Utility is a measure of the satisfaction or benefit consumers derive from certain goods or services. In finance, it refers to the benefit investors obtain from portfolio performance, taking risk into account. Utility functions are used to mathematically represent this benefit as a function of a portfolio's expected return, portfolio variance, and a measure of risk aversion. Investors can use utility functions to make investment decisions that align with their risk attitudes and strategies. This involves understanding their utility of money and their tolerance for risk, which can be categorized as risk-averse, risk-neutral, or risk-seeking. By maximizing expected utility, investors can choose investment strategies that provide the highest benefit while managing risk.

| Characteristics | Values |

|---|---|

| Utility | A measure of the satisfaction or benefit consumers derive from certain goods or services |

| Utility Function | A function that describes a consumer's preference for one bundle of goods over another |

| Ordinal Utility | Ranks a customer's choices by preference |

| Cardinal Utility | Assigns a numeric value to each preference to determine how much more one good is preferred over another |

| Marginal Utility | Measures the change in utility when the rate of consumption changes |

| Total Utility | Measures the satisfaction or benefit a person gets from the total consumption of a product or service |

| Risk-aversion | A type of utility curve where consumers have a decreasing desire to take on more risk as they take on more risk |

| Risk-neutrality | A type of utility curve where consumers continuously take on more risk as it results in more utility |

| Risk-seeking | A type of utility curve where consumers experience increasing marginal utility as they take on more risk |

| Utility Funds | A portfolio of stocks, bonds, or other securities in the utilities sector that provides reliable income and stock price appreciation potential with lower volatility |

| Expected Utility Theory | The idea that individuals seek to maximize the expected utility of their decisions, taking into account uncertainty and risk |

What You'll Learn

Risk-averse investors and utility

Risk-averse investors are those who tend to avoid uncertainty and prioritise the preservation of their capital over the potential for higher returns. In other words, they are more comfortable with a predictable, lower payoff than a highly unpredictable, possibly higher one. This is reflected in their investment choices, which tend to be low-risk and stable.

When it comes to utility, or the benefit derived from an investment, risk-averse investors tend to have a lower tolerance for risk and demand more return for every unit of increased risk. This is because, as risk increases, they require more return to maintain the same level of utility. This can be illustrated using an indifference curve, which shows the risk-return requirements of an investor at a certain level of utility. For a risk-averse investor, the curve will run "northeast", indicating that they must be compensated with higher returns for taking on more risk.

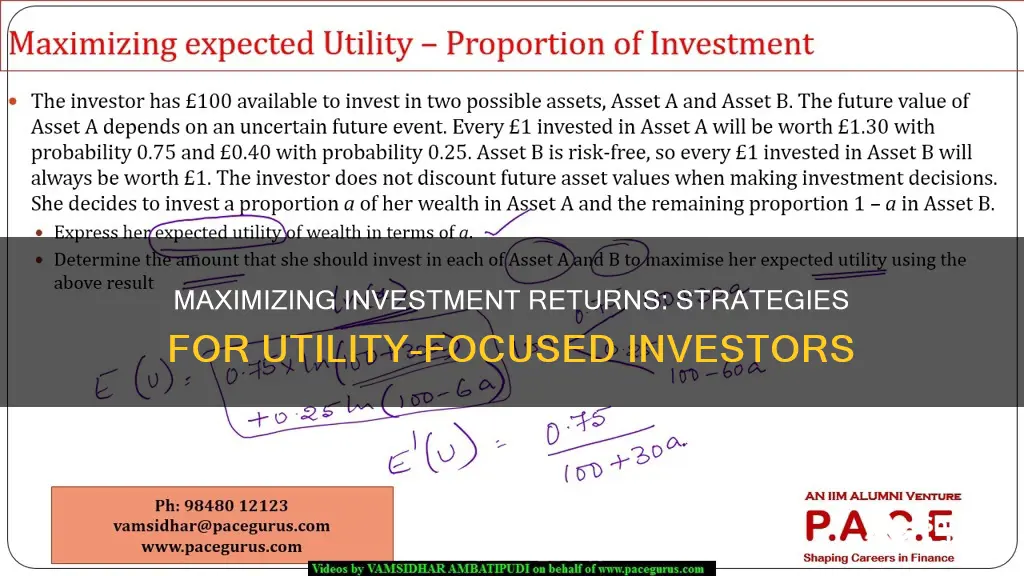

The utility function for a risk-averse investor can be represented mathematically as:

U = E(R) – ½ A * Variance

Where:

- U is the level of utility or satisfaction

- E(R) is the expected return of the investment

- A is the level of risk averseness

- Variance is the portfolio variance

From this function, we can observe that utility increases as expected returns increase, and decreases as variance or risk increases. Additionally, as risk aversion increases, utility decreases.

Risk-averse investors often favour liquid investments, such as savings accounts, certificates of deposit (CDs), municipal and corporate bonds, and dividend growth stocks. These types of investments provide stability and a reasonable, if not spectacular, return. For example, a high-yield savings account offers a stable return with virtually no investment risk, while dividend growth stocks provide predictable dividend payments that can offset losses during downturns.

Another strategy for risk-averse investors is to invest in utility funds, which consist of a portfolio of stocks, bonds, or other securities in the utilities sector. These funds provide reliable income and stock price appreciation potential with lower volatility compared to other sectors. The utilities sector is considered a "safe-haven" sector due to the stable demand for utility services, even during recessions.

In summary, risk-averse investors seek to minimise the potential for losses and are willing to sacrifice higher returns for greater stability. This is reflected in their utility function, which decreases as risk aversion increases, and their investment choices, which tend to be low-risk and liquid.

Index Funds: Diversified, Low-Cost, Long-Term Investment Strategy

You may want to see also

Utility and indifference curves

Utility

Utility is a measure of the benefit or satisfaction an individual derives from a good or service. In finance, it refers to the benefit investors obtain from the performance of their portfolios. While high returns are often desirable, they usually come with increased risk. Thus, understanding one's utility of money can help investors make decisions suited to their risk attitudes and investment strategies.

Indifference Curves

Indifference curves are graphical representations of different quantities of two goods, between which a consumer is indifferent. In other words, an indifference curve shows all combinations of two goods that provide a consumer with equal utility or satisfaction. Each point on the curve represents the same level of utility, and the consumer has no preference for one combination over another on the same curve.

For example, let's consider Lilly, who enjoys reading paperback books and eating doughnuts as her main relaxation activities. An indifference curve can be plotted to show all the combinations of books and doughnuts that provide Lilly with the same level of utility. If she has two books and 120 doughnuts, this may give her the same satisfaction as having three books and 84 doughnuts, or 11 books and 40 doughnuts, and so on.

The shape of an indifference curve is typically downward-sloping from left to right and convex with respect to the origin. This means it is steeper on the left and flatter on the right. The slope of the curve, known as the marginal rate of substitution, indicates the rate at which a consumer is willing to trade one good for another to maintain a constant level of utility.

Indifference curves are useful because they help us understand consumer preferences without needing to assign numerical values to utility, which can be challenging and unrealistic. By examining these curves, we can gain insights into how consumers make choices and how they respond to changes in prices, income, and substitution effects.

When it comes to investing, utility and indifference curves can be applied to understand how investors balance risk and return to maximise their satisfaction. The utility function for an investor can be represented mathematically as a function of the expected return of a portfolio, the portfolio variance, and a measure of risk aversion.

The two-fund separation theorem suggests that all investors, regardless of their preferences or wealth, will use a risk-free fund and a risky portfolio. The risk-free fund may be a government-issued asset with no risk. The risky portfolio combines risky assets to create a capital allocation line on a graph.

By plotting an investor's indifference curve with the capital allocation line, we can determine their optimal portfolio allocation. For instance, a risk-averse investor's indifference curve will run "northeast", indicating that they require higher returns to compensate for increased risk. On the other hand, a risk-seeking investor will have a flatter indifference curve, as they demand lower returns when taking on more risk.

In summary, utility and indifference curves are powerful tools for understanding consumer behaviour and investment decisions. They help us quantify the complex relationship between risk and return, allowing investors to make more informed choices that align with their risk tolerance and financial goals.

Roth Funds: Where to Invest and Why

You may want to see also

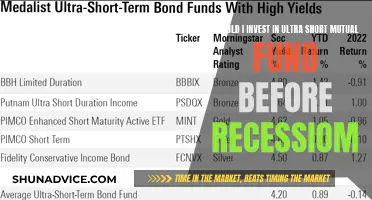

Utility funds and mutual funds

Utility funds can be categorized into two types: those following an index strategy and traditional utility funds or ETFs. Index funds aim to match the performance of a sector index or benchmark and are typically passively managed. Traditional utility funds or ETFs can be passively or actively managed, with the latter involving investment decisions aimed at outperforming benchmarks. The utilities sector is known for providing reliable dividend income, with yields typically ranging from 1-3%. Additionally, these funds offer defensive protection against inflation or recession, as utility companies can pass on higher fuel costs to consumers, maintaining their profit margins.

When selecting a utility fund, investors should consider their investment objectives, the fund's historical performance, dividend yield, the companies in the portfolio, expense ratios, and the fund's performance in different market conditions. Natural gas utility funds are particularly attractive due to their exposure to the energy sector and the growing demand for clean fossil fuels.

Mutual funds, on the other hand, offer a more diversified approach to investing. They typically invest in a wide range of companies and sectors, providing exposure to different areas of the market. Mutual funds can also be actively or passively managed, depending on the investment strategy and the fund manager's approach. While they may not offer the same level of stability as utility funds, mutual funds provide investors with access to a broader range of investment opportunities.

Ultimately, the decision to invest in utility funds, mutual funds, or a combination of both depends on the investor's risk tolerance, investment goals, and time horizon. It is essential for investors to carefully consider their options, assess their financial situation, and seek professional advice before making any investment decisions.

Aquabounty's Mutual Fund Investors: Who's Taking the Plunge?

You may want to see also

Utility functions and marginal utility

The utility function can be expressed mathematically as:

U = E(r) - 0.5 * σ^2

Where:

- U represents utility.

- E(r) is the expected return of the portfolio.

- Σ^2 denotes the portfolio variance.

The risk aversion coefficient, denoted as 'A', is a critical component of the utility function. It determines an investor's attitude towards risk:

- A > 0 indicates a risk-averse investor.

- A = 0 indicates a risk-neutral investor.

- A < 0 indicates a risk-seeking investor.

The utility function helps investors compare different portfolios and make decisions based on their risk tolerance and expected returns.

Marginal utility, on the other hand, refers to the additional benefit or satisfaction an investor derives from acquiring one more unit of a good, service, or investment. It is calculated by dividing the change in total utility by the change in the number of units consumed. Mathematically, it is expressed as:

Marginal Utility = Change in Total Utility / Change in Number of Units

Marginal utility can be positive, zero, or negative:

- Positive marginal utility occurs when consuming more of a good or service increases overall utility.

- Zero marginal utility is when consuming more has no impact on overall utility.

- Negative marginal utility arises when consuming more of a good or service decreases overall utility.

The law of diminishing marginal utility states that the first unit of consumption provides the highest utility, with each subsequent unit providing less utility. This concept is often used to explain economic behaviours, such as why consumers are willing to pay more for the first unit of a good or service.

Understanding marginal utility is crucial for investors as it helps them maximise their utility by allocating their investments efficiently. It also guides businesses in understanding consumer behaviour, setting prices, and deciding which products to innovate or upgrade.

Transamerica 401k: Where to Invest Your Funds Wisely

You may want to see also

Utility and portfolio management

When it comes to portfolio management, investors generally use two types of funds: a risk-free fund and a portfolio of risky assets. Risk-free assets are typically government-issued and carry no risk, while risky assets offer the potential for higher returns but also come with the possibility of losses. The combination of these two types of funds creates a capital allocation line on a graph, which helps investors visualise the relationship between risk and return.

To maximise utility, investors need to consider their risk preferences. A risk-averse investor may choose to invest only in risk-free assets, while a less risk-averse investor may allocate a small portion of their wealth to risky assets. On the other hand, an investor with a high-risk tolerance may borrow funds to invest in risky assets, allowing them to create a leveraged portfolio.

Utility can be represented mathematically as a function of expected return, portfolio variance, and risk aversion. This utility function can be used to rank portfolios based on their expected performance and risk characteristics. By plotting an investor's indifference curve, which shows the combination of risk and returns that an investor is willing to accept, together with the capital allocation line, investors can determine their optimal portfolio allocation.

In addition to risk-free assets and risky assets, investors can also consider utility funds, which are mutual funds that invest primarily in the utilities sector. Utility funds provide a diversified portfolio of stocks, bonds, or other securities in the utilities sector, which includes companies that provide essential services such as electricity, water, and natural gas. These funds are considered a safe investment option due to the stable demand for utility services and the ability of utility companies to maintain profit margins even during economic downturns.

Axis Long Term Equity Fund: A Smart Investment Strategy

You may want to see also

Frequently asked questions

Utility funds are a type of mutual fund that primarily invests in utilities, such as natural gas or crude oil. These funds provide a cost-effective way to gain exposure to a diversified portfolio of stocks, bonds, or other securities in the utilities sector.

Utility funds are considered a "safe-haven" investment because they provide reliable dividend income with lower volatility. Demand for utility services, such as electricity, water, and gas, tends to remain stable even during economic downturns. Additionally, utility companies can maintain profit margins by passing on higher fuel costs to consumers, making them a defensive investment against inflation or recession.

When selecting utility funds, it's important to consider your investment objectives and time horizon. If you are a long-term investor, you may prefer funds that focus on dividend income, while those seeking near-term returns might opt for funds focused on capital appreciation. Other factors to consider include the fund's historical performance, dividend yield, the companies in the fund's portfolio, fees, and how the fund has performed in different market conditions.