The NIFTY 50 is an index of India's top 50 large-cap companies by market capitalisation, listed on the National Stock Exchange (NSE). It is a benchmark index of the NSE and one of the two most referenced barometers used by investors to track the performance of the Indian stock market. The NIFTY 50 index is considered a hypothetical portfolio that reflects the performance of the Indian stock market.

Investing in NIFTY 50 index funds provides investors with exposure to the Indian equity market and allows them to diversify their portfolios across various sectors and industries. The funds aim to replicate the performance of the NIFTY 50 index, and their returns are closely linked to the index's performance.

There are two main ways to invest in the NIFTY 50:

1. Derivative Contracts: Investors can trade in NIFTY 50 stocks through derivative contracts such as Futures and Options (F&O). These contracts are more suitable for short-term investors with a higher risk appetite as they are linked to the fluctuations of the NIFTY Index.

2. Index Mutual Funds and Exchange-Traded Funds (ETFs): This option is more suitable for long-term investors seeking a lower-risk investment strategy. These funds have the same portfolio of stocks that feature in the NIFTY 50 index, allowing investors to benefit from the performance of the top 50 companies.

Before investing in NIFTY 50 index funds, it is important to consider factors such as investment objectives, risk tolerance, investment horizon, and the expense ratio of the fund.

| Characteristics | Values |

|---|---|

| Type of investment | Index fund |

| Index tracked | Nifty 50 |

| Investment options | Direct investment, mutual funds, exchange-traded funds (ETFs), derivatives, systematic investment plans (SIPs) |

| Investment suitability | Beginners, long-term investors, investors seeking passive investment options, lower expense ratios, or liquidity |

| Investment risks | Market risk, sector risk, stock-specific risk, lack of diversification, market timing |

| Investment considerations | Risk tolerance, investment goals and horizon, investment amount, cost and fees |

| Number of funds | Approximately 18 |

| Fund managers' role | Passively managed, no active buying or selling of stocks |

| Taxation | Short-term capital gains (STCG) taxed at 15% plus surcharge and cess, long-term capital gains (LTCG) taxed at 10% plus surcharge and cess if capital gains exceed INR 1 lakh |

What You'll Learn

- Direct investment: Purchase stocks of the 50 companies in the same proportion as their representation in the index

- Indirect investment: Invest in mutual funds or exchange-traded funds (ETFs) that track the Nifty 50 index

- Index Funds: Choose a fund with a portfolio matching the Nifty 50 index

- Derivative Contracts: Trade Nifty 50 stocks through futures and options

- Systematic Investment Plan (SIP): Regularly invest small amounts in index funds or ETFs

Direct investment: Purchase stocks of the 50 companies in the same proportion as their representation in the index

To directly invest in the Nifty 50 index, you can purchase stocks of the 50 companies that make up the index in the same proportion as their representation in the index. This approach is known as direct stock investment and offers some advantages over other investment methods.

Understanding Nifty 50

Before investing, it's important to understand what Nifty 50 represents. Nifty 50 is an index of India's top 50 companies by market capitalization, listed on the National Stock Exchange (NSE). These companies are selected based on specific criteria, including market capitalization, liquidity, and sector representation. The index is calculated using the free-float market capitalization method and is used as a benchmark to track the performance of the Indian stock market.

Steps to Invest Directly in Nifty 50 Stocks:

Open a Brokerage Account:

To purchase stocks directly, you will need a brokerage account. Choose a reputable broker that offers low brokerage fees and provides a user-friendly trading platform.

Research Nifty 50 Companies:

Study the list of 50 companies that comprise the Nifty 50 index. Analyze their financial performance, growth prospects, and sector representation. You can find the updated list of Nifty 50 companies and their weightage on various financial websites.

Calculate the Required Proportion:

Determine the proportion of each stock you need to purchase to match their representation in the index. This information is available in the weightage or float-adjusted market capitalization of each stock.

Purchase the Stocks:

Use your brokerage account to buy the stocks of the Nifty 50 companies in the calculated proportions. Keep in mind that this approach may require a significant amount of capital, as you will need to purchase a complete stock for each company, and the number of shares can be substantial.

Monitor and Adjust Your Portfolio:

The composition of the Nifty 50 index changes over time. The index is rebalanced semi-annually, and companies can be added or removed based on their performance. Therefore, you will need to monitor your portfolio regularly and make adjustments to maintain the same proportion as the index.

Benefits of Direct Investment in Nifty 50:

- Diversification: Direct investment in Nifty 50 provides instant diversification across multiple sectors and large-cap companies in India, reducing the risk associated with investing in individual stocks.

- Control and Flexibility: This approach allows you to have direct control over your investment portfolio. You can choose the companies you want to invest in and adjust your holdings as per your preferences.

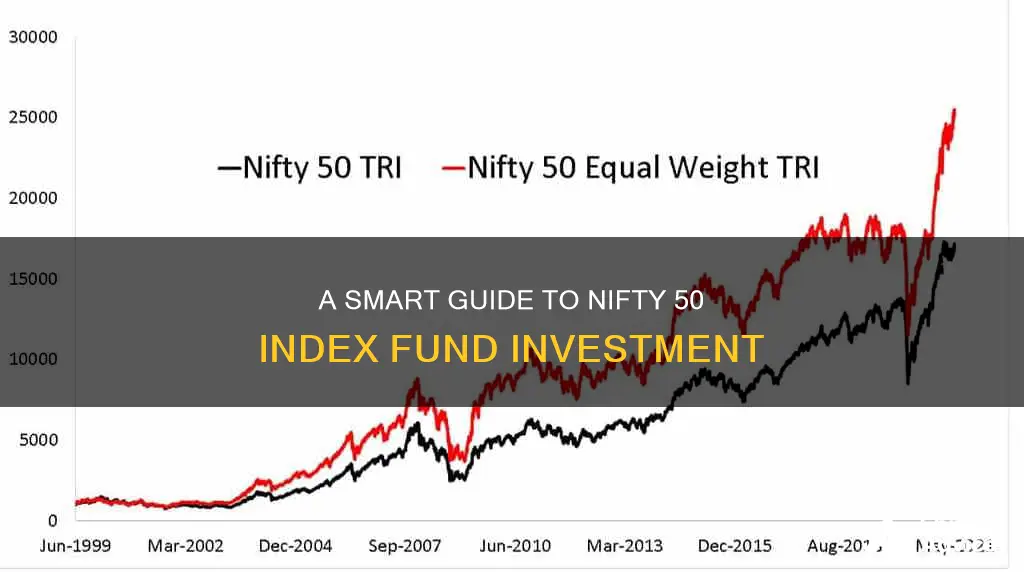

- Potential for Higher Returns: By investing in the top-performing companies in India, you increase your potential for higher returns. The Nifty 50 index has historically delivered significant returns over the long term.

Challenges of Direct Investment in Nifty 50:

- High Capital Requirement: Purchasing stocks of all 50 companies in the same proportion can be expensive and may require a substantial amount of capital.

- Time and Effort: Maintaining the same proportion as the index can be time-consuming and challenging. You will need to monitor the index regularly and make adjustments to your portfolio whenever there are changes.

- Lack of Fractional Shares: In India, you cannot buy fractional shares, which means you must purchase a complete stock for each company, further increasing the capital requirement.

In summary, direct investment in Nifty 50 offers the advantage of diversification and control over your investment portfolio. However, it may require a significant amount of capital and ongoing effort to maintain the same proportion as the index. It is important to carefully consider your investment goals, risk tolerance, and the challenges associated with this investment approach before proceeding.

Best S&P Index Funds: Top Picks for Your Portfolio

You may want to see also

Indirect investment: Invest in mutual funds or exchange-traded funds (ETFs) that track the Nifty 50 index

The Nifty 50 index is a benchmark index of the National Stock Exchange of India, comprising the country's top 50 large-cap companies across various sectors. Investing in Nifty 50 can be done directly or indirectly. This answer will focus on the indirect method, which involves investing in mutual funds or exchange-traded funds (ETFs) that track the Nifty 50 index.

Mutual Funds

Mutual funds are investment schemes that pool money from multiple investors to invest in stocks, bonds, and other securities. Index funds are a type of mutual fund that tracks a specific stock market index, such as the Nifty 50. The fund managers ensure that the weightage of the stocks in the portfolio matches the index's composition.

Index funds offer investors portfolio diversification, as they allocate investments across different sectors, reducing the risk of being impacted by the underperformance of a specific sector. They are passively managed, meaning fund managers are not actively involved in investment decisions, resulting in lower management fees and expense ratios.

Individuals can invest in Nifty 50 index funds through a Systematic Investment Plan (SIP), investing a fixed sum at regular intervals. The low investment amount, investment flexibility, and low costs make Nifty 50 index funds a convenient option for those seeking to match the market's performance.

Exchange-Traded Funds (ETFs)

ETFs are similar to index funds in that they aim to replicate the performance of an underlying index. However, ETFs are bought and sold on exchanges like stocks, and you need a DEMAT account to invest in them. ETFs offer intraday trading and higher transparency, as investors know exactly where their money is allocated.

ETFs have lower expense ratios than mutual funds but typically have higher trading costs. Investors also earn dividend income from ETFs, which can be reinvested in the share market. It's important to note that ETFs are dependent on the liquidity of the share market, and bearish trends can result in losses.

Comparison

Both mutual funds and ETFs provide diversification and professional management, and they both have Net Asset Values (NAVs) calculated at the end of the day. However, there are some key differences:

- ETFs require a DEMAT or trading account, while mutual funds do not.

- ETFs can be bought and sold on exchanges throughout the trading day at the current market price, while mutual funds are bought and sold through the fund house or intermediaries, and you receive the NAV at the end of the day.

- Mutual funds have higher expense ratios than ETFs because they aim to generate higher returns than the benchmark, whereas ETFs aim to mirror the index.

- ETFs have no lock-in period, while mutual funds may have varying lock-in periods depending on the type of fund.

- ETFs are more liquid than mutual funds due to their structure and ability to be traded on stock exchanges.

- ETFs typically do not have exit loads, while mutual funds may charge an exit load for early redemption.

- Mutual funds often have an active investment philosophy, while ETFs follow a passive strategy.

In summary, if you want to replicate the Nifty 50 index's performance, ETFs are a good choice. However, if you have a high-risk appetite and are seeking market-beating returns, mutual funds may be more suitable. Your decision should also consider factors such as investment horizon, liquidity needs, and tolerance for market volatility.

A Smart Guide to Index Funds S&P Investments

You may want to see also

Index Funds: Choose a fund with a portfolio matching the Nifty 50 index

Index funds are mutual fund schemes that track a stock market index, such as the Nifty 50. They invest in stocks that constitute a particular market index, with the weightage of the stocks identical to their proportion of the index. Nifty 50 index funds allocate their fund corpus to equity shares of the top 50 Indian companies in terms of market capitalization.

- Investment Objective: Index funds aim to match the market's performance, so they may not be suitable for investors seeking market-beating returns. Therefore, investors must identify their financial goals and risk tolerance before investing.

- Tracking Error: This metric indicates the difference between the returns generated by an index fund and its benchmark index. A lower tracking error means the fund is better at replicating the index's performance.

- Expense Ratio: The expense ratio is the annual fee charged by fund houses to cover expenses like management fees and advertising costs. As it impacts the net annual returns, investors should consider funds with lower expense ratios.

- Diversification: Index funds provide portfolio diversification by investing in companies across different sectors, reducing the risk associated with investing in individual stocks.

- Fund Manager Involvement: Index funds are passively managed, meaning fund managers are not actively involved in investment decisions. This results in lower management fees and a lower expense ratio.

- Bias in Investing: Index funds follow an automated investment strategy, removing human bias from decision-making. Fund managers have a defined mandate regarding which stocks to buy or sell and in what proportion.

When choosing a Nifty 50 index fund, investors should compare the top index funds in India that track the Nifty 50 to make an informed decision. It is crucial to understand the basics of the index and consider factors like risk tolerance, investment goals, and investment amount before investing.

A Guide to Investing in ICICI Prudential Funds

You may want to see also

Derivative Contracts: Trade Nifty 50 stocks through futures and options

Derivative contracts, such as futures and options, offer a way to trade Nifty 50 stocks by speculating on their future value. This method of trading is more complex than direct equity investments and requires knowledge of fundamental and technical analysis, F&O strategies, and understanding the derivatives market. Here is a detailed guide on trading Nifty 50 stocks through futures and options:

Understanding Futures and Options:

Futures and options are derivative products, with the key difference being that futures are obligations for both the buyer and seller to trade at a pre-set value, while options give the buyer the right but not the obligation to trade, providing more flexibility.

Trading Process:

To begin trading Nifty 50 stocks through futures and options, follow these steps:

- Open a Demat and trading account with a broker that offers Nifty 50 derivatives, such as ICICI Direct or Groww.

- Log in to your account and navigate to the F&O section, often found under 'top gainers'.

- Select 'Nifty 50' from the available options, which will display all the available contracts.

- Choose your preferred call or put option by examining the strike price, call price, and put price.

- Place your order by buying a Call Option if you predict rising prices or a Put Option if you anticipate a decline.

Important Considerations:

- Spot Price: The current market price of an asset, like currency or a commodity, is crucial in determining the pricing of futures contracts.

- Offset, Exercise, or Expiry: You can sell your options contract before expiry (offset), exercise it if the underlying asset's price moves favourably, or let it expire worthless if it moves unfavourably.

- Margins and Brokerage Costs: Keep in mind the rising margins during market volatility and the various costs associated with F&O trading, including brokerage, statutory charges, and stamp duty.

- Profit Targets and Stop Losses: Defining profit targets and utilising stop-loss orders can help limit potential losses and secure gains.

Trading Nifty 50 stocks through futures and options requires a thorough understanding of the market and carries a higher level of risk. Ensure you conduct thorough research and consult financial advisors before entering into any derivative contracts.

Mirae Asset India Equity Fund: Smart Investment Strategies

You may want to see also

Systematic Investment Plan (SIP): Regularly invest small amounts in index funds or ETFs

A Systematic Investment Plan (SIP) is a method of investing in mutual funds, allowing you to invest a fixed amount of your choice at fixed intervals. You can start investing in Nifty index funds with as little as Rs. 500 via a SIP. This is a great option for investors who want to avoid high-risk wagers but still seek equity exposure.

SIPs are a convenient and disciplined way to invest, allowing you to give your bank standing instructions to debit a fixed amount from your account at regular intervals, such as monthly or quarterly. This helps you build the habit of investing and ensures you are actively working towards growing your investments.

SIPs also allow you to benefit from rupee cost averaging, which means that when the market is low, you buy more units, and when the market is up, you buy fewer units, averaging out the cost of acquisition. This helps to reduce the impact of market volatility and can potentially generate long-term wealth accumulation.

It is important to note that SIPs often require a long-term commitment, which can range from 10 to 25 years. Investors should also be aware of potential costs, such as expense ratios and transaction charges, which are deducted from the invested amount.

Overall, SIPs provide a systematic and gradual way to invest in index funds, offering benefits such as flexibility, affordability, and the potential for dollar/rupee cost averaging.

A Smart Guide to Investing in Low-Fee Index Funds

You may want to see also

Frequently asked questions

NIFTY 50 is an index consisting of India's top 50 large-cap companies across various sectors. It is used as a hypothetical portfolio to reflect the overall movement in the Indian stock market.

The value of NIFTY 50 is calculated using the free-float market capitalisation method. The current market cap of all the stocks in NIFTY 50 is divided by the Market Cap of the base period (3rd November 1995) with an assigned base value of 1000.

Investing in Nifty 50 Index Funds offers benefits such as diversification, lower costs, passive management, professional management, lower risk, ease of access, long-term growth potential, and tax efficiency.

There are two main ways to invest in Nifty 50: direct stock investment and investing through index mutual funds. For direct stock investment, you need to research and select companies, open a Demat account, and place orders. For index mutual funds, you need to understand how they work, select a fund, decide on an investment amount, and monitor your investment.

Before investing, consider your investment objective, tracking error, and the expense ratio. Ensure that the fund aligns with your financial goals and assess the fund's performance in tracking the underlying benchmark.