The S&P 500 is a stock market index composed of about 500 publicly traded companies. It is one of the stock market indexes often considered a proxy for the overall health of the U.S. stock market. While you can't invest directly in the index, you can buy individual stocks of companies in the S&P 500, or buy an S&P 500 index fund or ETF. Index funds typically carry less risk than individual stocks.

The easiest way to invest in the S&P 500 is through an index fund or ETF. These funds aim to replicate the returns of the S&P 500 by tracking it, offering investors exposure to S&P 500 companies without the effort involved in purchasing the individual stock of each company. You can purchase index funds and ETFs in a taxable brokerage account, or if you're investing for retirement, in a 401(k) or IRA, which come with added tax benefits.

| Characteristics | Values |

|---|---|

| How to invest | Buy an S&P 500 index fund through a mutual fund or ETF |

| What is the S&P 500? | An index that tracks the 500 largest U.S. companies by market capitalization |

| Why do investors like S&P 500 index funds? | Ownership of many companies, diversification, low cost, solid performance, easy to buy |

| How to invest in an S&P 500 index fund | 1. Find your S&P 500 index fund 2. Go to your investing account or open a new one 3. Determine how much you can afford to invest 4. Buy the index fund |

| What is the expense ratio? | The cost that the fund manager will charge you over the course of the year to manage the fund as a percentage of your investment in the fund |

| What is the S&P 500? | A stock market index that tracks the performance of 500 of the largest U.S. public companies by market capitalization |

| Ways to invest in the S&P 500 | S&P 500 index fund, individual stocks |

| How to invest in the S&P 500 with an index fund | 1. Open an investment account 2. Add funds 3. Choose and buy your index fund |

| How to invest in the S&P 500 with an ETF | 1. Open an investment account 2. Add funds 3. Choose and buy your ETF |

| Pros of investing in the S&P 500 | Consistent long-term returns, instant diversification, no research or prior investment knowledge required |

| Cons of investing in the S&P 500 | Dominated by large-cap companies, short-term volatility, no exposure to international companies |

What You'll Learn

What is the S&P 500?

The S&P 500 is a stock market index that includes around 500 of the largest U.S. companies. It is one of the most commonly followed equity indices and is considered a bellwether for the American stock market. The index was launched in 1957 and is viewed as a measure of how well the stock market is performing overall.

The S&P 500 index is a free-float weighted/capitalization-weighted index, meaning it is weighted according to the size of the companies in the index. The larger the company, the more heft it carries. The weightings rely on each firm's market capitalization—the total value of its outstanding shares. The index includes companies across 11 sectors of the economy, as defined by the GICS classification system, and represents about 80% of the total market capitalization of U.S. public companies.

The S&P 500 is maintained by S&P Dow Jones Indices, a joint venture majority-owned by S&P Global. The components of the index are selected by a committee that assesses the eligibility of companies based on criteria such as market capitalization, market liquidity, volume, stock exchange, and domicile.

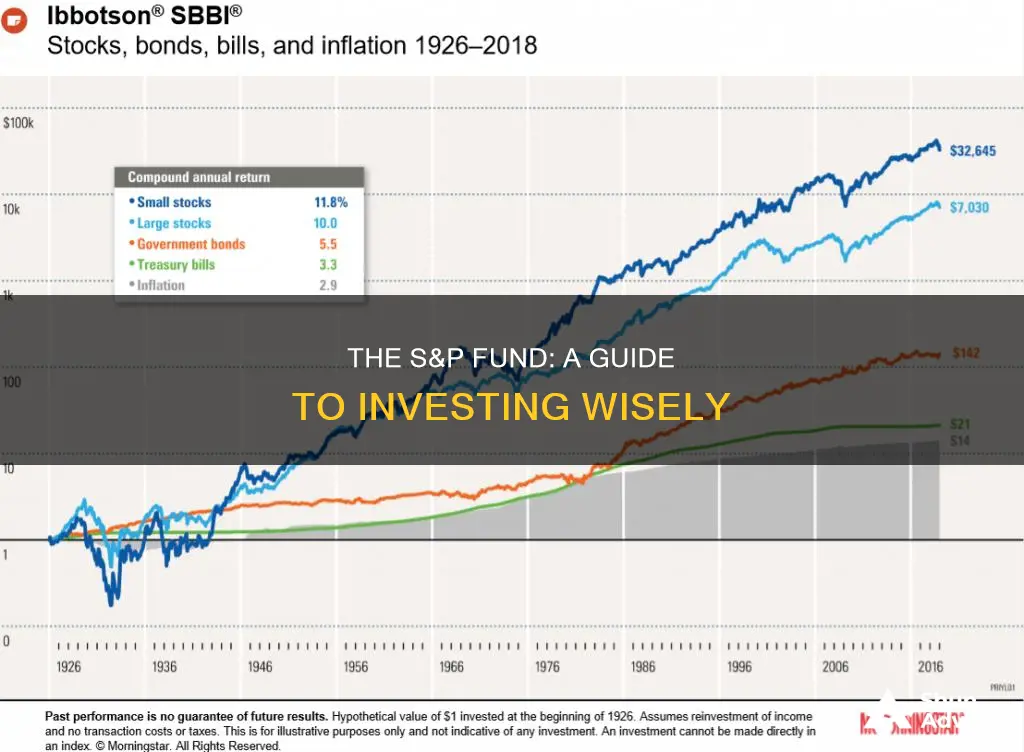

The S&P 500 has historically returned about 10% annually on average, making it one of the most successful stock indices in the world.

Maximizing Your 401(k): Where to Invest for Optimal Returns

You may want to see also

How to invest in the S&P 500 with an index fund

The S&P 500 is a stock market index composed of about 500 publicly traded companies. You can't directly invest in the index itself, but you can invest in an index fund or exchange-traded fund (ETF) that tracks the index. Here's how to invest in the S&P 500 with an index fund:

Step 1: Find your S&P 500 index fund

When selecting your fund, consider the expense ratio (the cost that the fund manager will charge you over the course of the year to manage the fund as a percentage of your investment) and sales load (a sales commission charged by the fund manager). S&P 500 index funds have some of the lowest expense ratios on the market, and you can find options that charge less than 0.10% annually.

Step 2: Go to your investing account or open a new one

You'll need an investing account such as a 401(k), an IRA, or a regular taxable brokerage account to purchase mutual funds or ETFs. If you don't already have an account, you can open one in about 15 minutes. Look for a broker that offers the type of investments you're planning to make without transaction fees or commissions.

Step 3: Determine how much you can afford to invest

Figure out how much you're able to invest and how often you can add money to your account. If you're investing a smaller amount, finding a broker with low fees is especially important. You can set up your account to regularly transfer money from your bank or directly from your paycheck.

Step 4: Buy the index fund

Go to your broker's website and use the easy trade entry form to input the fund's ticker symbol and the number of shares you'd like to buy, based on how much money you've put into your account. Many brokers also allow you to set up a recurring investment schedule.

Funding Connection: The Superior Investment Strategy Over Funding Capture

You may want to see also

How to invest in the S&P 500 with an ETF

The S&P 500 is a stock market index composed of about 500 large public U.S. companies. It is one of the stock market indexes often considered a proxy for the overall health of the U.S. stock market.

You cannot directly invest in the index itself, but you can buy an S&P 500 index fund or ETF. Here's how to invest in the S&P 500 with an ETF:

Find your S&P 500 ETF

Look for an ETF with a low expense ratio, or the cost that the fund manager will charge you over the course of the year to manage the fund as a percentage of your investment. You'll also want to avoid sales load, or a sales commission.

Go to your investing account or open a new one

Access your investing account, whether it's a 401(k), an IRA, or a regular taxable brokerage account. If you don't have an account, you'll need to open one, which you can do in 15 minutes or less.

Determine how much you can afford to invest

Figure out how much you're able to invest and add money regularly to the account. You'll want to hold it there for at least three to five years to allow the market enough time to rise and recover from any major downturns.

Buy the ETF

Go to your broker's website and set up the trade. Input the fund's ticker symbol and how many shares you'd like to buy, based on how much money you've put into the account.

Advantages of Investing in the S&P 500

- Exposure to the world's most dynamic companies: The S&P 500 includes companies like Apple, Amazon, and Microsoft.

- Consistent long-term returns: The S&P 500 has consistently performed, although returns in any single year can vary.

- Intricate analysis not required: You don't need to analyze or pick stocks when investing in the S&P 500 through an ETF.

- Can serve as a core holding: S&P 500 ETFs are liquid and trade with tight bid-ask spreads, making them ideal as core holdings for most investment portfolios.

Disadvantages of Investing in the S&P 500

- The index is dominated by large-cap companies: The S&P 500 has limited exposure to small-cap and mid-cap stocks that may have higher growth potential.

- The index has risks inherent in equity investing: The S&P 500 has risks such as volatility and downside risk, which newer investors may find challenging to tolerate.

- Only includes U.S. companies: The S&P 500 does not include international companies.

As long as your time horizon is three to five years or longer, an S&P 500 ETF could be a good addition to your portfolio. However, keep in mind that any investment can produce poor returns if it's purchased at overvalued prices.

Consider buying into the fund over a period of time using dollar-cost averaging to take advantage of any market downturns. Buying an S&P 500 ETF can be a wise decision for your portfolio, providing solid performance over time.

Mutual Funds: Where to Invest for Maximum Returns

You may want to see also

Pros and cons of investing in the S&P 500

Investing in the S&P 500 can be an attractive option for both seasoned investors and beginners. Here are some pros and cons to consider:

Pros

- Diversification: The S&P 500 offers instant diversification, providing exposure to 500 large-cap U.S. stocks from a wide range of sectors, including technology, healthcare, finance, and consumer goods. This helps reduce the risk associated with investing in individual stocks, as losses from underperforming companies can be offset by gains from others.

- Long-Term Growth: Historically, the S&P 500 has shown strong long-term growth potential, with consistent returns over extended periods, outperforming many other investment options. While short-term market fluctuations may occur, the underlying trend has been upward, driven by the growth of the U.S. economy.

- Accessibility: The S&P 500 is accessible to a wide range of investors, who can invest through index funds, exchange-traded funds (ETFs), or mutual funds. Many brokerage platforms also offer low-cost options.

- Professional Management: The S&P 500 is managed by a committee that ensures the index accurately represents the U.S. large-cap stock market. This committee regularly reviews and adjusts the index constituents, providing investors with confidence in the index's composition.

- Broad Market View: As the S&P 500 includes a diverse range of large-cap companies, it provides a broad view of the economic health of the U.S.

Cons

- Market Volatility: While the S&P 500 has shown long-term growth, it is not immune to market volatility and can experience significant declines during downturns.

- Lack of Individual Stock Selection: Investing in the S&P 500 means investors relinquish control over individual stock selection, potentially missing out on gains from stocks that outperform the broader market.

- Concentration in U.S. Stocks: The S&P 500 is heavily weighted towards U.S.-based companies, resulting in limited exposure to international markets and reduced diversification benefits.

- Inclusion of Underperforming Stocks: Despite periodic reviews, underperforming stocks may remain in the index for a certain period, impacting overall performance.

- Limited to Large-Cap Companies: The S&P 500 only includes large-cap companies, missing out on the much larger swath of mid- and small-cap stocks that make up most of the economy.

- Disproportionate Weighting: As a market-cap-weighted index, the S&P 500 gives disproportionate weight to the largest companies, which make up a significant portion of the index.

- Inaccurate Benchmark: For individual investors with portfolios that include small-cap, foreign companies, and assets other than stocks (e.g., bonds, precious metals, cash), the S&P 500 may not be an accurate benchmark for portfolio performance.

Overall, investing in the S&P 500 offers numerous advantages, but it's important to carefully consider these potential drawbacks before making any investment decisions.

A Beginner's Guide to Mutual Fund Investing in India

You may want to see also

Alternatives to the S&P 500 index

The S&P 500 is a stock market index composed of about 500 large public U.S. companies. While it is one of the most popular indices to invest in, there are several alternatives to consider. Here are some options:

Invest in Global Stocks:

U.S. stocks have outperformed global stocks for a record 15 years. However, international stocks are currently trading at a discount relative to U.S. stocks and have higher dividends, higher exposure to the real economy, and higher potential for sales growth and margin expansion. For U.S. investors, the Vanguard Total International Stock ETF (VXUS) is a good option, while European investors can consider the Vanguard FTSE All-World UCITS ETF Distributing ETF.

Focus on Value Stocks:

Value stocks are generally those with a low price relative to their earnings, book value, or cash flows. They are currently trading at an attractive discount compared to growth stocks and have a higher dividend yield and more exposure to the real economy. The Vanguard Value ETF (VTV) is a good option for U.S. investors, while European investors can consider the iShares Edge MSCI USA Value Factor UCITS ETF.

Explore Small-Cap Stocks:

Small-cap stocks are riskier due to lower profitability, more volatile cash flows, and higher cyclicality. However, they are currently trading at a discount to large-cap stocks and have more growth potential, bigger dividend yields, and higher exposure to the domestic U.S. economy. The Schwab US Small-Cap ETF (SCHA) is a good option for U.S. investors, while European investors can consider the SPDR Russell 2000 US Small Cap UCITS ETF (R2US).

Invest in Other Indices:

While the S&P 500 is a popular index, there are other indices to consider, such as the Dow Jones Industrial Average or the Nasdaq Composite. These indices may provide exposure to different sectors or focus on smaller or larger companies.

Equal-Weight S&P 500 ETFs:

Instead of investing in the S&P 500 through a traditional market-cap-weighted ETF, you could consider an equal-weight ETF like the Invesco S&P 500 Equal Weight ETF (RSP). This type of ETF holds every stock in the index in equal proportions, giving you more exposure to smaller stocks and reducing concentration risk.

A Beginner's Guide to Index Fund Investing with Fidelity

You may want to see also

Frequently asked questions

The S&P 500 is a stock market index that tracks the performance of 500 of the largest U.S. public companies by market capitalization. It is considered a bellwether for the American stock market and a proxy for the overall health of the U.S. stock market.

You can invest in the S&P 500 through index funds or exchange-traded funds (ETFs) that track the index. You can also buy individual stocks of companies in the S&P 500, but this is more costly and time-consuming.

Investing in the S&P 500 offers broad market exposure and instant diversification at a low cost. It provides access to some of the world's most dynamic companies and has historically provided consistent long-term returns.