India Post offers a variety of investment schemes, including savings accounts, Kisan Vikas Patra, National Savings Certificate (NSC), National Monthly Income Scheme, Sukanya Samriddhi Yojana, Senior Citizens Savings Scheme (SCSS), RD and time deposit accounts. These schemes are backed by the government, making them safe investment options with guaranteed returns. The post office savings schemes offer diverse investment options catering to different investor needs, with varying deposit limits, tax implications and returns. The interest rates for these schemes are highly competitive and range from 4% to 8.2%. The process of investing in these schemes is simple, with minimal documentation required.

| Characteristics | Values |

|---|---|

| Investment Options | Public Provident Fund (PPF), Sukanya Samriddhi Yojana (SSY), National Savings Certificate (NSC), Kisan Vikas Patra, Post Office Monthly Income Scheme, Senior Citizen Savings Scheme (SCSS) and more. |

| Interest Rates | 4% to 9% |

| Tax Benefits | Most schemes are tax-exempt up to Rs. 1,50,000. Some schemes like PPF and SSY have tax benefits on returns. |

| Risk | Minimal risk as the schemes are backed by the Indian Government |

| Investment Period | Up to 15 years for a PPF account |

| Transferability | Accounts are transferable from one post office to another |

| Eligibility | All citizens above 18 years of age are eligible for most schemes. SSY is for girl children below 10 years of age. SCSS is for senior citizens above 60 years of age. |

| Nomination | Mandatory for up to four individuals |

| Minimum Investment | Varies by scheme, starting from Rs. 100 per month |

| Maximum Investment | Varies by scheme, some schemes have no upper limit |

What You'll Learn

How to open a post office savings account in India

Opening a savings account with the post office in India is a straightforward process. Here is a step-by-step guide on how to do it:

- Visit your nearest post office or download the application form from the India Post website. Some post office savings schemes also allow you to open an account online through internet banking or by downloading the relevant mobile app.

- Fill out the form with your personal details.

- Gather the required documents, including proof of identity (such as an Aadhaar card or PAN card) and proof of address (such as a Voter ID or utility bill). You will also need to provide a passport-sized photograph.

- Make an initial deposit. The minimum deposit required to open a post office savings account is Rs. 500.

- Submit the completed form, documents, and initial deposit at your local post office.

- The post office officials will verify your application and open your account. They will also provide you with a passbook for the account.

It is important to note that only adults who are Indian citizens or minors above the age of 10 can open a post office savings account. Additionally, a guardian can open an account on behalf of a minor.

Post office savings accounts in India offer attractive interest rates, currently fixed at 4% by the central government, and other benefits such as no minimum balance requirement, easy withdrawals, and the ability to transfer the account between post offices.

How to Report Investment Management Fees in TurboTax

You may want to see also

Post office investment options for students

Post office investment schemes are a great way for students to start investing, with a variety of options to choose from. Here are some of the post office investment options available to students in India:

Post Office Savings Account:

- Minimum deposit of Rs. 500.

- Offers an interest rate of 4.0% per annum.

- Basic banking services like a cheque book and ATM card are available upon request.

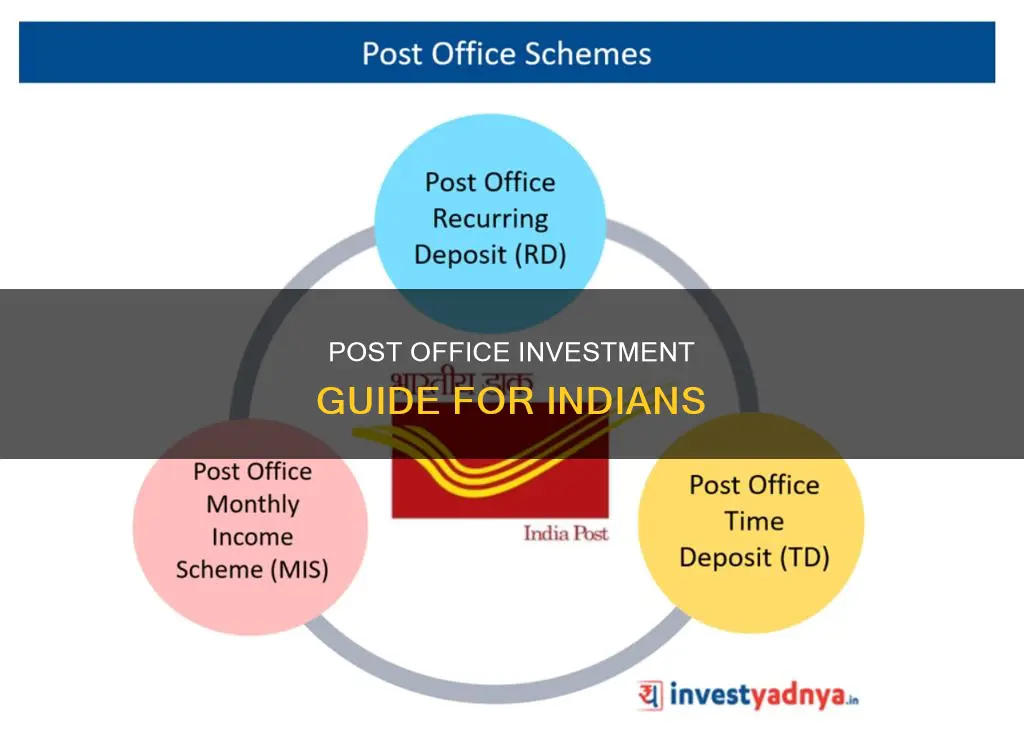

Post Office Recurring Deposit (RD) Account:

- Minimum deposit of Rs. 100 per month.

- Earn an attractive interest rate of 6.7% per annum, compounded quarterly.

- Loan facility available after 1 year.

- Partial withdrawal up to 50% of the balance is allowed after 1 year.

Post Office Time Deposit Account (TD):

- Flexible tenures of 1, 2, 3, or 5 years.

- Minimum deposit of Rs. 1,000.

- Interest rates vary based on tenure, ranging from 6.9% to 7.5% per annum.

- The 5-year TD option provides tax benefits under Section 80C.

Post Office Monthly Income Scheme Account (MIS):

- Minimum deposit of Rs. 1,000, with a maximum of Rs. 9 lakh for a single account and Rs. 15 lakh for a joint account.

- Offers an interest rate of 7.4% per annum, paid monthly.

- Premature withdrawal after 1 year is possible but attracts penalties.

Public Provident Fund (PPF):

- Tenure of 15 years, extendable in blocks of 5 years.

- Minimum investment of Rs. 500 per year, with a maximum of Rs. 1.5 lakh per year.

- Offers an interest rate of 7.1% per annum, compounded annually.

- Provides tax benefits under Section 80C, and the interest earned is tax-free.

National Savings Certificate (NSC):

- Tenure of 5 years.

- Minimum investment of Rs. 1,000, with no maximum limit.

- Offers an interest rate of 7.7% per annum, compounded annually and paid at maturity.

- Provides tax benefits under Section 80C.

Kisan Vikas Patra (KVP):

- Tenure of 115 months (9 years and 7 months).

- Minimum investment of Rs. 1,000, with no maximum limit.

- Offers an interest rate of 7.5% per annum, compounded annually, effectively doubling your investment.

- No tax benefits on the interest earned.

Sukanya Samriddhi Account (SSA):

- A government scheme for the financial well-being of the girl child.

- Can be opened for girls below 10 years of age.

- Minimum deposit of Rs. 250 and a maximum of Rs. 1.5 lakh per year.

- Offers an interest rate of 8.2% per annum, compounded annually.

- Provides tax benefits under Section 80C, and the interest earned is tax-exempt.

India's Workforce Training: Investing in the Future?

You may want to see also

How to fill out the post office investment form

To fill out the post office investment form in India, follow these steps:

- Download the relevant application form from the official website of the post office. The form will vary depending on the scheme you are interested in, such as the Post Office Monthly Income Scheme (POMIS), National Savings Certificate (NSC), Senior Citizen Savings Scheme (SCSS), Public Provident Fund (PPF), Kisan Vikas Patra (KVP), or Sukanya Samriddhi Yojana (SSY).

- Attach the necessary documents to support your application. This may include an Account Opening Form, KYC Form, Aadhaar card or other proof of identity and address, and proof of date of birth/birth certificate in the case of a minor.

- Complete the application form with your personal details, such as name, address, and nominee details. Specify the deposit amount, tenure, and the account from which the funds will be deposited.

- Submit the application form along with the required documents to your local post office branch.

- Make the minimum deposit required to open the account or scheme. The minimum deposit amount varies depending on the scheme. For example, the minimum deposit for the Post Office Savings Account is Rs. 500, while the minimum investment for the Post Office Monthly Income Scheme is Rs. 1,000.

- Wait for verification of your application by the post office officials. Once your application has been verified and processed, they will open your account and provide you with a passbook.

Please note that the specific steps and requirements may vary depending on the scheme you choose. It is recommended to refer to the official website of the Indian Post Office for detailed information on each scheme and the application process.

Establishing a Managed Investment Trust: A Step-by-Step Guide

You may want to see also

Post office investment tax benefits

Post office investment schemes in India offer a range of tax benefits to investors. Here is a detailed overview of the tax advantages offered by various post office investment schemes:

Public Provident Fund (PPF)

The Public Provident Fund is a long-term investment scheme with a tenure of 15 years. It offers tax benefits under Section 80C of the Income Tax Act, allowing deductions on the principal amount invested up to Rs. 1.5 lakh per financial year. Additionally, the interest earned on PPF investments is entirely tax-free. The current interest rate for PPF is 7.1% per annum, compounded annually.

Sukanya Samriddhi Account

The Sukanya Samriddhi Account is operated under the Sukanya Samriddhi Yojana and offers tax benefits under Section 80C. It has a tenure of 21 years and can be opened for girls below 10 years of age. The minimum yearly deposit is Rs. 50, while the maximum is Rs. 1.5 lakh. The interest earned on this scheme is also tax-exempt, and the current interest rate is 7.6% per annum.

National Savings Certificate (NSC)

The National Savings Certificate is a 5-year investment scheme that offers tax benefits under Section 80C. Individuals can invest a minimum of Rs. 1,000, with no upper limit. The interest is compounded annually and paid at maturity. While the total interest and withdrawal are taxable, the annual interest reinvested in the scheme for the first four years is deemed a separate investment and qualifies for tax deduction. The current interest rate for NSC is 7.7% per annum.

Senior Citizen Savings Scheme (SCSS)

The Senior Citizen Savings Scheme is specifically designed for individuals over 60 years of age or retired individuals between 55 and 60 years. It offers tax benefits under Section 80C, allowing deductions on deposits up to Rs. 1.5 lakh. The interest earned is taxable, and TDS is applicable if the interest amount exceeds Rs. 40,000. The current interest rate for SCSS is 8.2% per annum, paid quarterly.

Post Office Time Deposit (TD)

The Post Office Time Deposit is similar to a bank fixed deposit and offers tax benefits for the 5-year time deposit option under Section 80C. The minimum investment is Rs. 1,000, with no upper limit, and the interest rates vary based on the tenure chosen. The interest earned is taxable unless it is a five-year time deposit, in which case it qualifies for tax benefits.

Other Schemes

Other post office investment schemes like the Post Office Savings Account, Monthly Income Scheme (MIS), and Kisan Vikas Patra (KVP) do not offer significant tax benefits. While the savings account provides a deduction of up to Rs. 10,000 under Section 80TTA, the MIS and KVP are taxable, with no specific tax advantages. However, these schemes still offer attractive interest rates and are backed by the Government of India, making them relatively safe investment options.

Outsourcing Investment Management: Pros, Cons, and Practicalities

You may want to see also

Post office investment options for senior citizens

India's Post Office offers a variety of investment options that cater to different investor needs. These schemes are backed by the Indian government, making them a safe investment option. Here is a detailed overview of the investment options available for senior citizens:

Senior Citizen Savings Scheme (SCSS)

The Senior Citizen Savings Scheme is a government-backed retirement scheme that offers a guaranteed return. The scheme has a minimum entry age of 50 years for retired defence employees and 55 years for retired civilian employees. The maximum deposit limit has been increased to Rs. 30 lakhs, and the current interest rate offered is 8.2% per annum, payable quarterly. The maturity period is 5 years, and the investment is eligible for tax deduction under Section 80C of the Income Tax Act.

Post Office Monthly Income Scheme (POMIS)

The Post Office Monthly Income Scheme offers a guaranteed monthly income. The minimum investment limit is Rs. 1,000, and the maximum limit is Rs. 9 lakhs for a single account and Rs. 15 lakhs for a joint account. The interest rate is currently 7.4% per annum, payable monthly. The maturity period is 5 years, and the scheme offers liquidity by allowing withdrawals after 1 year with a penalty.

Public Provident Fund (PPF)

The Public Provident Fund is a long-term investment option with a 15-year maturity period. The minimum deposit amount is Rs. 500, and the maximum is Rs. 1,50,000 per financial year. The interest rate is 7.1% per annum, compounded annually, and the interest earned is tax-free. The investment qualifies for tax deduction under Section 80C of the Income Tax Act.

National Savings Certificate (NSC)

The National Savings Certificate has a maturity period of 5 years and a minimum investment amount of Rs. 1,000. There is no maximum investment limit. The interest rate is 7.7% per annum, compounded annually, and paid at maturity. The investment qualifies for tax deduction under Section 80C, and the interest earned is also deemed to be reinvested and is tax-deductible.

Kisan Vikas Patra (KVP)

The Kisan Vikas Patra is a unique scheme where the invested amount doubles every 115 months. The minimum investment amount is Rs. 1,000, and there is no maximum limit. The interest rate is 7.5% per annum, compounded annually. The investment is not tax-efficient as the principal amount is not tax-deductible, and the interest is taxable.

These investment options offer a range of benefits, including guaranteed returns, tax benefits, and flexibility. Senior citizens can choose the most suitable option based on their financial goals and risk appetite.

Building a Robust Investment Portfolio with Just $500

You may want to see also

Frequently asked questions

The post office in India offers a range of saving schemes that provide high interest rates, tax benefits, and the sovereign guarantee of the Indian government. These schemes are also easy to enrol in and require minimal documentation.

To open a post office savings scheme account, you will need to fill out an account opening form and a KYC form, which can be obtained from your local post office or downloaded from the official portal of the Indian Post Office. You will also need to indicate your preferred scheme and submit the necessary documents, such as proof of address and date of birth.

Some of the specific post office savings schemes available in India include the National Savings Time Deposit Account, the National Savings Monthly Income Account, the Senior Citizen Savings Scheme Account, and the Public Provident Fund Account. Each scheme has different features, interest rates, and eligibility criteria, so it is important to research the specific scheme you are interested in.