Fixed-income investing is a lower-risk investment strategy that focuses on generating consistent payments from investments such as bonds, money market funds, and certificates of deposit (CDs). It is a great option for those living on an actual fixed income and looking for ways to maximise their savings. Fixed-income investing can also be a good option for those who are worried about the volatility of the stock market.

Fixed-income investing works by giving you a consistent, fixed stream of money. When examining fixed-rate investments, you will need to consider interest rates, the timeline for payments, maturity dates, and the likelihood of being repaid.

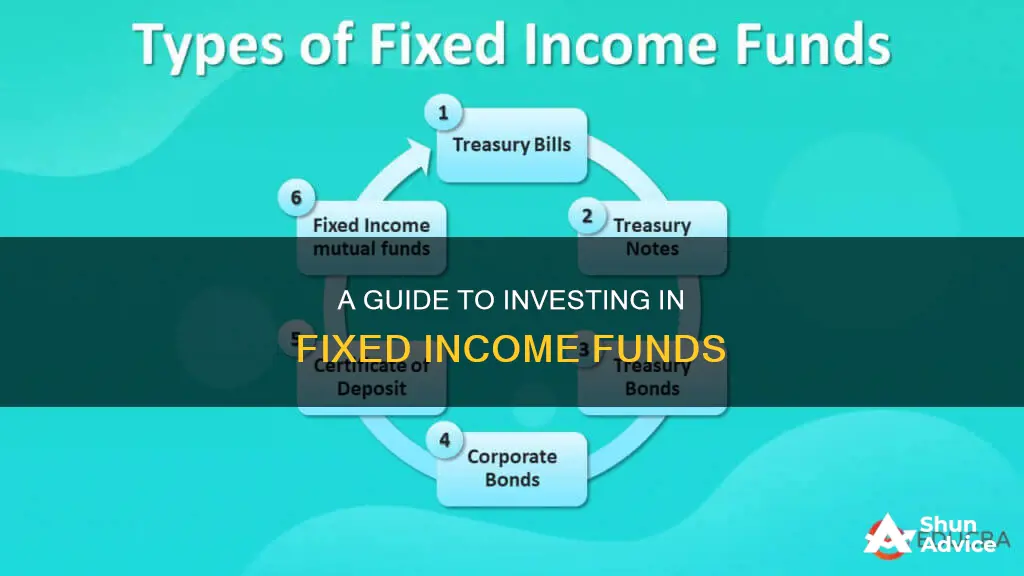

There are several types of fixed-income investments, including federal government bonds, municipal bonds, corporate bonds, CDs, and money market funds. These investments have various pros and cons, including potential tax benefits, lower returns, interest rate risk, and issues with cash access.

When investing in fixed income, it is important to assess your risk tolerance and stage in the investor life cycle to determine your asset allocation. The easiest way for individual investors to access diversified fixed-income investments is through bond mutual funds and bond exchange-traded funds (ETFs).

| Characteristics | Values |

|---|---|

| Definition | Fixed income refers to assets and securities that pay a set level of income to investors, typically in the form of fixed interest or dividends. |

| Examples | Government and corporate bonds, CDs, money market funds, commercial paper, preferred stock |

| Benefits | Steady income stream, more stable returns than stocks, higher claim to assets in bankruptcies, government and FDIC backing on some |

| Risks | Returns are often lower than other investments, credit and default risk exposure, susceptible to interest rate risk, sensitive to inflationary risk |

| How to Invest | Mutual funds, exchange-traded funds (ETFs), fixed income separately managed accounts (SMAs), direct access to a range of bond markets |

What You'll Learn

Mutual funds and exchange-traded funds (ETFs)

Mutual Funds:

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of assets, such as stocks, bonds, or other securities. They are commonly managed by financial institutions and can offer active portfolio management. Mutual funds typically have higher fees due to the costs associated with active management, marketing, distribution, and administration. They are also less tax-efficient than ETFs in certain jurisdictions, such as the United States. Mutual funds can be purchased directly from the issuer or through a brokerage firm, and they are traded only once daily at the net asset value of the fund after the market closes. One advantage of mutual funds is that they can be purchased in fractional shares or fixed dollar amounts, making them accessible to investors with varying budget constraints.

Exchange-Traded Funds (ETFs):

ETFs, on the other hand, are investment funds that are traded on stock exchanges, just like individual stocks. They offer low expense ratios and greater tax efficiency since they generally have lower turnover, resulting in fewer taxable events for investors. ETFs provide diversification benefits and can track various asset classes, including stocks, bonds, commodities, currencies, and even cryptocurrencies. They are more liquid than mutual funds as they can be bought and sold throughout the trading day at market prices. ETFs are also more transparent, as their holdings are typically published online daily. However, ETFs may have higher stockbroker commissions, and some brokers may not allow for automatic recurring investments or trading of fractional shares.

Choosing Between Mutual Funds and ETFs:

The choice between mutual funds and ETFs depends on your investment goals, risk tolerance, and preferences. Mutual funds may be suitable for investors seeking active portfolio management and a long-term buy-and-hold investment strategy. ETFs, on the other hand, offer more flexibility and are ideal for investors who want to make frequent trades or implement specific investment strategies. Additionally, ETFs are generally more cost-effective and provide easier access to diverse asset classes. It is important to carefully consider the fees, tax implications, liquidity, and investment objectives associated with each type of fund before making an investment decision.

Hedge Fund Memos: Where to Access and Read

You may want to see also

Government bonds

There are different types of government bonds, including Treasury bills (T-bills), Treasury notes (T-notes), and Treasury bonds (T-bonds). T-bills are short-term securities that mature within a year and do not make coupon payments. T-notes have maturities between two and ten years, pay a fixed interest rate, and are sold in multiples of $100. T-bonds are similar to T-notes but mature in 20 or 30 years.

When investing in government bonds, it is important to consider the level of risk and return that is appropriate for your investment goals and tolerance for risk. Government bonds are generally considered to be low-risk investments, but there is still the possibility of credit and default risk, interest rate risk, and inflationary risk.

Cytonn Money Market Fund: Your Guide to Investing

You may want to see also

Corporate bonds

In terms of maturity, corporate bonds can be loosely categorised as follows:

- Short-term notes (up to five years)

- Medium-term notes (between five and 12 years)

- Long-term bonds (more than 12 years)

Hedge Fund Investment Strategies: Where and How They Invest

You may want to see also

Interest rates

To mitigate this risk, investors can use a laddering strategy, investing in a series of short-term bonds with different maturities. As bonds mature, the returned principal can be reinvested in additional short-term bonds, providing a steady stream of interest income while also allowing investors to take advantage of rising market interest rates.

The interest rate risk associated with fixed-income investing is particularly relevant in the context of rising interest rates, as higher interest rates can make existing bonds less attractive, causing their prices to decline. This can lead to a loss for investors who sell their bonds before maturity.

Additionally, fixed-income investments can provide a hedge against market volatility, especially during periods of stock market decline. They offer a predictable stream of income and are considered lower-risk compared to growth-oriented investments like stocks. However, the relatively lower risk also translates to lower potential returns.

In summary, while fixed-income investments offer stability and regular income, investors need to carefully consider the interest rate environment and their investment horizon when making decisions.

Funding an Investment Farm: Strategies for Success

You may want to see also

Capital preservation

Investment Vehicles

There are several investment vehicles that can be used for capital preservation:

- US Treasury securities: These include Treasury bills, notes, and bonds, which are considered very safe due to their backing by the US government.

- High-yield savings accounts: These accounts offer higher interest rates than traditional savings accounts, providing a higher return on investment.

- Money market accounts: These accounts invest in short-term, high-quality debt securities and can provide a stable return with low risk.

- Bank certificates of deposit (CDs): CDs are insured by the Federal Deposit Insurance Corporation (FDIC) and offer a fixed rate of return, making them a safe investment option.

Benefits of Capital Preservation

The main benefit of capital preservation is the stability and security it provides. By investing in safe, short-term instruments, investors can protect their principal and generate a steady income stream. This strategy is particularly suitable for risk-averse investors or those with a low-risk tolerance.

Drawbacks of Capital Preservation

One significant drawback of capital preservation is the impact of inflation on the rate of return over prolonged periods. While inflation may not significantly affect returns in the short term, it can substantially erode the real value of an investment over time. For example, a modest 3% annual inflation rate can reduce the real value of an investment by 50% in 24 years. Therefore, investors utilising the capital preservation strategy are advised to invest in inflation-adjusted instruments, such as Treasury Inflation-Protected Securities (TIPS), to protect their investments from the effects of inflation.

Equity Funds in India: A Guide to Investing

You may want to see also

Frequently asked questions

Fixed-income funds are a type of investment fund that focuses on generating consistent returns through fixed-rate interest or dividend payments. These funds typically invest in low-risk assets such as bonds, certificates of deposit (CDs), and money market funds.

There are a few ways to invest in fixed-income funds, including:

- Fixed-income mutual funds: These funds pool investor dollars to purchase a diverse range of bonds and other fixed-income securities, providing investors with a steady income stream and professional portfolio management.

- Fixed-income exchange-traded funds (ETFs): ETFs work similarly to mutual funds but are traded on a public exchange, offering more accessibility and cost-effectiveness for individual investors.

- Individual bonds: Investors can also choose to build their own fixed-income portfolio by investing directly in individual bonds, CDs, and annuities.

Fixed-income funds offer a more conservative investment strategy with lower risk and more predictable returns compared to stocks. They provide a steady income stream, help diversify portfolios, and are often recommended for investors seeking capital preservation and stable returns.

While fixed-income funds are generally considered low-risk, they are still subject to certain risks, including:

- Interest rate risk: Rising interest rates can cause bond prices to fall, leading to potential losses if bonds are sold before maturity.

- Default risk: There is a possibility that the issuer of a bond or fixed-income security may default on their payments, resulting in losses for investors.

- Inflation risk: Inflation can erode the purchasing power of the income generated from fixed-income investments.