The Fidelity ZERO Large Cap Index Fund (FNILX) is an investment fund that seeks to provide investment results corresponding to the total return of stocks of large-capitalization U.S. companies. The fund normally invests at least 80% of its assets in common stocks of large-cap companies included in the Fidelity U.S. Large Cap Index, which is designed to reflect the performance of U.S. large-cap stocks. Large-cap stocks are considered the stocks of the largest 500 U.S. companies based on float-adjusted market capitalization.

There is no minimum initial investment required for the Fidelity ZERO Large Cap Index Fund, and it has a 0% expense ratio. This means that investors can start investing with any amount and will not be charged any management fees by Fidelity. However, other fees such as brokerage fees and taxes may still apply.

Before investing in the Fidelity ZERO Large Cap Index Fund, it is important to conduct thorough research and understand the potential risks involved. It is also crucial to consider factors such as one's financial situation, investment goals, and risk tolerance when deciding how much to invest and for how long.

| Characteristics | Values |

|---|---|

| Investment Objective | To provide investment results that correspond to the total return of stocks of large-capitalization U.S. companies |

| Investment Type | Common stocks of large-cap companies |

| Index Tracked | Fidelity U.S. Large Cap Index |

| Investment Amount | No minimum investment amount |

| Brokerage Account | Required to start investing |

| Investment Risk | Above Average compared to funds in the same category |

| Distribution Fee Level | Low |

| Share Class Type | No Load |

| Total Assets | 12.1 billion |

| Net Asset Value | 21.24 |

| 1-Day Return | -1.12% |

What You'll Learn

Opening a brokerage account

To start investing in the Fidelity ZERO Large Cap Index Fund, you will need to open a brokerage account. A brokerage account is an investment account that allows you to buy and sell various investments, such as stocks, bonds, mutual funds, and ETFs.

There are many brokerage companies on the market, but they differ in the broker's commission, the number of markets available for investing, the complexity of the platform, and the ease of opening an account. When choosing a brokerage firm, you should compare the fees, conditions, and how easily you understand the platform and the company's concept.

- Register your account: Most brokerage firms will require you to register and provide your personal details, such as your name, email address, and a password for your account.

- Verify your email address: After registering, you will need to verify your email address by clicking on the link sent to your email inbox.

- Provide additional information: You will then need to enter more personal information, including your date of birth, address, and phone number.

- Verify your identity: To comply with regulatory requirements, brokerage firms will ask you to upload a copy of your government-issued ID (such as a passport or driver's license) and proof of address (such as a utility bill or bank statement).

- Fund your account: Once your account is set up, you will need to deposit money into it using one of the available payment methods, such as credit/debit cards, bank transfers, or e-wallets.

It is important to note that opening a brokerage account is just the first step in investing in the Fidelity ZERO Large Cap Index Fund. After opening your brokerage account, you should conduct thorough research on the fund, determine your investment amount and risk tolerance, place your order, and regularly monitor your investment.

Investments Worth More Than Money Market Funds

You may want to see also

Researching the company

After deciding where to buy Fidelity Zero Large Cap Index Fund (FNILX) trusts, the next step is to research the company. This step is necessary to understand whether this company fits your financial goals and strategy.

- What is Fidelity Zero Large Cap Index Fund (FNILX)?

- What is the company's history, and how has it performed in the past?

- What are the risks associated with investing in the company?

- How does the company compare to its competitors?

- What is the company's strategy for growth?

To find answers to these questions, you can refer to the company's annual and quarterly reports, balance sheets, income statements, its website, and third-party evaluators for a comprehensive analysis. For example, you can find a detailed report on Fidelity Zero Large Cap Index Fund (FNILX) on the StockInvest.us website.

- Revenue: This is the total amount of money a company generates from its operations and is an essential measure of a company's size and growth potential.

- Net Income: Net income is a company's profit after all expenses have been deducted from its revenue and is a good indicator of profitability.

- Earnings Per Share (EPS): EPS is the amount of a company's profit allocated to each outstanding share of stock and is used to calculate the P/E ratio.

- Debt-to-Equity Ratio: This ratio indicates a company's leverage, or how much debt it has relative to its equity. A high debt-to-equity ratio may indicate a potential risk of defaulting on loans.

- Return on Equity (ROE): ROE measures how much profit a company generates for each dollar of shareholder equity and can indicate efficient use of shareholders' money.

- Price-to-Earnings Ratio (P/E Ratio): The P/E ratio compares a company's current stock price to its EPS. A high P/E ratio may indicate an overvalued stock, while a low P/E ratio may suggest an undervalued stock.

While these financials provide a good starting point for analysing a company's financial health and growth potential, it's important to consider other factors as well. These include industry trends, competition, management, and macroeconomic conditions.

Additionally, remember to check what analysts say about the company and regularly read the latest news and opinions of other investors.

Understanding the fund

The Fidelity ZERO Large Cap Index Fund (FNILX) seeks to provide investment results that correspond to the total return of stocks of large-capitalization U.S. companies. The fund normally invests at least 80% of its assets in common stocks of large-capitalization companies included in the Fidelity U.S. Large Cap Index℠, which is a float-adjusted market capitalization-weighted index designed to reflect the performance of U.S. large-cap stocks.

Large-capitalization stocks are considered the stocks of the largest 500 U.S. companies based on float-adjusted market capitalization. The fund has a 0% expense ratio and no minimum investment amount.

Comparison with competitors

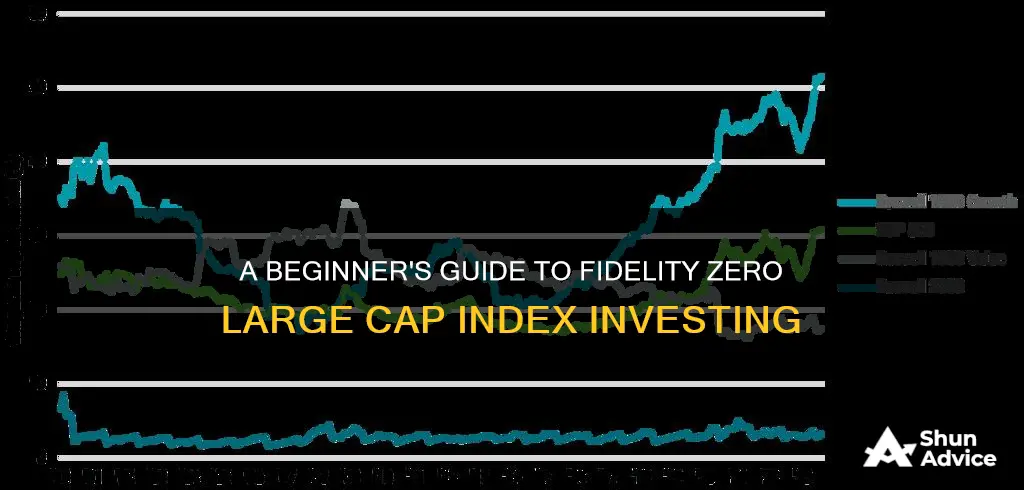

Fidelity's ZERO Large Cap Index Fund (FNILX) is designed to replicate the most popular stock index funds on the market, specifically the S&P 500 index funds. While Fidelity does not advertise it as such, this fund tracks the Fidelity U.S. Large Cap Index, which is similar to the S&P 500.

The S&P 500 comprises around 500 large U.S. companies, which together account for more than 80% of the U.S. stock market's value. While the Fidelity ZERO Large Cap Index Fund has a shorter operating history, it has managed to perform roughly in line with the S&P 500 over a three-month period since its launch, lagging by about 0.08%.

It's worth noting that the fund's ability to match the returns of the S&P 500 may improve as it grows. As of the end of 2024, the fund had $227 million in assets, which may not yet provide the scale to match the index as closely as larger, true S&P 500 funds.

Roth IRA or Mutual Funds: Where Should You Invest?

You may want to see also

Determining your investment amount

Before deciding on the amount you want to invest in the Fidelity ZERO Large Cap Index Fund, it is important to analyse your financial possibilities and risk tolerance.

Time horizon

The time horizon refers to the period an investor plans to hold an investment. It can be short-term (less than a year), medium-term (one to five years), or long-term (more than five years). This is an important consideration when choosing investments as it can impact the level of risk you are willing to take and the expected return on investment.

Risk tolerance

Risk tolerance measures the amount of risk an investor is willing to take. Some investors are comfortable taking on higher levels of risk for the possibility of higher returns, while others prefer lower-risk investments to preserve their capital. Financial situation, investment goals, and personal preferences can all influence an investor's risk tolerance.

Goals

Investor goals refer to the specific objectives an investor aims to achieve through their investments. These goals vary widely depending on the individual. Some common examples include building wealth, generating income, preserving capital, saving for retirement, or funding a child's education. Understanding your goals can help you make better decisions and develop a more effective investment strategy.

Before choosing the investment amount and contribution frequency, it is important to ensure you have an emergency fund that can cover 3-6 months of living expenses and a budget for your investing strategy. It is also crucial to be emotionally prepared, as a clear head is essential when making investment decisions.

Investment amount

Once you have analysed your financial possibilities and risk tolerance, you can determine the amount you want to invest in the Fidelity ZERO Large Cap Index Fund. There is no minimum investment amount required, allowing you to invest according to your budget and goals.

Order type

When placing an order, you have two main options: a market order or a limit order. A market order is executed at the current market price, prioritising speed over price. On the other hand, a limit order allows you to set a maximum price you are willing to pay, prioritising price over speed. The choice between these order types depends on your investment strategy, risk tolerance, and goals. It is important to understand the risks and potential benefits of each type before placing an order.

Retirement Year Funds: Smart or Risky Move?

You may want to see also

Placing an order

To place an order for the Fidelity ZERO Large Cap Index Fund (FNILX), you will need to follow these steps:

Open a Brokerage Account:

You will need a brokerage account to start investing. Compare the fees, conditions, and ease of use of different brokerage platforms before choosing one. eToro, for example, offers a free registration process and a virtual portfolio demo account for practice. You will need to provide personal details such as your name, email address, date of birth, address, phone number, and a copy of your government-issued ID and proof of address for verification.

Research the Fidelity ZERO Large Cap Index Fund:

Before investing, it is essential to understand whether this fund aligns with your financial goals and strategy. Research the company's history, past performance, risks, growth strategy, and how it compares to its competitors. You can find this information in the company's annual and quarterly reports, balance sheets, income statements, and on its website.

Determine Your Investment Amount and Risk Tolerance:

Analyze your financial possibilities, including your time horizon (short-term, medium-term, or long-term) and risk tolerance. Ensure you have an emergency fund and a budget for your investing strategy.

Place Your Order:

You can place a market order or a limit order. A market order is executed at the current market price and is typically faster, while a limit order is executed at a specified price or better and allows for more precision. Choose the type of order that aligns with your investment strategy, risk tolerance, and goals.

Monitor Your Investment and Set a Stop-Loss:

Regularly monitor your investments to stay informed about their performance. Setting a stop-loss order can help limit potential losses by automatically selling if the stock falls below a certain price. This can help minimize risk and keep you on track with your long-term goals.

Be Aware of Potential Risks:

Understand the common risks associated with investing, such as market risk, credit risk, liquidity risk, diversification risk, emotional and behavioral risk, and company-specific risk.

Index Funds: Investing or Just Buying the Market?

You may want to see also

Monitoring your investment and setting a stop-loss

Monitoring your investments is crucial to staying informed about your portfolio's performance and making necessary adjustments to your strategy. Setting a stop-loss order is an essential tool to limit potential losses by triggering the automatic sale of a stock if it falls below a certain price.

For example, a recommended stop-loss for the Fidelity Zero Large Cap Index Fund is $20.58 (-4.18%). While it's important to keep a close eye on your investments, overreacting to short-term market fluctuations should be avoided. The stock market is notoriously volatile, and stocks often experience temporary dips before rebounding. Therefore, setting a stop-loss and adhering to your long-term investment strategy can help minimise risk and keep you on track to achieving your financial goals.

In addition to monitoring your investments, it's advisable to periodically review your investment strategy to ensure it remains aligned with your goals and risk tolerance. As your circumstances and priorities change over time, you may need to adjust your strategy to meet your evolving needs. By staying informed, proactive, and making thoughtful decisions, you can ensure your investments are working hard for you.

- Regularly monitor your investments to stay informed about your portfolio's performance.

- Set a stop-loss order to limit potential losses automatically.

- Avoid overreacting to short-term market fluctuations, as stocks often rebound after temporary dips.

- Periodically review your investment strategy to ensure it aligns with your changing goals and risk tolerance.

- Stay informed, proactive, and thoughtful in your decision-making to optimise your investment outcomes.

Target Maturity Funds: A Guide to Investing Wisely

You may want to see also

Frequently asked questions

The Fidelity ZERO Large Cap Index Fund (FNILX) is a fund that seeks to provide investment results that correspond to the total return of stocks of large-capitalization US companies. It normally invests at least 80% of its assets in common stocks of large-capitalization companies included in the Fidelity US Large Cap Index, which is designed to reflect the performance of US large-cap stocks.

To invest, you will need to open a brokerage account, conduct research on the fund, determine how much you want to invest, place an order, monitor your investment regularly, and be aware of potential risks.

Some key financials to consider are revenue, net income, earnings per share (EPS), debt-to-equity ratio, return on equity (ROE), and price-to-earnings ratio (P/E Ratio).

Some potential risks to consider are market risk, credit risk, liquidity risk, diversification risk, emotional and behavioral risk, and company-specific risk.