Investing in venture capital funds is a risky but potentially rewarding endeavour. Venture capital funds pool money from investors to finance early-stage startups with high long-term growth potential. The funds are typically structured as limited partnerships, with a general partner managing the fund and limited partners as investors. The general partner identifies specific targets for investment, monitors investments, and works with entrepreneurs to optimise strategy and capital efficiency.

Venture capital funds tend to focus on companies in a particular industry sector, business type, or geographic region where they can best leverage the general partner's expertise. Due to the high risk of failure among startups, venture funds tend to spread their investments across a large number of companies.

Investors in venture capital funds are typically institutional investors such as pension funds, insurance companies, and high-net-worth individuals. However, regulatory changes in recent years have opened up opportunities for non-accredited investors to participate in venture capital through equity crowdfunding platforms.

| Characteristics | Values |

|---|---|

| Investment type | High-risk |

| Investment style | Similar to an investment program |

| Investment accessibility | More accessible than hedge funds |

| Investment timing | Gradual over time |

| Initial investment | 5-10% of the total commitment |

| Investment period | 3-5 years |

| Commitment | Cannot be changed once the subscription period is over |

| Minimum investment | $500k |

| Investor type | High net worth individuals |

| Investor requirements | Accredited investor with a net worth of $1 million or $200,000 in income |

| Investment returns | 25% |

What You'll Learn

Understanding the risks

Venture capital investments are inherently risky. They are typically high-risk, illiquid, and speculative investments. The failure rate of startups is high, and the majority of new companies, products, and ideas do not succeed. As a result, there is a real possibility of losing your entire investment. However, it's important to note that the small percentage of startups that do succeed can produce very high returns on investment.

When investing in venture capital, it's crucial to understand that there is limited liquidity. Investors may need to wait for several years to receive their principal investment, and in some cases, failed startups may result in zero investment returns. The management of these companies is also a significant risk factor, as venture capitalists cannot always predict how individuals will behave. They may not be able to guarantee that a talented management team will stay on board or deliver on their promises.

Market trends and external factors, such as government regulations, economic downturns, corporate theft, and patent infringements, can also impact the success of a venture-capital-backed company. These factors are often outside the company's control, and venture capitalists risk facing unforeseen challenges that affect their investments.

Additionally, venture capital funds generally have a longer holding period than other types of investments. The investment period is typically 3 to 5 years, and investors should be prepared to commit their funds gradually over this time. The initial investment is usually between 5 to 10 percent, with subsequent capital calls made periodically to fund the remaining commitment.

It is also worth noting that venture capital investments are typically only accessible to accredited investors who meet specific income or net worth requirements. In recent years, regulatory changes have opened up opportunities for non-accredited investors to participate through equity crowdfunding platforms, but the field remains largely exclusive to wealthy individuals.

Mutual Funds: US Market Investment Options for Indians

You may want to see also

The role of angel investors

Angel investors are individuals who provide initial seed money to startup businesses, usually in exchange for ownership equity in the company. They are often wealthy individuals looking for a higher rate of return than more traditional investments can offer. They are typically looking for startups with intriguing ideas and will invest their own money to help develop them further.

Angel investors can be involved in multiple startup projects at once, and their involvement can be hands-off or deep, depending on their interests and the wishes of the company. They may be involved in bringing an idea to market and can provide regular injections of cash to help with this. They may also be involved in a mentor-type role with the startup's management team.

Angel investors are generally accredited, meaning they have a net worth of $1 million or more in assets or have earned $200,000 in income for the previous two years ($300,000 if married and filing taxes jointly).

Angel investors are often sought after by entrepreneurs who cannot obtain conventional bank loans or who do not want the burden of debt until their ideas take off. They are a primary source of funding for many entrepreneurs in the early planning stages of turning their ideas into businesses.

Angel investing is risky, and each investment usually represents only a small percentage of an angel investor's portfolio. They can lose their entire investment if the startup fails.

A Guide to Investing in HDFC Small Cap Fund

You may want to see also

How to become an accredited investor

To become an accredited investor, an individual or entity must meet certain income and net worth guidelines. The Securities and Exchange Commission (SEC) defines an accredited investor through the confines of income and net worth in two ways:

- A natural person with income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

- A natural person who has an individual net worth, or joint net worth with the person’s spouse, that exceeds $1 million at the time of the purchase, excluding the value of the primary residence of such person.

The SEC has also outlined other criteria for qualifying as an accredited investor, including:

- Investment professionals in good standing holding the general securities representative license (Series 7), the investment adviser representative license (Series 65), or the private securities offerings representative license (Series 82)

- Directors, executive officers, or general partners (GP) of the company selling the securities (or of a GP of that company)

- Any “family client” of a “family office” that qualifies as an accredited investor

- For investments in a private fund, “knowledgeable employees” of the fund

It is important to note that there is no formal process or certification for becoming an accredited investor. The companies that issue unregistered securities determine a potential investor’s status by conducting due diligence prior to the sale.

The benefits of being an accredited investor include access to unique and restricted investments, high returns, and increased diversification. However, there are also drawbacks, such as high risk, high minimum investment amounts, high fees, and illiquidity of investments.

Parag Parikh Flexi Cap Fund: Smart Investing Strategies

You may want to see also

The venture capital fund structure

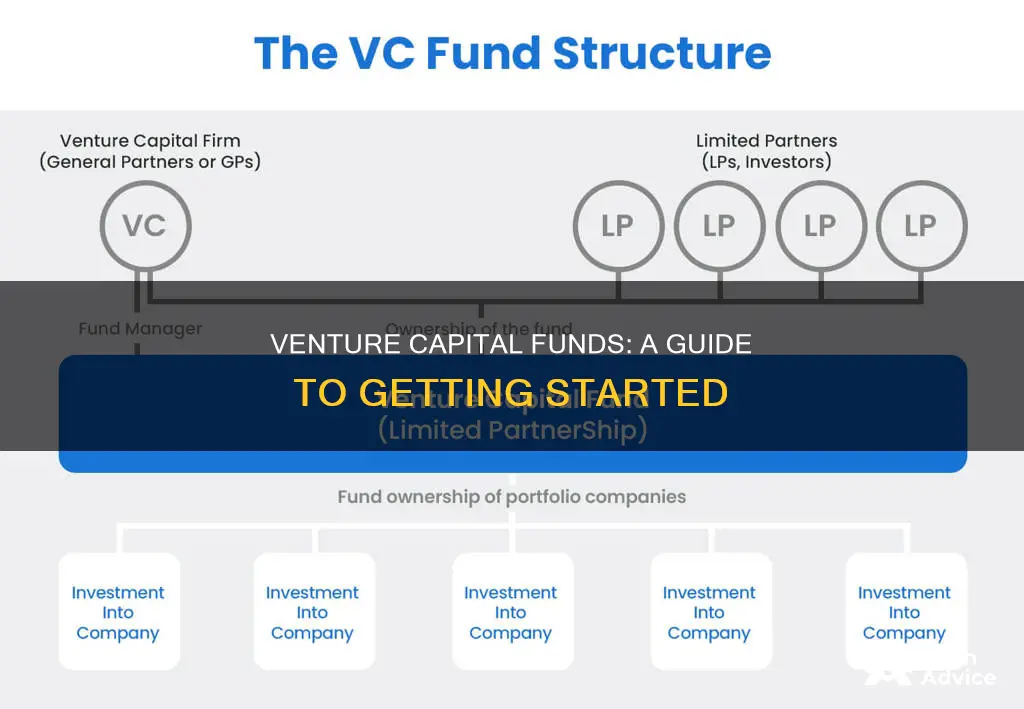

Venture capital funds are typically structured as limited partnerships that are managed by a general partner (GP) and financed by investors who serve as limited partners (LPs). The limited partnership structure has ‘pass-through’ tax benefits over corporate structures that make it preferable for venture funds.

General Partners (GPs)

GPs may be individuals or business entities and they manage the venture fund and make the investment decisions on behalf of the fund. They are usually dedicated venture capital firms with experience and expertise in venture financing. The GP assumes full legal responsibility for the fund’s operation, handling investor administration, and managing the target investments of the fund. The GP is paid a fee by the fund for these responsibilities in addition to a share of the profits.

Limited Partners (LPs)

LPs are the fund’s investors and can be high-net-worth individuals or institutional investors such as pension funds, insurance companies, or family offices. They provide the capital as passive investors and their liability is limited to their investment since management responsibilities and legal liabilities are absorbed by the GP in partnership structures.

The Limited Partnership Agreement (LPA)

The LPA is a legally binding agreement that details the relationship and roles of the GP and LPs in a limited partnership. It spells out all of the particulars of how the partnership will operate, what it plans to invest in, and how the proceeds of those investments will be shared.

The Management Company

The management company is the entity behind the fund itself and is responsible for raising and managing multiple funds. They are responsible for prospecting investments, collecting fees and expenses, branding, and more. They often receive a management fee from their funds to help deploy and grow their funds.

The Fundraising Stage

During the fundraising stage, a VC fund will set up its partnership structure, finalise its strategy and LPA, and solicit investors. The GP will also be researching and identifying potential targets, setting up its LLC, and assembling its team.

The Investment Stage

The investment stage is where the GP identifies specific targets for investment, meets with the founders, and evaluates the target as a potential investment. Once this initial due diligence is accomplished, the fund will begin placing investment capital with selected companies. To make its investments, the fund will issue capital calls to the investors and receive their funds.

The Value Creation Stage

During the value creation stage, the GP will monitor its investments, meeting regularly with target companies and providing guidance and strategic advice where warranted. VC funds do not generally assume management roles in their investments but the GPs will work with the company’s founders and management team at a strategic level to offer their expertise and connections.

The Exit Stage

During the exit stage, the GP works with target companies to identify and arrange exits in order to return capital to the investors. Exits may take the form of IPOs, acquisitions, or secondary sales to other funds or investors. The uncertainties surrounding such exits frequently require more time than anticipated, which is why holding periods tend to be longer for VC funds than other private equity funds.

Tax-Free Mutual Funds: Smart Investment Strategies

You may want to see also

The venture capital fund life cycle

Venture capital funds tend to go through four stages in their life cycle.

Stage 1: Fundraising

During the fundraising stage, a VC fund will set up its partnership structure, finalise its strategy and limited partnership agreement (LPA), and solicit investors. The general partner (GP) will also be researching and identifying potential targets, setting up its limited liability corporation (LLC), and assembling its team.

Stage 2: Investment

In the investment stage, the GP identifies specific targets for investment, meets with the founders, and evaluates the target as a potential investment. Once this initial due diligence is accomplished, the fund will begin placing investment capital with selected companies. To make its investments, the fund will issue capital calls to the investors and receive their funds.

Stage 3: Value Creation

During the value creation stage, the GP will monitor its investments, meeting regularly with target companies and providing guidance and strategic advice. VC funds do not generally assume management roles in their investments but will work with the company’s founders and management team at a strategic level to offer their expertise and connections.

Stage 4: Exit

During the exit stage, the GP works with target companies to identify and arrange exits in order to return capital to the investors in the form of distributions. Exits may take the form of initial public offerings (IPOs), acquisitions, or secondary sales to other funds or investors. The uncertainties surrounding such exits frequently require more time than anticipated, which is why holding periods tend to be longer for VC funds than other private equity funds.

Time Horizon

Most venture funds have a 10-year time horizon to invest all of their capital and then return the profits to the fund’s investors. Funds typically have a lifespan of 8 to 12 years in which to enter into and exit from all of their investments.

Best S&P Index Funds: Top Picks for Your Portfolio

You may want to see also

Frequently asked questions

Venture capital investing is putting money into early-stage companies or startup companies that show potential for long-term growth. The people who make these investments are known as venture capitalists (VCs). Venture capital investments are made when a venture capitalist buys shares of such a company and becomes a financial partner in the business.

The venture capital process involves several parties: entrepreneurs, limited partners, venture capitalists or VC firms, and investment bankers. VC firms raise funding from limited partners and connect them with entrepreneurs seeking funding. They also stay in touch with investment bankers to assess potential exit options.

During the venture capital process, startups navigate through multiple stages or rounds of financing, including seed, early, and late. In the seed stage, entrepreneurs develop their business plan and often use seed capital for research and development. In the early stage, the business raises its first round of funding, called Series A, followed by successive rounds (Series B, C, etc.) as the business grows. In the late stage, the business prepares for M&A or an IPO and may issue additional funding rounds (Series D, E, etc.) to create exit opportunities for VC investors.

Typically, the limited partners of VC firms are institutional investors such as foundations, endowments, insurance companies, pension funds, or family offices. High-net-worth individuals who are accredited investors can also participate in venture capital funds and direct investments. The minimum investment and qualifications required differ with each venture capital fund offering. Crowdfunding platforms have also opened up opportunities for both accredited and non-accredited investors to access venture capital funds.