Philam Life Mutual Funds are a great option for those looking to grow their money for future use. Investing in mutual funds is a form of passive income, which many Filipinos may not be familiar with. The basic idea is that you pool your money with that of other investors, creating a large asset base, and this is then used to invest in different assets.

The advantage of Philam Life Mutual Funds is that they offer both an investment and a life insurance plan. This means that your chosen beneficiaries will receive death benefits plus the earnings of your investments.

There are a few simple steps to follow if you want to invest in mutual funds. First, you need to evaluate your financial goals and risk appetite. Next, choose a company that fits your needs—make sure they are regulated by the Securities and Exchange Commission (SEC). Then, talk to an agent and pick the best type of mutual fund for you. Finally, submit the required documentation and start tracking your investment.

What You'll Learn

Evaluate your goals and risk appetite

Before investing in Philam Life Mutual Funds, it is important to evaluate your goals and risk appetite. Ask yourself why you want to start investing in mutual funds. What level of risk are you comfortable with? How much money are you willing to invest? This will help you determine if mutual funds are the right investment vehicle for you.

When it comes to risk, it is important to understand that different types of mutual funds come with different levels of risk. For example, bond funds are considered low-risk investments, while equity funds are considered high-risk. If you are a beginner investor, you may want to start with a low-risk option to get a sense of how mutual funds work before taking on more risk. On the other hand, if you are an experienced investor with a high-risk tolerance, you may be comfortable investing in equity funds.

Another factor to consider is your investment goals. Are you investing for the short term or the long term? Do you want to generate passive income, or are you focused on capital growth? Philam Life Mutual Funds offer a range of investment objectives, including long-term capital growth, capital preservation, and income generation. By understanding your goals, you can choose the fund that best aligns with your objectives.

Additionally, it is crucial to assess your financial situation and determine how much you can afford to invest. Philam Life Mutual Funds have different minimum investment requirements, so you need to ensure that you meet those thresholds. For example, the PAMI Equity Index Fund requires a minimum investment of PHP 5,000, while the Philam Life Money Tree has a minimum one-time payment of PHP 125,000.

Once you have evaluated your risk appetite, investment goals, and financial situation, you can start researching specific Philam Life Mutual Funds that align with your criteria. Examine the fund profiles, investment objectives, and portfolio allocations to find the funds that match your preferences. Consider factors such as the types of securities the fund invests in, the level of diversification, and the historical performance.

Remember, investing in mutual funds always carries some level of risk, and it is essential to carefully consider your options before making any investment decisions. By evaluating your goals and risk appetite, you can make informed choices that align with your financial objectives and comfort level.

Dividend Fund Investment: A Guide to Smart Investing

You may want to see also

Choose the right company

Before you choose a company to manage your mutual funds, it's important to do your research. Here are some key things to keep in mind:

- Regulation: In the Philippines, mutual fund companies are regulated by the Securities and Exchange Commission (SEC). Make sure any company you consider is registered and compliant with the SEC.

- Affiliation: Look for companies that are affiliated with major insurance firms or banks. These companies typically have a proven track record and are more likely to be legitimate.

- Performance: You can find information on mutual fund company performance on the website of the Philippine Investment Funds Association (PIFA). Check their Net Asset Value Per Share (NAVPS) to get an idea of how they have performed financially.

- Suitability: Different companies will cater to different types of investors. For example, some companies focus on conservative investors, while others cater to those with a higher risk appetite. Consider your financial goals and risk tolerance before deciding which company is the best fit for you.

- Support: When you invest in mutual funds, you are passing on control to a professional fund manager. Choose a company that provides an agent or representative to guide you through the process and help you monitor your investment.

- Fees: Understand the fees associated with the mutual fund company. Some companies may charge an annual fee for fund management, which is usually a percentage of your fund's total value.

Remember, investing in mutual funds is a long-term commitment. Take the time to research and choose a reputable company that aligns with your financial goals and risk tolerance.

A Guide to Investing in CPSE Exchange Traded Funds

You may want to see also

Talk to an agent

Once you have decided that Philam Life Mutual Funds are the right investment vehicle for you, you can get in touch with an agent who will be assigned to answer your questions. It is recommended that you list down all your questions before meeting with the agent so that you do not forget anything. The agent will help you find the best type of mutual fund for your needs and guide you through the process of investing and monitoring your investment.

Philam Life Mutual Funds are offered by Philam Life, soon to be rebranded as AIA Philippines, the country's premier life insurance company. The company offers a complete range of insurance solutions, including life protection, health insurance, savings, education, retirement, investment, and group and credit life insurance.

Philam Life Mutual Funds are variable unit-linked (VUL) products, which means they have two components: the investment and the life insurance plan. The advantage of this type of product is that your chosen beneficiaries will receive death benefits plus the earnings of your investments. With Philam Life Mutual Funds, you are saving for the future while also ensuring that you and your family are protected from life's uncertainties.

The Philam Life Money Tree is one such product offered by Philam Life Mutual Funds. It is available at a minimum one-time payment of PHP 125,000 and offers guaranteed life insurance coverage of at least 125% of your initial investment. The Money Tree also provides investment flexibility, allowing you to choose the type of fund to invest your money in based on your risk appetite or investment goals. You can switch funds and change fund allocations at any time, and additional investments can be made starting at PHP 1,000.

Another option for investing in Philam Life Mutual Funds is through the Philam Asset Management, Inc. (PAMI) Equity Index Fund. This fund allows investors to grow their money with the country's 30 largest corporations that make up the Philippine Stock Exchange Index (PSEi). A minimum investment of PHP 5,000 is required to invest in this fund.

When you meet with the agent, they will help you assess your financial goals, risk tolerance, and investment timeframe to determine if Philam Life Mutual Funds are the right choice for you. They will also guide you through the process of submitting the necessary requirements, which may include a personal information sheet, valid IDs, an Order Ticket, and an Investor Profile Questionnaire.

Remember to always monitor your investment and make payments for mutual funds only at the company's office or a partnered bank.

Invest in ICICI Prudential Technology Fund: A Smart Guide

You may want to see also

Pick the best fund type

There are four types of mutual funds in the Philippines to choose from. You can invest in one or a combination of them, depending on your investment time frames, financial goals, risk appetite, and fund availability.

Debt funds

Debt funds, also known as bond funds, are ideal for beginners as they only require a minimum investment. This type of fund is perfect for investors who want low to moderate risk while protecting their savings against inflation. Bond funds may also offer higher profits compared to money markets and time deposits.

Equity funds

Equity funds are used to invest in the stocks and shares of different companies to make a profit. Some equity funds may even target specific sectors for stock investment. This is a high-risk mutual fund and is more suited for investors willing to have a longer investment timeframe. If you are a seasoned investor with experience in the Philippine Stock Market (PSE), equity funds may be ideal for you.

Money market funds

Money market funds invest in high-quality, short-term instruments like cash and cash-equivalent securities. In general, money market funds invest in certificates of deposits (CDs), treasuries, bankers’ acceptances, and repurchase agreements. Money market funds carry lower risks, so the returns can be quite small.

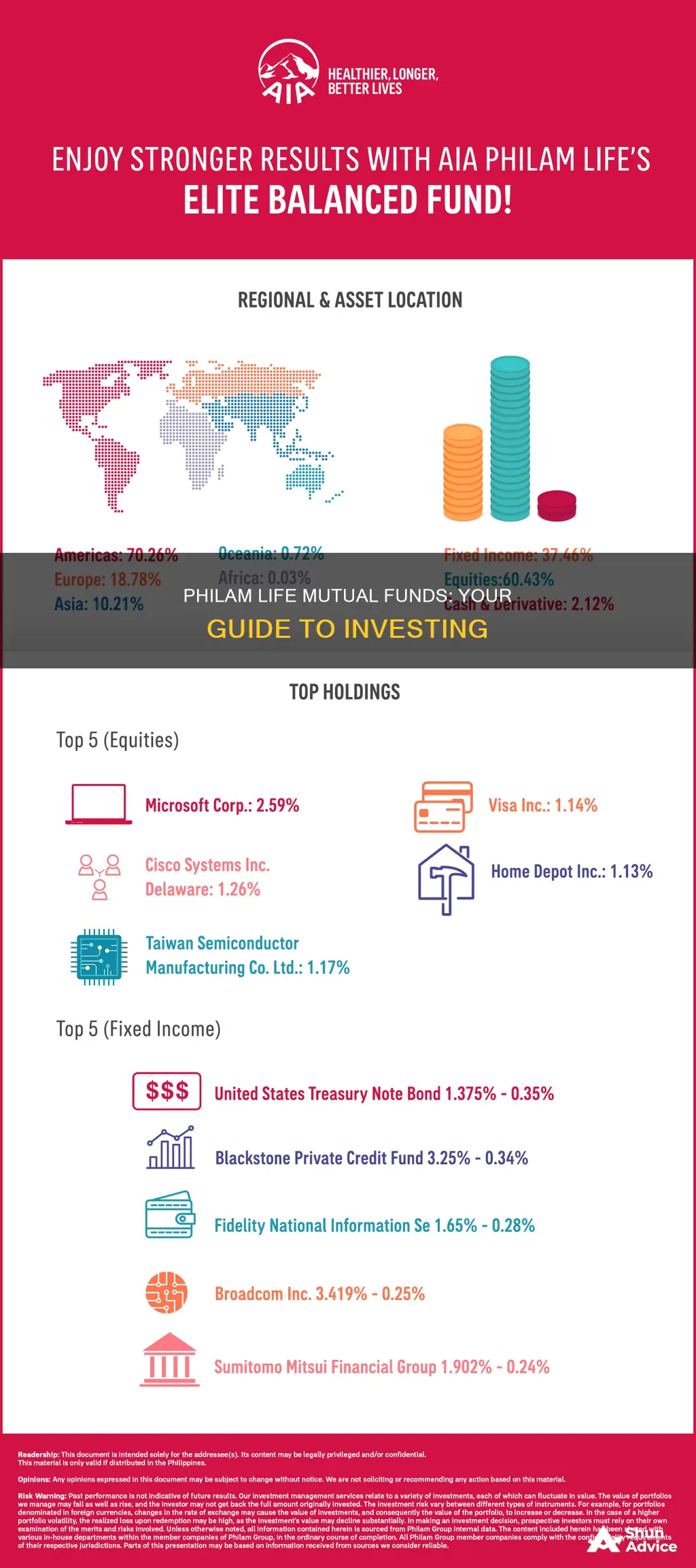

Balanced funds

Balanced funds are a mix of bonds, stocks, and other securities. They are also known as hybrid funds because they aim to make a profit by investing in a combination of various mutual fund types. Typically, balanced funds are composed of 60% stocks and 40% bonds. This type of fund is ideal for investors with low to moderate appetite for risk who want to earn a bit more than what bond funds offer. The investment timeframe for this type of mutual fund is three to five years.

Mutual Funds: Risky Business and Poor Investment Choice

You may want to see also

Submit the requirements

As an investor, you will be required to submit a personal information sheet, valid IDs, and an Order Ticket to determine how many shares you plan to purchase. You will also need to fill out an Investor Profile Questionnaire to determine what type of investor you are and your risk tolerance.

Personal Information Sheet

This document will require you to provide personal information such as your full name, date of birth, address, contact details, and other relevant information. Make sure to have all the necessary details ready and review the form for accuracy before submission.

Valid IDs

You will need to submit copies of one or more valid IDs, such as your passport, driver's license, government-issued ID, or any other accepted identification documents. Ensure that your IDs are up-to-date and legible.

Order Ticket

The Order Ticket is used to specify the number of shares you intend to purchase. It is essential to carefully consider your investment goals and financial capacity before determining the number of shares.

Investor Profile Questionnaire

The Investor Profile Questionnaire is designed to assess your investor profile and risk tolerance. It will typically include questions about your investment objectives, financial situation, investment experience, and risk tolerance. Be honest and thoughtful in your responses to ensure accurate assessment.

After submitting these requirements, you will be well on your way to investing in Philam Life Mutual Funds. Remember to carefully review all the documents before submission and don't hesitate to reach out to the fund managers if you have any questions or concerns.

Mortgage Investment Strategies to Boost College Funds

You may want to see also

Frequently asked questions

A mutual fund is an investment company that pools money from many individual and institutional investors to create a large asset base. The money is then used to invest in different assets, such as stocks and bonds.

First, evaluate your financial goals and risk appetite. Then, do your research on mutual fund companies in the Philippines, ensuring they are registered and regulated by the Securities and Exchange Commission (SEC). Philam Life Mutual Funds is a well-known option.

Once you've chosen a company, talk to an agent and pick the best type of mutual fund for your needs. You will then need to submit some requirements, including a personal information sheet, valid IDs, and an Order Ticket.

Philam Life Mutual Funds offers a range of benefits, including life insurance coverage, potential for financial growth, and full control over your investment plan. The funds are also managed by experienced professionals, and you can choose from a variety of investment options to suit your risk appetite.