Municipal bonds are a type of debt security issued by local or state governments to fund public projects. They are often referred to as muni bonds and are considered a safe and reliable way to invest, particularly for those who are older and approaching retirement. Municipal bonds are generally backed by states, cities, or local governments, and they yield steady returns with lower default rates. They also offer tax benefits, as the interest earned is often exempt from federal and state taxes. There are two main types of municipal bonds: general obligation bonds and revenue bonds. General obligation bonds are used to finance public projects that are not linked to a specific revenue stream, while revenue bonds are used for projects with the potential to generate revenue. Municipal bonds can be purchased directly through traditional sources such as banks, investment brokerage companies, or even directly from the issuing municipality. They can also be bought on the primary or secondary market, or through mutual funds or exchange-traded funds (ETFs). When investing in municipal bonds, it is important to consider the associated fees, potential markup, and the credit rating of the issuer.

| Characteristics | Values |

|---|---|

| Definition | Municipal bonds are debt securities issued by local or state governments to fund public projects. |

| Types | General obligation bonds and revenue bonds |

| Interest payments | Twice a year |

| Taxation | Interest income is often exempt from federal, state, and local taxes. |

| Risk | Low-risk investments with a very high expectation of recouping the investment plus interest. |

| Investment methods | Primary market, secondary market, mutual funds, exchange-traded funds (ETFs), self-directed accounts with online brokers, robo-advisers |

| Investment platforms | TD Ameritrade, Merrill Edge, MuniMarket.com, InvestinginBonds.com, MunicipalBonds.com, Investor.gov |

| Investment advice | Accredited financial planners, robo-advisers |

What You'll Learn

The two types of municipal bond

Municipal bonds, also known as "muni" bonds, are debt securities issued by state and local governments. They are often used to fund public works such as parks, libraries, bridges, roads, and other infrastructure. There are two main types of municipal bonds: general obligation bonds and revenue bonds.

General obligation bonds are issued by governmental entities such as states, cities, or counties and are backed by the "full faith and credit" of the issuer. This means that the issuer has the power to tax residents to pay bondholders. General obligation bonds are used to fund public projects that are not linked to a particular revenue stream, such as building a park or improving a school system. They are considered to be one of the safest types of bonds due to their backing by the issuer.

Revenue bonds, on the other hand, are used to finance public projects with the potential to generate revenue, such as a toll road or concert hall. The cash generated by the project is used to pay back investors in those bonds. Revenue bonds are not backed by the government's taxing power but by revenues from the specific project or source, such as highway tolls or lease fees. They have higher default rates than general obligation bonds as the funds are used for specific projects that may not be completed on time or within budget and may not generate the expected revenues.

Both types of municipal bonds offer tax benefits, with interest income often being exempt from federal income tax and, in some cases, state and local taxes. Municipal bonds generally have lower default rates compared to corporate bonds, making them a relatively low-risk investment option.

Global Bond Funds: Diversify and Grow Your Investments

You may want to see also

Tax benefits

Municipal bonds are generally exempt from federal taxes and, in many cases, state and local taxes as well. They are often favoured by investors in high-income tax brackets because of the tax advantages. Municipal bonds are commonly tax-free at the federal level but can be taxable at state or local income tax levels or under certain circumstances.

Municipal bonds are often exempt from local and state tax when the bond's investor lives in the state in which the bond was issued. If an investor buys the muni bonds of another state, their home state may tax interest income from the bond.

While the interest income is usually tax-exempt for municipal bonds, capital gains realised from selling a bond are subject to federal and state taxes. The short-term or long-term capital gain, or loss, on a bond sale is the difference between the selling price of the bond and the original purchase price of the bond.

When buying munis on the secondary market, investors must be aware that bonds purchased at a discount (less than par value) will be taxed upon redemption at the capital gains rate. Note that this tax does not apply to coupon payments, only the principal of the bond.

Municipal bonds are free from federal taxes and are often free from state taxes if the bond issuer is not in the purchaser's state of residence. In states like Oklahoma, Illinois, Iowa, and Wisconsin, interest income is taxable for residents. In states with no income tax, the purchaser can purchase munis from any state without a state tax obligation.

Municipal bonds can be purchased from a broker-dealer or bank that deals with municipal securities, from an investment advisor, through a self-managed account, or in a muni mutual fund or exchange-traded fund (ETF).

A Guide to Investing in ICICI Prudential Funds

You may want to see also

Default risk

The first factor to consider is the type of municipal bond. General obligation bonds are backed by the "full faith and credit" of the issuing government and are generally considered safer than revenue bonds. General obligation bonds are not linked to a specific revenue stream, and the issuer typically has the power to raise taxes to make bond payments. On the other hand, revenue bonds are backed by fees from public services such as utilities, toll roads, and airports. While revenue bonds can provide higher returns, they are more vulnerable to changes in consumer tastes or general economic downturns.

The second factor is the creditworthiness of the municipal bond issuer. It is important to research the issuer's credit rating and financial health before investing. Credit rating agencies such as Moody's, S&P Global, and Fitch provide ratings based on the likelihood of the issuer meeting its financial obligations. A higher credit rating generally indicates lower default risk, but it is important to monitor the issuer's financial health as credit ratings can change over time.

The third factor is the maturity of the municipal bond. Longer-term bonds are more susceptible to interest rate changes, which can affect the issuer's ability to make payments. Short-term municipal bonds with a maturity of less than five years are generally considered lower risk, as it is more likely that the issuer will be able to repay the principal within this timeframe.

The fourth factor is diversification. Investing in a variety of municipal bond funds can help spread the default risk across multiple issuers and industries. By diversifying your investments, you reduce the impact of a potential default by any single issuer.

Finally, it is important to remember that while municipal bonds have a low default rate, they are not risk-free. There have been cases where governments have defaulted on their municipal bonds, such as Detroit in 2013 and Puerto Rico in 2016. Therefore, it is crucial to carefully consider all the risks and factors before investing in municipal bond funds.

Mutual Funds: India's Smart Investment Choice

You may want to see also

Where to buy municipal bonds

Municipal bonds can be purchased in a few different ways. One way is through the secondary market, where you can buy already-issued bonds from other investors or sell not-yet-matured bonds you already hold. This is similar to how stocks are traded. You'll typically buy and sell through a broker, who is required to register with the Municipal Securities Rulemaking Board (MSRB) and disclose certain pricing information.

Another option is to invest in a mutual fund or exchange-traded fund (ETF) that holds municipal bonds. This gives you a small stake in every municipal bond the fund owns and provides instant diversification, although it may come with potentially high management fees.

You can also buy municipal bonds directly from a broker or financial institution, such as Charles Schwab or Fidelity, which offer resources and tools for investing in bonds. When considering where to buy municipal bonds, it's important to understand the fees and potential markups, as well as the creditworthiness of the issuer and the tax implications of the investment.

Mutual Fund Dividend Reinvestment: Powering Compounding Returns

You may want to see also

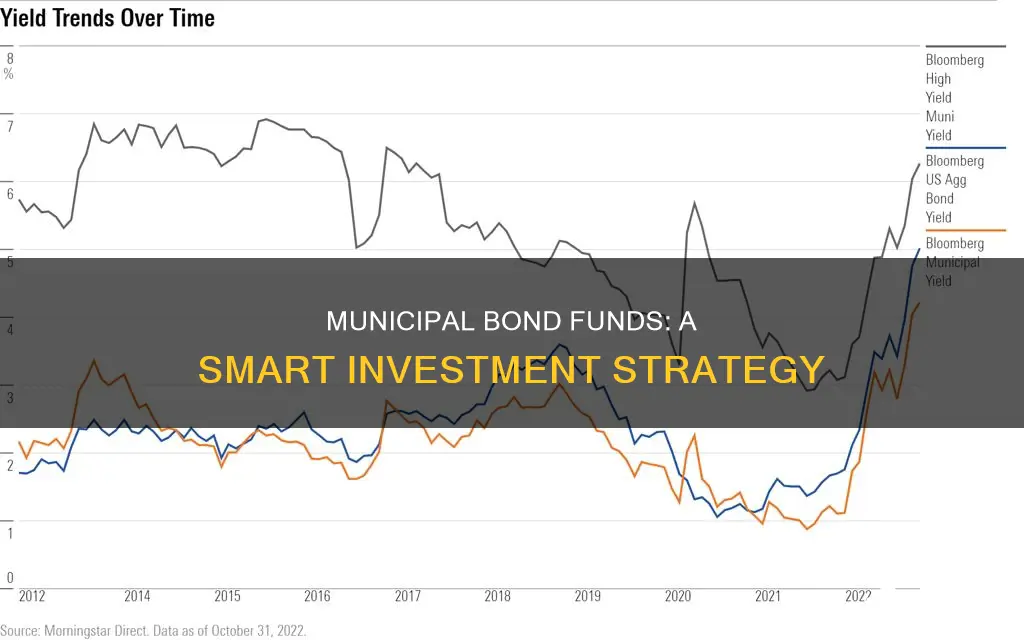

Municipal bond funds

There are two types of municipal bonds: general obligation bonds and revenue bonds. General obligation bonds are backed by a state, city, or local government and are deemed highly reliable by investment professionals. Revenue bonds, on the other hand, are backed by a public organisation, such as a city or state hospital, or a public water or sewer service.

Municipal bonds are often referred to as tax-free because they come with favourable tax treatment compared to other types of bonds. The interest earned on bonds issued by state and local governments is often exempt from federal income tax, and if you live in the state where the bond is issued, you may also be exempt from state income taxes.

There are several ways to invest in municipal bond funds. You can purchase bonds directly through traditional sources like banks, investment brokerage companies, or bond dealers. You can also buy them directly from the municipality that issues the bonds. Another option is to purchase them on the primary or secondary market. The primary market is usually reserved for high-net-worth investors, while the secondary market is where most Main Street investors purchase municipal bonds.

You can also invest in municipal bond funds through mutual funds or exchange-traded funds (ETFs). Mutual funds provide access to professional fund managers who choose which municipal bonds to include in the fund and when to sell them. ETFs, on the other hand, are traded on the market like stocks, making it easy to gain exposure to municipal bonds without actually owning them. However, with any type of municipal bond fund, you don't directly own the bond.

Liquid Funds India: A Smart Investment Guide

You may want to see also