The Future Fund is an independently managed sovereign wealth fund established in 2006 to strengthen the Australian government's long-term financial position. As of 31 December 2023, the fund had $272.3 billion in assets under management. The fund's main objective is to strengthen the Commonwealth's long-term financial position by investing in various sectors and asset classes, including public and private markets, to build a diversified portfolio. The Future Fund also manages other Australian sovereign wealth funds, such as the DisabilityCare Australia Fund, the Medical Research Future Fund, and the Aboriginal and Torres Strait Islander Land and Sea Future Fund.

If you are considering investing in the Future Fund, it is important to understand its investment strategies, risk management approach, and the sectors or companies it focuses on. Additionally, seeking advice from a financial advisor or conducting further research on the fund's performance and updates is crucial before making any investment decisions.

What You'll Learn

Investment mandates and strategies

Investment mandates are a set of instructions or guidelines for how an investment manager may invest money for a particular fund. They are also referred to as "mandates" or "fund mandates". They are important because they ensure that investment managers abide by the desired strategy and stay within specific risk parameters.

Mandates are important for both the investor and the investment manager. For the investor, they ensure that their money is invested wisely and in line with their strategic goals. For the investment manager, they clarify expectations and let them know where they have flexibility and where they must abide by specific parameters.

Mandates may include rules or guidelines on the following:

- Priorities and goals

- Acceptable levels of risk

- Types of funds to be chosen or avoided

- Benchmarks to be used

- Specific investments or types that should be included or avoided

Mandates are particularly important for pooled funds, where they ensure that all parties—investors, potential investors, and the investment manager—are on the same page regarding the fund's goals, level of risk, and types of investments included in the portfolio.

In addition to investment mandates, there are also investment strategies that guide how to allocate and invest money. Investment strategies may include:

- Skill-based absolute return strategies and other risk premia providing diversity of return streams

- Treasury bills, bank bills, and deposits

- Fixed interest securities, including mortgages, high-yield credit, and corporate loans

- Exposures to listed currencies, developed and emerging market currency, domestic and global interest rates, and portfolio protection strategies

- Equities in Australia, global developed markets, and global emerging markets

- Venture capital, growth capital, and buyout

- Real estate, infrastructure, and timber assets gained through public or private markets

Vanguard's Anti-Gun Investment: Funds for a Safer Future

You may want to see also

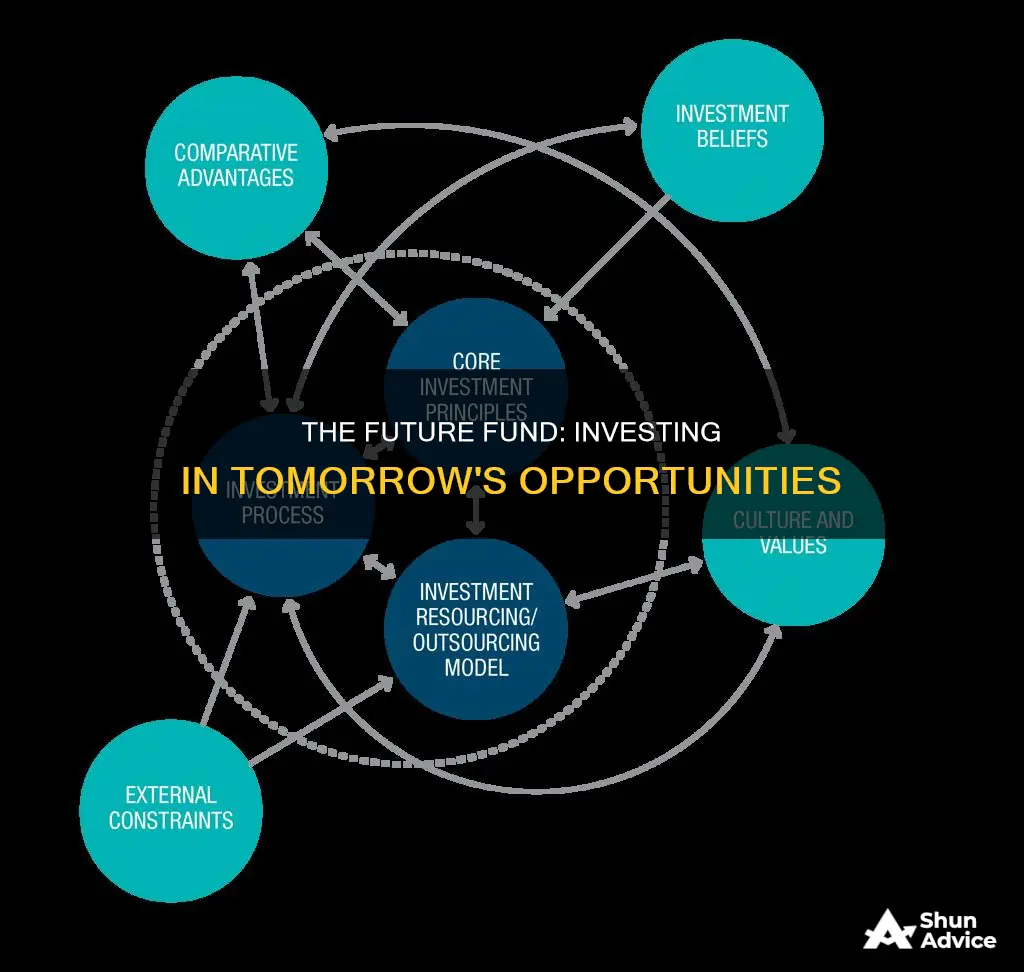

Investment beliefs

- Strong Governance: The Future Fund emphasises the importance of strong governance in their investment process. This includes adhering to regulatory requirements, maintaining transparency, and making informed decisions in the best interests of their clients.

- "One Team, One Purpose" Culture: The fund fosters a unified culture with a shared goal. This culture promotes collaboration, effective decision-making, and a consistent investment approach across the organisation.

- Total Portfolio Approach: They believe in focusing on the whole-of-portfolio level rather than individual investments in isolation. This approach helps them stay focused on long-term performance and effectively integrate diverse investment ideas.

- Active Management: The Future Fund believes that market inefficiencies present opportunities for active management. They aim to add value by exploiting these inefficiencies and making strategic investment decisions.

- Multi-Faceted Risk Management: Recognising that risk is inherent in investing, they adopt a robust risk management framework. This involves understanding the multifaceted nature of risk and implementing strategies to enhance their ability to achieve investment mandates while managing risks effectively.

- Value Creation: The fund focuses on the net value added by their investments, aiming to utilise their scale and market standing to reduce costs and maximise returns. They also recognise the importance of their comparative advantages, such as their long-term investment horizon and sovereign reputation, in achieving their investment objectives.

- Long-Term Investment Horizon: As a long-term investor, the Future Fund can withstand short-term market volatility and take strategic positions expected to pay off over time. This includes investing in private or illiquid assets that offer additional returns.

- Access to High-Calibre External Partners: By leveraging their scale, sovereign status, and reputation, the Future Fund gains access to skilled external partners and fund managers. This allows them to tap into diverse expertise and enhance their investment capabilities.

- Single Client and Single Purpose: The Future Fund has a clear mission to invest for the benefit of future generations of Australians, represented by their single client, the Australian Government. This singular focus enhances their investment strategy and aligns with their investment objectives.

TSP Funds: Where to Invest for Maximum Returns

You may want to see also

Investment model

The Future Fund is an independently managed sovereign wealth fund established in 2006 to strengthen the Australian Government's long-term financial position. The fund's main objective is to "strengthen the Commonwealth's long-term financial position" by making provisions for unfunded superannuation liabilities for politicians and public servants. The fund is managed by the Future Fund Board of Guardians with the support of the Future Fund Management Agency.

The Investment Mandate for the Future Fund is to target a benchmark return of at least the Consumer Price Index + 4 to 5% per annum over the long term, while taking an acceptable but not excessive level of risk. The fund takes a tailored approach to investing, seeking out the best investment ideas for the targeted risk and return objectives in a given environment.

The Future Fund's investment categories include:

- Skill-based absolute return strategies and other risk premia providing diversity of return streams

- Treasury bills, bank bills, and deposits

- Non-government fixed-interest securities extending to mortgages, high-yield credit, and corporate loans

- Exposures to listed currencies, developed and emerging market currencies, domestic and global interest rates, portfolio protection strategies, and other return-enhancing and/or risk mitigation strategies

- Australian equities, global developed market equities, and global emerging market equities

- Venture capital, growth capital, and buyout

- Real estate, infrastructure, and timber assets gained through public or private markets

The fund's investment beliefs shape the way the investment team behaves, interacts with external providers, and makes decisions. These beliefs include:

- Strong governance

- A 'One team, One purpose' culture

- A total portfolio approach to improve long-term performance

- Inefficiencies in markets create opportunities for active management

- Robust risk management enhances the ability to achieve mandates

- Focusing on the value added, net of all costs, while utilising scale and market standing to reduce costs

The Future Fund also has several comparative advantages that help it achieve its mandates, including:

- Being a long-term investor with a long investment horizon that allows it to look through short-term volatility and take patient positions

- Its reputation as a sovereign institution, which grants it access to other sovereign institutions and highly regarded peers, investment organisations, and staff

- Access to high-calibre external partners, including best-in-class external partners and fund managers, due to its scale, sovereign status, and reputation

UK Index Fund Investment: A Beginner's Guide

You may want to see also

Investment policies

The Future Fund is an independently managed sovereign wealth fund established in 2006 to strengthen the Australian Government's long-term financial position. The fund seeks to make provisions for unfunded superannuation liabilities for politicians and public servants, which will be payable during a period when an ageing population is likely to strain the Commonwealth's finances. As of 31 December 2023, the fund had $272.3 billion in assets under management.

The Future Fund Board is responsible for several other Australian sovereign wealth funds, including the DisabilityCare Australia Fund, Medical Research Future Fund, Future Drought Fund, Aboriginal and Torres Strait Islander Land and Sea Future Fund, Disaster Ready Fund, and Housing Australia Future Fund.

The Future Fund's investment approach is based on its 'one team, one purpose' strategy, where investment teams collaborate to bring together expertise and respond nimbly and innovatively to opportunities. The fund seeks to balance the risk and return aspects of each fund's investment mandate to grow and protect capital and build diversified portfolios.

The fund's investment policies are outlined in its Statement of Investment Policies, which includes the following:

- Investment strategies for each of the funds managed by the Future Fund Board of Guardians

- Investment manager and asset selection, monitoring, and divestment policy

- Risk management policy

- Tax risk management policy

- Liquidity risk management policy

- Ownership rights and environmental, social, and governance policy

The fund invests globally across public and private markets to build highly diversified investment portfolios. It seeks out the best investment ideas that align with its targeted risk and return objectives within a given investment environment. The fund's investment categories include skill-based absolute return strategies, treasury and bank bills, fixed-interest securities, currency exposures, equity investments, venture capital, real estate, and infrastructure assets.

The Future Fund's long-term investment horizon allows it to look beyond short-term volatility and take positions expected to pay off over time. Its reputation as a sovereign institution provides access to highly qualified staff and best-in-class external partners and fund managers.

Strategies for Investing Like a Hedge Fund Manager

You may want to see also

Investment managers

The fund's investment approach is guided by its core investment beliefs, which shape the behaviour of the investment team and their interactions with external providers. The fund's "One team, One purpose" culture fosters collaboration and innovation, ensuring that teams bring together diverse expertise to respond agilely to investment opportunities.

The Future Fund's investment mandates, beliefs, models, and policies shape their investment portfolios. They seek to understand the investment environment and key drivers of portfolio risks to make informed decisions. The fund takes a long-term investment horizon, allowing them to weather short-term volatility and focus on long-term gains.

The fund's investment strategy is designed to be resilient and aligned with its core investment beliefs. They invest globally across public and private markets to create highly diversified portfolios. The fund's investments cover a wide range of asset classes, including skill-based absolute return strategies, treasury and bank bills, fixed-interest securities, currency exposures, equity markets, venture capital, real estate, and infrastructure assets.

The Future Fund also has access to high-calibre external partners, leveraging the skills and experience of best-in-class external partners and fund managers due to its scale, sovereign status, and reputation. This allows them to make well-informed decisions and maximise returns while managing risks effectively.

Senior Living Fund: A Smart Investment for Your Future

You may want to see also

Frequently asked questions

The Future Fund is an independently managed sovereign wealth fund established in 2006 to strengthen the Australian Government's long-term financial position.

The Future Fund's main objective is to "strengthen the Commonwealth's long-term financial position". The fund targets a benchmark return of at least the Consumer Price Index + 4 to 5% per annum over the long term, while taking a moderate level of risk.

The Future Fund seeks out the best investment ideas for the targeted risk and return objectives in a given investment environment. They invest globally across public and private markets to build highly diversified investment portfolios.

The Future Fund invests in a range of asset classes, including equities, fixed-income securities, currencies, real estate, infrastructure, and venture capital. They also focus on transformative companies that are changing the world by capitalizing on secular trends.

You can invest in the Future Fund by purchasing their ETFs (exchange-traded funds). The Future Fund LLC is an SEC-Registered Investment Advisor. They offer a Long/Short ETF that seeks to identify inflection points in multi-year secular trends and invest in companies that can exploit these trends.