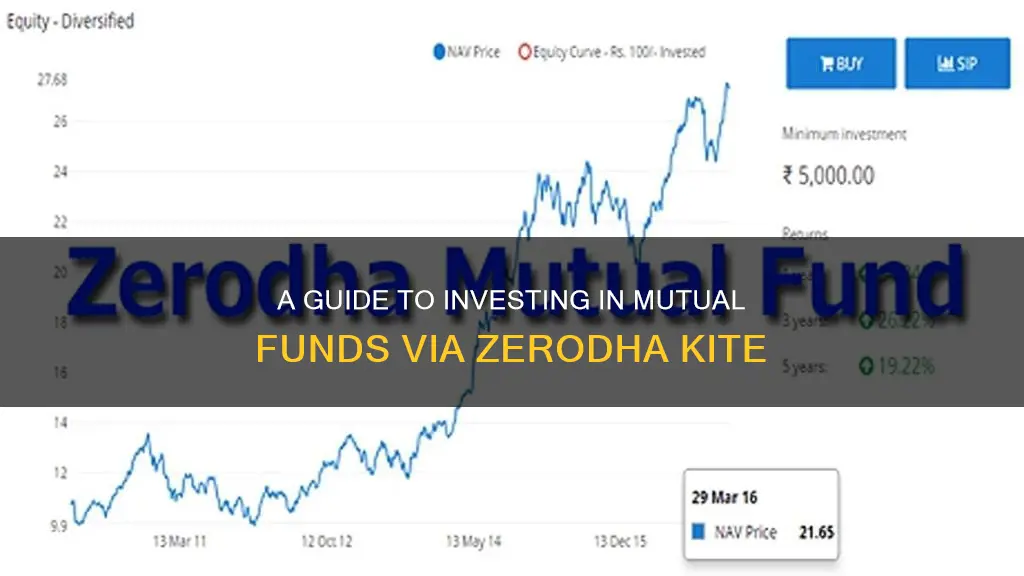

Investing in mutual funds through Zerodha's Kite software is a convenient way to invest in multiple stocks and bonds through a single fund. By pooling money from multiple investors, mutual funds offer the benefits of diversification and professional management at a relatively low cost.

To start investing in mutual funds through Zerodha Kite, you need to create an account and complete the KYC process. Once that is done, you can log in to Zerodha Kite, go to the 'Coin' tab, search for the mutual fund you want to invest in, and click 'Buy' to complete the transaction.

The 'Coin' platform on Zerodha Kite makes it easy for beginners to start investing in mutual funds. It offers a wide range of features, including a SIP facility, fund performance tracking, and commission-free mutual funds.

| Characteristics | Values |

|---|---|

| Platform | Zerodha Kite |

| Investment Types | Lump sum, SIP |

| Investment Amount | Lump sum minimum amount for Zerodha Nifty Large Midcap 250 Index Fund is ₹100 and for SIP, it is ₹100. Lump sum minimum amount for Zerodha ELSS Tax Saver Nifty Large Midcap 250 Index Fund is ₹500 and for SIP, it is ₹500. |

| Investment Process | Create a Zerodha account and complete the KYC process, login to Zerodha Kite, go to the ‘Coin’ tab, use the search bar to find the mutual fund, click on ‘Buy’ and specify the amount, confirm the transaction and wait for the mutual fund units to be allocated to your account |

| Fees | Commission-free |

| Interface | Easy to use |

| Other Features | SIP facility, fund performance tracking |

What You'll Learn

How to create a Zerodha account and complete the KYC process

To create a Zerodha account, you can either open an account online or offline. Here is how you can open an account online:

- Visit the Zerodha website and click on the "Signup" button.

- Enter your mobile number and confirm the OTP received on your phone.

- Enter your personal details, such as your name and email ID, and click continue.

- Enter your PAN ID and date of birth and click continue.

- Pay the account opening fees using UPI, net banking, debit, or credit card.

- Log in to Digilocker using your Aadhar card and click next.

- Enter the temporary OTP you receive and click "Allow" to access Aadhar Data.

- Update your profile with information such as your father's name, mother's name, income range, trading experience, occupation, and political exposure.

- Link your bank account. If your bank account name matches the IT database, you do not need to provide proof of your bank account. Otherwise, you must provide proof.

- Go through IPV verification, allowing the camera to access and record a video of you.

- Upload all the required documents, such as a copy of your PAN card or proof of signature.

- Complete the e-sign with Aadhar.

- Verify your email ID by entering your security code.

- Review the account opening form and click on "Sign Now".

- Enter your Aadhar number or VID and the OTP received on your registered mobile number.

The registration process is now complete, and your account will be opened within 72 hours if your KYC has been verified and the documents submitted are correct. If the KYC is not up to date, the account opening may take longer than 72 hours.

To complete the KYC process, you will need to provide the following:

- Proof of Identity (POI): Any document that carries your photo, name, and date of birth, such as an Aadhaar card or driving license.

- Proof of Address (POA): A document that includes your address, such as an Aadhaar card or driving license.

- Bank account information: Your bank account details will be validated.

- In-person verification (IPV): This can be done physically or online through a webcam.

Gold ETF Funds: A Guide to Investing in India

You may want to see also

How to access the 'Coin' tab on the Kite platform

To access the Coin tab on the Kite platform, you must first open an account with Zerodha. After opening an account, you will receive a welcome email with a login button. Click on the login button and set up your password and two-factor authentication.

Once you have logged in, you can access the Coin tab by following these steps:

- Visit the Kite website or mobile app.

- Enter your user ID and password.

- Enter the app code and click "Continue".

- A prompt to take a tour of Kite will appear. You can access this at any time from the drop-down menu in the top right corner.

- Click on the "Coin" tab, which is located on the Kite dashboard.

The Coin tab on the Kite platform provides access to Zerodha's mutual fund investment platform, where you can search and invest in mutual funds, modify and pause SIPs, track holdings, and more.

Liquid Fund Investment: Timing for Optimal Returns

You may want to see also

How to use the search bar to find a mutual fund

To use the search bar to find a mutual fund on the Zerodha Kite platform, follow these steps:

- Log in to the Kite app or portal.

- Go to the 'Coin' tab.

- Use the search bar to find the mutual fund you want to invest in. You can search by the name of the Asset Management Company (AMC) or the name of the mutual fund.

- Click on the 'Buy' option.

- Enter the parameters, such as quantity, product type, price, and order type.

- Place your order.

- Confirm the transaction and wait for the mutual fund units to be allocated to your account.

Strategies for Picking a Hedge Fund to Invest In

You may want to see also

How to confirm a transaction

To confirm a transaction on Zerodha, follow these steps:

Using the Kite Web Platform:

- Log in to the Kite web by visiting Kite.zerodha.com.

- Enter your client ID and password provided by Zerodha.

- Enter your Zerodha trading PIN, and you will be logged in.

- On the left side of your screen, you will see a watchlist. Here, you can view and analyze different stocks.

- To add a new stock to your watchlist, enter the stock name/initials under "search", click on that stock, and select the "+" icon. Choose between NSE and BSE for individual stocks.

- Your added stock (on the watchlist) will contain the "buy" option in blue and the "sell" option in red.

- If you wish to buy, click the blue "buy" box, and the stock's buy window will appear at the bottom.

- Select the product type, CNC, and MIS in Zerodha Kite for delivery trade and day trading, respectively.

- Now, select the type of order you wish to place—market, limit, stop-loss limit, stop-loss market, and IOC in Zerodha.

- Enter the stop-loss or limit amounts if and where required.

- Once you have filled in all the details, click on "buy", and your order will be placed.

- To view your order status, click on "Orders" from the top dashboard, which will show you the details of all open and executed orders.

Using the Kite Mobile App:

- Log in to Kite mobile by entering your Zerodha ID and password. You will be asked to set up a PIN for authentication.

- Once you enter and confirm the PIN, you will be directed to the "watchlist" section (you can have up to 5 watchlists, each of which can include up to 50 stocks and indices).

- You can add a particular stock to your watchlist by entering its initials/name in the search section and then clicking on the "+" option.

- You can club stocks together in the watchlist 1, indices in the watchlist 2, and derivatives (futures & options) in watchlist 3 as per your convenience.

- For deleting a stock from your watchlist, press and hold on that particular stock, tap the "delete icon" beside it, and finally, click on "save."

- The second section in the Kite mobile app is "orders", which contains "pending", "executed", and "GTT" segments.

- As the name suggests, all your unexecuted/pending orders can be viewed in the "pending" segment, all executed/completed orders in the "executed" segment, and all delivery orders in the "GTT" segment.

- Good Till Triggered (GTT) orders in Zerodha are used when a trader wants to invest in a stock and hold it rather than buy it immediately. There are no additional Zerodha GTT charges for this.

- The third section is "portfolio", where you can view your "holdings" and "positions."

- All your current holdings, i.e., the stocks you have held for investment, can be viewed under "holdings."

- Under "positions", you can view all your currently held positions in respective stocks.

- To confirm a transaction, go to the "account" section, where you can view/edit your profile details, change your app settings, add & withdraw funds, and access your Zerodha Console.

- Click on "funds" for Zerodha Fund Transfer to your trading account. Enter the transfer amount, select the payment option (Google Pay, UPI, or Net Banking), and confirm the payment.

Venture Funds That Invested in Theranos: A Comprehensive List

You may want to see also

How to start a Systematic Investment Plan (SIP)

A Systematic Investment Plan (SIP) is a method of investing a fixed amount at fixed intervals. It is a scientific way to invest in mutual fund schemes at regular intervals. Here are the steps to start a SIP on Zerodha Coin:

- Log in to the Zerodha Coin website or mobile app.

- On the Coin Dashboard, use the search bar and enter the name of an AMC or any Mutual Fund.

- You will see direct mutual fund options; click on the 'Direct SIP' option.

- Choose the initial investment amount.

- Choose the frequency of the mutual fund SIP as weekly, 15 days, monthly, or quarterly.

- Choose the installment amount to deduct on the interval for SIPs.

- If you want a particular number of installments or a particular installment amount to deduct, choose it.

- Click on 'Start SIP' and confirm the order.

- To initiate automatic payments for Coin SIP installments, register for the eMandate feature on Console. You need to add a debit card or net banking details for automatic fund transfer.

All SIP orders are sent to the exchange at 1:30 PM on trading days. Orders placed after the 1:30 PM cut-off time will be sent for execution on the next trading day. The mutual fund units will be credited to your demat account T+1 day (1 trading day). For orders placed on Monday before the cut-off time, the units will be allotted to you by Tuesday at the end of the day.

Advisor Fund Investment: Long-Term Strategy for Success

You may want to see also