The S&P 500 is a stock market index composed of 500 leading U.S. companies, and while you can't invest directly in the index itself, you can invest in an index fund or exchange-traded fund (ETF) that tracks it. Index funds are passively managed investments that aim to replicate the returns of the index they follow, and they typically carry less risk than individual stocks. ETFs are traded on major exchanges and are typically as easy to buy and sell as stocks.

If you want to invest in the S&P 500, you can do so through a taxable brokerage account, a 401(k), or an IRA. You'll need to open a brokerage account if you don't already have one, and then you can purchase an S&P 500 index fund or ETF. When choosing a fund, consider the expense ratio (the annual fee charged by the fund manager) and whether there is a sales load (a commission charged by the fund manager).

It's worth noting that the S&P 500 is dominated by large-cap companies, so it has limited exposure to small-cap and mid-cap stocks, and it only includes U.S. companies. However, investing in the S&P 500 can provide exposure to some of the world's most dynamic companies and has historically offered consistent long-term returns.

| Characteristics | Values |

|---|---|

| Investment type | Index funds or ETFs |

| Investment vehicle | Taxable brokerage account, 401(k), or IRA |

| Investment strategy | Passive index replication |

| Investment diversification | Exposure to 500 leading U.S. companies |

| Investment performance | Historically about 10% annual returns on average over long periods |

| Investment costs | Low expense ratios and no sales load |

| Investment accessibility | Available on E*TRADE and other major brokers |

What You'll Learn

The benefits of investing in an S&P 500 index fund

Investing in an S&P 500 index fund can be a great way to diversify your portfolio and gain exposure to some of the world's most dynamic companies. Here are some key benefits of investing in an S&P 500 index fund:

- Instant Diversification: Investing in an S&P 500 index fund provides instant diversification as it comprises 500 leading U.S. companies across various sectors, including Information Technology, Financials, and Healthcare. By investing in this index fund, you instantly gain access to a diverse range of companies, reducing the risk associated with investing in individual stocks.

- Broad Market Exposure: The S&P 500 index is considered the best benchmark of how the U.S. stock market is performing. By investing in an S&P 500 index fund, you get broad exposure to the overall performance of the U.S. stock market. This index includes some of the most important U.S. companies, representing approximately 80% of the total U.S. stock market's value.

- Low Costs and Passive Investing: Index funds, in general, have lower expense ratios compared to actively managed funds. The S&P 500 index funds are passively managed, tracking the performance of the underlying index. This passive investment strategy results in lower fees, meaning more of your money goes into the actual investment rather than fund management fees. Some S&P 500 index funds have extremely low expense ratios, with some even falling below 0.10% annually.

- Strong Long-Term Performance: Historically, the S&P 500 index has delivered strong long-term returns, averaging about 10% annually over the last century. By investing in an S&P 500 index fund, you can expect your investments to perform in line with the broader market over the long term.

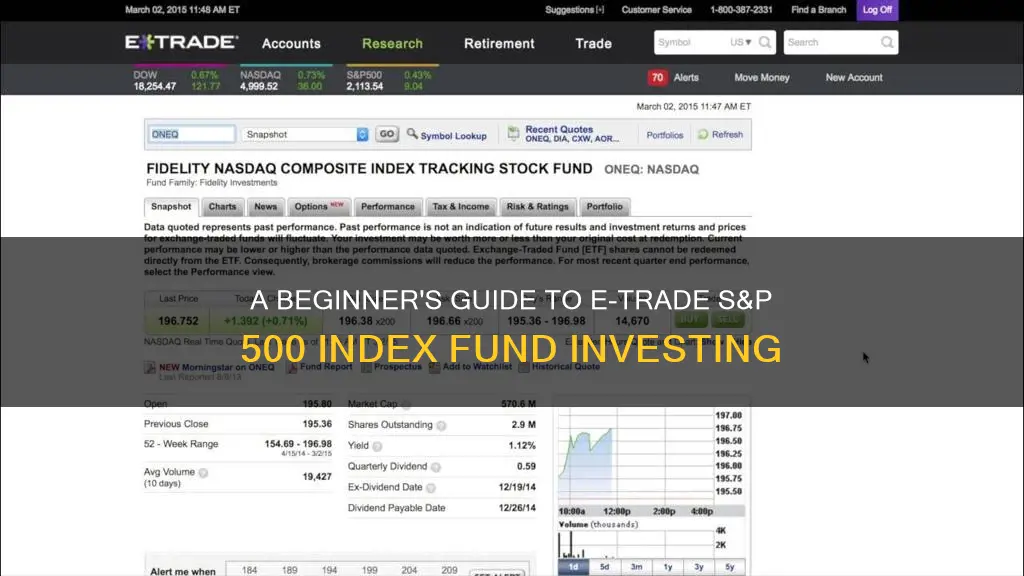

- Simplicity and Accessibility: Investing in an S&P 500 index fund is a straightforward and accessible way to invest in the stock market. You can purchase shares of an S&P 500 index fund through various brokers and investment platforms, including E*TRADE. These funds are also available in taxable brokerage accounts, 401(k) plans, and IRAs, making them a flexible option for investors with different financial goals.

Investing in ICICI Prudential Bluechip Fund: A Comprehensive Guide

You may want to see also

How to open an Etrade account

To open an E*TRADE account, you can follow these steps:

- Choose the type of account you want. ETRADE offers a variety of accounts, including brokerage accounts, retirement accounts, and premium savings accounts. Select the one that best suits your financial goals and needs.

- Complete the online application. You can find the ETRADE from Morgan Stanley brokerage or Morgan Stanley Private Bank online application on their website. Fill out the application form with the required information.

- Fund your account. You can choose to fund your account instantly online or mail in your direct deposit. You can also transfer money electronically, by check, or by wire transfer.

- Start trading. Once your account is funded and the funds have cleared, you can start trading within your brokerage or IRA account.

The process of opening an E*TRADE account is straightforward and can be completed in about 10 minutes. It is important to provide accurate and complete information when filling out the application form. Additionally, make sure to review the terms and conditions before submitting your application.

Robinhood Index Fund Investing: A Beginner's Guide

You may want to see also

The difference between ETFs and mutual funds

Exchange-traded funds (ETFs) and mutual funds are two popular ways for investors to diversify their portfolios. While they share some similarities, there are also some key differences to be aware of when deciding which option is right for you.

Both ETFs and mutual funds are professionally managed collections, or "baskets", of individual stocks or bonds. They are both less risky than investing in individual stocks and bonds due to their built-in diversification. This means that if one stock or bond is performing poorly, there is a chance that another is doing well, reducing your overall risk and potential losses.

ETFs and mutual funds also both offer a wide variety of investment options, from broad total market funds to more specific high-dividend stock funds or sector funds. They are also both overseen by professional portfolio managers who choose and monitor the stocks or bonds the funds invest in.

However, there are some important differences between the two. ETFs have lower investment minimums, as you can buy an ETF for the price of a single share, whereas mutual fund minimum initial investments are typically a flat dollar amount. ETFs also provide more hands-on control over the price of your trade, with real-time pricing and more sophisticated order types. ETFs can also be traded throughout the day like ordinary stocks, whereas mutual funds can only be sold once a day after the market closes.

ETFs are also usually passively managed, tracking a market index or sector sub-index, whereas mutual funds are usually actively managed, with fund managers making decisions about how to allocate assets to try to beat the market. As a result, ETFs tend to be cheaper to invest in, with lower expense ratios.

So, which is right for you? If you prefer lower investment minimums, more hands-on control over the price of your trade, and the ability to trade throughout the day, then ETFs may be the better option. If you are happy with a higher investment minimum and less frequent trading, then mutual funds could be a suitable choice. It's important to consider your personal goals and investing style when making this decision.

Best HDFC Mutual Funds: Where to Invest Smartly

You may want to see also

The pros and cons of investing in the S&P 500

The S&P 500 is a stock market index composed of 500 large US companies, and it powers some popular index funds. While you can't directly invest in the S&P 500 index itself, you can invest in an index fund or exchange-traded fund (ETF) that tracks the index. Here are some of the pros and cons of investing in the S&P 500:

Pros:

- Diversification: The S&P 500 provides instant diversification by encompassing 500 large-cap US stocks from various sectors, including technology, healthcare, finance, and consumer goods. This diversification helps reduce the risk associated with investing in individual stocks, as losses from underperforming companies can be offset by gains from others.

- Long-term growth: Historically, the S&P 500 has shown strong long-term growth potential. Over extended periods, the index has delivered consistent returns, outperforming many other investment options. While there may be short-term market fluctuations, the S&P 500's underlying trend has been upward, driven by the growth of the US economy.

- Accessibility: The S&P 500 is accessible to a wide range of investors. It can be invested in through index funds, ETFs, or mutual funds, making it suitable for both individual investors and those with limited investment knowledge. Additionally, many brokerage platforms offer low-cost options for investing in the S&P 500.

- Professional management: The S&P 500 is managed by a committee that ensures the index accurately represents the US large-cap stock market. This committee regularly reviews and adjusts the index constituents, providing investors with a sense of confidence in the index's composition.

Cons:

- Market volatility: While the S&P 500 has historically shown long-term growth, it is not immune to market volatility. Periods of market downturns can result in significant declines in the index value. Investors in the S&P 500 need to have a long-term investment horizon and be able to weather short-term market fluctuations.

- Lack of individual stock selection: Investing in the S&P 500 means giving up control over individual stock selection. While this offers diversification benefits, it also means potentially missing out on gains from individual stocks that may outperform the broader market. Investors seeking more control over their portfolio may prefer a strategy that includes individual stock selection.

- Concentration in US stocks: The S&P 500 is heavily weighted towards US-based companies, which may result in a lack of exposure to international markets. Investors looking for broader international exposure may need to consider additional investment options to gain the diversification benefits of global investments.

- Inclusion of underperforming stocks: While the S&P 500's committee periodically reviews the index constituents, there may be times when underperforming stocks remain in the index for a certain period, impacting the overall performance of the index during those times.

Navigating Investment Funds: Knowing When to Change for Success

You may want to see also

How to buy an S&P 500 index fund

The S&P 500 is a stock market index composed of about 500 large public U.S. companies. It is often considered a proxy for the overall health of the U.S. stock market. Here is a step-by-step guide on how to buy an S&P 500 index fund:

Step 1: Find your S&P 500 index fund

When choosing an S&P 500 index fund, consider the expense ratio (the fund manager's annual fee, charged as a percentage of your investment) and sales load (a commission charged by the fund manager). S&P 500 index funds tend to have low expense ratios, with many charging less than 0.10% annually.

Step 2: Go to your investing account or open a new one

You will need an investing account to purchase mutual funds or ETFs, such as a 401(k), IRA, or regular taxable brokerage account. If you don't already have one, you can open a brokerage account in 15 minutes or less. Look for a broker that offers commission-free trading and a wide range of ETFs and mutual funds.

Step 3: Determine how much you can afford to invest

Figure out how much you can invest and plan to add money regularly to your account. Consider your budget and how often you can transfer funds. The less you can invest, the more important it is to find a broker with low fees. Move your desired investment amount to your brokerage account.

Step 4: Buy the index fund

Go to your broker's website and set up the trade using the fund's ticker symbol and the number of shares you wish to purchase. Many brokers allow you to set up a recurring investment schedule, so you can automatically invest a set amount at regular intervals.

Additional Considerations:

- Time Horizon: It is generally recommended to hold your investment for at least three to five years to allow for market fluctuations and potential downturns.

- Diversification: While the S&P 500 provides exposure to a diverse range of large-cap U.S. companies, consider including other asset classes in your portfolio, such as mid- and small-cap companies, international companies, bonds, and cash.

- Costs and Fees: Be mindful of the expense ratios and sales loads associated with the fund. ETFs generally do not charge a sales load, and some brokers offer commission-free trading.

Floating Rate Funds: A Smart Investment Strategy

You may want to see also

Frequently asked questions

The S&P 500 is a stock market index composed of 500 leading U.S. companies. It is considered a proxy for the overall health of the U.S. stock market.

You can invest in the S&P 500 through index funds or exchange-traded funds (ETFs) that track the index. You can choose a taxable brokerage account, a 401(k), or an IRA.

Investing in the S&P 500 offers exposure to some of the world's largest and most dynamic companies, such as Apple, Amazon, and Microsoft. It provides consistent long-term returns and does not require intricate analysis or stock-picking. S&P 500 index funds and ETFs are also highly liquid and trade with tight bid-ask spreads, making them ideal as core holdings for investment portfolios.