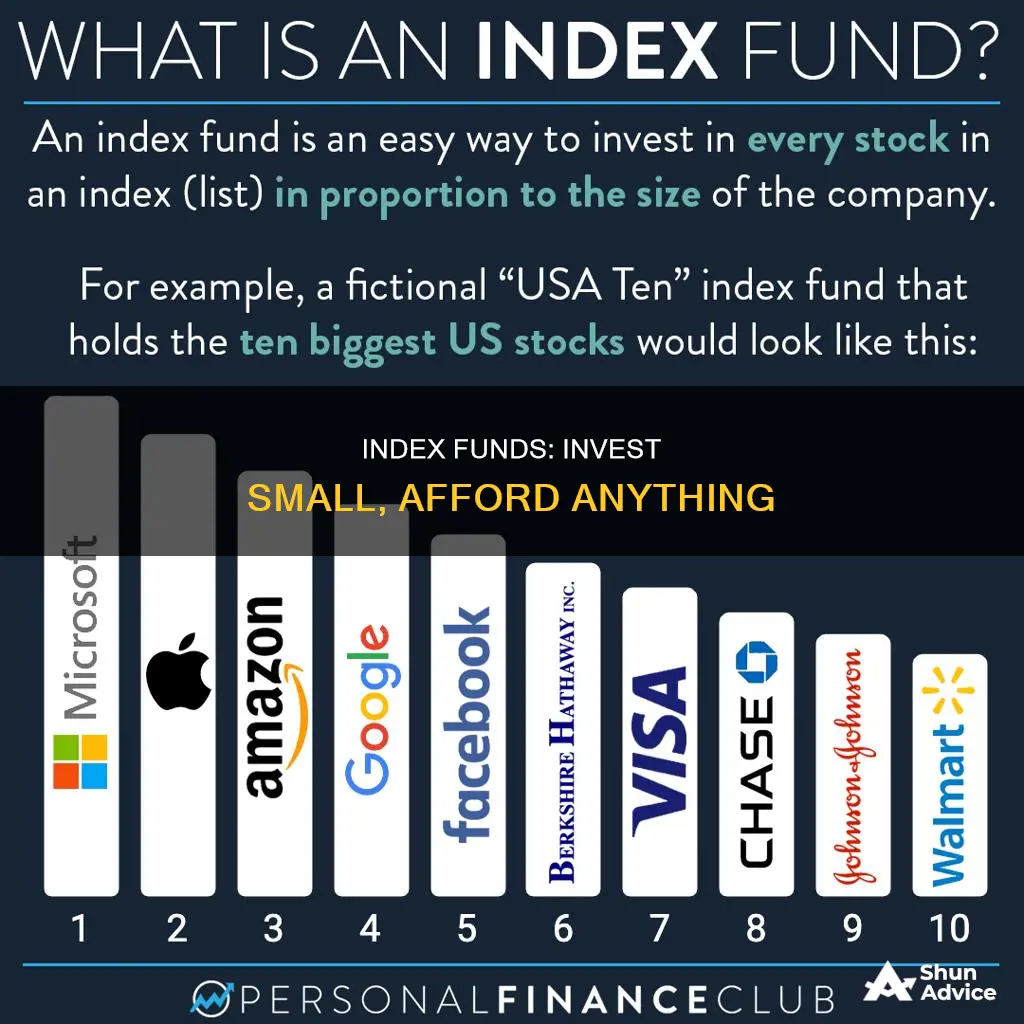

Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500. They are a passive investment strategy, meaning they don't require active management, and are designed to mirror the performance of the index they track. This makes them a low-cost, low-maintenance, and low-risk investment option. Index funds are also highly diversified, as they hold all or a representative sample of the securities in the index they track. This means that with a single fund, investors can gain exposure to a broad range of stocks or bonds.

When investing in index funds, it is important to consider your investment goals and risk tolerance. Different types of index funds exist, such as broad market funds, sector funds, domestic funds, international funds, and bond funds, each with its own risk and return characteristics. It is also crucial to research and analyze the fees associated with index funds, such as expense ratios and investment minimums, as these can impact your returns over time.

Overall, index funds offer an attractive investment opportunity for those seeking a simple, low-cost way to invest in the stock market and build wealth over the long term.

| Characteristics | Values |

|---|---|

| Investment type | Mutual fund or exchange-traded fund (ETF) |

| Investment aim | To match the performance of a designated market index |

| Investment management | Passive |

| Investment risk | Low |

| Investment fees | Low |

| Investment tax | Tax advantages |

| Investment performance | Consistently outperformed other types of funds in terms of total return |

What You'll Learn

Understand the basics of index funds

Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a specific market index, such as the S&P 500. They are designed to mirror the performance of this index as closely as possible by holding all or a representative sample of the securities in that index. This means that by investing in an index fund, you are essentially investing in a broad range of stocks or bonds with just one fund.

Index funds are passively managed, meaning they don't require active decision-making about which investments to buy or sell. Instead, they aim to replicate the performance of the index they are tracking. This passive management strategy helps to keep costs low, as there is no need to pay for the expertise of a fund manager. These lower costs can make a significant difference to your returns, especially over time.

Index funds are also highly diversified, which helps to reduce risk. By investing in an index fund, you are investing in a large number of different companies, so your investment is not dependent on the performance of just a few individual stocks. This diversification means that index funds tend to be less volatile than individual stocks and can provide more stable returns over time.

When choosing an index fund to invest in, it is important to consider your investment goals and risk tolerance. Different index funds will track different indexes, and these indexes may focus on specific industries, sectors, or geographic regions. Some funds may also be weighted towards large-cap, mid-cap, or small-cap companies. It is important to understand the composition of the index a fund is tracking to ensure it aligns with your investment goals.

You can purchase index funds through a brokerage account, directly from an index fund provider, or through an employer-sponsored retirement plan such as a 401(k). When deciding where to purchase an index fund, consider factors such as fund selection, convenience, trading costs, and any account-related fees.

In summary, index funds offer a low-cost, low-risk way to invest in a diversified portfolio of stocks or bonds. By tracking a specific market index, they provide a passive investment strategy that can help you build wealth over the long term.

Blackstone's Borrowed Funds: A Strategic Investment Move

You may want to see also

Set clear investment goals

Setting clear investment goals is an important step in investing in index funds. Here are some key considerations to help you define your investment objectives:

Investment Timeline and Risk Tolerance

Understand your investment horizon, or how long you plan to invest for. If you have a shorter timeline, you may have a lower risk tolerance and opt for less aggressive investments. In this case, bond index funds could be a more suitable option. On the other hand, if you have a longer timeline, you may be willing to take on more risk, making equity index funds a viable choice.

Investment Objectives and Account Types

Determine what you want your money to achieve. Are you saving for retirement, your child's education, or some other financial goal? Different goals may require different types of accounts. For instance, retirement savings can be done through an employer-sponsored plan like a 401(k) or an Individual Retirement Account (IRA). If you're saving for your child's education, a 529 plan or a custodial account could be more appropriate. Each account type has its own contribution limits, tax implications, and features, so choosing the right one is crucial.

Index Fund Types and Investment Strategies

Decide on the types of index funds that align with your goals. Broad market funds offer diversification and are generally used for long-term investing. Sector funds allow you to invest in specific industries or markets, providing targeted growth opportunities but with higher risk. Domestic funds focus on US-based companies, while international funds provide exposure to foreign markets and can help diversify your portfolio. Bond funds are another option, offering regular income through dividends or interest payments. You may choose to invest in a combination of these funds to create a diversified portfolio that matches your risk tolerance and objectives.

Investment Amount and Costs

Consider how much you can comfortably invest in index funds. Evaluate your financial situation, essential expenses, and emergency savings to determine the amount you can allocate towards index funds. Keep in mind that some funds have investment minimums, while others allow for more flexible contributions. Additionally, factor in the costs associated with investing in index funds, such as expense ratios and trading fees. Compare the fees across different funds and brokers to find the most cost-effective options.

By setting clear investment goals and considering these key factors, you can make informed decisions about investing in index funds and ensure that your choices align with your financial objectives and risk tolerance.

Investing 529 Funds for High School: A Guide for Parents

You may want to see also

Research and analyse index funds

Researching and analysing index funds is a crucial step in the investment process. Here are some key considerations to keep in mind:

- Location and Business Sector: Consider the geographic focus and market sector of the index fund. For example, some funds might focus on specific regions like Asia-Pacific or specific industries like pharmaceuticals or technology.

- Market Opportunity: Evaluate the investment opportunities presented by the index fund. For instance, is the fund investing in pharmaceutical companies due to their promising new drugs or their ability to generate steady dividends? Understanding the fund's investment strategy is essential.

- Fund Performance: Evaluate the long-term performance of the index fund, ideally over five to ten years. While past performance doesn't guarantee future results, it provides valuable insights into the fund's potential.

- Expenses and Fees: Compare the expense ratios and trading costs of different index funds. Minimising fees is crucial, as these can significantly impact your overall returns.

- Tax Efficiency: Consider the tax implications of investing in index funds. Mutual funds, for instance, often distribute taxable capital gains at the end of the year, while ETFs do not.

- Investment Minimums: Be mindful of the minimum investment requirements for different index funds. Mutual funds often have higher minimums compared to ETFs, and these can vary significantly between funds.

- Diversification: Assess the level of diversification offered by the index fund. Index funds that track broad market indexes like the S&P 500 or Nasdaq-100 provide extensive diversification, while sector-specific funds may offer a more targeted approach.

- Risk and Return: Understand the risk-return profile of the index fund. While index funds are generally considered less risky than individual stocks due to their diversification, they still carry market risk. Evaluate how the fund has performed during different market conditions.

- Fund Size: Consider the size of the index fund. Larger funds often have lower fees due to economies of scale, but smaller funds may offer more targeted investment opportunities.

- Fund Families: Research the fund families or fund providers offering index funds. Reputable providers with strong track records can be a good choice, as they may have a wider range of funds and stronger performance.

Remember to conduct thorough research, compare multiple index funds, and consider your investment goals and risk tolerance before making any investment decisions.

Merrill Mutual Funds: Choosing the Right Investment for You

You may want to see also

Decide on a fund to buy

When deciding on a fund to buy, it's important to consider your investment goals and risk tolerance. Different index funds are better suited for different goals, so it's crucial to match your goals with the right type of fund. Here are some factors to consider when deciding on a fund to buy:

- Investment goals: Are you saving for retirement, education, health expenses, or something else? Each of these goals may be better served by different types of index funds. For example, if you're saving for retirement, you might opt for stock index funds, while if you're saving for the short term, bond-based index funds might be a more conservative option.

- Account type: Different types of accounts are suitable for different goals. For instance, you might use a 401(k) or IRA for retirement savings, a 529 plan for education savings, or a taxable brokerage account for more flexible goals.

- Index fund type: There are several types of index funds to choose from, including broad market funds, sector funds, domestic funds, international funds, and bond funds. Broad market funds provide diversification within an asset class, while sector funds allow you to invest in a specific industry or market. Domestic funds invest in US-based companies, while international funds provide exposure to foreign markets. Bond funds, on the other hand, invest in bonds and often pay dividends or interest.

- Risk tolerance: Consider your risk tolerance when deciding on an index fund. Aggressive investors may opt for a higher-risk, higher-reward strategy with a larger allocation to equities, while more conservative investors might prefer a larger allocation to bonds.

- Fees and expenses: Index funds typically have lower fees than actively managed funds, but it's important to compare fees and expenses across different funds. Look for funds with low expense ratios and no or low sales loads.

- Performance: While past performance doesn't guarantee future results, it's still worth considering the long-term performance of an index fund. Compare the performance of different funds tracking the same index to see which has performed better over time.

- Investment minimums: Some index funds require a minimum initial investment, so be sure to consider this when deciding on a fund. If you can't meet the minimum, consider exchange-traded funds (ETFs) that track the same index but usually don't have investment minimums.

Remember, it's important to do your research and carefully evaluate your goals, risk tolerance, and the characteristics of different index funds before deciding on a fund to buy. This will help ensure that the fund you choose aligns with your investment objectives and risk profile.

Global Index Funds: A Beginner's Guide to Investing

You may want to see also

Purchase your first index funds

Now that you've decided on your investment goals and timelines, picked an index fund strategy, and researched potential index funds, it's time to make your first index fund purchase. Here's a step-by-step guide to help you get started:

- Open an investment account: If you don't already have one, you'll need to open an investment account before you can invest in an index fund. You can choose from various account types, such as education savings accounts (e.g., 529 plans), retirement accounts (e.g., IRA, Roth IRA, or 401(k)), or taxable brokerage accounts for goals other than retirement. When choosing a brokerage, consider any account-related fees, such as transaction fees.

- Fund your account: Once your investment account is set up, transfer funds into it. You can decide how much you want to invest in index funds based on your financial situation and comfort level. Remember to consider any fund minimums and ensure you have enough to meet those requirements.

- Choose your index fund: Select the specific index fund you want to invest in. Consider factors such as the fund's investment objectives, fees, and performance. You can purchase index funds directly from a mutual fund company or a brokerage.

- Place your trade: Work with your broker to complete a trade ticket, specifying how your money will be invested. You can choose to buy at the market price or place a limit order, which executes the trade at a specified price or lower.

- Monitor your investment: After your trade is completed, your money is invested in the index fund. Remember to periodically review the performance of your index funds and rebalance your portfolio as needed to ensure it aligns with your investment goals.

Remember to consider the potential risks and fees associated with index funds. While they are generally considered low-cost and low-risk, it's important to research and understand the specific funds you plan to invest in.

Floating Rate Funds: A Smart Investment Strategy

You may want to see also

Frequently asked questions

An index fund is a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a specific market index, such as the S&P 500. Index funds aim to mirror the index's performance by holding all or a representative sample of the securities in that index.

Index funds offer several advantages, including low fees, tax advantages, and low risk due to their diversified nature. They are also easy to invest in and often perform very well over the long term.

When choosing an index fund, consider your investment goals and risk tolerance. Match these with the return characteristics and volatility of the index the fund is tracking. Compare expense ratios and fees across different funds, as these can impact your returns over time.

You can purchase index funds through a brokerage account, directly from a mutual fund or ETF provider, or through an online platform. Research and analyze different index funds, considering factors such as geographic location, market sector, and market opportunity. Decide on a fund that aligns with your investment goals and has low fees.