Hedge funds are a risky alternative investment choice that requires a high minimum investment or net worth. They are not intended for the average investor. Hedge funds are loosely regulated by the SEC and employ complex investing strategies that can include the use of leverage, derivatives, or alternative asset classes to boost returns. They also carry high fee structures and can be opaque and risky. Before investing in a hedge fund, it is important to understand the cost-benefit calculation of the fund's strategy and value proposition. Additionally, hedge funds typically require investors to have a liquid net worth of at least $1 million or an annual income of over $200,000. They are often considered exclusive and only accept investors who meet these financial requirements.

| Characteristics | Values |

|---|---|

| Minimum Investment | From $100,000 to upwards of $2 million |

| Liquidity | Less liquid than stocks or bonds |

| Fees | 1% to 2% asset management fee and 20% performance fee |

| Risk | Riskier than most other investments |

| Investor Type | Institutional investors, such as pension funds, or accredited investors |

| Strategies | Leverage, debt-based investing, short-selling, investing in real estate, art and currency |

What You'll Learn

Understanding the risks

Hedge funds are considered a risky investment choice and are usually only available to accredited investors with a high net worth or large income. They are not suitable for the average investor.

Hedge funds are not as strictly regulated as other funds, and they employ aggressive investment strategies, such as leveraged, debt-based investing and short-selling. They can also invest in alternative asset classes such as real estate, art, and currency. These strategies come with significant risk, and it is possible for investors to lose some or all of their investment.

Hedge funds also carry high fees, typically with a 2% management fee and a 20% performance fee. These fees can eat into overall returns, and hedge funds have historically underperformed stock market indices.

Hedge funds are also considered illiquid, with investors often required to keep their money in the fund for at least a year, and withdrawals may only be permitted at certain intervals.

Additionally, hedge fund returns tend to be negatively skewed, meaning they have "fat tails" characterised by positive returns but a few cases of extreme losses. This makes measures of downside risk, such as Value at Risk (VaR), more useful than traditional volatility measures.

When considering investing in a hedge fund, it is important to conduct thorough due diligence, including understanding the fund's investment strategy, fees, liquidity provisions, and the background and reputation of the fund managers.

International Index Funds: Diversify Your Portfolio, Maximize Returns

You may want to see also

Who can invest

Hedge funds are not your average investment vehicle—they are designed for high-net-worth individuals and institutional investors. Due to the higher levels of risk associated with hedge funds, the U.S. Securities and Exchange Commission (SEC) places regulations on who can invest in them.

To invest in hedge funds as an individual, you must be an accredited investor with a net worth of at least $1 million (excluding the value of your primary residence) or an annual income of over $200,000 ($300,000 if married). These investors are considered sophisticated enough to handle the potential risks that hedge funds carry.

Accredited investors also include institutional investors such as pension funds, insurance companies, trusts, and college endowments.

Funds of Hedge Funds

Funds of hedge funds have become popular as they provide automatic diversification and are more accessible to individual investors. These are pooled funds that allocate capital among several hedge funds, usually around 15 to 25 different funds. They are often registered with the SEC and promoted to individual investors. The net worth and income requirements for these funds are typically lower than investing in a single hedge fund. However, they create a double-fee structure, as you pay fees to both the fund of hedge funds manager and the underlying hedge funds.

Publicly Traded Hedge Fund Companies

Another option for individual investors to get exposure to hedge funds is through publicly traded hedge fund companies or investment companies that have hedge funds as part of their business. Examples include Apollo Global Management (APO) and KKR & Co. (KKR).

Index Funds: Smart Savings or Risky Business?

You may want to see also

How to invest

Hedge funds are considered a risky alternative investment choice that requires a high minimum investment or net worth. They are not intended for the average investor and are usually only available to institutional investors or accredited investors. An accredited investor is defined as an individual with an annual income of over $200,000 or a net worth exceeding $1 million, excluding their primary residence.

If you are an accredited investor, there are a few steps you can take to invest in a hedge fund:

- Research: First, research funds that are currently accepting new investors. You will probably need the guidance of a financial advisor to locate potential hedge funds.

- Review Form ADV: Once you've identified potential funds, look into the fund managers and their investment goals using Form ADV, which can be found on the fund's website or through the SEC's Investment Adviser Public Disclosure database.

- Contact the Hedge Fund: Reach out to the hedge fund to inquire about minimum investment requirements.

- Verify Accredited Investor Status: There is no standardized method for verifying accredited investor status. Each fund determines your status using its own practices, which may include evaluating your income, assets, debts, and experience. This information will often need to be confirmed by licensed third parties, such as financial institutions, investment advisors, or attorneys.

- Understand the Risks and Costs: Hedge funds employ complex investing strategies that can include the use of leverage, derivatives, or alternative asset classes, making them riskier than most other investments. They also carry hefty fees, typically following a "2 and 20" fee system, with a 2% management fee and a 20% performance fee.

- Review Fund Documents: Before investing, be sure to read the hedge fund's documents and agreements, which contain important information about the fund's investment strategies, location, and anticipated risks.

- Understand the Lock-Up Period: Hedge funds often require investors to keep their money in the fund for a specific period (typically one year) before they are allowed to withdraw funds.

If you are not an accredited investor, there are still a few options to get exposure to hedge funds:

- Funds of Hedge Funds: These are pooled funds that allocate capital among several hedge funds, usually investing in 8-25 different funds. They provide automatic diversification and are often registered with the SEC, making them more accessible to individual investors. However, they also create a double-fee structure, as you pay fees to both the fund of funds manager and the underlying hedge funds.

- Publicly Traded Hedge-Fund Companies: You can indirectly invest in hedge funds by investing in publicly traded companies that operate hedge funds or have hedge funds as part of their business, such as Apollo Global Management (APO) or KKR & Co. (KKR).

- ETFs: Hedge Fund ETFs allow investors to access popular trading and investing strategies employed by hedge funds, such as merger arbitrage, long/short, and managed futures.

Remember, investing in hedge funds is a complex and risky endeavour, and it is important to thoroughly research and understand the potential risks and costs before investing.

Vanguard Funds: Ethical Investing and Weapons Manufacturers

You may want to see also

Hedge fund fees

Hedge funds employ a standard "2 and 20" fee system, which refers to a 2% management fee and a 20% performance fee. The management fee is based on the net asset value of each investor's shares. For example, an investment of $1 million will incur a $20,000 management fee for that year. The performance fee is usually 20% of profits. So, if a $1 million investment increases to $1.2 million in one year, the fee owed to the fund will be $40,000.

The 2% management fee is paid to hedge fund managers regardless of the fund's performance. This means that a hedge fund manager with $1 billion in assets under management (AUM) will earn $20 million in management fees annually, even if the fund performs poorly. The 20% performance fee is charged if the fund achieves a level of performance that exceeds a certain base threshold known as the hurdle rate. The hurdle rate could be a preset percentage or based on a benchmark such as the return on an equity or bond index.

Some hedge funds also have a high watermark clause in their performance fee structure. This means that the fund manager will only be paid a percentage of the profits if the fund's net value exceeds its previous highest value. This prevents the fund manager from being paid large sums for poor performance and ensures that any losses must be made up before performance fees are paid out.

The 2 and 20 fee structure has come under scrutiny in recent years, with some investors and politicians considering it excessively high. This is especially true when hedge funds struggle to perform optimally, as has been the case in the wake of the 2008 financial crisis. As a result, some investors have sought out hedge funds that charge lower fees.

There are alternative fee structures that some hedge funds have adopted. For example, startup and emerging hedge funds may offer "founders shares", which entitle investors to a lower fee structure. Another option is to use a discounted fee for investors who are willing to lock up their investments for a specified time period.

A Smart Guide to Investing in Dow Jones Index Funds

You may want to see also

Historical performance

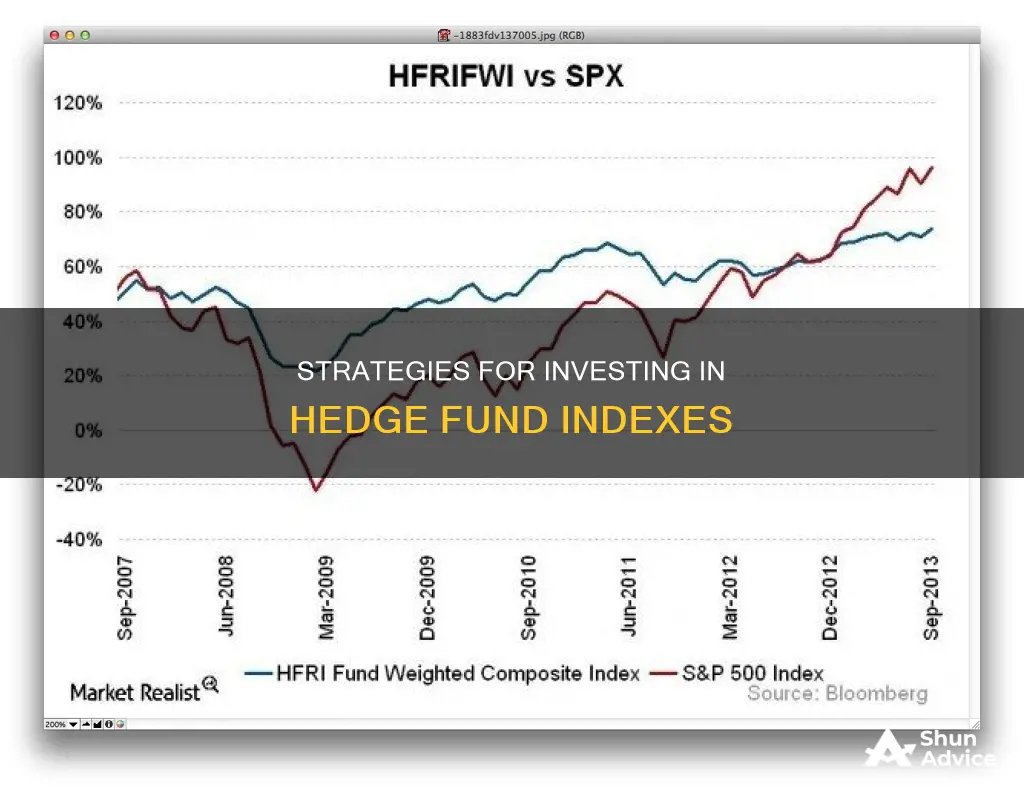

From January 1994 to June 2023, the passive S&P 500 Index outperformed every major hedge fund strategy by over 2.8 percentage points in annualised return. During this period, which included both bull and bear markets, the Credit Suisse Hedge Fund Index lagged behind the S&P 500 with a net average annual performance of 7.02% versus 9.83% for the S&P 500.

From January 2009 to January 2019, hedge funds only beat the S&P 500 in a single year: 2018. This was due to an overall market plunge in December 2018 that almost brought a decade-long bull market into bear market territory. In 2018, hedge funds lost 4.07%, compared to the S&P 500's 4.38% loss.

By 2019, hedge funds were up again, returning 6.96% on average. However, during that same time, the S&P 500 increased by 28.9%, the Dow Jones Industrial Average rose by 22.3%, and the NASDAQ grew by 35.2%.

From 1980 through 2008, hedge funds averaged returns of 6.1 percent after fees, according to the Journal of Financial Economics. During that same period, the S&P 500 rose 12.5% each year on average.

Hedge funds have historically underperformed stock market indices. However, it's important to note that the goal of hedge funds isn't necessarily to outperform the indices but rather to provide growth despite market conditions.

Looking at a longer time period, from January 2000 to January 2013, hedge fund products were somewhere in between equities and bonds in terms of performance. Over this period, asset prices recovered from the dark days of 2008 and early 2009, thanks to ongoing interventions.

In the 1980s and 1990s, hedge fund returns were more directional and the industry was much smaller and nimbler, operating more freely without the observation of investors, media, and regulators. During this period, hedge funds delivered equity-like returns with bond-like volatility.

However, in the 2000s, which was the back end of an unprecedented monetary policy and technology-driven bull market, hedge fund returns were akin to that of a bond portfolio.

Hedge funds have not performed well in the current decade, underperforming both equities and bonds.

Magazine Investment Funds: Where to Invest Wisely

You may want to see also