Mongolia is a country with vast natural resource wealth and the potential to be one of the fastest-growing economies in the world. With its large deposits of valuable minerals such as coal, copper, gold, and iron, Mongolia is attracting foreign investment in large mining projects. The Mongolian Stock Exchange (MSE) offers opportunities for investors to gain exposure to the country's growing economy, and in 2024, the MSE opened up to foreign ETFs, mutual funds, and institutions for the first time. There are also a number of ETFs available that provide exposure to Mongolia's market, such as the Global X Central Asia & Mongolia ETF (AZIA) and the FMG Mongolia Fund. These funds offer investors the opportunity to invest in one of the world's most resource-rich countries and capture its potential for high growth.

What You'll Learn

The Mongolian Stock Exchange

The history of the MSE's securities market began between 1992 and 1995 when 475 state-owned entities were privatised through the MSE, distributing 96.1 million shares worth 8.2 billion MNT (7.0 million USD) to the citizens of Mongolia. The MSE's privatisation scheme involved issuing vouchers to citizens, which could be redeemed for shares in large enterprises or traded in secondary markets for assets of small enterprises.

The MSE has played a crucial role in the privatisation of state assets and the transition to a market economy in Mongolia. It has also contributed to the country's impressive economic growth, which is driven by foreign investments in mining projects, high levels of agricultural production, and spillover effects from China's growth.

In recent years, the MSE has undergone modernisation and technological upgrades, including the adoption of electronic trading and the integration of sophisticated trading platforms. It has also established relationships with international stock exchanges, such as the London Stock Exchange Group, to enhance its infrastructure and attract foreign investment.

The MSE continues to be an essential platform for companies seeking to raise capital and investors looking to tap into Mongolia's economic potential. With its rapid growth and ongoing developments, the MSE is an exciting opportunity for those interested in investing in Mongolia.

A Guide to Investing in ASX 200 ETFs

You may want to see also

Natural resources

Mongolia has a wealth of natural resources and minerals, including vast deposits of coal, copper, gold, tungsten, tin, nickel, zinc, silver, and iron. The country is also rich in petroleum and natural gas reserves. The discovery of the world-class Oyu Tolgoi copper-gold mine in 2001 has been a significant driver of foreign investment in Mongolia's mining sector. The country's economy, traditionally based on herding and agriculture, is now aggressively expanding due to these foreign investments in large mining projects.

Mongolia's geographic location also benefits its primary commodities and agriculture exports to both China and Russia. The country's proximity to these large global resource markets, along with its flexible regulations relating to foreign investors, make it an attractive destination for investments in natural resources.

The Global X Central Asia & Mongolia Index ETF (AZIA) is a fund that offers exposure to this region. While it has gained traction in recent years, with an 8.5% increase in the last three months as of September 30, 2013, it still has relatively low trading volumes compared to other emerging market ETFs.

The Mongolian government has also made efforts to attract foreign investment by implementing favourable laws and regulations. For example, the Stabilization Certificate provides investors with stability in taxes and rates for a duration of 5 to 20 years, depending on the investment amount. Additionally, the new Securities Market Law and Investment Fund Law have brought more transparency to Mongolian companies' reporting requirements and introduced the legal concepts of nominee and beneficial ownership.

With its abundant natural resources, favourable investment policies, and proximity to major markets, Mongolia presents opportunities for investors interested in natural resources and the mining sector.

Defi ETF Investment: Strategies for Beginners

You may want to see also

Foreign investment

The Mongolian government has implemented several measures to attract foreign investment, such as abolishing controversial laws like the Strategic Entities Foreign Investment Law (SEFIL) and replacing them with more investor-friendly regulations. The country has also ratified the U.S.-Mongolia Agreement on Transparency in Matters Related to International Trade and Investment, which requires public comment periods before new laws and regulations are finalized.

However, there are still challenges to foreign investment in Mongolia. The country faces vulnerability to external economic and financial shocks, ineffective dispute resolution, and a lack of input from stakeholders during rule-making. Additionally, investing in politically sensitive sectors like mining carries higher risks.

To successfully invest in Mongolia, foreign investors should be aware of the following key considerations:

- Mongolia generally does not discriminate against foreign investors, but there are some exceptions. For example, foreign investors must invest a minimum of $100,000 to establish a venture, while Mongolian investors face no investment minimums.

- Foreign investors may obtain use rights for land, but these rights are limited to a set number of years and come with restricted renewal options.

- Mongolia offers a "One-Stop-Shop for Investors," providing services related to visas, taxation, notarization, and business registration.

- The country has a well-established registry for immovable property and a central register for use rights, although there are challenges with conflicting use rights in rural areas.

- The Mongolian government strongly encourages domestic sourcing of inputs, especially for natural resource extraction industries.

- Foreign investors should be aware of potential corruption and bribery demands from officials and political operatives.

- Mongolia has a stable political and security environment, but resource sector investors may face protests and disorder from disputes over local resource utilization.

Overall, foreign investment in Mongolia requires careful consideration of the country's unique economic and regulatory landscape. Investors should conduct thorough due diligence and seek expert advice before making any investment decisions.

ETFs: A Liquid Investment Option?

You may want to see also

The FMG Mongolia Fund

FMG considers liquidity an integral part of the portfolio management process. The fund employs a fundamental approach combined with a long-term quantitative model to determine allocations. This blend of fundamental and quantitative analysis helps identify potential investment opportunities and manage risks effectively. The fund also lost 16.8% in the 3rd Quarter, highlighting the potential volatility of Mongolian assets.

It is important to note that the FMG Mongolia Fund is not available to citizens or residents of the United States and India. Interested investors should carefully review the fund's prospectus and consider their risk tolerance before investing. Mongolia's economy and stock market offer significant growth potential, but it is essential to understand the associated risks and volatility.

Overall, the FMG Mongolia Fund provides investors with a unique opportunity to gain exposure to one of the world's most resource-rich countries, offering the potential for long-term capital growth and a diverse investment portfolio.

M1 Finance: Invest in ETFs with Ease

You may want to see also

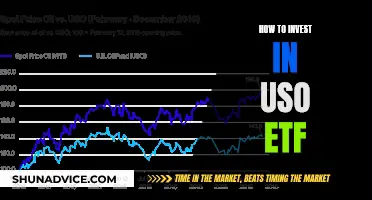

Global X Central Asia & Mongolia ETF

The Global X Central Asia & Mongolia ETF (AZIA) is an exchange-traded fund (ETF) that offers investors exposure to the public equity markets of Central Asian countries, including Mongolia, Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan. The fund, which is domiciled in the United States, seeks to replicate the performance of the Solactive Central Asia & Mongolia Index by investing in stocks across diversified sectors and all market capitalizations.

Global X Funds, the fund's manager, launched the ETF on April 2, 2013. The fund had an initial bid/ask price of 0.00/0.00 and a year-to-date daily total return of 8.35% as of October 22, 2015. However, as of this date, the fund is no longer in business.

Investing in Mongolia can be attractive due to the country's natural resource wealth and potential for high per capita GDP. The country's economy has traditionally been based on herding and agriculture, but foreign investments in large mining projects are driving aggressive expansion. Mongolia's growth is further bolstered by high levels of agricultural production and the spillover effects of China's economic boom.

The Mongolian Stock Exchange (MSE) has also made efforts to attract foreign investment and improve transparency. In 2014, the MSE introduced new laws, including the Securities Market Law, the Investment Law, and the Investment Fund Law, which aim to create a more sustainable and attractive investment environment.

Schwab ETF Investing: A Beginner's Guide

You may want to see also

Frequently asked questions

Some of the top ETFs with exposure to Mongolia include Invesco Emerging Markets Sovereign Debt ETF, Xtrackers Emerging Markets Bond- Interest Rate Hedged ETF, and SPDR Bloomberg Barclays Emerging Markets USD Bond ETF.

Mongolia has vast mineral wealth and is forecast to be one of the fastest-growing economies globally. With its large deposits of critical resources like coal, copper, gold, and iron, it has the potential for significant economic growth.

Investing in Mongolia ETFs provides exposure to a country with high economic growth potential. Mongolia's economy is expanding due to foreign investments in mining projects, and its location near China and Russia gives it a strategic advantage in terms of transportation costs.

The MSE has made significant strides towards attracting foreign investment and improving transparency. It has implemented new laws, such as the Investment Law, Securities Market Law, and Investment Fund Law, to create a more favourable investment environment and facilitate capital inflows.

Yes, the FMG Mongolia Fund offers exposure to the Mongolian market by investing in equities listed on the Mongolia Stock Exchange and offshore-traded securities with assets in the country. This fund targets investors with a higher risk-reward return profile.