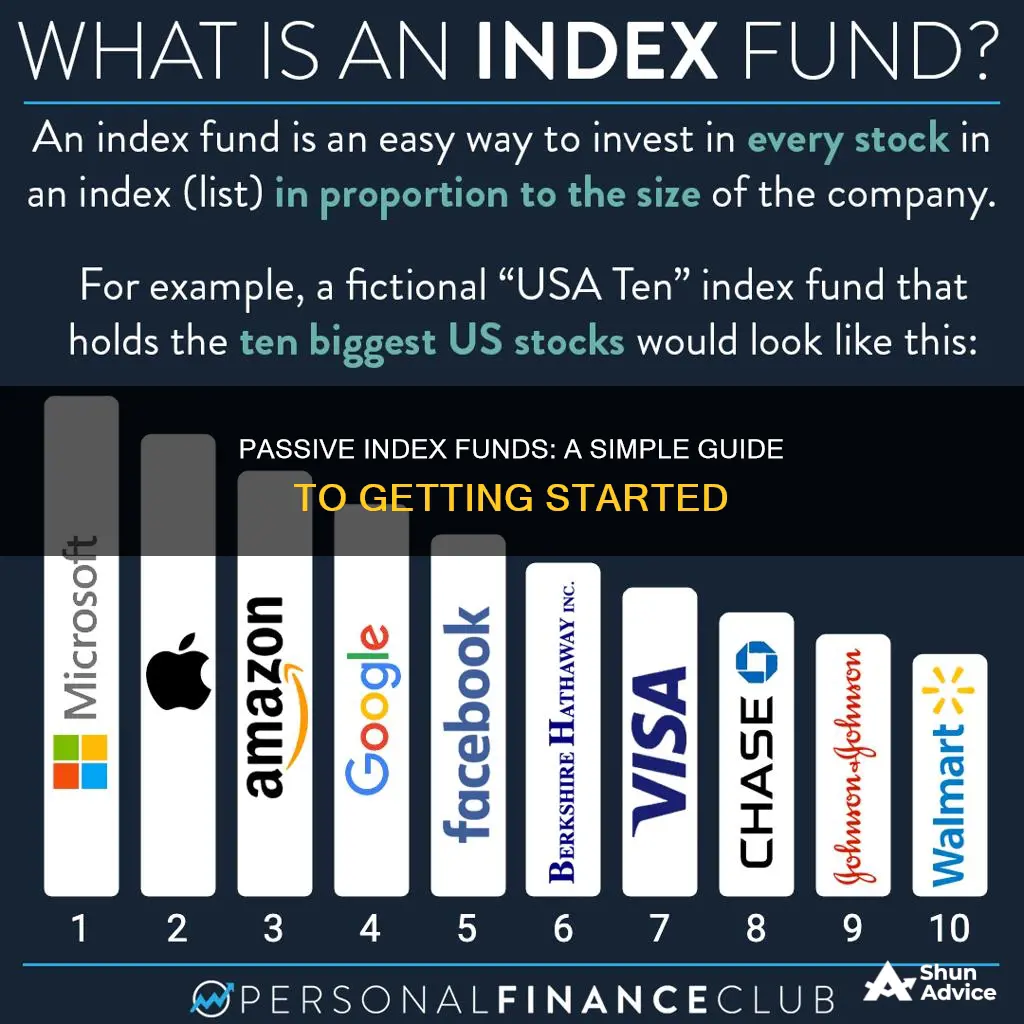

Index funds are a type of passive investment strategy that aims to mirror the performance of a specific market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. Index funds are typically offered as mutual funds or exchange-traded funds (ETFs) and are designed to be a long-term, buy-and-hold investment strategy. This means that investors buy and hold the securities in the index fund for long periods, avoiding frequent trading and the associated costs. The goal of index funds is to maximize returns by minimizing the costs of buying and selling securities.

Index funds are a popular investment choice due to their low costs, diversification benefits, and historical performance. They are often considered a good option for beginner investors as they provide a simple, cost-effective way to invest in a broad range of stocks or bonds. When investing in index funds, it is important to consider factors such as the fund's performance history, management fees, and the index it tracks. Additionally, investors should decide whether to invest in index mutual funds or ETFs, which differ in terms of trading flexibility, costs, and tax implications.

| Characteristics | Values |

|---|---|

| Investment type | Passive |

| Investment strategy | Long-term |

| Investment aim | Replicate market performance |

| Investment approach | Buy-and-hold |

| Investment scope | Broad market index or indices |

| Costs | Lower than active investing |

| Returns | Superior after-tax results over medium to long time horizons |

| Risk | Subject to market risk |

| Flexibility | Lack of flexibility |

| Performance | May underperform and lose money |

| Management | No active hunting for investments |

| Taxes | Tax-efficient |

What You'll Learn

Passive investing vs active investing

Passive investing is a strategy that aims to maximise returns by minimising the costs of buying and selling securities. It is a long-term, buy-and-hold strategy that seeks to build wealth gradually by avoiding frequent trading and reducing costs in the form of transaction fees, commissions, and taxable capital gains. Index investing is a common passive investing strategy where investors purchase securities in a representative benchmark, such as the S&P 500 index, and hold them for a long time. Passive investing is typically done by investing in mutual funds or exchange-traded funds (ETFs) that mimic the index's holdings.

On the other hand, active investing involves buying and selling investments based on their short-term performance, attempting to beat average market returns. Active investors must research and decide which securities to own, and they often take a hands-on approach by using a portfolio manager or another active participant. Active investing requires analysing investments for price changes and returns, and it can involve deeper analysis and the expertise to know when to pivot into or out of a particular stock, bond, or asset.

Advantages and disadvantages of passive investing

Passive investing has several benefits, including ultra-low fees, transparency, and tax efficiency. However, it also has some disadvantages, such as being too limited, small returns, and reliance on fund managers. Passive funds are limited to a specific index or set of investments, and they may not be able to beat the market during times of turmoil.

Advantages and disadvantages of active investing

Active investing offers flexibility, hedging, and tax management advantages. Active managers can buy stocks they believe are undervalued and can use various techniques to hedge their bets. They can also tailor tax management strategies to individual investors. However, active investing has higher costs, active risk, and management risk. The fees for active investing are typically higher due to transaction costs and the salaries of the analyst team. Additionally, fund managers can make costly investing mistakes.

Both passive and active investing strategies have their advantages and disadvantages, and the best strategy may depend on an investor's personal priorities, timelines, and goals. Passive investing has historically earned more money than active investing, and it has garnered more investment flows. However, active investing has become more popular during market upheavals and when the market is volatile or the economy is weakening. Some investment advisors believe that blending the two strategies can help minimise wild swings in stock prices and further diversify a portfolio.

Vanguard Funds: Best Investment Options for Your Portfolio

You may want to see also

Index funds vs mutual funds

Index funds and mutual funds are both investment options that pool investors' money into a large basket. However, there are some key differences between the two.

Management Style

Index funds are passively managed, meaning they track a specific market index such as the S&P 500 or Nasdaq Composite Index. The fund's portfolio only changes when the benchmark index changes. This passive management style allows index funds to charge lower investment advisory fees.

On the other hand, most mutual funds are actively managed. This means that individuals or companies make investment decisions based on what they believe will create the best return for investors. Actively managed funds tend to have higher fees to cover the cost of research and analysis.

Investment Objective

Index funds seek to mirror the performance of the market index they are tracking. This means that if the overall market grows, your investment in an index fund is likely to follow the market.

Mutual funds, on the other hand, aim to outperform the market by having experts pick investments they think will beat the market. This active management style gives mutual funds the potential to deliver higher returns but also comes with a higher risk of underperforming the market.

Costs

Index funds tend to have lower fees and expenses than actively managed mutual funds. The passive management style of index funds means they do not require a team of analysts and portfolio managers, resulting in lower costs that are passed on to investors.

Mutual funds, on the other hand, typically have higher fees to cover the cost of active management, including salaries, bonuses, employee benefits, and marketing materials. These higher fees can cut into the returns that investors receive.

Suitability

Index funds are often recommended for beginners and long-term investors who want a simple, cost-effective, and diversified investment option. The passive management style of index funds means they require less research and monitoring, making them a good option for those who want a "set it and forget it" investment.

Mutual funds may be more suitable for investors who want more control over their investments and are willing to pay higher fees for the potential of higher returns. Actively managed mutual funds also offer more choices in terms of investment objectives and strategies.

Maximizing Pension Fund Investments with 80CCC Contributions

You may want to see also

Index funds vs exchange-traded funds (ETFs)

Index funds and exchange-traded funds (ETFs) are both passive investment vehicles that track a specific market index. However, there are some key differences between the two.

Trading Mechanism

The most significant difference between index funds and ETFs is how shares are bought and sold. Index funds can only be bought and sold at the end of the trading day, based on the fund's net asset value (NAV). In contrast, ETFs are traded on stock exchanges throughout the day, just like individual stocks, and their price fluctuates based on supply and demand. This makes ETFs more suitable for intraday trading, while index funds are better suited for long-term investors.

Minimum Investment

ETFs typically have lower minimum investment requirements than index funds. ETFs can be purchased individually or in fractional shares, making them more accessible to investors with a small amount to invest. On the other hand, index funds often have higher minimum investment requirements, which can be a barrier for some investors.

Taxation

ETFs are generally more tax-efficient than index funds due to their structure. ETFs use an "in-kind" creation and redemption process, which minimises capital gains distributions and potential tax liabilities for investors. In contrast, index funds may generate capital gains when the fund manager sells holdings to meet redemptions, potentially triggering a tax event for investors even if they haven't sold their shares.

Costs

ETFs and index funds both offer low-cost investment options, with expense ratios that can be below 0.10%. However, there may be other costs to consider, such as trading commissions and bid-ask spreads for ETFs, and transaction fees for index funds. It's important to compare the overall costs of each investment option before making a decision.

Liquidity

ETFs are considered more liquid than index funds due to their intraday trading flexibility. Index funds, which can only be bought and sold at the end of the trading day, have more limited liquidity.

Suitability

Both index funds and ETFs offer instant diversification and are suitable for long-term investors. ETFs may be more suitable for investors who want more flexibility and trading opportunities, while index funds may be preferred by those who value simplicity and lower costs.

Maharlika Investment Fund: A Sovereign Wealth Fund for the Philippines

You may want to see also

How to choose an index fund

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. They are designed to reflect the performance of a particular index, so their returns should be very close to those of the index.

- Fees and expense ratios: Index funds typically charge an annual fee called an expense ratio, which covers the fund's operating expenses. This is an important consideration as higher fees can erode an investor's returns over time. It is worth noting that some index funds also charge front-end or back-end loads (commissions or sales charges) and 12b-1 fees (annual distribution or marketing fees). When taken cumulatively, these fees can have a significant impact on returns.

- Tracking errors: Not all index funds accurately track the underlying index or sector. Tracking errors refer to the divergence between the fund's value and that of the index it tracks. Larger deviations may indicate high fees or operating expenses, poor fund construction, or both.

- Diversification: Index funds vary in terms of diversification. While some funds, such as those tracking the S&P 500, hold a broad range of stocks across various sectors, others may hold only a few components, exposing investors to higher risk.

- Investment strategy: Some index funds are passively managed, meaning the fund manager does little day-to-day adjustment of the fund's allocations. Other funds may have a more active management strategy, aiming to outperform the index. These funds typically have higher fees.

- Performance: It is important to consider the long-term performance of the index fund (ideally at least five to ten years) to gauge potential future returns. However, past performance is not a guarantee of future results.

- Tax efficiency: Index funds are often more tax-efficient than similar active funds due to lower turnover rates, resulting in fewer capital gains distributions.

- Flexibility: Index funds are generally less flexible than actively managed funds as they are designed to mirror a specific market and cannot pivot when the market shifts.

SpaceX Investors: Fidelity Funds and Their Interests Explored

You may want to see also

The risks of investing in index funds

Index funds are a popular investment choice due to their low costs, broad diversification, and ability to replicate market performance. However, they also come with certain risks that investors should be aware of. Here are some key points about the risks of investing in index funds:

- Market Risk: Index funds are subject to market risk, meaning that when the prices of stocks, bonds, or other securities in an index fall, the share prices of index funds tracking those securities will also decline. This is because index funds are designed to mirror the performance of the underlying index.

- Lack of Flexibility: Index fund managers usually have limited flexibility in their investment strategies. They typically cannot use defensive measures such as reducing their position in shares of particular securities, even if they anticipate a decline in their value.

- Performance Constraints: Passively managed index funds aim to closely track their benchmark index rather than outperform it. They rarely beat the return on the index and usually deliver slightly lower returns due to operating costs.

- Magnificent Seven Stocks: In recent years, a small group of large companies, known as the "Magnificent Seven," have come to dominate major market indexes like the S&P 500. This concentration can increase the risk of index funds as their performance becomes heavily influenced by these few large companies.

- Limited Defensive Strategies: Index funds may not provide adequate downside protection during prolonged market downturns. Their passive nature and broad diversification can lead to underperformance during extended bearish periods.

- Back-tested Performance Discrepancies: Many index funds are based on newly created indexes with limited live track records. The back-tested performance of these indexes may not accurately reflect their future performance, and they may underperform their corresponding category indexes after becoming the target of a fund.

- Tracking Error: Tracking error measures the gap between an index's performance and a benchmark. Higher tracking errors indicate that an index is taking more active risks relative to its category index. While this can lead to potential outperformance, it also introduces higher volatility and the possibility of underperformance.

- Market-Cap Weighting: Many index funds use market-cap weighting, where companies with higher market capitalizations have a larger influence on the fund's performance. This can result in a concentration of risk in a few large companies, increasing the potential for losses if these companies underperform.

- Tax Implications: While index funds generally have lower tax costs due to their low turnover, certain types of funds, such as mutual funds, tend to be less tax-efficient than ETFs. Mutual funds often distribute taxable capital gains at the end of the year, whereas ETFs do not have this requirement.

- Lack of Individual Stock Selection: Index funds invest based on the underlying indices they track, rather than actively selecting individual stocks. This means that investors may be exposed to companies that are overvalued or fundamentally weak, while potentially missing out on better-performing stocks.

Mutual Fund Roth IRA: Best Investment Options

You may want to see also

Frequently asked questions

Passive investing is a long-term strategy for building wealth by buying securities that mirror stock market indexes and holding them for a long time.

In active investing, you research individual companies and buy and sell stocks in an attempt to beat the stock market. In passive investing, you buy a basket of assets and try to mirror what the stock market is doing.

Some of the pros of passive investing are lower maintenance, steady returns, lower fees, lower capital gains taxes, and lower risk. On the other hand, some of the cons are limited investment options and the possibility of not getting above-market returns.

Two common ways to be a passive investor are to buy index funds or exchange-traded funds (ETFs). Both are types of mutual funds that let you invest in holdings from various industries, helping you diversify your portfolio.

First, have a goal for your index funds. Then, research index funds and pick the ones that align with your goals. Decide where to buy your index funds, such as directly from a mutual fund company or a brokerage. Finally, keep an eye on your index funds to ensure they are doing their job and are not too expensive.