Index funds are a type of investment vehicle that tracks a market index such as the S&P 500 or the Russell 2000. They are a great way to build wealth over time, especially for retirement investors, due to their low costs, passive management, and diversification benefits. By investing in an index fund, you can mirror the performance of an existing stock market index without the need for active fund management, resulting in lower fees. This means that when the index goes up or down, so does the value of your fund.

In this article, we will explore the steps to start investing in index funds on a monthly basis, including choosing the right funds, opening an investment account, and setting up a purchase plan. We will also discuss the advantages and disadvantages of index funds and provide insights into how they work and why they are a popular choice for investors.

What You'll Learn

Pick your exchange

The NASDAQ, for example, tends to focus on growth stocks and is more aggressive on the risk-reward scale. The Dow and S&P 500 are less volatile, though, like any investment, they are not immune to risk. In 2022, they dropped by 8.78% and 19.44% respectively, but recovered value in the first half of 2023.

It's important to study the exchanges for past performances and the types of companies listed before investing any money. Then factor in your risk tolerance and time horizon.

The S&P 500 is probably the most well-known index, but there are also indexes based on company size, business sector, and market opportunity, such as emerging markets. Equity indexes are generally well-suited to adding growth potential (and risk) to your portfolio, and the more niche your equity index, generally, the more risk you're taking on.

Bond-based indexes add stability to investment portfolios and more modest returns. The Barclays Capital Aggregate Bond Index is an example of an index based in the bond and fixed-income markets. Indexes with corporate bonds typically offer higher returns (and more risk) than those that only invest in government bonds.

If you're investing in a taxable account, you'll have to consider capital gains taxes and whether you can offset gains with losses in other investments through a process called tax-loss harvesting. If you're in a tax-advantaged retirement account, you'll want to brainstorm ways to minimise the taxable income you earn each year through retirement account withdrawals.

A financial advisor or tax professional can help you figure out the best strategies for managing withdrawals from any type of investment account.

The biggest difference between an index fund and an ETF is the way they're traded. An ETF is traded like a stock—you can buy and sell it throughout the day. An index fund can only be bought and sold at the price set when the trading day ends. ETFs are often a good option for investors who save each month or with every paycheck.

Mutual Fund Investors: Declare Investments in Your ITR

You may want to see also

Pick your fund

There are many index funds to choose from, and they can be categorized in several ways. The first is by the asset class they invest in. The most common index funds are equity index funds, which track a stock market index such as the S&P 500 or Nasdaq-100. These funds are considered broad as they cover large-cap companies, but there are also more niche equity index funds that try to match thematic indexes, like those that track socially responsible companies or innovative technology companies.

Bond index funds are another type of index fund that simply tracks bond indexes, which may include assets like U.S. Treasuries, corporate bonds, or municipal bonds. There can be significant variation in bond index funds, depending on factors such as the maturity of the bonds (short-term vs. long-term) or the credit rating (with lower-rated bonds typically offering higher risk and reward).

International index funds are also an option. These funds, whether for stocks or other assets, follow indexes outside of the U.S. For example, the FTSE Global All Cap ex US Index is a popular international index that tracks a wide range of stocks outside the US. Some index funds track this index, while others might track more regional ones.

Finally, there are sector-specific index funds that track indexes in certain industries, like technology, healthcare, or energy. This can be a good way to still gain some diversification while betting on a particular sector.

When deciding which index fund to invest in, it's important to research the different fees and portfolio constructions of each fund. Some key fees to look out for are the expense ratio, which is the annual percentage-based charge that encompasses all fees related to managing the fund, and the tax-cost ratio, which tracks the percentage of returns lost due to taxes.

Other things to consider are the fund size and liquidity, as larger funds tend to offer more liquidity and lower trading costs, and the tracking error, or the variance in returns between the fund and its underlying index.

Additionally, you'll want to think about your personal situation and goals. If you're close to retirement, for example, you might prefer the relative stability of a bond index fund rather than an equity index fund. You should also consider your risk tolerance and budget.

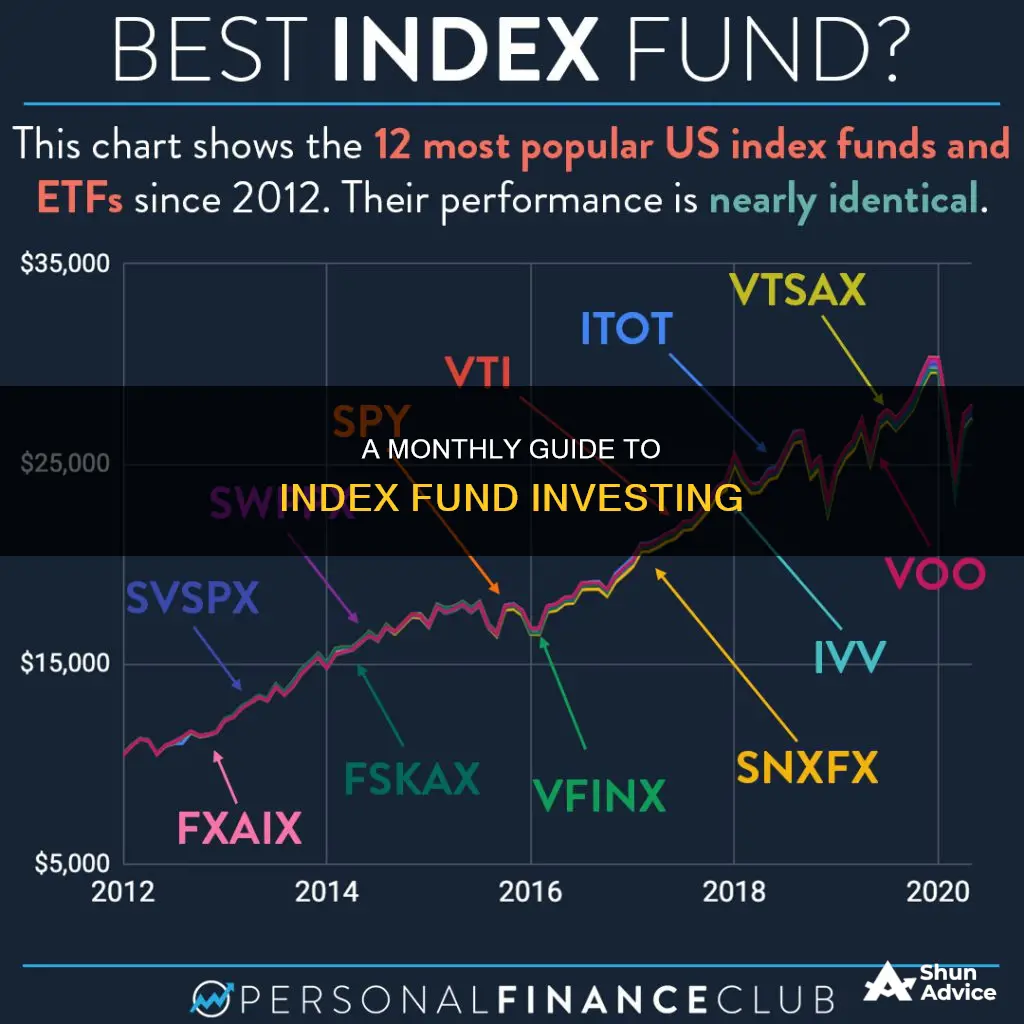

- Vanguard S&P 500 ETF (VOO) (minimum investment: $1; expense ratio: 0.03%)

- Invesco QQQ ETF (QQQ) (minimum investment: NA; expense ratio: 0.2%)

- SPDR Dow Jones Industrial Average ETF Trust (DIA) (minimum investment: none; expense ratio: 0.16%)

Bond Fund Basics: Strategies for Investing Wisely

You may want to see also

Open an investment account

To start investing in index funds, you'll first need to open an investment account. There are several types of investment accounts to choose from, each with its own advantages and considerations:

- Taxable brokerage accounts: These accounts are suitable for financial goals other than retirement, such as saving for a home down payment. They are also a good choice if you've already maxed out your retirement contributions for the year. However, keep in mind that you may owe taxes on any income generated, such as dividends or profits from asset sales.

- Retirement accounts: Accounts like an IRA or 401(k) offer tax benefits for long-term investing towards retirement. Withdrawals from these accounts before retirement could result in penalties and taxes.

- Educational expense accounts: 529 plans are designed for investing in educational expenses. Contributions may be tax-deductible, and investments grow tax-free within the account. Withdrawals used for eligible education expenses may also be tax-free.

- Custodial accounts: Also known as UTMA/UGMA accounts, these accounts allow you to invest on behalf of a child. The cash and investment assets in the account become the child's property when they reach a designated age, usually between 18 and 25, depending on the state.

When choosing an investment account, consider your level of financial expertise and how involved you want to be in the investment process. If you're a self-directed investor who enjoys researching and learning about stocks and bonds, an online brokerage account may be a good option. On the other hand, if you prefer a more hands-off approach, you could consider hiring a financial advisor or using a robo-advisor, which provides automated investment and rebalancing services.

Once you've decided on the type of account that best suits your needs, you can proceed to open an account with a brokerage firm or financial institution of your choice. This process typically involves providing personal information, such as your name, contact details, and social security number. You may also need to set up funding for your account, which can be done by linking a bank account or arranging for fund transfers. Be sure to review the terms and conditions of the account, including any fees, minimum investment requirements, and other relevant details before finalising the account opening process.

Invest Wisely: Bitwise Index Fund Strategies for Beginners

You may want to see also

Decide on your investment strategy

Index funds are a type of investment vehicle that aims to match the returns of a specific market index. They are passively managed, meaning that they are designed to mirror the performance of a particular stock market index, such as the S&P 500 or the Dow Jones Industrial Average. This passive management strategy means that index funds do not actively select which investments to buy or sell. Instead, they aim to be the market by buying stocks of every firm listed on a market index. As a result, index funds are often considered a more stable investment strategy, as market swings tend to be less volatile across an index compared to individual stocks.

When deciding on your investment strategy for index funds, there are several key factors to consider:

- Financial goals: Are you investing for retirement, saving for a down payment on a home, or investing in your child's education? Different financial goals may require different types of investment accounts, such as taxable brokerage accounts, retirement accounts like an IRA or 401(k), or custodial accounts.

- Risk tolerance: How much risk are you willing to take with your investments? Index funds can vary in risk depending on the underlying index they track. For example, the NASDAQ index tends to be more aggressive, while the Dow and S&P 500 are less volatile. Consider your risk tolerance and investment horizon when selecting an index.

- Time horizon: Are your investment goals short-term or long-term? If you are investing for the short term, you may be better off with less risky investments such as high-yield savings accounts or certificates of deposit (CDs). For longer-term goals, you may want to consider taking on more risk by investing in stock index funds.

- Diversification: Index funds can provide diversification by allowing you to invest in a wide range of stocks or bonds within a single fund. You can choose index funds that focus on specific sectors, such as technology or healthcare, or broad-market indexes like the S&P 500 or Dow Jones Industrial Average.

- Costs: Index funds typically have lower fees than actively managed funds, but it's important to consider the expense ratios, trading fees, and investment minimums associated with the fund. Compare the costs of different index funds to find the most cost-effective option.

- Investment account: You will need to open an investment account to purchase index funds. You can choose between an online brokerage account, where you manually invest in funds yourself, or a robo-advisor, which provides automated investment and rebalancing services. Alternatively, you can hire a financial advisor to manage your index fund portfolio and other investments, although this option may be more costly.

By considering these factors, you can develop an investment strategy for index funds that aligns with your financial goals, risk tolerance, and time horizon. Remember to regularly review and rebalance your portfolio to ensure it remains on track to reach your goals.

Bernie Madoff's Ponzi Scheme: Avoiding Client Fund Investments

You may want to see also

Research your index funds

Researching your index funds is a crucial step in the investment process. Here are some key considerations to keep in mind:

- Location and Business Sector: Consider the geographic focus and market sector of the index fund. For example, some funds might invest in American companies, while others could focus on a specific country or region like France or Asia-Pacific. Additionally, determine whether the fund specialises in certain industries, such as pharmaceutical or technology companies.

- Market Opportunity: Understand the investment opportunities presented by the index fund. For instance, is the fund investing in pharmaceutical companies due to their development of groundbreaking drugs or their ability to generate steady dividends? Evaluate whether the fund focuses on high-yield or high-growth stocks.

- Fund Performance and History: Evaluate the long-term performance of the index fund, ideally over a period of at least five to ten years. While past performance doesn't guarantee future results, it provides valuable insights into the fund's potential.

- Expenses and Fees: Compare the expense ratios and fees of different index funds. Mutual funds may charge a sales load (a commission for buying or selling the fund) and an expense ratio (an ongoing fee based on your assets in the fund). ETFs, on the other hand, typically only charge an expense ratio. Choose funds with low expense ratios to maximise your returns.

- Tax Implications: Understand the tax implications of investing in index funds. Mutual funds often pay out taxable capital gains distributions at the end of the year, whereas ETFs do not. Additionally, consider the tax-cost ratio, as owning the fund may trigger capital gains taxes if held outside tax-advantaged accounts.

- Investment and Account Minimums: Mutual funds often have minimum investment amounts for your initial purchase, which could be several thousand dollars. In contrast, ETFs usually have no minimum investment requirements, and your broker may even allow you to purchase fractional shares.

- Trading Costs and Brokerage Options: Some brokers offer attractive prices for buying mutual funds, and many now allow ETF trading without commissions. Be cautious about sales loads or commissions, as they can reduce your investment by 1-2%. Additionally, consider whether the broker you choose offers the specific fund families you're interested in.

Best Banks for Investment: Where to Invest Your Money?

You may want to see also

Frequently asked questions

Whether the market is down or up, as long as you're investing for the long term in a well-diversified portfolio, it's as good a time as any.

As with all investments, it is possible to lose money in an index fund. However, if you invest in an index fund and hold it over the long term, it is likely that your investment will increase in value over time.

Yes, index funds are often good choices for beginners because of their simplicity, low cost, and diversification.

In some sense, index funds are equivalent to the market. However, index funds often outperform actively managed funds over the long term.