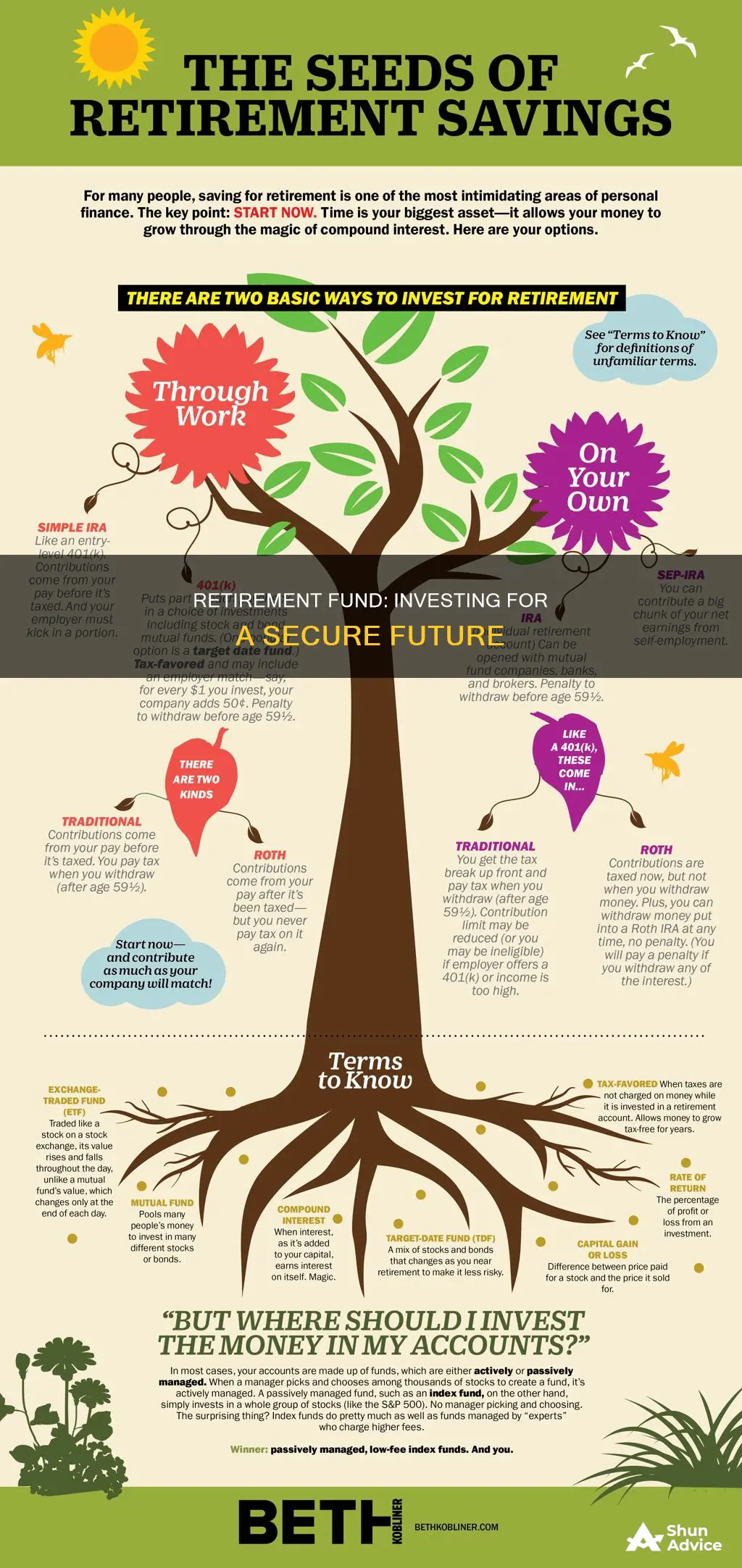

Retirement planning is a crucial aspect of financial management, and investing in a retirement fund is a key step towards securing your future. When it comes to retirement funds, individuals typically have a few main options, including employer-offered plans like 401(k)s or 403(b)s, tax-advantaged accounts such as IRAs, and regular investment accounts without tax advantages. Each option has its own set of advantages and eligibility rules, and understanding these is essential for making informed decisions.

One of the critical factors in retirement investing is starting early. Compounding plays a significant role in growing your investments over time. Additionally, it's important to understand the different types of investments available, such as stocks, bonds, mutual funds, and ETFs, and to create a balanced portfolio that aligns with your risk tolerance and financial goals.

Retirement investing also involves considerations like calculating net worth, managing emotions, and being mindful of investment fees, which can significantly impact your returns. Seeking advice from financial professionals can be beneficial, especially when navigating the complexities of retirement planning.

| Characteristics | Values |

|---|---|

| Types of Retirement Accounts | Defined-Benefit Plans, 401(k)s and Company Plans, Individual Retirement Accounts (IRAs), Thrift Savings Plan (TSP), Brokerage Accounts, Roth IRAs, SEP IRAs, SIMPLE IRAs |

| When to Start Saving for Retirement | The earlier, the better; the longer your money has to work for you, the better the outcome |

| How Much to Save for Retirement | This depends on several factors, including your retirement age, the number of years you have to save, your cost of living, your lifestyle, and your healthcare needs |

| Investment Options | Stocks, Mutual Funds, Exchange-Traded Funds (ETFs), Bonds, Certificates of Deposit (CDs), Dividend Reinvestment Plans (DRIPs), Annuities |

| Asset Allocation | The mix of assets you hold is critical as it determines the level and types of risk your money is exposed to, as well as the returns you earn; the allocation should be adjusted as you get closer to retirement |

| Investment Fees | Investment fees include management fees, expense ratios, and transaction costs; these fees can erode your retirement funds, so it's important to pay attention to them |

| Seeking Professional Help | Consider working with a financial professional or advisor if you need help or advice with your retirement investments |

What You'll Learn

Understand your retirement account options

When it comes to retirement accounts, you have several options to choose from. Here are the key types of retirement accounts you should know about:

Tax-Advantaged Accounts

These include 401(k) plans and Individual Retirement Accounts (IRAs). With these accounts, you don't have to pay taxes on your contributions or earnings until you withdraw the money during retirement. Traditional 401(k)s and IRAs are funded with pre-tax dollars, so you get a tax deduction when you contribute. On the other hand, Roth 401(k)s and Roth IRAs are funded with after-tax dollars, meaning you can't deduct contributions but you won't pay taxes on withdrawals in retirement.

Taxable Accounts

These accounts don't offer any tax breaks. They are funded with after-tax dollars, and you pay taxes on any investment income or capital gains in the year you receive them. Most brokerage and bank accounts fall into this category, but you can also maintain a tax-deferred account like an IRA at a brokerage or bank.

Defined-Benefit Plans

Also known as pensions, these are funded by employers and guarantee a specific retirement benefit based on your salary history and duration of employment. However, they are becoming less common outside of the public sector.

K)s and Company Plans

These are employer-sponsored defined contribution plans that employees fund themselves. They offer tax incentives and automatic savings, and sometimes matching contributions from the employer. There are limits on how much you can contribute each year, and these limits increase if you're 50 or older.

IRAs

IRAs, or Individual Retirement Arrangements, provide a tax-advantaged savings plan for those without a workplace retirement plan. They also serve as an account into which employees can roll over their plan assets when changing jobs or retiring. There are different types of IRAs, including traditional IRAs, Roth IRAs, and SEP IRAs, each with its own rules and eligibility requirements.

When choosing a retirement account, consider factors such as tax advantages, contribution limits, and eligibility rules. Additionally, think about your long-term financial goals and risk tolerance to determine which type of account best aligns with your retirement plans.

Mutual Funds vs Real Estate: Where Should You Invest?

You may want to see also

Calculate your net worth

To calculate your net worth, you must first understand what constitutes your net worth. Your net worth is the value of all your assets, minus the total of all your liabilities. In other words, it is what you own minus what you owe. If you own more than you owe, you will have a positive net worth, and if you owe more than you own, you will have a negative net worth.

Assets are valuable possessions that you own. This includes things like cash, retirement and investment accounts, vehicles, and property. Liabilities are your financial debts, such as credit card debt, student loans, mortgages, and auto loans.

To calculate your net worth, start by listing all your assets and their approximate values. This may include cash, savings and checking accounts, investments, stocks, bonds, real estate, vehicles, and any other valuable possessions. Then, total up the value of all your assets.

Next, list all your liabilities, such as credit card debt, student loans, mortgages, auto loans, and any other debts or outstanding payments you owe. Total up the value of all your liabilities.

Finally, subtract the total value of your liabilities from the total value of your assets. The resulting number will be your net worth.

For example, if you own a house worth $250,000, have $50,000 in investments, and own a car worth $25,000, your total assets would be $325,000. If you have a $100,000 mortgage, a $10,000 car loan, and $5,000 in credit card debt, your total liabilities would be $115,000.

Subtracting your liabilities from your assets, your net worth in this example would be $210,000 ($325,000 - $115,000 = $210,000).

Calculating your net worth can be a helpful step in planning for retirement, as it gives you an overview of your financial position and can help you determine how much you need to save and invest for retirement.

The Rich Avoid Index Funds: Why?

You may want to see also

Know your risk tolerance

When it comes to investing in a retirement fund, it's important to know your risk tolerance. This refers to how much risk you're comfortable with taking on in your investment portfolio. Risk tolerance is a key factor in determining your investment strategy and asset allocation. Here are some things to consider when assessing your risk tolerance:

Time Horizon

If you're investing for retirement, consider how many years you have until retirement. Generally, the further away your retirement is, the more risk you can take on in your investments. This is because you have more time to recover from any short-term losses and market fluctuations. Younger investors with a longer time horizon can focus more on growth-oriented investments, such as stocks, which tend to be riskier but offer higher potential returns. As you get closer to retirement, you may want to gradually shift towards more conservative investments, such as bonds, to protect your savings.

Personal Risk Tolerance

Everyone has a different level of comfort when it comes to taking risks. Some people are comfortable with market volatility and short-term losses, while others may find it stressful. Consider your own emotional and psychological response to risk. If you're someone who gets anxious about market fluctuations and tends to make impulsive decisions, you may have a lower risk tolerance. On the other hand, if you're comfortable with market ups and downs and can stay invested during volatile periods, you may have a higher risk tolerance.

Financial Situation

Your financial situation also plays a role in determining your risk tolerance. If you have a stable income, a healthy emergency fund, and some discretionary funds, you may be in a position to take on more risk in your investments. On the other hand, if you're living paycheck to paycheck or have a lot of financial obligations, you may have a lower risk tolerance. Consider your overall financial stability and how much risk you can comfortably take on without jeopardizing your financial security.

Investment Knowledge and Experience

Your knowledge and experience in investing can also impact your risk tolerance. If you're a seasoned investor who understands market dynamics and has experienced different market cycles, you may feel more comfortable taking on risk. On the other hand, if you're new to investing, you may want to start with a more conservative approach until you gain more knowledge and confidence.

Risk-Return Trade-off

It's important to understand the relationship between risk and return. Generally, investments with higher risk offer the potential for higher returns, while lower-risk investments tend to provide lower returns. Assess your risk tolerance by considering the potential impact of different levels of risk on your investment returns. Are you comfortable with taking on more risk for the potential of higher returns, or would you prefer to prioritize capital preservation with lower-risk investments?

Asset Allocation

Your risk tolerance will guide your asset allocation, which is the mix of stocks, bonds, and other investments in your portfolio. If you have a higher risk tolerance, you may allocate a larger portion of your portfolio to stocks, which tend to provide higher returns over the long term but come with higher risk. If you have a lower risk tolerance, you may allocate more to bonds or other fixed-income investments, which are generally less risky but offer lower returns.

Remember, knowing your risk tolerance is an important step in retirement planning. It will help you make informed investment decisions and create a portfolio that aligns with your financial goals and comfort level. You can also take a risk tolerance quiz to get a more personalized assessment of your risk tolerance.

Adani's Success: Mutual Funds Investing in the Giant

You may want to see also

Pick an asset mix

When it comes to picking an asset mix for your retirement fund, there are a few key things to keep in mind. Firstly, your asset mix is critical because it determines the level of risk your money is exposed to, as well as the returns you can expect. The mix of assets you hold will depend on your risk tolerance and your timeline until retirement. If you're decades away from retirement, you can focus more on maximising long-term growth and take on more risk. As you get closer to retirement, you'll want to lower your risk of losses while still earning more than the rate of inflation.

A good rule of thumb is to subtract your age from 110 or 100 to find the percentage of your portfolio that should be invested in stocks or equities; the rest should be in bonds or other less risky assets. Stocks are generally considered the riskiest way to invest, while bonds and other fixed-income investments are less risky. However, it's important to keep in mind that your risk tolerance and financial goals may vary, so you should adjust your asset allocation accordingly.

Additionally, you'll want to consider the different types of assets available for your retirement fund. Mutual funds, for example, pool shareholder money and invest it in a variety of securities, offering diversification and professional management. Exchange-traded funds (ETFs) combine the benefits of mutual funds with the trading flexibility of individual stocks. Certificates of deposit (CDs) and savings accounts are less risky but typically earn a lower rate of return.

When deciding on your asset mix, it's essential to seek professional advice and consider your own financial circumstances and goals.

Large-Cap Funds: A Smart Investment for Your Money

You may want to see also

Minimise fees

Fees are an unavoidable part of investing in a retirement fund, but there are ways to minimise them. Here are some strategies to reduce the fees associated with your retirement fund:

Understand the fees

The first step to minimising fees is to understand what they are and how they are charged. Fees can be confusing, and often investors don't realise they are paying them. Regulations require that investment fees are disclosed, and you should receive a prospectus outlining the fees when you enrol in a retirement plan. This prospectus should be updated annually, and you can also check your account statements for line items such as Total Asset-Based Fees, Total Operating Expenses As a %, and Expense Ratios.

Choose low-cost funds

When selecting a retirement fund, opt for low-cost funds such as index funds or exchange-traded funds (ETFs). These funds are passively managed, meaning they don't have a person actively managing them, which results in lower fees. According to Morningstar, the average fee for actively managed funds is 1.2%, while the average ETF charges around 0.44%.

Avoid load funds

When choosing a mutual fund, try to avoid funds with a load, also known as a commission. A front-end load means you are charged the commission upfront, while a back-end load is charged when you sell the fund within a specified number of years. These loads can be up to 5% of the invested assets. Instead, opt for a no-load mutual fund, which has zero commission attached to it.

Choose a discount broker

If you like to actively manage your portfolio by picking individual stocks, consider using a discount broker that charges lower fees per trade. The fees charged by brokerage firms can vary significantly, and choosing a low-cost broker can help you save on transaction fees.

Minimise transaction fees

Even if you prefer a brokerage firm with higher fees, you can reduce your overall costs by minimising the number of trades you make. This will not only lower your transaction fees but will also encourage you to become a buy-and-hold investor, which can lead to higher returns over the long term.

Be aware of annual fees

Some brokerage firms charge annual fees if you don't trade frequently or if your account balance falls below a certain threshold. Be aware of these rules and try to avoid them by choosing a firm that doesn't charge such fees or by maintaining the required account balance.

Compare expense ratios

When selecting individual funds within your retirement plan, pay attention to the expense ratio, which represents the sum of fees expressed as an annualised percentage. Opt for funds with lower expense ratios, as these will help reduce the overall fees you pay.

While it is impossible to avoid all fees, by implementing these strategies, you can significantly reduce the costs associated with your retirement fund and improve your overall returns.

Mutual Funds and Treps: A Smart Investment Strategy

You may want to see also

Frequently asked questions

You can put your money into a retirement account offered by your employer, such as a 401(k) or 403(b) plan, which offers tax benefits. Alternatively, you can choose a tax-advantaged retirement account such as an IRA, or a regular investment account without tax advantages.

The earlier, the better. The longer your money has to grow, the better your chances of a comfortable retirement.

This depends on several factors, including your age, desired retirement age, current income, and expected expenses during retirement. A financial advisor can help you calculate this.

You can invest in stocks, bonds, mutual funds, ETFs (exchange-traded funds), or certificates of deposit (CDs). The right mix of these depends on your risk tolerance and how far away retirement is.

This depends on your investment strategy and risk tolerance. Checking in annually is a good idea to ensure your investments are performing as expected and to make any necessary adjustments.