reputable brokerage firm. You can then research and select companies or sectors you believe will perform well over time. Consider investing in blue-chip companies with a strong track record and a history of dividend payments. Diversifying your portfolio across different sectors and industries is also crucial to managing risk.

India has a diverse economy, and several sectors offer long-term investment opportunities. The technology and information technology (IT) sectors are known for their growth potential, with many Indian companies excelling in software development, IT services, and digital solutions. Additionally, the infrastructure, banking, and financial services sectors are often considered stable and reliable for long-term investments. Keep an eye on emerging sectors like renewable energy, healthcare, and e-commerce, which are expected to grow significantly in the coming years.

Understanding the tax rules is essential for long-term investors. In India, capital gains from the sale of listed securities are taxed at a flat rate of 15% for individuals. However, if you hold the investment for more than 12 months, the tax rate can be reduced to 10%. Dividend income is generally tax-free if the holding period is 36 months or more. It's advisable to consult a financial advisor or tax expert to ensure you are taking advantage of all available tax benefits and deductions.