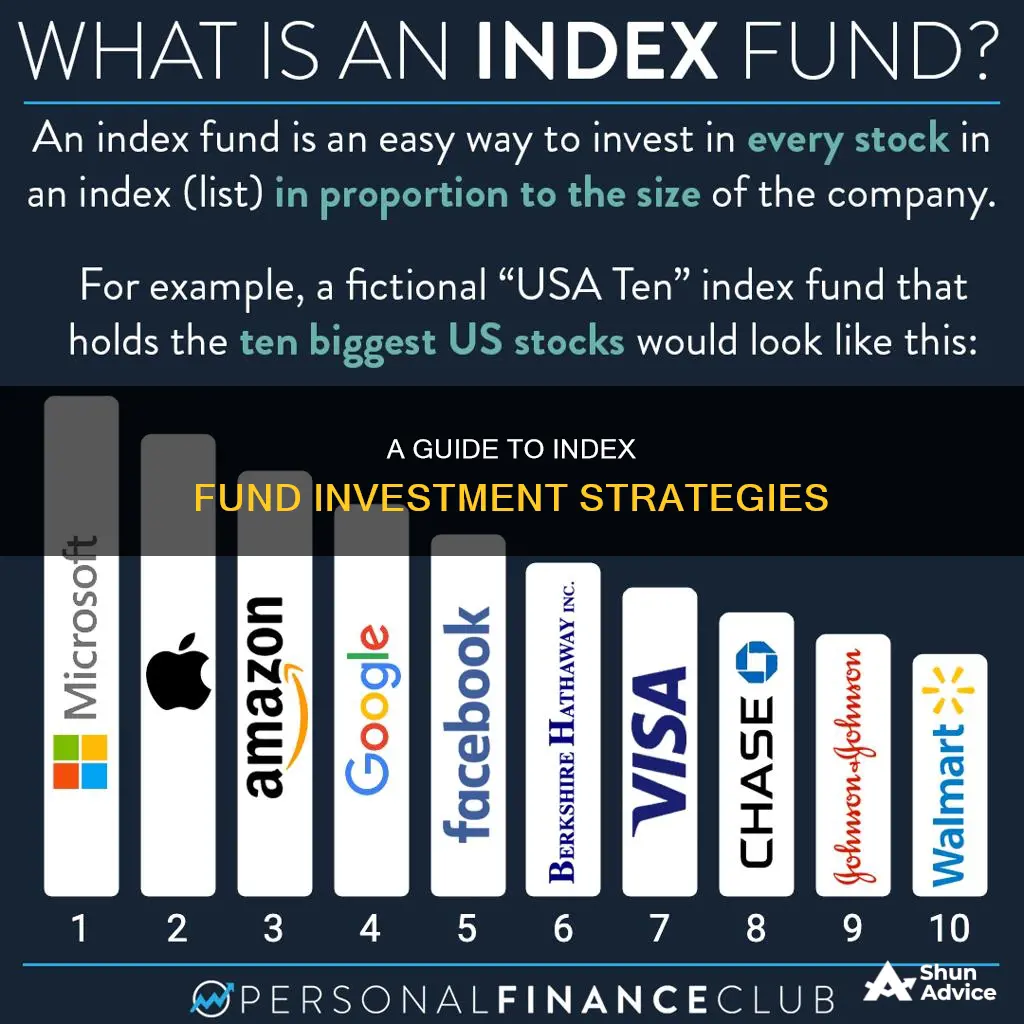

Index funds are a type of investment vehicle that aims to match the returns of a specific market index, such as the S&P 500 or the Russell 2000. They are considered a passive form of investing as they aim to duplicate the makeup of a market index, rather than trying to beat it. Index funds are typically low-cost, well-diversified, and simple to understand, making them a popular choice for investors.

| Characteristics | Values |

|---|---|

| Definition | A type of mutual fund or exchange-traded fund (ETF) that holds all (or a representative sample) of the securities in a specific index, with the goal of matching the performance of that benchmark as closely as possible. |

| Benefits | Low fees, tax advantages (they generate less taxable income), and low risk (since they’re highly diversified). |

| Drawbacks | A portfolio that rises with its index falls with its index. |

| How to invest | Open an investment account, decide on an investment strategy, research your index funds, buy the index funds, set up your purchase plan, decide on your exit strategy. |

What You'll Learn

Understand the benefits and drawbacks of index funds

Index funds are a passive investment method achieved by investing in an index fund. They are a great investment for building wealth over the long term. Here are some of the benefits and drawbacks of investing in index funds:

Benefits

- Low fees: Index funds have much lower management fees than other funds because they are passively managed. Index funds are also cheaper because they don't have a manager actively trading or a research team analyzing securities and making recommendations.

- Tax advantages: Index funds generate less taxable income than other funds because they trade in and out of securities less frequently. They also have another tax advantage because they buy new lots of securities whenever investors put money into the fund, so they can sell the lots with the lowest capital gains and therefore the lowest tax bite.

- Low risk: Index funds are highly diversified, meaning your portfolio is less likely to be significantly harmed by the poor performance of a single stock.

- Convenience: Index funds contain hundreds of stocks that would be hard to replicate at an individual level.

- Diversification: Holding a large array of stocks diversifies away idiosyncratic (firm-specific) risk.

- Performance: Index funds have consistently beaten other types of funds in terms of total return.

Drawbacks

- No downside protection: If you have a fund that tracks the S&P 500, for example, you will be vulnerable when the market drops.

- No choice in the index fund's composition: You cannot add or remove any holdings.

- Can't beat the market: Index funds can only achieve market returns (generally).

- Lack of professional portfolio management: The expertise of a good investment manager can protect a portfolio and even outperform the market, but few managers have been able to do this consistently, year after year.

- Limited upside: The broad-based basket of stocks in an index fund may be dragged down by some underperformers, compared to a more cherry-picked portfolio in another fund.

Mutual Funds: Smart Investment, Diversified Portfolio, and Profits

You may want to see also

Learn how to open an investment account

To open an investment account, you'll need to follow a few steps. Firstly, decide whether you want a margin account, which lets you borrow money to invest, or a cash account, which only lets you invest the money you have. Then, evaluate how a brokerage can help you manage risk and choose the best online brokerage account for your needs. Next, start the application process by providing basic identification, tax, and income information. After your application has been approved, fund your account by transferring money from your bank account. Finally, practice trading before you start investing for real.

Here's a more detailed breakdown of the process:

Decide on the Type of Account:

Determine whether you want a margin account or a cash account. A margin account lets you borrow money to invest, increasing potential profits and losses. A cash account is less risky, as you can only invest the money you have.

Evaluate Brokerage Options:

Research different brokerages and consider how they can help you reduce risk. Evaluate their tools, research capabilities, and educational resources. Look into investment options, account fees, and minimums. Choose a brokerage that aligns with your goals, risk tolerance, and investment strategy.

Start the Application:

Provide basic personal information, such as your Social Security number, name, address, and tax information. You may also need to provide details about your investment goals, net worth, and annual income.

Fund Your Account:

Once your application is approved, transfer funds from your bank account to your brokerage account. You may need the bank name, routing number, and account number to complete the transfer.

Practice Trading:

Before you start investing with real money, practice trading to familiarise yourself with the process. Many brokers offer simulated trading accounts or virtual trading platforms where you can learn without risking your capital.

Activewear: Which Investment Funds are Taking an Interest?

You may want to see also

Decide on an investment strategy

Before investing in index funds, it is important to have a clear understanding of your financial goals and risk tolerance. Ask yourself: When do you want to retire and how far away is that milestone? What does your risk tolerance and budget look like? Knowing your personal situation and life goals will help you determine the role index funds will play in your investment strategy and how to invest in them.

For example, if you have a low-risk tolerance and are looking for stable, long-term growth, you might opt for a bond index fund. On the other hand, if you are comfortable with taking on more risk and are investing for the long term, you might choose an equity index fund, which offers greater potential returns.

Another factor to consider is your timeline. If you have a longer investment horizon, you may be able to take on more risk, while a shorter timeline might indicate a more conservative approach.

Once you have assessed your goals and risk tolerance, you can decide on an index fund investment strategy that aligns with your objectives. This includes choosing the right asset allocation, such as the percentage of your portfolio allocated to stocks versus bonds, and selecting the specific index funds that match your criteria.

It is also important to consider the costs associated with index funds, such as expense ratios and investment minimums, and to compare different funds to find the most cost-effective options. Additionally, you may want to diversify your investments across different types of index funds, such as those focused on specific sectors, industries, or geographic regions.

By carefully considering your investment strategy and conducting thorough research, you can make informed decisions about investing in index funds that align with your financial goals and risk tolerance.

Tudor Funds: A Guide to Investing in Their Success

You may want to see also

Research index funds

Index funds are a type of investment fund that tracks the performance of a specific market index, such as the S&P 500 or the Nasdaq Composite. They are designed to mirror the performance of a particular index by holding the same stocks or bonds, or a representative sample of them. When researching index funds, there are several factors to consider:

- Investment goals and risk tolerance: Before investing in index funds, it is important to understand your investment goals and risk tolerance. Different index funds have different levels of risk, so choosing one that aligns with your goals and risk tolerance is crucial.

- Company size and capitalization: Index funds can track small, medium, or large companies, also known as small-, mid-, or large-cap indexes.

- Geography: Some index funds focus on stocks that trade on foreign exchanges or a combination of international exchanges.

- Business sector or industry: There are index funds that specialize in specific sectors or industries, such as consumer goods, technology, or health-related businesses.

- Asset type: Different index funds track different types of assets, such as bonds, commodities, or cash.

- Market opportunities: Some index funds focus on emerging markets or other growing sectors.

- Fees and expenses: Index funds typically have lower fees and expenses than actively managed funds, but it is important to consider the expense ratio and other costs associated with the fund.

- Performance: Review the long-term performance of the index fund to get an idea of its potential future returns.

- Diversification: Index funds offer immediate diversification by investing in a variety of different stocks or bonds.

- Tax efficiency: Index funds are generally more tax-efficient than actively managed funds because they buy and sell holdings less frequently.

When researching index funds, it is also important to compare different funds that track the same index to find the one with the lowest fees and the best performance. Additionally, consider seeking professional advice from a financial advisor to ensure that your investment choices align with your financial goals and risk tolerance.

JPMorgan Growth Advantage Fund Class R6: Smart Investment Move?

You may want to see also

Buy the index funds

Index funds are a great investment for building wealth over the long term. They are a group of stocks that mirror the performance of an existing stock market index, such as the Standard & Poor's 500 index. An index fund will be made up of the same investments that make up the index it tracks, allowing its performance to closely mirror that of the index.

Have a goal for your index funds:

Know what you want your money to do for you. If you're looking for a short-term investment, you may be more interested in certificates of deposit, savings accounts, or money market funds. However, if you're looking to grow your money slowly over time, particularly for retirement, index funds can be a great option.

Research index funds:

When researching an index fund, consider the following factors:

- Company size and capitalization: Index funds can track small, medium, or large companies, also known as small-, mid-, or large-cap indexes.

- Geography: Look into funds that focus on stocks trading on foreign exchanges or a combination of international exchanges.

- Business sector or industry: Explore funds focusing on specific sectors like consumer goods, technology, or health-related businesses.

- Asset type: There are funds that track bonds, commodities, or cash.

- Market opportunities: Consider funds that focus on emerging markets or other growing sectors.

Pick your index funds:

When choosing an index fund, one of the most important considerations is cost. Look for funds with low expense ratios, as these fees will be subtracted from your overall investment returns. Compare the expense ratios of different funds tracking the same index, as they can vary significantly.

Decide where to buy your index funds:

You can purchase an index fund directly from a mutual fund company or a brokerage. For mutual funds, consider factors like fund selection, convenience, trading costs, impact investing, and commission-free options. For exchange-traded funds (ETFs), you'll need to go through a broker, and factors like trading costs and commission-free options are important.

Open an investment account:

To purchase shares of an index fund, you'll need an investment account. This can be a brokerage account, an individual retirement account (IRA), or a Roth IRA. You can then buy the fund within this account.

Buy the index fund:

Go to your broker's website and set up the trade. Input the fund's ticker symbol and the number of shares you wish to purchase, based on your investment budget. Many brokers allow you to set up a recurring investment schedule, which is a great way to automate your investments and take advantage of dollar-cost averaging.

By following these steps, you can invest in index funds, a popular investment choice known for its low costs, diversification benefits, and solid long-term performance.

Obtaining Proof of ELSS Mutual Fund Investments

You may want to see also

Frequently asked questions

An index fund is a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them.

You can invest in an index fund by opening and funding a brokerage account, or by using a robo-advisor to automate your index fund investing. You can then buy shares of your chosen fund through your brokerage account or directly from an index fund provider.

Index funds offer broad market exposure and diversification across various sectors and asset classes, low fees, and tax advantages (they generate less taxable income). They are also considered safer than individual stocks due to their inherent diversification.

Yes, there are many different types of index funds, including equity (or stock) index funds, bond index funds, international index funds, and sector-specific index funds.

When choosing an index fund, it is important to research the fund's fees, performance, fund size, and liquidity. You should also consider your personal financial situation, goals, and risk tolerance to ensure the fund aligns with your investment objectives.