Grayscale Bitcoin Trust (BTC) is a digital currency fund launched and managed by Grayscale Investments, LLC. The fund invests in Bitcoins and Bitcoin-related derivatives such as futures, swaps, and other CFTC-regulated derivatives that reference digital currencies. It is the world's leading crypto asset manager by assets under management, aiming to transform disruptive technologies of the future into investment opportunities. The trust provides indirect exposure to Bitcoin, allowing investors to gain access to the cryptocurrency without actually buying it. However, investing in the trust comes with significant risks and complexities, and it is not a true common stock.

| Characteristics | Values |

|---|---|

| Type of Investment | Grayscale Bitcoin Trust is a statutory trust that is publicly traded and holds substantial amounts of Bitcoin. |

| Investment Options | Grayscale Bitcoin Trust (GBTC) is a trust that only holds Bitcoin. |

| Price | The stock price of Grayscale Bitcoin Trust (BTC) is currently 40.35. |

| Stock Symbol | The stock symbol for Grayscale Bitcoin Trust (BTC) is "GBTC_OLD." |

| Stock Exchange | Grayscale Bitcoin Trust (BTC) is listed and trades on the OTC Markets stock exchange. |

| Performance | The price of Grayscale Bitcoin Trust (BTC) has hit its highest level in the last year (52-week period). |

| Risks | The investment comes with significant risks and riders. |

| Benefits | GBTC is a convenient vehicle for institutional investors and hedge funds to gain indirect exposure to Bitcoin without associated costs like custody. |

What You'll Learn

What is Grayscale Bitcoin Trust?

Grayscale Bitcoin Trust (GBTC) is a digital currency investment product that makes bitcoins available to individual and institutional investors. It is a trust that only holds Bitcoin. It is sponsored by Grayscale, which is the world's leading crypto asset manager by assets under management.

The trust was originally launched in 2013 but was only available to institutional and accredited investors. On 21 January 2020, GBTC became a Securities and Exchange Commission (SEC) reporting company, registering its shares and making the trust the first digital currency investment vehicle to have this status. In January 2024, Grayscale was finally approved to operate GBTC as a spot bitcoin exchange-traded fund (ETF), along with ten other funds.

GBTC is solely and passively invested in Bitcoin. Its investment objective is to reflect the value of Bitcoin held by the Trust, less expenses and other liabilities. Bitcoin is a digital asset that is created and transmitted through the operations of the peer-to-peer Bitcoin Network, a decentralised network of computers that operates on cryptographic protocols. The Bitcoin Network allows people to exchange tokens of value, Bitcoins, which are recorded on a public transaction ledger known as a Blockchain.

GBTC is available for investors to buy and sell in the same way as virtually any ETF. It can be traded through brokerage firms and is also available within tax-advantaged accounts like individual retirement accounts or 401(k)s. This presents a potential tax benefit for investors, allowing them to gain exposure to Bitcoin in a tax-friendly manner, a significant advantage considering the capital gains tax implications of direct cryptocurrency investments.

One of the primary advantages of GBTC is its ability to provide simplified access to Bitcoin, especially for individuals unfamiliar with the ins and outs of cryptocurrency trading and digital wallets. Unlike direct investments in Bitcoin, which require a good understanding of blockchain technology and cryptocurrency exchanges, GBTC allows investors to trade shares in traditional brokerage accounts. This streamlined access can appeal to those seeking exposure to Bitcoin's price movements without learning the intricacies of cryptocurrency transactions.

Another significant advantage of GBTC is its security. Storing cryptocurrency safely is challenging, and Grayscale says its assets are safeguarded in line with the best industry standards. Investing in GBTC sidesteps the common security risks of cryptocurrency exchanges and wallet providers. These platforms are frequently targeted by hackers, and many investors have lost funds from security breaches.

The Tax Implications of Bitcoin Investments

You may want to see also

How does Grayscale Bitcoin Trust work?

The Grayscale Bitcoin Trust (GBTC) is a digital currency investment product that allows individuals and institutions to buy shares representing partial ownership in the trust. It is tailored for institutional investors and offers a compliant and secure avenue for cautious investors in the evolving cryptocurrency market.

GBTC functions as an ETF, enabling institutional investment in the primary market and providing regulated access to Bitcoin for retail investors in the secondary market. Authorized partners seeking to invest in GBTC can do so by Grayscale acquiring Bitcoin on the primary crypto market and issuing an equivalent number of GBTC shares in return for capital. These shares can then be sold on the stock market to retail investors.

GBTC is traded on the over-the-counter (OTC) market, making it accessible to a wide range of investors, including individuals, institutional investors, and even retirement accounts like 401ks and IRAs. It is designed to offer individuals interested in cryptocurrencies exposure to the Bitcoin market, eliminating the need for direct acquisition of the underlying asset.

Grayscale Bitcoin Trust is one of the first securities solely and passively invested in Bitcoin (“BTC”) that enables investors to gain exposure to BTC in the form of a security while avoiding the challenges of buying, storing, and safekeeping BTC directly. Shares (based on BTC per share) are designed to reflect the value of BTC held by the Trust, determined by reference to the Index Price, less the Trust's expenses and other liabilities.

The trust passively invests solely in BTC, offering investors exposure to BTC as a security without the complexities of directly buying, storing, and securing Bitcoin. Initially accessible only as a private placement, GBTC started trading publicly on the OTC market in 2015, following the alternative reporting standard for companies not obligated to register with the SEC.

Get Bitcoin for Free: No Investment Needed

You may want to see also

How to invest in Grayscale Bitcoin Trust

Grayscale Bitcoin Trust (GBTC) is a publicly traded statutory trust that offers investors indirect exposure to Bitcoin. It is a convenient vehicle for institutional investors and hedge funds to gain exposure to the volatile asset without paying associated costs such as custody.

GBTC is not a common stock but a grantor trust that holds Bitcoin. It is important to note that the Investment Company Act of 1940 does not cover grantor trusts, so they do not provide investor protections.

To invest in GBTC, you can purchase shares on the OTC Markets stock exchange, where the trust is listed and traded. The stock symbol for Grayscale Bitcoin Trust is "GBTC_OLD."

Before investing, it is essential to conduct comprehensive analysis and assess the potential of the investment. You can sign up for InvestingPro to evaluate the stock's fair value and other essential metrics.

Grayscale Bitcoin Trust's share price closely mirrors the performance of Bitcoin, but it can over- or undershoot Bitcoin's performance based on investor sentiment. The trust's shares often mimic the volatile price movements of its holding asset.

Grayscale, the company behind the trust, is the world's leading crypto asset manager by assets under management. They offer various investment products and funds, including private placements and publicly traded funds, providing investors with different options to gain exposure to the digital economy.

It is worth noting that Grayscale has faced challenges in its attempts to convert the trust into an exchange-traded fund (ETF). Regulators have rejected these efforts, citing concerns about investor protection and the lack of oversight over cryptocurrency-trading venues not registered as exchanges in the U.S.

Bitcoin: Risky Business or Safe Bet?

You may want to see also

Risks and benefits of investing in Grayscale Bitcoin Trust

The Grayscale Bitcoin Trust (GBTC) is a digital currency investment product that makes Bitcoin available to individual and institutional investors. It is one of the only ways that US investors can gain exposure to Bitcoin through the stock market.

Benefits

One of the primary advantages of GBTC is its ability to provide simplified access to Bitcoin, especially for individuals unfamiliar with cryptocurrency trading and digital wallets. GBTC allows investors to trade shares in traditional brokerage accounts, making it a more streamlined and appealing process.

GBTC is also available within tax-advantaged accounts like individual retirement accounts or 401(k)s, presenting a potential tax benefit for investors. The trust structure may provide certain tax advantages or considerations that individual investors should review with a tax advisor.

Another significant advantage is security. Storing cryptocurrency safely is challenging, and Grayscale claims its assets are safeguarded using the best industry standards. Investing in GBTC helps investors sidestep the common security risks of cryptocurrency exchanges and wallet providers, which are frequent targets for hackers.

Risks

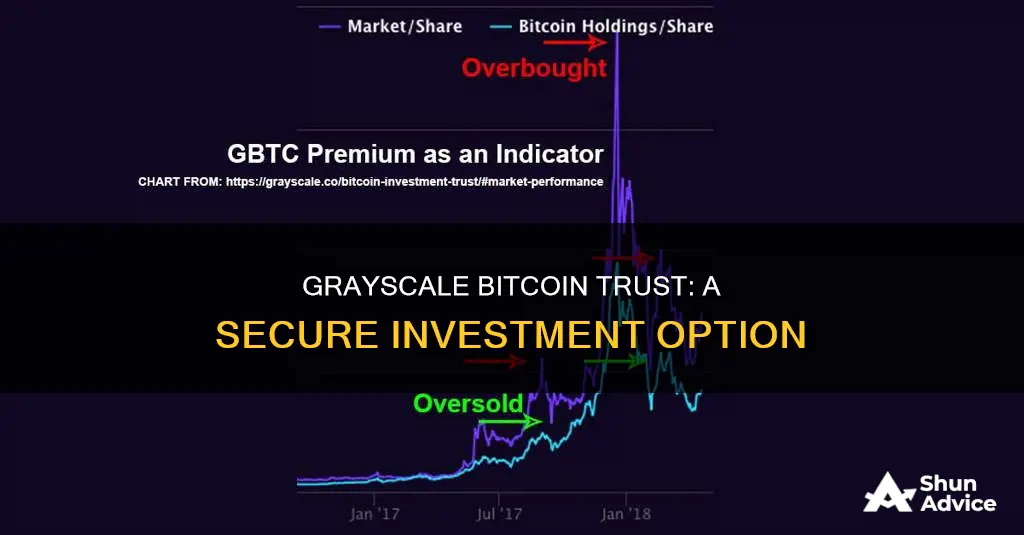

GBTC has been criticised for carrying significant risks, including volatility and high premiums. The shares in the fund can trade at either a premium or a discount to the actual price of Bitcoin, and historically, they have almost always traded at a premium. This is good for Grayscale and its investors, who profit from the premium, but it is less advantageous for investors.

GBTC is also known for its high management fees (1.5%) compared to other pooled investment vehicles. The fee structure could erode returns, especially in a bear market, making it a less cost-effective option for investors.

Additionally, regulatory concerns have surrounded GBTC due to the SEC's cautious approach toward cryptocurrency-based financial products. This has resulted in regulatory uncertainty, impacting the trust's shares, which have traded at a discount for extended periods.

Strategizing Your Bitcoin Mine Investment: A Comprehensive Guide

You may want to see also

How does Grayscale Bitcoin Trust compare to other investment options?

The Grayscale Bitcoin Trust (GBTC) is a digital currency investment product that makes Bitcoins available to individual and institutional investors. It is one of the only ways that US investors can gain exposure to Bitcoin through the stock market. It is similar in structure to a closed-end fund.

GBTC offers a more traditional investment in the form of shares. These shares can be traded through brokerage firms and are also available within tax-advantaged accounts like individual retirement accounts or 401(k)s. This presents a potential tax benefit for investors, allowing them to gain exposure to Bitcoin in a tax-friendly manner.

Another advantage of GBTC is its security. Storing cryptocurrency safely is challenging, and Grayscale claims its assets are safeguarded in line with the best industry standards. Investing in GBTC sidesteps the common security risks of cryptocurrency exchanges and wallet providers, which are frequently targeted by hackers.

However, GBTC is known for its high management fees (1.5%) compared to other pooled investment vehicles. The fee structure could erode returns, especially in a bear market, making it less cost-effective than other investment options.

GBTC also carries significant risks, including volatility and high premiums. The price of its shares is meant to reflect the value of Bitcoin held per share, but GBTC shares have frequently traded at a large premium or discount to the actual value of the underlying Bitcoin.

Compared to other investment options, GBTC provides a convenient way for investors to access Bitcoin without direct ownership. It is available to individuals and institutions through brokerage accounts, IRAs, and 401(k)s, offering simplified Bitcoin exposure. However, it has downsides such as high management fees and limited flexibility.

Grayscale also offers several other exchange-traded products, tracking Ethereum, Bitcoin Cash, Litecoin, and other cryptocurrencies. These provide alternative investment options for those seeking exposure to the crypto market without directly purchasing cryptocurrencies.

Egypt's Bitcoin Investment Guide: Getting Started

You may want to see also

Frequently asked questions

The Grayscale Bitcoin Trust (GBTC) is a publicly traded statutory trust that invests in Bitcoin and tracks the Bitcoin price based on the TradeBlock XBX Index.

The trust provides indirect exposure to Bitcoin by investing in derivatives such as futures, swaps, and other CFTC-regulated derivatives that reference digital currencies.

For institutional investors and hedge funds, GBTC is a convenient vehicle to gain indirect exposure to Bitcoin without paying associated costs such as custody. It also offers tax benefits to the Bitcoin trade.

Investing in the trust comes with significant risks. The shares often mimic the volatile price movements of Bitcoin, and the trust's complicated setup means that private investors can offload their shares at a premium in public markets, regardless of the underlying asset's actual worth.

To invest in the Grayscale Bitcoin Trust, you can visit the official website of Grayscale and start your application process.