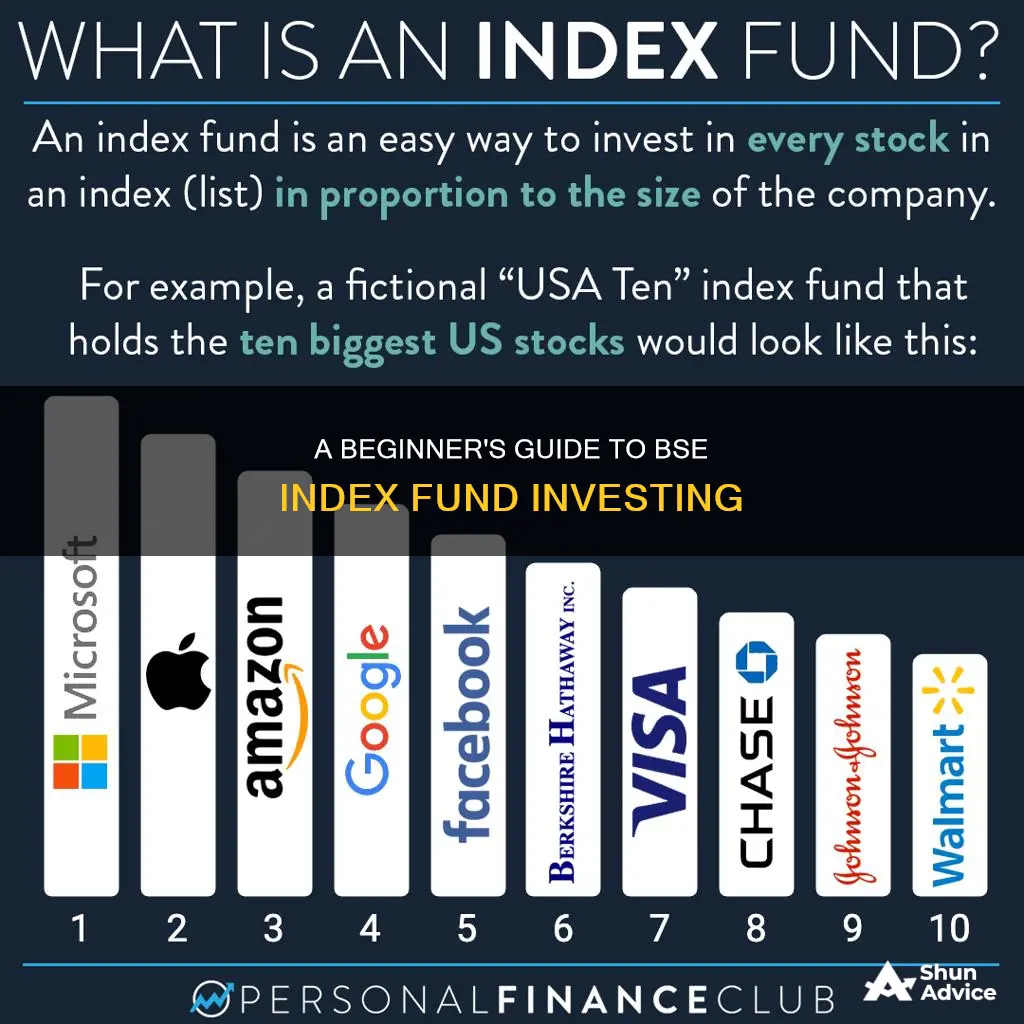

Index funds are a type of mutual fund that replicates the portfolio composition of a particular market index, such as the BSE Sensitive Index (Sensex). These funds aim to mimic the performance of the underlying index rather than actively trying to outperform it. They purchase stocks in the same proportion as the index, resulting in a passive investment strategy. The benefit of this approach is that it offers lower expenses compared to actively managed funds, as there is no active buying and selling of stocks to generate returns. However, it's important to note that index funds may not always match the returns of the index they track due to a factor called tracking error. When considering investing in index funds, individuals have options such as funds tracking the Sensex or the Nifty, or index-plus funds, which combine passive and active investment strategies.

| Characteristics | Values |

|---|---|

| Investment objective | To replicate the composition of the BSE Sensex to generate returns that are commensurate with its performance |

| Investment strategy | Passive strategy to replicate the performance of the BSE Sensex |

| Portfolio | Shares in the same proportion as in the BSE Sensex |

| Performance | Depends on the performance of the BSE Sensex |

| Risk | Moderately high |

| Returns | 10.8% CAGR since launch |

| Top securities holdings | HDFC Bank Ltd, Reliance Industries Ltd, ICICI Bank Ltd, Infosys Ltd, ITC Ltd, Larsen & Toubro Ltd, Tata Consultancy Services Ltd, Bharti Airtel Ltd, State Bank of India, Axis Bank Ltd |

| Management | Not actively managed; fund manager chooses stocks according to the BSE Sensex |

| Expenses | Lower than actively-managed funds |

| Tracking error | Small difference between index fund's returns and the BSE Sensex's returns |

What You'll Learn

What are BSE index funds?

Index funds are a type of mutual fund that replicates the portfolio composition of a particular market index, such as the BSE Sensitive Index (Sensex). These funds are designed to mimic the performance of the index, aiming to generate returns that are in line with the index's performance. For example, if the Sensex index has 15% of its portfolio allocated to ONGC Limited shares, a Sensex index fund will also allocate 15% of its fund money to these shares.

BSE index funds follow a passive investment strategy, meaning they do not actively manage their portfolio by buying and selling stocks. Instead, they aim to replicate the index's composition, which includes stocks from a diverse range of sectors such as energy, financial services, technology, and consumer defensive. This passive approach results in lower fund management charges compared to actively managed funds.

One of the key benefits of investing in BSE index funds is that they provide exposure to a broad range of stocks, reducing security-specific risk. The funds automatically adjust their portfolios based on the performance of the underlying index, removing any underperforming assets. This feature ensures that investors don't have to worry about actively monitoring and adjusting their investments.

When investing in BSE index funds, it's important to consider the tracking error, which is the difference between the fund's returns and the performance of the index it tracks. While index funds aim to replicate the index's performance, there may be slight deviations due to various factors. A lower tracking error indicates better fund performance.

BSE index funds are suitable for investors who want to invest in equities but don't want to actively track their performances. These funds are also attractive due to their lower costs compared to actively managed funds, making them a popular choice among new investors. However, it's important to note that while BSE index funds offer returns linked to the performance of a particular index, they might not always match the returns of actively managed funds, especially in the short term.

Funding Investments: Strategies for Covering Total Amounts Received

You may want to see also

How to invest in BSE index funds directly

Investing in the BSE SENSEX index is a great choice if you’re looking for a safer investment with more price stability compared to picking individual stocks. It gives you an instantly diverse portfolio with exposure to a broad area of the stock market.

- Sign up to a stock broker: You will need to sign up for a brokerage account. You may need to supply a form of photo ID to verify the account.

- Decide how to buy BSE SENSEX: You can choose between a BSE SENSEX ETF or CFD. ETFs are generally better suited to investors who want to passively track the BSE SENSEX’s performance. CFDs offer a greater range of trading options: you can use leverage, short the index, or buy and sell it outside of trading hours.

- Invest in the BSE SENSEX: Sign into your trading account and search for the BSE SENSEX. Hit the ‘buy’ button and enter the details of your purchase, such as how much you want to spend. Hit ‘buy’ again to execute the trade.

- Monitor your investment: When you buy a CFD, the trade goes through almost instantly, and you’ll be able to see your new open position in your trading account. ETF purchases can take longer, and if you buy outside of traditional trading hours, it won’t go through until the next morning.

There are other ways to invest in the BSE SENSEX index, such as index funds, mutual funds, futures, and buying individual stocks. However, ETFs are the simplest option for beginners.

The cost of investing in the BSE SENSEX index depends on how you invest. ETFs and CFDs are generally the cheapest option overall, as they have low fees and a low minimum investment. Index funds and mutual funds have low fees but may have a high minimum investment. Buying individual stocks is the most expensive option in absolute terms, because the share price of a single large company is often more than $100.

- SBI Magnum Midcap Fund

- HDFC Small Cap Fund

- ICICI Prudential Bluechip Fund

Activewear: Which Investment Funds are Taking an Interest?

You may want to see also

How to invest in BSE index funds through an agent

Investing in BSE index funds through an agent is a straightforward process. Here is a step-by-step guide:

Step 1: Find a Registered Agent

Locate an agent or investor who is registered with the Association of Mutual Funds in India (AMFI) and has a valid AMFI Registration Number. This is important to ensure they are authorised to facilitate your investment.

Step 2: Evaluate the Agent's Services

Before engaging their services, understand the fees and commissions associated with the agent. Ensure that any commissions paid do not significantly eat into your returns. It is also essential to know the level of service provided, such as whether they offer financial advice and portfolio management.

Step 3: Provide Necessary Information and Documents

The agent will require personal information and documents, such as your name, contact details, and proof of identity and address. They may also ask about your financial goals, risk tolerance, and investment horizon to ensure that investing in BSE index funds aligns with your investment objectives.

Step 4: Finalise the Investment

Work with your agent to decide on the specific BSE index fund that suits your needs. Consider factors such as the fund's performance, expense ratio, and the underlying index it tracks. Once you've selected the fund, your agent will facilitate the investment process by guiding you through the necessary paperwork and transactions.

Step 5: Monitor Your Investment

After investing, it is crucial to periodically review the performance of your BSE index fund holdings. Your agent should provide you with updates and insights to help you make informed decisions. They can also assist in rebalancing your portfolio if needed.

By following these steps, you can effectively invest in BSE index funds through an agent, benefiting from their guidance and expertise in navigating the investment process.

Mutual Fund Strategies: Diversification for Long-Term Success

You may want to see also

Pros and cons of BSE index funds

Index funds are a form of passive investing that involves buying and holding a portfolio of stocks that mirrors the constituents of a specific index, such as the BSE Sensex. This means that the fund manager creates a portfolio that has a proportionate representation of each security of the relevant index. The aim is to match the returns of that index, and these funds are not meant to beat the index.

Pros

- Diversification: Index funds provide exposure to different sectors and industries, which can help to mitigate the risk associated with investing in a single stock or sector.

- Relatively low cost: Passive index funds have lower expense ratios compared to actively managed mutual funds because they don't require active management.

- Tax efficiency: Capital gains from equity-oriented index funds may receive favourable taxation, depending on the holding period. For example, investments held for more than a year are subject to a lower long-term capital gains tax rate.

- Easy diversification: Index funds enable investors to diversify their portfolio through a single investment, which can be appealing to new investors.

- Lower expense ratio: Index funds have a lower expense ratio than actively managed funds.

Cons

- Not aiming to outperform the index: The fund does not aim to outperform the benchmark index, which may reduce return potential in some market conditions.

- Fewer choices: Investors have fewer choices compared to active mutual funds, as the fund manager does not handpick stocks.

- Tracking error: Index funds are subject to tracking errors, which is the deviation between the fund's performance and that of the benchmark index. While tracking error is generally low for index funds, it is still a risk to consider.

- Limited control: As index funds are passively managed, investors have limited control over the specific stocks included in the fund and rely on the performance of the broader market.

Mutual Funds Backing AMD: Who's Investing in the Tech Giant?

You may want to see also

BSE index funds vs. other investment options

BSE index funds are a type of mutual fund designed to mimic the performance of the Sensex, which includes the 30 largest and most established companies listed on the Bombay Stock Exchange (BSE). These funds invest across multiple sectors, offering diversified exposure within a single investment. They are passively managed, aiming to replicate the performance of the index rather than beat it, and have lower fund management charges as a result.

When considering BSE index funds vs. other investment options, it's important to understand the benefits and drawbacks of each. Here's a comparison to help you make an informed decision:

BSE Index Funds:

- Diversification: BSE index funds provide diversification across leading companies from various sectors, reducing individual stock risk.

- Lower Risk: These funds invest in large-cap, well-established companies, making them less volatile compared to funds focused on smaller companies or individual stocks.

- Simplicity and Ease of Investment: BSE index funds offer a straightforward approach to investing without the need to analyze individual stocks. They are ideal for new investors as they provide exposure to the stock market without the complexity of managing a portfolio.

- Lower Fees: BSE index funds have lower expense ratios than actively managed funds, making them a cost-effective option.

- Long-Term Investment: BSE index funds are typically suited for long-term investment strategies as they help ride out short-term market volatility.

Other Investment Options:

- Active Funds: Active funds aim to outperform the market, whereas index funds aim to replicate market performance. As a result, active funds may deliver higher returns but also carry higher fees and potentially more risk.

- Individual Stocks: Investing in individual stocks provides the potential for higher returns but also carries higher risk. It requires more knowledge and active management of your portfolio.

- Other Mutual Funds: Different types of mutual funds offer various benefits, such as sector-specific funds or actively managed funds with the potential to beat the market. However, these funds may carry higher fees and require more active management.

- Bonds, Commodities, and Other Asset Classes: Depending on your investment goals, you may consider other asset classes like bonds, commodities, or real estate. These options can provide diversification and potentially lower risk, but they may also have lower return potential.

In summary, BSE index funds offer a simple, diversified, and relatively low-risk investment option for those seeking exposure to the stock market. They are ideal for new and risk-averse investors, as well as those seeking long-term growth and stability. However, it's important to remember that all investments carry some level of risk, and BSE index funds are subject to market fluctuations and potential losses during economic downturns.

A Beginner's Guide to Mutual Fund Investing

You may want to see also

Frequently asked questions

BSE index funds are a type of mutual fund that replicates the portfolio of the BSE Sensitive index (Sensex). They invest in securities with the same weightage as the index, aiming to mimic the index's performance.

You can invest in BSE index funds in two ways: directly or through an agent. If you choose to invest directly, you can do so either online or offline. If you go through an agent, ensure they are registered with the Association of Mutual Funds in India and have an AMFI Registration Number.

BSE index funds offer several benefits, including:

- Lower costs compared to actively managed funds due to passive monitoring of the index's performance.

- Automatic clean-up of portfolios as underperforming assets are removed from the index.

- No need for active management, allowing investors to focus on periodically revaluating their portfolios.

- Lower risk as the investment is made in a basket of assets rather than individual securities.