Index funds are a passive investment strategy that aims to mirror the performance of a market index, such as the Standard & Poor's 500. They are a low-cost, easy way to build wealth over the long term. TD Ameritrade, now acquired by Charles Schwab, offers commission-free ETFs and a range of investment choices, including access to the thinkorswim platform suite. This article will explore how to invest in index funds through TD Ameritrade, including the steps to open an investment account and purchase index funds.

| Characteristics | Values |

|---|---|

| Account minimum | $0 |

| Investment minimum | $0 - a few thousand dollars |

| Management expense ratios (MERs) | Low |

| Commission fees | None |

| Broad market exposure | Yes |

| Investment account | Required |

What You'll Learn

TD Ameritrade has been acquired by Charles Schwab

The Acquisition of TD Ameritrade by Charles Schwab

Charles Schwab, a well-known investment firm, has acquired TD Ameritrade, creating a unified entity. This acquisition combines the resources and expertise of two established companies in the investment industry. The integration of TD Ameritrade into Charles Schwab provides investors with enhanced capabilities and a broader spectrum of investment choices.

Enhanced Investment Options

With the acquisition, investors can access a wider range of investment products and services. Charles Schwab offers comprehensive investment management solutions, including self-directed investing, automated investing, and professional wealth management. They provide access to various investment products, such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

Streamlined Trading Platforms

Charles Schwab has robust trading platforms, including their award-winning thinkorswim® platform. This platform offers advanced tools and features for active traders, providing a seamless trading experience. The integration of TD Ameritrade's technology further enhances the trading experience for investors, giving them access to innovative tools and research resources.

Focus on Client Satisfaction

Both Charles Schwab and TD Ameritrade have a strong culture of client-centricity. Charles Schwab guarantees client satisfaction and security, offering transparent pricing and low costs. They also provide a satisfaction guarantee, ensuring that eligible fees or commissions will be refunded if clients are not completely satisfied. This commitment to client satisfaction aligns with TD Ameritrade's focus on customer service.

Simplified Account Management

The acquisition simplifies account management for investors. By consolidating accounts onto the Charles Schwab platform, investors can more easily manage their investments and access a full range of tools and resources. Additionally, Charles Schwab offers 24/7 online assistance and a network of branches for in-person support, ensuring that investors can conveniently access the help they need.

Broadened Access to Research and Education

Charles Schwab provides extensive insights and educational resources to help investors make informed decisions. They offer expert commentary, market updates, investing strategies, and financial planning tools. By leveraging the combined expertise of TD Ameritrade and Charles Schwab, investors can benefit from a broader knowledge base and stay informed about market trends and investment opportunities.

In summary, the acquisition of TD Ameritrade by Charles Schwab brings together the strengths of both companies, resulting in expanded investment options, enhanced trading platforms, and a continued commitment to client satisfaction. Investors can now access a wider range of investment products, advanced trading tools, and valuable educational resources, all backed by the client-centric approach of the unified entity.

Retirement Mutual Funds: Where to Invest for a Secure Future

You may want to see also

No commission to buy and sell TD Ameritrade index funds

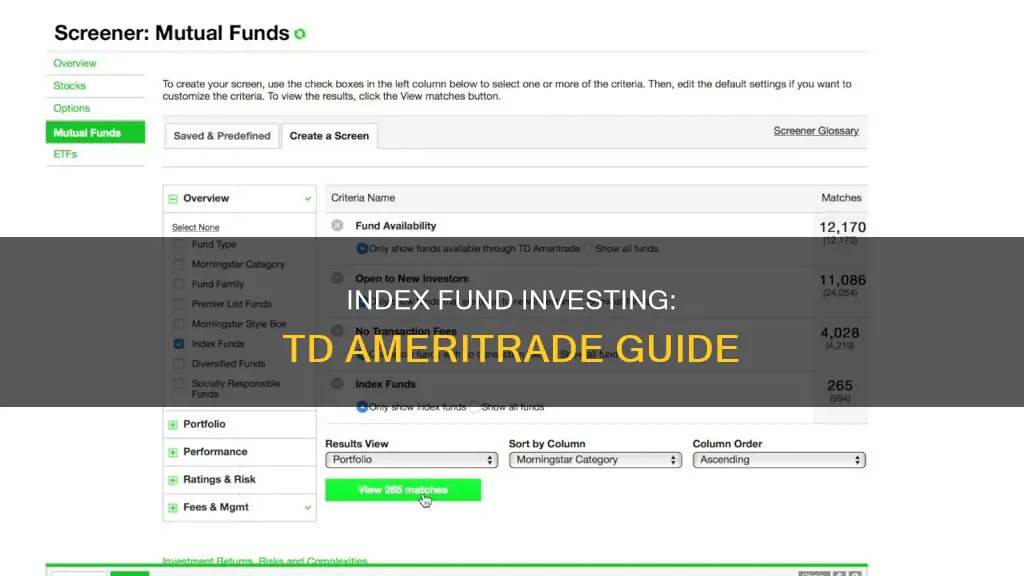

TD Ameritrade offers a wide range of investment options, including index funds. Index funds are a passive investment strategy that mirror the performance of market indices. One of the benefits of investing in index funds with TD Ameritrade is that there are no commissions charged for buying or selling index mutual funds. This means that you can buy and sell index funds without incurring any transaction fees, making it a cost-effective way to invest.

In addition to no commissions, TD Ameritrade's index funds also offer other benefits such as lower management expense ratios (MERs) compared to actively managed funds. This can help minimize your investment costs. TD Ameritrade's index funds also provide broad market exposure, allowing you to pick funds that track small, mid-sized, or large companies, as well as funds that focus on specific sectors.

When investing in index funds with TD Ameritrade, you have the option to open an investment account with a bank, credit union, or another financial institution. They can help you select an index fund that aligns with your investment goals and risk tolerance. Alternatively, you can open a self-directed investment account through an online brokerage firm, such as TD Direct Investing, which gives you access to a wide range of investment options, including index funds, mutual funds, ETFs, stocks, and more. Keep in mind that commissions and fees may apply depending on your trades and minimum account balance.

Overall, TD Ameritrade's no-commission policy on buying and selling index funds makes it an attractive option for investors looking for a cost-effective way to invest in the stock market and build a diversified portfolio.

ESG Funds: Smart Investment, Sustainable Future

You may want to see also

TD Direct Investing offers a wide variety of investment asset classes

Index funds are a passive investment strategy with low fees. They are designed to track and perform like market indices. Index funds purchase securities that make up a market index and attempt to match the market instead of trying to beat it. TD Direct Investing offers a wide variety of investment asset classes, including index funds, mutual funds, ETFs, stocks, and more.

TD Direct Investing provides investors with access to various investment options, such as stocks, ETFs, mutual funds, GICs, fixed-income investments, and options trading. These investment types differ in their risk levels and potential for growth, allowing investors to choose the ones that align with their goals and risk tolerance.

One of the key advantages of investing with TD Direct Investing is the ability to diversify your portfolio across different asset classes. Common asset classes include cash/cash equivalents, equities, fixed income, and alternative investments. Equities consist of stocks or equity funds, while fixed income includes bonds, bond funds, GICs, and similar investments. Alternative investments cover a range of financial products such as real estate, cryptocurrency, options, and future contracts.

By investing in different asset classes, you can reduce risk and increase your chances of positive returns. Each asset class has unique risks and returns, performing differently in various market conditions. Therefore, it is essential to understand your goals and follow an investment plan tailored to your needs.

In addition to the range of investment options, TD Direct Investing also provides educational resources and tools to support your investment journey. You can access articles, videos, masterclasses, and webinars to enhance your investing knowledge and build confidence.

Emergency Fund Strategies: Where to Invest for Peace of Mind

You may want to see also

TD Ameritrade offers commission-free ETFs

Commission-free ETFs are available for investors with certain accounts, and it's important to note that various restrictions may apply. The specific ETFs available for commission-free trading can be found on the TD Ameritrade website or through the ETF Screener tool. This tool allows investors to filter ETFs by their availability in commission-free accounts, making it easier to identify the options that align with your investment strategy.

By taking advantage of commission-free ETFs, investors can diversify their portfolios and gain exposure to various asset classes, sectors, and investment themes without paying brokerage commissions. This can be especially beneficial for long-term investment strategies, as the cost savings can compound over time.

It's important to carefully consider your investment objectives, risk tolerance, and perform your own due diligence before investing in any ETF, even those that are commission-free. Remember to review the ETF's prospectus, expense ratio, and underlying holdings to ensure it aligns with your investment goals.

India's Best Investment Funds: Where to Invest?

You may want to see also

TD Ameritrade has a range of investment choices

You can access the thinkorswim platform suite, including the desktop, web, and mobile versions. The thinkorswim platform is intuitive and designed for traders and investors. It includes streaming quotes, customisable charting tools, and options trading features.

Additionally, you can use the Schwab.com and Schwab Mobile app, which offer a comprehensive portfolio performance view, investing income tools, fundamental research, thematic investing, and more.

TD Ameritrade also offers over 400 physical branches for in-person support.

Actively Managed Mutual Funds: Understanding Diverse Investments

You may want to see also

Frequently asked questions

Index funds are a passive investment strategy with low fees. They are designed to mirror the performance of market indices and carry less risk than individual stocks. They are also less expensive than actively managed funds.

You can buy and sell index funds by opening an investment account with a bank, credit union, or financial institution. You can also open a self-directed investment account through an online brokerage firm, which gives you access to a wide variety of investment asset classes.

As with all investments, it is possible to lose money in an index fund. The stock market can be volatile and unpredictable, but most market indices tend to rise in value over time.

The amount of money required to invest in an index fund varies. Index ETFs have no minimum, and you can buy as little as one share. However, it is important to consider your capacity for risk and investment objectives before investing.