Vanguard's Admiral Shares are a separate class of shares in Vanguard-administered mutual funds, offering lower fees than the standard Investor Share class. To qualify for Admiral Shares, investors in most index funds and tax-managed funds must maintain a minimum investment of $3,000. The Vanguard 500 Index Fund Admiral Shares is an investment fund that tracks the Standard & Poor's 500 index, one of the most widely watched benchmarks for U.S. stocks. The fund managers attempt to replicate the performance of the S&P 500, with the major difference being the fund’s low expense ratio of 0.04%.

| Characteristics | Values |

|---|---|

| Fund Name | Vanguard 500 Index Fund Admiral Shares (VFIAX) |

| Investment Objective | Track the performance of the S&P 500 |

| Fund Managers | Donald Butler (since 2016), Michelle Louie (since 2017) |

| Top Holdings | Apple, Microsoft, Amazon, Facebook, Johnson & Johnson |

| Total Net Assets | $464.448 billion |

| Expense Ratio | 0.04% |

| Minimum Initial Investment | $10,000 |

| Risk Level | Average compared to other large-blend funds |

| Return | Above average for trailing 3-, 5-, and 10-year periods |

| Fund Launch Date | August 1976 |

What You'll Learn

Vanguard 500 Index Fund Admiral Shares vs. S&P 500

The Vanguard 500 Index Fund Admiral Shares (VFIAX) is a mutual fund that seeks to track the performance of the Standard & Poor's 500 index (S&P 500), one of the most widely watched benchmarks for US stocks. The fund falls into Morningstar's large-blend category and is considered a core large-cap stock holding. The fund's top holdings include Apple, Microsoft, Amazon, Facebook, and Johnson & Johnson.

The main difference between the Vanguard 500 Index Fund Admiral Shares and the S&P 500 is the expense ratio. The Vanguard fund has a low expense ratio of 0.14%, while the admiral shares version of the fund offers an even lower expense ratio of 0.04% with a higher minimum investment of $10,000 compared to the standard version's $3,000 minimum. The fund's expense ratio is significantly lower than the category average of 0.85%.

The Vanguard 500 Index Fund Admiral Shares aim to replicate the performance of the S&P 500 by investing all its assets in the stocks that comprise the index, with the same approximate weightings. As of November 27, 2023, the fund had assets totaling nearly $851.21 billion invested in 508 different holdings.

In terms of performance, the fund has delivered solid returns over the past year, three years, five years, and decade. As of October 31, 2017, the fund's composition in terms of holdings by market capitalization and sectors was largely aligned with its benchmark index. The fund's risk is considered average compared to other funds in the large-blend peer group for the trailing three and ten-year periods, and below average for the trailing five years.

Overall, the Vanguard 500 Index Fund Admiral Shares offer investors a cost-effective way to gain exposure to the performance of the S&P 500, making it a popular choice for long-term investors.

Funding Sources for Your Real Estate Investment

You may want to see also

The fund's low expense ratio

The Vanguard 500 Index Fund Admiral Shares offer a low expense ratio of 0.04%, which is lower than the category average of 0.85% and Morningstar's classification of 0.5%. This low expense ratio is a key feature of the fund, as it allows investors to replicate the performance of the S&P 500 at a lower cost.

The expense ratio of 0.04% is available with a $10,000 minimum investment, while the standard fund has a minimum initial investment of $3,000 and an expense ratio of 0.14%. This makes the Vanguard 500 Index Fund Admiral Shares an attractive option for investors looking to minimize fees while still benefiting from the fund's performance.

The low expense ratio of the Vanguard 500 Index Fund Admiral Shares is a significant advantage, especially when compared to other funds in the index fund space. The fund's low costs are a trademark of its parent company, Vanguard, which is known for its low-cost index products. This approach has led to significant inflows of assets into Vanguard's funds in recent years.

The Vanguard 500 Index Fund Admiral Shares' low expense ratio of 0.04% is a key factor in its overall performance and risk profile. According to Morningstar, the fund's risk is considered average compared to other large-blend funds for the trailing three- and 10-year periods, and below average for the trailing five years. The level of return is above average for the trailing three-, five-, and 10-year periods relative to its peers.

Overall, the Vanguard 500 Index Fund Admiral Shares' low expense ratio of 0.04% makes it a cost-effective option for investors seeking to track the performance of the S&P 500. The fund's low costs contribute to its competitive performance and risk profile, making it a compelling choice for long-term investors.

A Beginner's Guide to Index Fund Investing with Fidelity

You may want to see also

Minimum investment requirements

To invest in Vanguard 500 Index Fund Admiral Shares, you must meet the minimum investment requirements. These requirements vary depending on the type of fund you are investing in.

For most index funds, a minimum investment of $3,000 is required. This includes tax-managed funds and Vanguard's 44 index mutual funds.

For most actively managed funds, the minimum investment amount is $50,000.

If you are interested in sector-specific index funds, the minimum investment requirement is $100,000.

It is important to note that Vanguard periodically evaluates client balances to determine if they qualify for Admiral Shares. If an investor's account holdings become eligible, Vanguard can convert their mutual fund shares into Admiral Shares, typically in a tax-free and cost-free manner.

Investing in Funds: Diversification, Expertise, and Access

You may want to see also

The fund's performance

The Vanguard 500 Index Fund Admiral Shares (VFIAX) has a strong performance track record. As of 28 February 2024, the fund had a 52-week range of 356.71 to 475.03, with a 52-week average return of 28.81%. The fund's total net assets amount to $464.448 billion, with 508 different holdings as of 27 November 2023.

The fund's top holdings are in well-known companies such as Apple, Microsoft, Amazon, Meta Platforms (formerly Facebook), and Johnson & Johnson. As of 15 October 2024, the Net Asset Value (NAV) was 540.96, with a 1-day return of +0.77%.

The fund seeks to replicate the performance of its benchmark index, the S&P 500, which covers about 80% of the investable market capitalization of the US equity market. The fund's expense ratio is 0.04%, which is significantly lower than the category average of 0.85%.

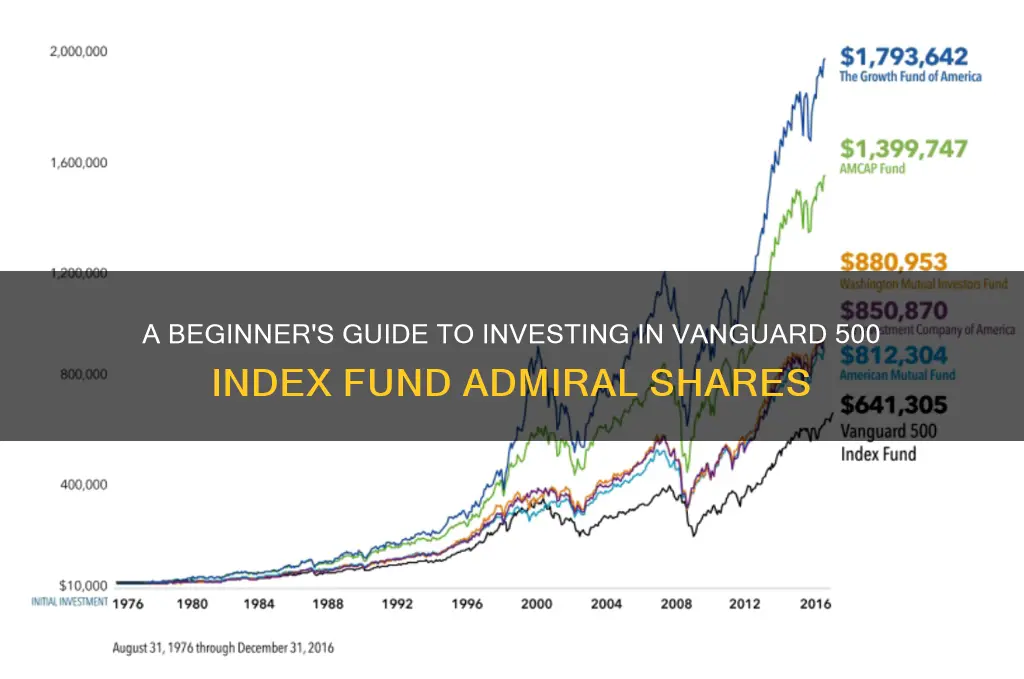

Over the years, the fund has delivered solid returns. As of October 2017, the fund had returned 10.10% over the past year, 10.32% over three years, 10.97% over five years, and 11.14% over the past decade.

Overall, the Vanguard 500 Index Fund Admiral Shares has consistently demonstrated strong performance, offering investors a well-diversified, low-cost option to track the S&P 500.

Key Factors for Choosing the Right Mutual Fund Investments

You may want to see also

The benefits of investing in Admiral Shares

The Vanguard 500 Index Fund Admiral Shares are a great investment option for those seeking to track the performance of the S&P 500, a widely recognised benchmark for U.S. stocks. Here are some key benefits of investing in Admiral Shares:

Low Expense Ratio

The fund's expense ratio is 0.04%, which is significantly lower than the industry average of 0.85% and even lower than Vanguard's own Investor Shares, which average 0.28%. This means you keep more of your returns without losing a large portion to fees.

Strong Track Record

As of October 31, 2017, the fund's makeup in terms of holdings by market capitalization and sectors was in line with its benchmark index, the S&P 500. Over the past decade, the fund has returned 11.14%, with returns of 10.97% over the past five years, 10.32% over the past three years, and 10.10% over the last year.

Diversification

The Vanguard 500 Index Fund Admiral Shares provide exposure to a diverse range of U.S. stocks, covering about 80% of the investable market capitalization of the U.S. equity market. The fund's top holdings include well-known companies such as Apple, Microsoft, Amazon, Facebook, and Johnson & Johnson.

Automatic Conversion to Admiral Shares

Vanguard periodically evaluates client balances, and if your investments meet the minimum requirements for Admiral Shares, they will automatically convert your mutual fund shares to Admiral Shares, typically in a tax-free and cost-free manner.

Minimum Investment Options

The Vanguard 500 Index Fund Admiral Shares have a minimum investment requirement of $10,000, which is higher than the Investor Shares but offers the benefit of lower fees. This option is suitable for those looking to invest a larger sum and take advantage of the cost savings that come with Admiral Shares.

Overall, the Vanguard 500 Index Fund Admiral Shares offer a compelling option for investors seeking to track the performance of the S&P 500 while benefiting from lower fees, strong historical returns, and a diverse portfolio of U.S. stocks.

A Beginner's Guide to Scottrade Mutual Funds

You may want to see also

Frequently asked questions

The minimum investment for Vanguard 500 Index Fund Admiral Shares is $10,000.

The expense ratio of Vanguard 500 Index Fund Admiral Shares is 0.04%.

To invest in Vanguard 500 Index Fund Admiral Shares, you can log in to your Vanguard account to determine your eligibility. If your account is eligible, Vanguard can convert your mutual fund shares into Admiral Shares.