Exchange-Traded Funds (ETFs) are a type of investment fund that can be traded on a stock exchange, much like stocks. They are a collection of stocks, bonds, or commodities that reflect the composition of an index, such as the S&P CNX Nifty or BSE Sensex. ETFs have become popular in India and worldwide due to their low expense ratios and broad diversification with liquidity. In India, there are three indices tracked by ETFs: FTSE India 30/18 Capped, MSCI India, and Nifty 50. The expense ratio of ETFs in India can be as low as 0.19% p.a., making them an attractive investment option for those seeking to diversify their portfolios and minimise risk.

| Characteristics | Values |

|---|---|

| Definition | Exchange Traded Funds (ETFs) are funds that trade on an exchange, just like a stock and replicate the portfolio and performance of a publicly available Index. |

| How to Invest | To invest in ETFs, you need to have a demat and trading account with a stockbroker. |

| Benefits | Broad diversification with liquidity at a lower cost. |

| Types | Index ETFs, Gold ETFs, Bank ETFs, International ETFs, and Liquid ETFs. |

| Key Parameters | Total Expense Ratio, Tracking Error, and Liquidity. |

| Comparison with Mutual Funds | ETFs are traded on the stock exchange, but regular mutual funds are not. ETFs are passive funds that track a benchmark index, whereas mutual funds aim to generate alpha by outperforming a market benchmark. |

| Comparison with Stocks | ETFs are like shares that can be easily traded on stock exchanges. |

What You'll Learn

- Understanding ETFs: What they are, how they work, and their benefits

- Choosing the right ETF: Factors to consider, such as category, sub-category, liquidity, and expense ratio

- Where to invest: Platforms and accounts needed to start investing in ETFs in India?

- ETF alternatives: Comparing ETFs to stocks, mutual funds, and F&O

- ETF types: Exploring the different types of ETFs available, such as index, gold, and international ETFs

Understanding ETFs: What they are, how they work, and their benefits

Exchange-Traded Funds (ETFs) are a type of investment fund that can be traded on a stock exchange, much like stocks. ETFs are designed to replicate the performance of a specific index, such as the S&P CNX Nifty or BSE Sensex in India, or a basket of assets. They offer investors broad exposure to entire stock markets or specific sectors, providing an easy and cost-effective way to diversify their investment portfolios.

How ETFs Work

ETFs function by pooling money from multiple investors, similar to mutual funds. However, unlike traditional mutual funds, ETFs are passively managed, aiming to replicate the performance of a chosen index or sector. The fund managers of ETFs purchase stocks or assets that match the composition of the chosen index, ensuring that the ETF's returns closely follow the index's returns.

Benefits of ETFs

There are several advantages to investing in ETFs:

- Broad Diversification: ETFs provide investors with exposure to a wide range of stocks, bonds, commodities, or other assets, allowing for a diversified investment portfolio.

- Liquidity: ETFs are traded directly on stock exchanges, where investors can buy and sell ETF stocks at any given time, providing liquidity to their investments.

- Lower Costs: ETFs generally have lower expense ratios compared to traditional mutual funds, making them a more cost-effective investment option.

- Reduced Risk: Index ETFs help to minimise risk by diversifying investments across various stocks or assets within an index. Additionally, ETFs eliminate unsystematic risk as they simply track the performance of an index.

- Simplicity: ETFs offer a simpler investment approach compared to actively managed funds. Investors can select an index to track without the need to analyse past performance or understand complex investment strategies.

Investing in ETFs in India

When investing in ETFs in India, it is essential to have a demat and trading account with a stockbroker. Some popular ETF categories in India include:

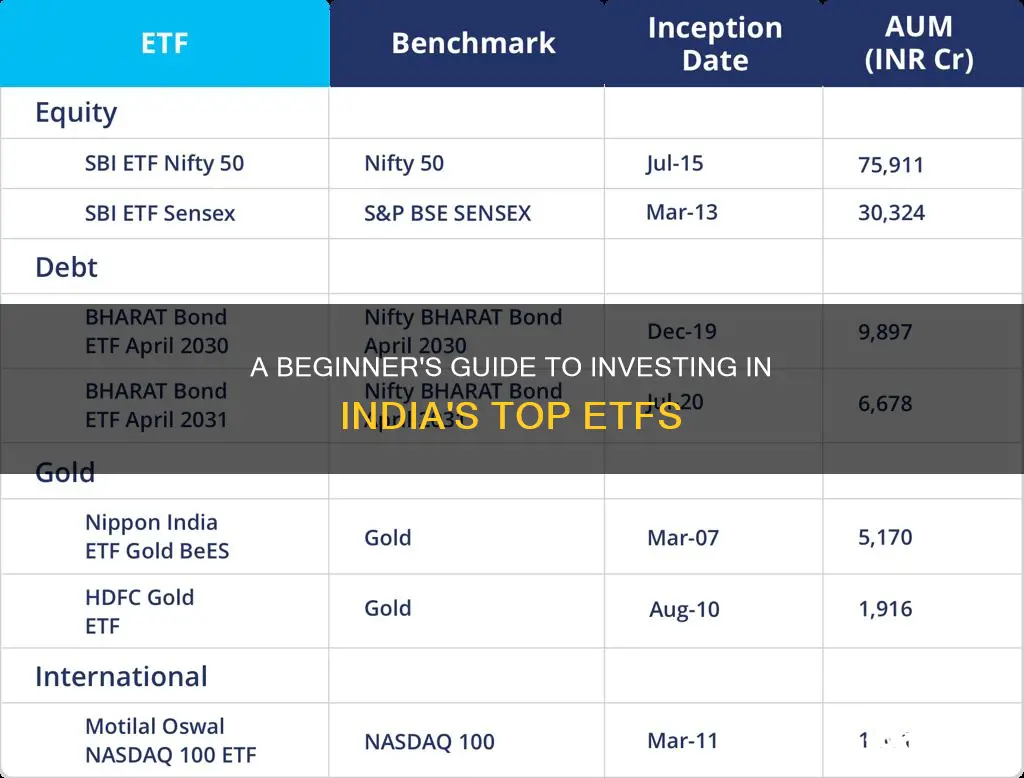

- Index ETFs: These track specific market indices such as Sensex, Nifty, BSE 100, or Nifty 100.

- Gold ETFs: These ETFs invest in gold bullion, allowing investors to include gold in their portfolios without purchasing physical gold.

- Bank ETFs: These invest in a basket of banking stocks listed on Indian stock exchanges.

- International ETFs: These focus on foreign-based securities and can track global markets or country-specific benchmark indices.

- Liquid ETFs: These invest in short-term government securities, call money, or money market instruments, aiming to enhance returns and reduce price risk.

A Simple Guide to Investing in the S&P 500 Index Funds

You may want to see also

Choosing the right ETF: Factors to consider, such as category, sub-category, liquidity, and expense ratio

When choosing an ETF, there are several factors to consider to ensure that it aligns with your investment goals and risk tolerance. Here are the key factors to keep in mind:

Category and Sub-Category

ETFs can be broadly categorized by asset class, such as stock ETFs and bond ETFs. You can choose an ETF that offers broad asset class exposure or opt for more specialized ETFs that target a specific sub-class or sub-category within the broad class. For instance, if you're interested in investing in the Indian stock market, you can consider ETFs that track indices like the FTSE India 30/18 Capped, MSCI India, or Nifty 50.

Additionally, you can explore sector-specific ETFs that focus on particular industry sectors like financials, consumer discretionary goods, or information technology. Alternatively, you might consider thematic ETFs that revolve around investing trends or social changes, such as Environmental, Social, and Governance (ESG) criteria or emerging technologies.

Liquidity

ETFs are known for providing higher daily liquidity compared to mutual fund schemes. This means that you can easily buy or sell ETF shares without significant impact on their market price. The liquidity of an ETF is derived from the trading of its units in the secondary market and the in-kind creation/redemption process with the fund. The trading volume of ETFs is typically higher than individual stocks due to their basket-like nature, contributing to their overall liquidity.

Expense Ratio

The expense ratio of an ETF is an important consideration as it directly impacts your investment returns. ETFs generally have lower expense ratios compared to actively managed mutual funds. The typical administrative costs of ETFs are often below 0.20% per annum, whereas actively managed funds can exceed 1% yearly. When evaluating ETFs, look for those with lower expense ratios to maximize your returns over time.

Smartly Investing 5 Lacs in Mutual Funds

You may want to see also

Where to invest: Platforms and accounts needed to start investing in ETFs in India

To start investing in Exchange Traded Funds (ETFs) in India, you will need to have a demat and trading account with a stockbroker. You can then use your stockbroker to invest in or trade ETFs listed on the stock exchanges.

Some online platforms, such as Groww, also allow you to invest in ETFs. With Groww, you can check information related to ETFs, such as the expense ratio, fund manager details, scheme objectives, and track the live price of the underlying securities. To start investing in ETFs on Groww, you will also need to have a Demat account.

It is also possible to invest in "ETF-like" investment products, which are passive funds that track an index. These are called Index Funds and can be purchased directly from an Asset Management Company (AMC) or through a Mutual Fund Distributor (MFD). However, it is important to note that the expense ratios of index funds are typically higher than those of ETFs.

Axis Quant Fund: A Smart Investment Strategy

You may want to see also

ETF alternatives: Comparing ETFs to stocks, mutual funds, and F&O

Exchange-Traded Funds (ETFs) are a popular investment vehicle, offering several benefits to investors. However, it is worth considering how they compare to other investment options like stocks, mutual funds, and derivatives (F&O).

ETFs vs. Stocks

ETFs are baskets of stocks, designed to reflect the composition of an index, like the S&P CNX Nifty or BSE Sensex. They are traded on exchanges, just like stocks. However, ETFs are less risky than investing in individual stocks as they provide built-in diversification. An ETF could include tens, hundreds, or even thousands of individual stocks, so if one stock is performing poorly, there is a chance that another is doing well, reducing potential losses.

ETFs vs. Mutual Funds

Mutual funds and ETFs have a lot in common. Both are professionally managed collections of individual stocks or bonds, overseen by expert portfolio managers. They both offer a wide variety of investment options, giving access to U.S. and international stocks and bonds. However, there are some key differences. ETFs usually have lower investment minimums, often requiring only the price of one share to buy in. ETFs also provide real-time pricing and allow for more sophisticated order types, giving investors more control over their trades. Mutual funds, on the other hand, are purchased at a flat dollar amount and the price is calculated at the end of the trading day. Mutual funds also allow for automatic investments and withdrawals, which ETFs do not.

ETFs vs. F&O

When comparing ETFs to derivatives (F&O), it is important to understand the nature of derivatives. Derivatives are financial contracts whose value is derived from an underlying asset, like stocks, bonds, commodities, or currencies. Examples of derivatives include options, futures, forwards, and swaps. ETFs, on the other hand, are not derivatives; they are baskets of stocks traded on exchanges. One key difference is that ETFs have a net asset value (NAV), which is the market value of the fund's total assets minus liabilities, divided by the number of shares. This NAV is calculated daily for ETFs, whereas derivatives are typically priced based on complex models that take into account various factors, such as underlying asset price, time to expiration, and volatility.

In conclusion, while ETFs offer a range of benefits, including broad exposure to stock markets, diversification, and low costs, it is important to consider the alternatives. Each investment option has its own advantages and disadvantages, and the right choice will depend on the investor's goals, risk tolerance, and investment style.

Value Funds: A Smart Investment for Long-Term Growth

You may want to see also

ETF types: Exploring the different types of ETFs available, such as index, gold, and international ETFs

Exchange-Traded Funds (ETFs) are a type of investment that can be bought and sold on stock exchanges. ETFs are similar to mutual funds but can be traded like stocks and are listed and traded on exchanges. They enable investors to gain broad exposure to entire stock markets in different countries and specific sectors with relative ease, in real-time, and at a lower cost than many other forms of investing. ETFs are typically classified based on their underlying assets. Here are some of the different types of ETFs available:

Index ETFs

Index ETFs are passive mutual funds that allow investors to purchase a pool of securities in a single transaction. The objective is to track the performance of a stock market index, such as the Nifty 50 in India. When an investor buys a quantity of an index fund or ETF, they are essentially purchasing a share of a portfolio that contains the securities of the underlying index. Some popular Indian Index ETFs include HDFC Index Fund-Nifty, IDFC Nifty Fund, and ICICI Prudential Nifty ETF.

Gold ETFs

Gold ETFs are instruments that are based on gold prices or invest directly in gold bullion. They track the performance of gold, so when the price of gold increases, the value of the ETF rises, and vice versa. Gold ETFs provide investors with the opportunity to invest in precious metals in a digital format instead of buying physical gold. In India, some of the best-performing gold ETFs include Invesco India Gold Fund Growth, Aditya Birla Sun Life Gold Fund Growth, and Nippon India Gold Savings Fund Growth.

Bond ETFs

Bond ETFs are similar to bond mutual funds and provide exposure to fixed-income instruments like debentures and government bonds with various maturities. They combine the benefits of debt investments with the flexibility of stock investments and the simplicity of mutual funds. Examples of bond ETFs in India include LIC Nomura MF G-Sec Long Term ETF and SBI ETF 10-year Gilt.

International ETFs

International ETFs allow investors to invest directly in foreign companies by mirroring the index of global markets or country-specific indices. Examples of international ETFs include MOSL NASDAQ 100, HDFC World Index Fund, and Mirae Asset NYSE FANG+ETF. These ETFs provide investors with an opportunity to diversify their portfolios by investing in companies outside of India.

Sectoral/Thematic ETFs

Sectoral or thematic ETFs are designed to replicate the performance of a specific sector or industry. For instance, a banking ETF will invest in stocks and securities from the banking sector. Some examples of sectoral ETFs in India include Kotak IT ETF, ICICI Prudential Nifty Auto ETF, and Axis Banking ETF.

Retirement Funds: Best Indian Investment Options

You may want to see also

Frequently asked questions

An Exchange-Traded Fund (ETF) is a fund that is traded on an exchange, like a stock, and replicates the portfolio and performance of a publicly available index. ETFs are essentially index funds that are listed and traded on exchanges.

ETFs in India are traded directly on the stock exchanges, where one can buy and sell ETF stocks at any given point in time. The current trading value of an ETF is derived from the net asset value of the underlying stocks or commodities that it represents.

ETFs provide broad diversification with liquidity at a lower cost compared to other forms of investing or mutual funds. They enable investors to gain broad exposure to entire stock markets in different countries and specific sectors with relative ease.

To invest in ETFs in India, you need to have a demat and trading account with a stockbroker. You can then buy and sell ETFs through your stockbroker.

Some popular ETF categories in India include Index ETFs, Gold ETFs, Bank ETFs, International ETFs, and Liquid ETFs. Popular ETF schemes include Nifty BeEs, S&P CNX Nifty, BSE Sensex, and Nifty Next 50.