The Quantum Long Term Equity Value Fund is a mutual fund scheme launched by Quantum Mutual Fund in September 2005. The fund aims to achieve long-term capital appreciation by investing in shares of companies included in the BSE 200 Index that are attractively priced compared to their intrinsic value. It has a minimum investment amount of ₹500 and an expense ratio of 1.1% to 1.29%. The fund has generated average annual returns of 13.50% to 15.0% since its inception and has a very high-risk rating.

What You'll Learn

The benefits of investing in an equity fund of funds

Investing in an equity fund of funds, such as the Quantum Long Term Equity Value Fund, offers several benefits to investors. Here are some key advantages to consider:

- Diversification: Equity funds provide risk diversification by investing in a wide range of stocks across different sectors. By spreading investments among various companies and industries, equity funds help to reduce stock-specific and sector-specific risks. This diversification also minimises the impact of any single stock's performance on the overall portfolio.

- Professional Management: Fund managers of equity funds are experienced professionals who aim to outperform the market and generate superior returns for investors. They have the expertise to identify stocks with higher earnings growth potential and make informed investment decisions.

- Long-Term Wealth Creation: Equity mutual funds are designed for long-term wealth creation. They offer the potential for higher returns compared to traditional investment options. While there may be fluctuations in the short term, equity funds have historically provided attractive long-term returns, making them attractive to investors seeking to build wealth over time.

- Liquidity: Open-ended equity mutual funds offer high liquidity. Investors can redeem their investments partially or fully by submitting a redemption request to the Asset Management Company (AMC). However, redemptions during the exit load period may attract charges.

- Transparency and Regulation: Equity funds are highly transparent, with AMCs disclosing the underlying securities and performance metrics regularly. Additionally, in India, equity funds are regulated by the Securities Exchange Board of India (SEBI), which protects the interests of investors and makes these funds relatively safer compared to unregulated investment options.

- Tax Efficiency: Equity mutual funds are considered one of the most tax-efficient investment options. Taxation arises only upon redemption or dividend payout, and long-term capital gains above a certain threshold are taxed at a lower rate. This makes equity funds a tax-efficient way to invest and create wealth.

The Quantum Long Term Equity Value Fund specifically aims to provide certainty and predictable outcomes in the unpredictable world of finance. It follows a value-oriented approach, investing in attractively priced stocks across various sectors with a focus on liquidity, governance, and valuations. With a disciplined research and investment process, this fund seeks to deliver on its estimated upside potential and reduce the uncertainty associated with equity investing.

Liquid Fund Investment: A Beginner's Guide to Getting Started

You may want to see also

How to invest in the Quantum Long Term Equity Fund

The Quantum Long Term Equity Value Fund is a mutual fund scheme from Quantum Mutual Fund. The fund has been in existence for over 18 years, having been launched on 8 February 2006. It has a total expense ratio of 1.1%, which is higher than what most other Value-Oriented funds charge. The fund has delivered average annual returns of 15.0% since its inception.

The scheme aims to achieve long-term capital appreciation by investing primarily in shares of companies that are typically included in the BSE 200 Index and are attractively priced in the market when compared to the Investment Managers' valuation of the company.

Step 1:

You can invest in the Quantum Long Term Equity Fund directly from the website of the fund house, Quantum Mutual Fund. You will need to create an account and provide your PAN details and complete your KYC.

Step 2:

The minimum investment amount for the Quantum Long Term Equity Fund is ₹500, and you can choose to invest through a Systematic Investment Plan (SIP) with a minimum monthly investment of ₹500 or a daily investment of ₹100.

Step 3:

Provide your bank account details, as the applicable NAV (Net Asset Value) for your investment will be subject to the realisation and availability of funds in your bank account before the cut-off timings.

Step 4:

Keep in mind that the Quantum Long Term Equity Fund is suitable for investors with a long-term view and a very high-risk appetite. The fund is not suitable for those who need to redeem their investment in less than five years.

Step 5:

Monitor the performance of your investment. The NAV of the Quantum Long Term Equity Fund as of 20 September 2024 was ₹134.75.

You can also invest in the Quantum Long Term Equity Fund through platforms like MF Central, MF Utility, or with the help of a mutual fund distributor, such as a bank.

Hedge Fund Investment: Choosing the Right One

You may want to see also

The fund's historical performance

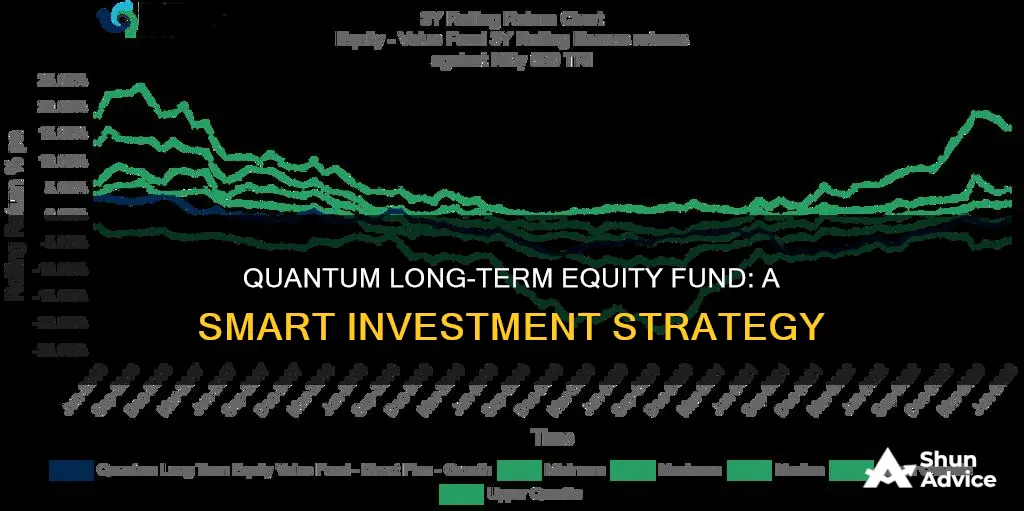

The Quantum Long Term Equity Value Fund has demonstrated strong historical performance, with a consistent track record of delivering returns above the benchmark. Here is an overview of its performance over the years:

Historical Performance Overview:

- The fund has generated an average annual return of 15.06% since its inception in February 2006, doubling the invested money every four years.

- As of September 20, 2024, the fund's NAV was ₹134.75, with a 1-day change of +1.07%.

- Over the last one year, the fund has delivered returns of 42.71%.

- In the last three years, the fund has generated returns of 75.85%.

- Since its launch, the fund has achieved a cumulative return of 178.01%.

- The fund has an asset under management (AUM) of ₹1,220 Crores as of June 30, 2024, and an expense ratio of 1.1%.

Comparison with Benchmarks:

- The fund has consistently outperformed its benchmark, the BSE 500 Total Return Index, in the last three years.

- The fund's historical performance chart, estimated monthly since December 2007, showcases the fund's commitment to transparency and accuracy.

- The fund's actual growth mirrored the estimated increase over a 17-year period, with an 11.2 times increase in Portfolio NAV at a 14.3% CAGR.

- The fund has demonstrated resilience during turbulent market conditions, such as the Global Financial Crisis and the COVID-19 pandemic.

Risk Management and Sector Allocation:

- The fund focuses on minimizing risks related to liquidity, governance, and valuation.

- It holds shares with a daily trading volume of $1 Million to ensure flexibility in redemption.

- The fund maintains a well-diversified equity portfolio, typically investing in 25-40 stocks across various sectors.

- The top sectors the fund has invested in include Financial, Technology, Automobile, Insurance, and Healthcare.

- The fund's portfolio includes stocks such as HDFC Bank Ltd., ICICI Bank Ltd., Infosys Ltd., Bharti Airtel Ltd., and Crompton Greaves Consumer Electricals Ltd.

In summary, the Quantum Long Term Equity Value Fund has a strong track record of delivering returns, outperforming benchmarks, and managing risks effectively. Its well-diversified portfolio and robust research-driven approach make it a reliable option for investors seeking long-term capital appreciation.

Index Funds: Risky Business or Smart Investing?

You may want to see also

The fund's portfolio and asset allocation

The Quantum Long Term Equity Value Fund is a mutual fund scheme launched by Quantum Mutual Fund. The fund aims to achieve long-term capital appreciation by investing in shares of companies that are typically included in the BSE 200 Index and are attractively priced compared to their intrinsic value. The fund follows a value/contrarian style of investing, focusing on undervalued companies with strong growth potential.

Portfolio

The Quantum Long Term Equity Value Fund has a well-diversified portfolio, investing in 25-40 stocks across various sectors. The fund's top holdings include:

- HDFC Bank Ltd.

- ICICI Bank Ltd.

- Infosys Ltd.

- Bharti Airtel Ltd.

- Crompton Greaves Consumer Electricals Ltd.

- ICICI Prudential Life Insurance Company Ltd.

- Eicher Motors Ltd.

- LIC Housing Finance Ltd.

The fund's portfolio is largely conservative, with most of its holdings in Large Cap stocks and debt instruments. It has 86.01% investment in equities, with 55.69% in Large Cap stocks, 12.07% in Mid Cap stocks, and 1.59% in Small Cap stocks. The remaining 13.99% is invested in debt, primarily in Treasury Bills.

Asset Allocation

The Quantum Long Term Equity Value Fund has a suggested asset allocation of 12|20:80, with 86.63% investment in domestic equities and 0.04% in debt. The fund is suitable for investors with advanced knowledge of macro trends who are willing to take on moderate to high risks for higher returns.

Invest Wisely: Franklin India Low Duration Fund Guide

You may want to see also

The fund's risk and expense ratio

The Quantum Long Term Equity Value Fund is a mutual fund scheme that aims to achieve long-term capital appreciation by investing in shares of companies that are typically included in the BSE 200 Index and are attractively priced compared to their intrinsic value. The fund has been in existence for over 18 years, with an inception date of February 8, 2006.

Risk and Expense Ratio:

The Quantum Long Term Equity Value Fund is considered a high-risk investment, with a riskometer level of "Very High" as per SEBI's Riskometer. This indicates that there is a high possibility of negative returns on the investment. The fund's performance has been mixed, with a lower consistency of returns compared to other funds in its category. It has generated annual returns of only 10.6% in 70% of the time for investors holding for at least 5 years, which is lower than the category average. The fund's ability to control losses in a falling market is also below average.

The expense ratio of the fund is 1.1%, which is higher than what most other Value-Oriented funds charge. The expense ratio is an annual fee charged by the fund for managing your investment. It is a percentage of the fund's assets used for administrative, management, advertising, and other expenses. A lower expense ratio is preferable as it leads to higher returns for investors.

The fund's portfolio is considered conservative, with most of its holdings in Large Cap stocks and debt instruments. As of June 30, 2024, the fund had invested 86.01% in equity and 13.99% in debt. The fund's top holdings include HDFC Bank Ltd., ICICI Bank Ltd., Infosys Ltd., and Bharti Airtel Ltd.

The fund has a minimum investment amount of ₹500 for both SIP and lump-sum investments. It is important to note that this fund is suitable for investors with a long-term investment horizon and a high-risk appetite.

Guide to Investing in Mutual Funds: Strategies for Beginners

You may want to see also

Frequently asked questions

The Quantum Long Term Equity Value Fund follows a value style approach, investing in undervalued companies with strong growth potential. The fund focuses on companies with robust fundamentals across various sectors, emphasizing liquidity, governance, and valuations.

You can invest in the Quantum Long Term Equity Value Fund directly through the Quantum Mutual Fund website or through a mutual fund distributor or advisor. On platforms like MF Central and MF Utility, you can also buy mutual funds.

The minimum SIP amount for the Quantum Long Term Equity Value Fund is ₹500.