The Quant Active Fund is a Multi Cap mutual fund scheme from Quant Mutual Fund, one of the oldest and pioneering mutual funds in India. The fund aims to provide long-term capital appreciation and generate income by investing in a diversified portfolio of Large Cap, Mid Cap, and Small Cap companies. To invest in the Quant Active Fund, you can follow these steps:

1. Log in to your personal account on a mutual fund portal, such as Groww, or visit the website of the fund house, Quant Mutual Fund.

2. Provide a copy of your identification, such as a PAN or Aadhaar card.

3. Provide proof of residence, such as a passport or Voter ID card.

4. Choose a risk option based on your investment amount and risk appetite.

5. Select the tenure of the investment.

6. Decide between investing a lump sum or starting a Systematic Investment Plan (SIP).

It's important to note that Quant Active Fund is considered a high-risk investment, and it is mandated to invest at least 25% of its assets in large, mid, and small-cap stocks. Therefore, it is suitable for long-term investors who are comfortable with higher risk.

| Characteristics | Values |

|---|---|

| Investment Objective | Long-term capital appreciation and income generation with a diversified portfolio of Large Cap, Mid Cap and Small Cap companies |

| Fund Manager | Sanjeev Sharma |

| Fund Launch Date | 15 April 1996 |

| Investment Options | Systematic Investment Plan (SIP) or one-time investment |

| Minimum Investment Amount | Lump sum: ₹5,000; SIP: ₹1,000 |

| Risk Level | Very High |

| Expense Ratio | 0.58% |

| Exit Load | 1% if redeemed within 15 days |

| Taxation | 20% if redeemed before 1 year; 12.5% on returns of ₹1.25 lakh+ in a financial year if redeemed after 1 year |

| Top Holdings | Reliance Industries Ltd., Aurobindo Pharma Ltd., Steel Authority of India Ltd. |

| Asset Allocation | Equity: 83.29%; F&O Holdings: 6.08%; Foreign Equity Holdings: 0.00%; Total: 89.37% |

What You'll Learn

How to invest in Quant Active Fund via Groww

Step 1: Sign Up and Log In

If you are a new user, sign up on the Groww website or mobile app using your email address or mobile number. If you already have an account, simply log in.

Step 2: Complete your KYC

To invest in mutual funds through Groww, you need to complete your KYC (Know Your Customer) process. This is a one-time process and can be done online through the Groww platform. You will need to provide your personal details, including your name, date of birth, address, and bank account information.

Step 3: Explore Quant Active Fund

On the Groww platform, search for the Quant Active Fund. You will find detailed information about the fund, including its investment objective, fund manager, performance, and portfolio holdings. Make sure to review the fund details carefully before investing.

Step 4: Choose Your Investment Option

Groww offers two investment options: lump sum and SIP (Systematic Investment Plan). Decide whether you want to invest a one-time lump sum amount or opt for a regular SIP investment. With SIP, you can invest a fixed amount at regular intervals (monthly, quarterly, etc.).

Step 5: Place Your Investment Order

Once you have decided on the investment option, enter the amount you wish to invest. Review your investment details, including the fund name, investment option, and amount. Then, place your investment order.

Step 6: Payment

After placing your investment order, you will need to make the payment. You can use various payment methods, such as net banking, UPI, or debit cards. Complete the payment process, and your investment in the Quant Active Fund via Groww will be finalized.

By following these steps, you can easily invest in the Quant Active Fund through the Groww platform. Remember to consider your financial goals, risk tolerance, and investment horizon before investing. Also, keep in mind that mutual fund investments are subject to market risks, so carefully review the offer document and make informed investment decisions.

Investment Fund Balance Stagnation: Why It Happens

You may want to see also

Quant Active Fund's performance and returns

The Quant Active Fund is a Multi Cap mutual fund scheme from Quant Mutual Fund. The fund has been in existence for 11 years and 9 months, having been launched on 1st January 2013. As of 30th September 2024, the fund has ₹11,229 Crores worth of assets under management (AUM) and is considered a medium-sized fund in its category. The expense ratio of the fund is 0.58%, which is close to what most other Multi Cap funds charge.

The Quant Active Fund has delivered average annual returns of 21.7% since its inception. The fund has doubled the money invested in it every 4 years. The returns of the Quant Active Fund are currently better than the category average. The fund's ability to deliver returns consistently is in line with most funds in its category, but its ability to control losses in a falling market is low.

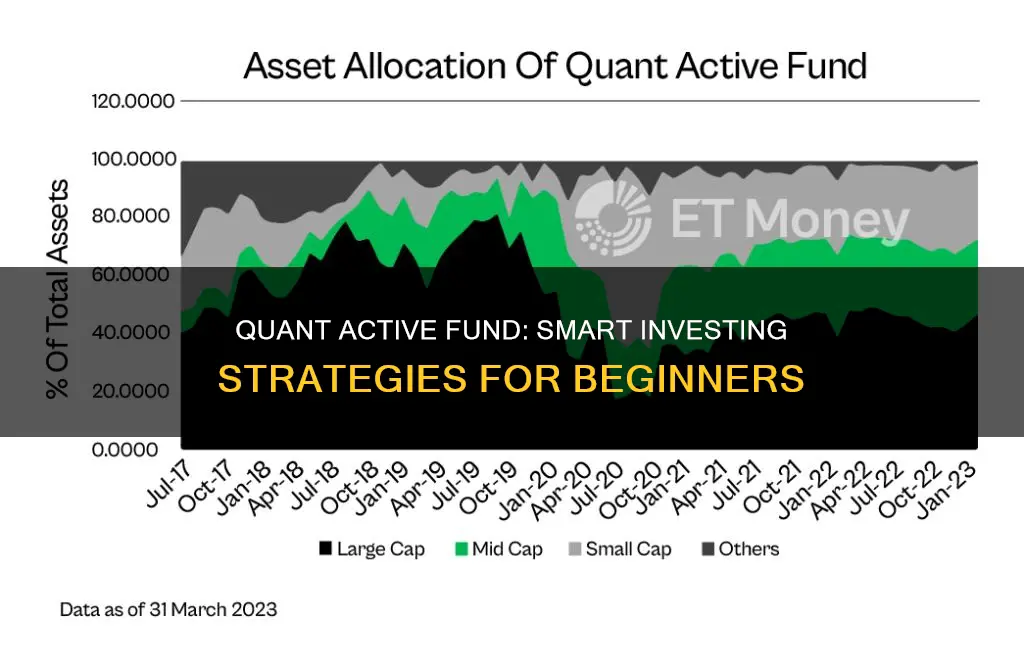

The fund's top holdings are in the stocks of the following companies: Reliance Industries Ltd., Aurobindo Pharma Ltd., Steel Authority of India Ltd., Larsen & Toubro Ltd., and Britannia Industries Ltd. As of 30th September 2024, the fund has invested 86.76% in domestic equities, with 34.32% in Large Cap stocks, 18.05% in Mid Cap stocks, and 19.31% in Small Cap stocks. The fund has also invested 1.77% in Government securities.

The Quant Active Fund is suitable for investors who are looking to invest money for at least 3-4 years and are seeking high returns. These investors should also be prepared for the possibility of moderate losses in their investments. The fund has a Very High-risk rating and does not have a lock-in period.

Index Fund Investing: A Guide for Ireland-Based Investors

You may want to see also

Quant Active Fund's risk and volatility

The Quant Active Fund is a Multi-Cap mutual fund scheme from Quant Mutual Fund that has been in existence for 11 years and 9 months, as of January 2024. The fund has a mandate to invest at least 25% of its money in stocks of large, medium, and small-sized companies. This means that at least 50% of its assets are always invested in mid and small-cap stocks, which generally experience more severe volatility.

The fund's ability to deliver consistent returns is in line with most funds in its category, but its ability to control losses in a falling market is low. The Quant Active Fund ranks lower in terms of protecting against volatility within its category. The fund has a beta of more than 1, indicating that it is more volatile than the market.

The Quant Active Fund has a Riskometer level of "Very High" and has delivered poor risk-adjusted returns. The fund's Sharpe ratio, which evaluates a fund's return relative to its risk, is also low, indicating poor risk-adjusted returns. The Treynor ratio, another risk-adjusted performance measure, is also poor.

The Quant Active Fund has an exit load of 1% if redeemed within 15 days. Short-term capital gains are taxed at 20% if redeemed before 1 year, and long-term capital gains are taxed at 12.5% on returns of ₹1.25 lakh or more in a financial year.

Axis Bluechip Fund SIP: A Smart Investment Strategy

You may want to see also

Quant Active Fund's expense ratio and exit load

The Quant Active Fund is a Multi Cap mutual fund scheme from Quant Mutual Fund. The fund has an expense ratio of 0.58%, which is close to what most other Multi Cap funds charge. The expense ratio of the direct plan of Quant Active Fund is 0.58%. The expense ratio is the annual charge you pay to the mutual fund company for managing your investments in that fund.

The fund features an exit load of 1% if redeemed within 15 days. This means that if you redeem your investment within 15 days, you will be charged a fee of 1% of your total investment.

The Quant Active Fund has been in existence for almost 12 years, having been launched on 01/01/2013. It has delivered average annual returns of 21.7% since its inception. The fund has an AUM (Asset Under Management) of ₹11,229 Crore as of 30/09/2024, making it a medium-sized fund in its category.

Mutual Funds: Philippines' Smart Investment Choice

You may want to see also

Quant Active Fund's investment objective

The Quant Active Fund is a Multi Cap mutual fund scheme that aims to provide long-term capital appreciation and generate income. The fund has been in existence for over 11 years and has a medium size fund in its category. The investment objective of the Quant Active Fund is to provide long-term capital appreciation and generate income by investing in a diversified portfolio of Large Cap, Mid Cap, and Small Cap companies.

The fund is mandated to invest at least 25% of its assets in each of the large, mid, and small-cap stocks. This makes the fund suitable for long-term investors who are comfortable with higher risk. The fund has a conservative investment strategy, with most of its holdings in Large Cap stocks and debt instruments. The fund has underperformed in beating the benchmark but has provided consistent returns that are higher than the category average.

The Quant Active Fund has an expense ratio of 0.58%, which is close to the average for Multi Cap funds. The fund has delivered average annual returns of 21.7% since its inception and has doubled the money invested every four years. The fund's top holdings include stocks from companies such as Reliance Industries Ltd., Aurobindo Pharma Ltd., and Steel Authority of India Ltd.

Overall, the Quant Active Fund offers a diversified portfolio of large, mid, and small-cap companies, providing long-term capital appreciation and generating income for investors.

A Guide to Mutual Fund Investing in Australia

You may want to see also

Frequently asked questions

You can invest in Quant Active Fund online via the Groww Mutual Fund portal. You will need to provide a copy of your identification and proof of residence, choose a risk option, select the tenure, and decide whether to invest a lump sum or start a Systematic Investment Plan (SIP).

The minimum lump sum investment amount is ₹5,000 and the minimum SIP amount is ₹1,000.

The expense ratio of Quant Active Fund is 0.58%. This is the annual fee charged by the Mutual Fund company for managing your investments, and it is taken from the returns generated by the fund.