Dimensional Fund Advisors (DFA) is a low-cost passive mutual fund family that offers equity and fixed income funds. DFA funds are based on the work of finance professors Eugene Fama and Ken French, who developed the Fama French Three-Factor Model. This model demonstrates that additional returns can be achieved by weighting portfolios towards smaller and more valuable companies. While DFA funds have been celebrated for their performance, fund researcher Morningstar gives them mediocre performance ratings. It's important to note that DFA funds can only be purchased through an advisor, which results in lower returns after advisor fees. However, there are backdoor methods to invest in DFA funds without an advisor, such as through specific 529 plans or certain employers' 401k-type plans.

| Characteristics | Values |

|---|---|

| Investment type | Equity and fixed income funds |

| Investment approach | Evidence-based, Nobel Prize-winning insights, financial science |

| Performance | Outperformed benchmarks over 20 years |

| Performance rating (Morningstar) | Average (3.0 average rating) |

| Performance (2007-2011) | Returned a total of 16.2%, 5.9% higher than the category average |

| Volatility | Higher volatility due to holding more small-cap stocks |

| Investment access | Only through a DFA-approved financial advisor |

| Fees | Lower fees compared to competitors |

What You'll Learn

- DFA funds can be purchased through an advisor, which results in lower returns after advisor fees

- DFA funds are low-cost passive mutual funds

- DFA funds are based on the Fama French Three Factor Model

- DFA funds capture the small cap and value factors better

- DFA funds are not available for distribution outside the US

DFA funds can be purchased through an advisor, which results in lower returns after advisor fees

Dimensional Fund Advisors (DFA) is an investment firm that was founded in 1981. The company has around $600 billion in assets under management and is known for its academic approach to investing, which is backed by a board that includes Nobel Prize winners and other notable academics.

DFA funds are not available to the general public and can only be purchased through select financial advisors who have gone through an approval process. This means that individual investors incur additional fees when investing with DFA on top of the fund's expense ratios and portfolio turnover costs. The first of these additional fees is the fee paid to the DFA-approved advisor, which can range from less than $1,000 per year for a small portfolio to tens of thousands of dollars for larger portfolios. The second layer of fees is the commission paid to the custodian for buying or selling DFA funds, which can cost between $250 and $750 per year for a typical portfolio.

While DFA funds are well-regarded for their performance, these additional advisor and custodian fees will result in lower returns for investors. For example, a $50,000 portfolio with an advisor charging a 0.45% assets fee would incur $225 in annual fees, plus around $224 in transaction costs for a total cost of $449 or 0.90% of assets. On the other hand, a $2 million portfolio with a $2,000 fixed annual advisor fee would pay around $549 in transaction fees for a total of $2,549 or 0.13% of assets.

Therefore, while DFA funds can be purchased through an advisor, investors should be aware that the additional fees will result in lower returns compared to the fund's performance.

Investment Firm Fund Closures: Strategies Behind the Scenes

You may want to see also

DFA funds are low-cost passive mutual funds

Dimensional Fund Advisors (DFA) is a low-cost fund family that uses passive investing, emphasising small-cap and value investing. DFA funds are not available to the general public but are instead available only to clients of a select group of independent financial advisors and certain institutions. DFA funds are offered to advisors if they provide a passive investment solution to their clients. Passive investing is based on the idea that markets are generally efficient and that asset allocation is the most important investment decision.

DFA has been in existence for more than 25 years and manages over $100 billion in assets. The group's investment philosophy is based on a Nobel Prize-winning approach rooted in rigorous academic and scientific research. This enables DFA to offer mutual funds that provide what it believes to be the purest representation in certain asset classes, especially small-cap, micro-cap, and value, for both domestic and foreign stocks.

DFA's trading infrastructure helps minimise trading costs, resulting in expense ratios that are generally below industry averages. Exchange-traded funds, another passive investment choice, offer even lower expenses, which accrue directly to the investor's return.

DFA offers passively structured funds designed to capture the returns of academically defined asset classes globally. These funds are not designed to match the performance of well-known indexes but rather to capture specific risk factors in the market. By using a passively structured approach, DFA can account for the unique characteristics of a particular asset class, such as small-cap stocks, which can be difficult and costly to index. This approach prioritises minimising trading costs and allows for moderate overweighting or underweighting in specific securities.

In summary, DFA funds are low-cost passive mutual funds that offer investors access to a scientifically driven, Nobel Prize-winning investment approach. By utilising passively structured funds, DFA aims to capture specific risk factors and provide a more accurate representation of certain asset classes, particularly in small-cap and value stocks.

A Simple Guide to Mutual Funds: Investing Your First $100

You may want to see also

DFA funds are based on the Fama French Three Factor Model

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. The company is driven by an evidence-based approach, Nobel Prize-winning insights, and decades of expertise applying financial science to real-world portfolios.

Dimensional funds outperformed benchmarks over 20 years. The company uses information in market prices to target outperformance and manage risk.

DFA funds are based on the Fama-French Three-Factor Model (also known as the Fama-French Model). This model was developed in 1992 by Nobel Laureates Eugene Fama and his colleague Kenneth French. It is an asset pricing model that expands on the Capital Asset Pricing Model (CAPM) by adding size risk and value risk factors to the market risk factor in CAPM. The Fama-French Model considers the fact that value and small-cap stocks outperform markets on a regular basis.

The three factors of the Fama-French Model are:

- The size of firms: small minus big (SMB), which accounts for publicly traded companies with small market caps that generate higher returns.

- Book-to-market values: high minus low (HML), which accounts for value stocks with high book-to-market ratios that generate higher returns in comparison to the market.

- Excess return on the market: the portfolio's return less the risk-free rate of return.

The Fama-French Model is used to explain differences in the returns of diversified equity portfolios. The model compares a portfolio to three distinct risks found in the equity market to assist in decomposing returns. This model is thought to be a better tool for evaluating manager performance than the CAPM model.

Finding Mutual Fund Managers: Where Do They Invest?

You may want to see also

DFA funds capture the small cap and value factors better

Dimensional Fund Advisors (DFA) is a pioneer in factor-based funds, and its co-founder David Booth played a pivotal role in the development of index funds. DFA's Board of Directors includes renowned figures such as Eugene Fama, Kenneth French, and Myron Scholes, with Merton Miller among its founding board members.

DFA's approach is deeply rooted in academic investment research, which reveals that value stocks, or those trading at a discount compared to their fair value and industry peers, tend to outperform growth stocks over time. The DFA US Small Cap Value Portfolio exemplifies this strategy by targeting the cheapest 35% of the US small-cap universe, giving it a deeper value tilt than its peers.

The fund's average market capitalization is in line with its benchmark index, the Russell 2000 Value, but its market cap is only about 60% of the average fund in the small-value category. As of November 27, 2023, the fund had assets totalling almost $13.29 billion invested in 952 different holdings. The fund's expenses are a low 0.52%, well below the average and median fund in Morningstar's small-cap institutional category.

DFA's funds provide broad, diversified market exposure with targeted, evidence-based factor exposure. They aim to capture the Market, Size, Value, and Profitability factor premia while maintaining portfolio diversification across cap sizes and geographies, and minimizing turnover, trading costs, and tax impact.

One of their offerings, the Dimensional US Small Cap Value ETF (DFSV), is a true small-cap value fund with superior factor loadings. It has a mutual fund equivalent, DFSVX, which has been in existence since 1993. DFSV has an expense ratio of 0.31%, making it a cost-effective option for investors.

Mutual Fund Investing: A Daily Habit for Financial Success

You may want to see also

DFA funds are not available for distribution outside the US

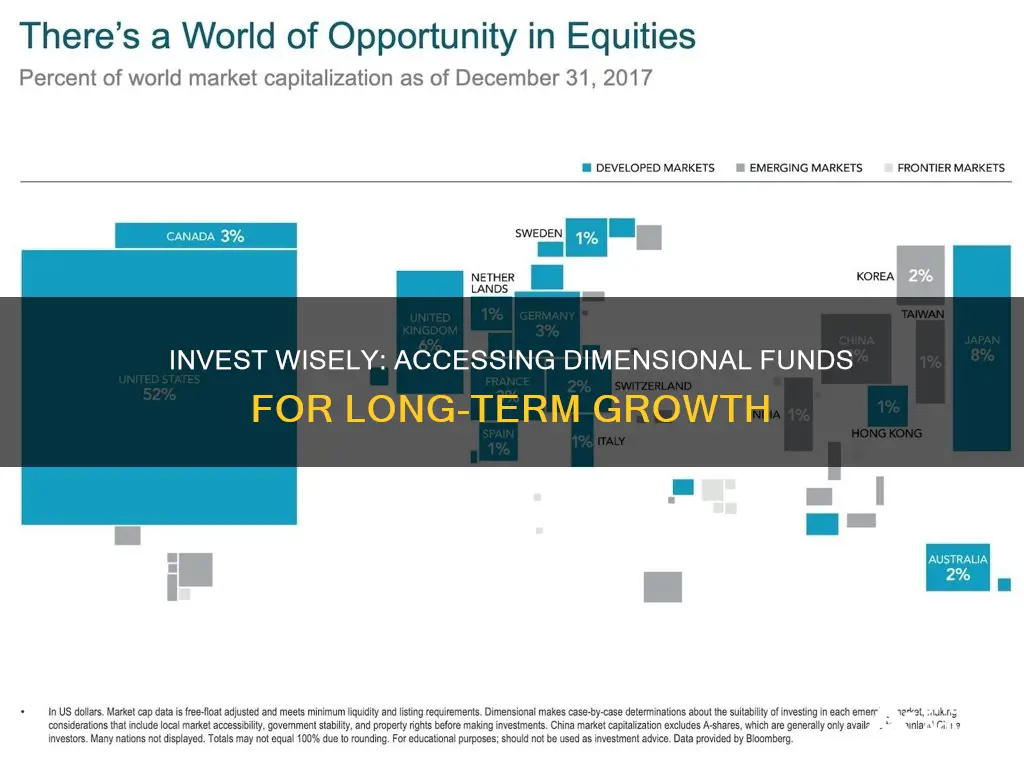

Dimensional Fund Advisors, L.P. (DFA) is a privately-owned investment firm founded in Brooklyn in 1981. The company is headquartered in Austin, Texas, and has offices in several countries, including Canada, the UK, Germany, the Netherlands, Australia, Singapore, and Japan.

DFA's investment strategy is based on the application of the efficient market hypothesis, and the company was one of the first to offer passive investing. The firm offers equity and fixed-income mutual funds, exchange-traded funds (ETFs), separately managed accounts, and model portfolios.

While DFA has a global presence, it is important to note that their funds are not available for distribution outside the US. This restriction is common for US-domiciled mutual funds and ETFs, which are typically not offered for distribution in other countries.

This limitation does not mean that international investors are completely excluded from investing in DFA funds. Investors from outside the US may still have access to DFA funds through financial advisors, brokerage platforms, or plan providers. These professionals can guide investors in navigating the regulations and requirements for investing in DFA funds, ensuring compliance with the laws and restrictions of the investor's country of residence.

It is always advisable for investors to consult with a financial professional before making any investment decisions, as they can provide personalized advice and ensure that investments align with an individual's financial goals and risk tolerance.

Debt Fund Investment Guide for Indians

You may want to see also

Frequently asked questions

Dimensional funds are a low-cost passive mutual fund family based on the work of finance professors Eugene Fama and Ken French, known as the Fama French Three-Factor Model. The model shows that additional returns can be achieved by weighting portfolios toward smaller and value companies.

You can only purchase dimensional funds through an advisor. Some employers offer dimensional funds in their 401k-type plans. Alternatively, you can use a 529 plan such as West Virginia Smart529 Select Plan or Utah's 529 plan UESP.

Dimensional funds are known for their low fees. However, you will need to pay advisor fees if you choose to invest in them.

Dimensional funds are celebrated for their great performance. Between 2007 and 2011, they returned a total of 16.2%, outperforming the category average of the same asset classes by 5.9 percentage points. However, Morningstar gives the funds mediocre performance ratings, stating that they are only average when adjusted for risk.

As with any investment, there are risks involved when investing in dimensional funds. These include the loss of principal, fluctuating value, and increased volatility due to holding more small-cap stocks.