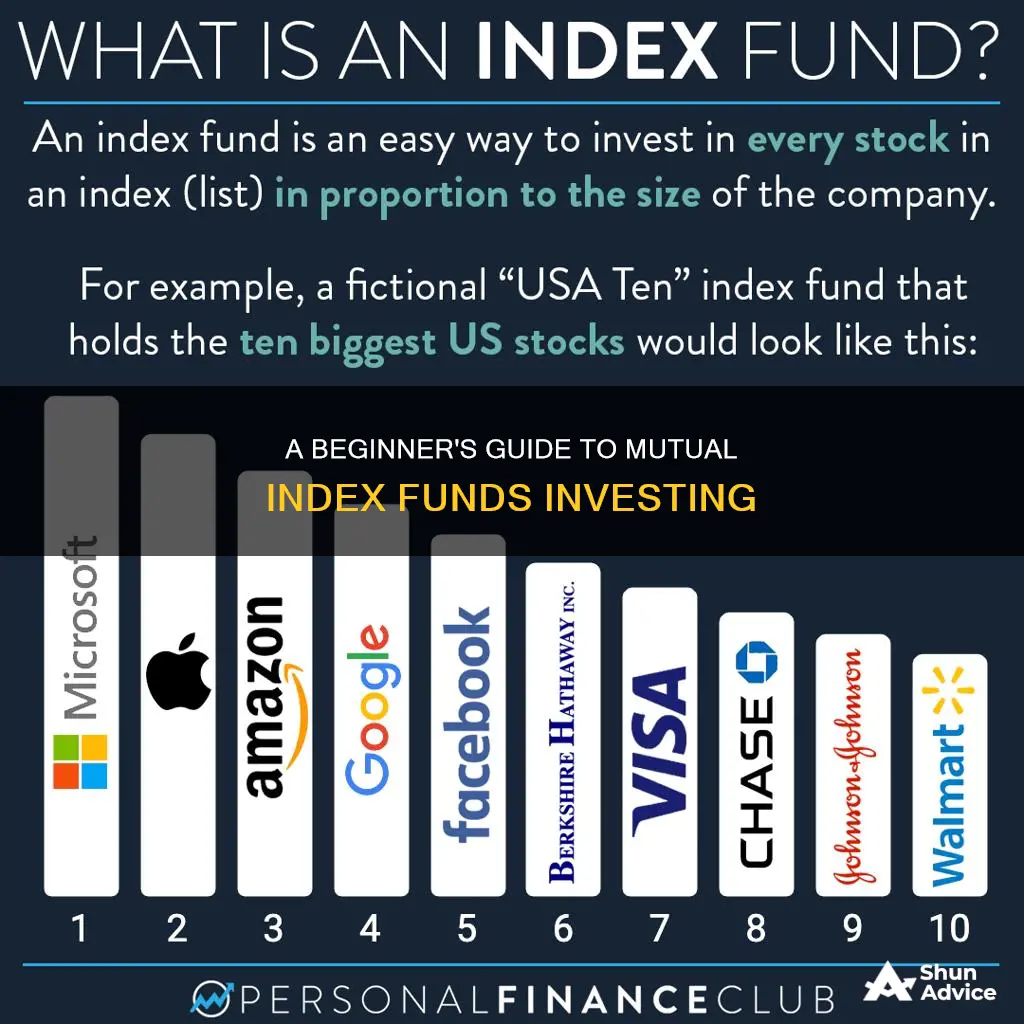

Index funds are a type of mutual fund that tracks a particular market index, such as the Nifty 50 or Sensex. These funds aim to mirror the performance of the chosen index by investing in the same stocks and in the same proportions. As a result, the returns generated by index funds are similar to those of the market index they track.

Index funds are passively managed, meaning the fund manager does not actively select individual stocks or attempt to outperform the market. Instead, they replicate the composition of the chosen index, leading to lower management fees and a more straightforward investment strategy. This passive nature of index funds makes them a popular choice for investors seeking a simple, low-cost, and diversified investment option.

When investing in index funds, it is essential to consider factors such as expense ratios, assets under management, and the fund manager's track record. Additionally, understanding the investment horizon is crucial, as index funds are typically recommended for long-term investments of at least seven years.

| Characteristics | Values |

|---|---|

| Investment type | Mutual funds that track a particular market index |

| Investment strategy | Passive |

| Investment selection | Replicates the index composition |

| Investment maintenance | Low maintenance |

| Investment risk | Low risk |

| Investment diversification | High diversification |

| Investment performance | Average market returns |

| Investment time horizon | Long-term investment horizon |

| Investment accessibility | Accessible through online mutual fund distribution platforms or directly through the AMC's website |

| Investment amount | Minimum of ₹ 500 |

What You'll Learn

The benefits of index funds

Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a specific market index, such as the popular S&P 500. They are considered a "passive" investment strategy because, instead of hand-picking stocks or bonds, the fund's manager buys all or a representative sample of the securities in the index it tracks. Here are some benefits of investing in index funds:

Low Fees and Low Risk

Index funds typically have much lower management fees than other funds because they are passively managed. Instead of having a manager actively trading, the index fund's portfolio duplicates that of its designated index. Index funds also have lower transaction costs since they don't buy and sell individual securities as frequently as actively managed funds. These lower costs can make a significant difference in your returns over time.

Tax Advantages

Index funds generate less taxable income than other types of investments. By trading securities less frequently, index funds produce fewer taxable capital gains distributions, which can reduce your tax bill. Additionally, index funds can take advantage of tax-loss harvesting, where they sell the lots with the lowest capital gains to minimize the tax burden.

Broad Diversification

Index funds contain a preselected collection of hundreds or thousands of stocks or bonds. This diversification helps minimize losses because, if a single stock or bond performs poorly, there is a good chance that another is performing well. Diversification also reduces overall investment risk and makes it easier to manage your portfolio.

Consistency and Transparency

Index funds provide consistent, long-term returns by mirroring the performance of the market index they track. This passive investment strategy removes the need for active fund management, reducing fund managerial expenses. Index funds also offer transparency, as they represent a published list of holdings in a specific index.

Retirement Fund Investment: Choosing the Right Path

You may want to see also

How to select the right index fund

Index funds are a type of mutual fund that tracks a market index, such as the S&P 500, Nifty 50, or Sensex. They are passively managed, meaning the fund manager does not alter the portfolio's composition and instead invests in the same securities that are present in the underlying index in the same proportion.

- Expense Ratio: Index funds typically have lower expense ratios than actively managed funds, which means you can invest more of your money in the fund itself. Look for funds with the lowest expense ratios, as these will maximize your returns over time.

- Diversification: Index funds offer diversification across multiple sectors and minimize concentration risk. Avoid indices that focus on a small number of stocks, such as Small Cap 50 and Mid Cap 50. Broader indices, like the Nifty 500, tend to offer better returns and lower volatility.

- Investment Horizon: Index funds are generally recommended for investors with a long-term investment horizon of at least five years, preferably seven years or more. This allows enough time for the investments to grow and smooth out short-term fluctuations.

- Performance and Tracking Error: When evaluating the performance of an index fund, look at rolling returns over a longer period, such as 15 years. Compare the returns of different indices and consider splitting your investments between two broader indices, such as the Nifty 50 and Nifty Next 50. Additionally, look for funds with the lowest tracking error to ensure the fund accurately replicates the performance of the underlying index.

- Fund Size and Liquidity: Consider the size and liquidity of the index fund. Larger funds tend to be more established and liquid, making it easier to buy and sell units.

- Tax Implications: Be mindful of the tax implications of investing in index funds, particularly dividend distribution tax and capital gains tax. Consult a financial advisor to understand how taxes may impact your overall returns.

In summary, when selecting an index fund, focus on minimizing fees, diversifying your investments across broader indices, and aligning your investment horizon with the recommended timeframe for index funds. Compare the performance and tracking accuracy of different funds, and consider the tax implications to make a well-informed decision.

Invest Smartly: Direct Mutual Funds Guide

You may want to see also

How to invest in index funds

Index funds are a type of mutual fund that tracks and replicates the performance of a market index, such as the NIFTY 50, NIFTY Next 50, or Sensex. They are passively managed, meaning the fund manager does not actively select stocks, but instead invests in the same securities that are present in the underlying index in the same proportion. Due to their passive nature, index funds have lower expense ratios and management fees compared to actively managed funds, making them a more cost-effective option for long-term investors.

- Open a mutual fund account through a secure website of your choice.

- Complete your Know Your Customer (KYC) procedures.

- Provide necessary information, such as personal and financial details.

- Choose the fund or funds you want to invest in, aligning with your financial objectives and risk tolerance.

- Transfer the required amount to the selected fund(s).

- (Optional) Set up a standing instruction with your bank if you want to invest monthly via a Systematic Investment Plan (SIP).

When selecting an index fund, it is important to consider the expense ratio, assets under management (AUM), and the historical performance of the fund and its manager. Index funds are recommended for investors with a long-term investment horizon of at least seven years, as they tend to experience fluctuations in the short term but can provide stable returns over a longer period.

It is also important to note that index funds are subject to market risks and can generate negative returns in the short term. They are suitable for investors seeking predictable returns and a lower-risk approach to investing in the equity markets.

A Beginner's Guide to Mutual Funds for NRIs

You may want to see also

The risks of index funds

Index funds are a type of mutual fund that tracks and replicates the performance of a market index. They are passively managed, meaning the fund manager does not alter the portfolio's composition and instead invests in the same securities that are present in the underlying index in the same proportion. While index funds offer several benefits, such as low costs, passive investing strategy, diversification, and consistency, they also come with certain risks that investors should be aware of. Here are some key points to consider regarding the risks of investing in index funds:

- Market Risk: Index funds are subject to market risk, which means that when the market goes down, index funds will also decrease in value along with their benchmark index. During a market slump, it is usually recommended to switch to actively managed funds, as they have the potential to outperform the market.

- Limited Outperformance: By design, index funds aim to replicate the performance of a specific market index. As a result, it is unlikely that they will significantly outperform the market. Investors who are seeking higher returns may prefer actively managed funds, which have the potential to generate returns above the market average.

- Concentration Risk: Index funds mirror the composition of the underlying index, including its weightings. If the index has a high concentration in a few specific stocks or sectors, the index fund will inherit that concentration risk. This lack of diversification can increase the potential for losses if the concentrated holdings underperform.

- Tracking Errors: While index funds aim to replicate the performance of an index, they may not always achieve identical returns. Tracking errors can occur due to factors such as transaction costs, timing differences, or sampling techniques used by the fund manager. These errors can lead to deviations from the expected performance of the index.

- Limited Flexibility: Index funds have a fixed investment strategy tied to the underlying index. They do not allow for tactical adjustments or taking advantage of market opportunities. Investors who seek more flexibility and the potential to exploit market inefficiencies may prefer actively managed funds.

- Sector or Stock-Specific Risk: Certain indices may have a significant exposure to specific sectors or individual stocks. For example, the S&P 500 index has a large allocation to technology stocks. If a particular sector or stock underperforms, it can negatively impact the performance of the index fund.

- Long-Term Investment Horizon: Index funds are generally recommended for long-term investment horizons of at least five to seven years. They may experience fluctuations in the short term, but their performance tends to average out over longer periods. Investors with shorter investment horizons may need to consider other options.

- Expenses and Fees: While index funds are known for their low costs, there are still expenses and fees associated with these funds. The expense ratio, which represents the fund's operating expenses as a percentage of its assets, can impact the overall returns of the fund. It is important to consider the expense ratio when evaluating index funds.

In conclusion, while index funds offer a range of benefits, including low costs and diversification, it is important to be aware of the potential risks involved. Understanding these risks can help investors make more informed decisions and manage their expectations when investing in index funds.

Maximizing HSA Investment: A Guide to PayFlex

You may want to see also

The taxes associated with index funds

Index funds are considered to be tax-efficient funds. They are passively managed, which means they are not actively traded and therefore have a low turnover ratio. This results in fewer taxable events, reducing tax liabilities and increasing after-tax returns over time.

Index funds are taxed in a similar way to mutual funds and ETFs. When you sell shares of a mutual fund or ETF for a profit, you will owe taxes on that "realised gain". However, index funds can also be subject to taxes if the fund realises a gain by selling a security for more than the original purchase price, even if you haven't sold any shares. This is because, by law, the fund must pass on any net gains to shareholders at least once a year.

In a down market, shareholders often take money out of funds, meaning the fund manager has to sell some of a fund's holdings to meet demand. If the fund sells lots with large built-in gains, this could lead to net gains, which you will be taxed on, even if the fund's share price went down during the year.

On the other hand, capital gains are considered short-term or long-term based on how long the fund held the securities being sold. So, even if you recently bought into the fund, you will pay the preferential long-term capital gains rate if the fund held the securities for more than a year.

In addition, dividend distributions from index funds are taxed as income. Most index funds produce lower dividends than actively managed funds, but some are specifically designed to buy and hold dividend-paying stocks, so it is important to check the specifics of the fund.

How to Reinvest Dividends with Chase You Invest Mutual Funds

You may want to see also