Setting up an LLC for investing is a safe way to build a group of investors and take advantage of the liability protection and tax benefits. An LLC, or limited liability company, is a popular business structure used by many entrepreneurs and startup companies. It can be a vehicle for several purposes, including allowing groups of people to pool their money together to invest in real estate, stocks, bonds, and properties. When setting up an LLC for investing, it is essential to appoint a registered agent, file formation paperwork with the state, and outline an operating agreement that details the investment strategy, authority on investments, and guidelines for distributing earnings and transferring ownership.

What You'll Learn

- LLCs can be used to invest in real estate, land, stocks, bonds, and other businesses

- LLCs can be funded by member contributions, which can be in the form of cash, property, or services

- Each member of an LLC has a capital account that tracks their initial and ongoing contributions

- LLCs offer limited liability protection, meaning personal finances are protected from financial losses

- LLCs are taxed as pass-through entities by default, but they can elect to be taxed as corporations

LLCs can be used to invest in real estate, land, stocks, bonds, and other businesses

An LLC, or limited liability company, is a popular vehicle for investing in real estate, land, stocks, bonds, and other businesses. This is because LLCs offer liability protection and tax benefits.

Real Estate and Land

LLCs are commonly used to invest in real estate, including commercial and residential property and land. This is because an LLC provides a layer of protection between your personal finances and your investments. For example, if your LLC suffers a financial loss, only the money you've invested is affected, and your personal financial accounts remain untouched.

LLCs are also useful for real estate investors because they provide added asset protection and limited liability. No one wants to be held personally liable for a loan default or a lawsuit related to a rental property they've co-invested in.

Stocks and Bonds

LLCs can also be used to invest in stocks and bonds. This is a good strategy if you want to build a long-term portfolio and pay yourself from the company when you retire. Additionally, if you are an active stock market investor, you can avoid paying as much capital gains and stock dividend tax by trading as an LLC.

Other Businesses

Your LLC can also invest in other businesses. You can purchase and flip companies, or acquire equity in another business. You can act as a small venture firm by pooling money from other investors and funding interesting projects in exchange for an equity percentage.

Other Benefits of LLCs

In addition to the ability to invest in a range of assets, there are several other benefits to investing through an LLC:

- Limited liability protection: LLC members are protected from liability and cannot be held personally responsible for the company's actions.

- Pass-through taxation: LLCs have flexibility in how they report federal taxes, which lends to several tax advantages. By default, the IRS views an LLC as a "disregarded entity", meaning the company's income and losses flow through to the members and are reported on the member's individual tax returns.

- Flexible management structure: LLCs can be member-managed or manager-managed.

Indian Chickpea Exports: A Smart Investment Strategy

You may want to see also

LLCs can be funded by member contributions, which can be in the form of cash, property, or services

An LLC, or limited liability company, is a popular business structure that offers liability protection and tax benefits. It is a great vehicle for pooling money from several informal investors, such as friends, family, or business partners.

If contributing cash, the process is as simple as writing a cheque from your personal funds to the LLC. Property contributions require a market valuation to determine their value, and there may be associated tax consequences. Service contributions are treated as income, and personal income taxes must be paid on their value, making them a less popular option.

The LLC operating agreement will often detail a schedule of additional capital contributions that members commit to making throughout the LLC's existence. It is essential to meet these commitments as stated in the agreement. To properly track member contributions and distributions, each member will have a capital account for record-keeping purposes.

Overall, while LLCs offer flexibility in funding through member contributions, it is important to maintain accurate records and be mindful of any tax implications.

Investing vs. Saving: What's the Real Difference?

You may want to see also

Each member of an LLC has a capital account that tracks their initial and ongoing contributions

An LLC, or limited liability company, is a popular choice for small business owners due to its flexibility and liability protection. Each member of an LLC has a capital account that tracks their initial and ongoing contributions. These accounts are essential for understanding ownership percentages and ensuring that profits and losses are distributed fairly.

When an LLC is formed, each member contributes money, property, or services to the business. These contributions are recorded in their capital account, with the total value determining their initial capital account balance. For example, if member A contributes $50,000 in cash and member B contributes $50,000 in machinery, both have capital accounts equal to $50,000.

The LLC's operating agreement outlines how profits or losses will be divided among members annually. For instance, if members A and B agree to share income and losses equally, and the LLC loses $50,000 in the first year but generates $100,000 in the second, both their capital accounts would increase by $25,000 over that two-year period.

Capital accounts also consider any distributions made by the LLC to the owners. If the business distributes cash to its members, the capital account of each member is decreased by that amount. Conversely, the accounts are increased by the value of any additional contributions made by the members after the initial investment. For example, if member A contributes $25,000 worth of raw material inventory and member B contributes $25,000 in cash, both accounts are increased by $25,000.

LLC capital accounts play a crucial role in decision-making, especially when distributing profits and making capital-intensive investments. When profits are distributed, the LLC typically follows the ownership percentages outlined in the operating agreement, with members holding higher account balances receiving larger portions. Capital accounts also influence decision-making regarding new members' admission or the sale of ownership interests. Members with larger capital account balances often have more say in these matters due to their greater financial stake in the company.

In summary, each member's capital account in an LLC is a financial record that tracks their ownership interest in the company. It represents their financial stake and is influenced by contributions, distributions, profits, and losses. By maintaining accurate records and consulting professionals when needed, small business owners can effectively manage their LLC's capital accounts to support their business growth.

Social Security's Equity Investment Prohibition: Why?

You may want to see also

LLCs offer limited liability protection, meaning personal finances are protected from financial losses

An LLC, or limited liability company, offers its members limited liability protection, meaning personal finances are protected from financial losses. This is the main advantage of an LLC.

LLCs are popular because they limit the personal liability of their members and owners, protecting their personal assets. They are designed to keep their owner's assets separate from their business assets, so in the case of bankruptcy or a lawsuit, the personal assets and personal income of the LLC's owners and members are protected from business liability.

In all states, if you form an LLC to operate your business and don't personally guarantee or promise to pay its debts, you will not be personally liable for the LLC's debts. The LLC's creditors can only go after the LLC's bank accounts and other property, and cannot touch your personal property, such as your personal bank accounts, home, or car.

LLC members also have protection from personal liability for any wrongdoing committed by the co-owners or employees of an LLC during the course of business. If the LLC is found liable for negligence or wrongdoing by its owner or employee, only the LLC's money or property can be taken by creditors to satisfy a judgment against the LLC. The LLC owners would not be personally liable for that debt.

However, there is an exception to this limited liability. LLC owners will remain personally liable for any wrongdoing they commit during the course of LLC business. For example, LLC owners can be held personally liable if they personally and directly injure someone during the course of business due to their negligence, or if they intentionally do something fraudulent or illegal that causes harm to the company or someone else.

LLCs also offer flexibility in how they report federal taxes. By default, the IRS views an LLC as a "disregarded entity", meaning the company's income and losses flow through to the members and are reported on the member's individual tax returns. However, LLCs can also elect to be taxed as an S-corporation or C-corporation.

Investing in Indian Fixed Deposits: A Guide for US Residents

You may want to see also

LLCs are taxed as pass-through entities by default, but they can elect to be taxed as corporations

When it comes to LLCs and taxes, there are a few things to keep in mind. Firstly, LLC stands for Limited Liability Company, and it is a business structure allowed by state statute. The owners of an LLC are called members, and most states permit both "single-member" and "multi-member" LLCs.

Now, by default, LLCs are taxed as pass-through entities. This means that the LLC's income and expenses pass through the LLC to its members, who then report this information on their individual tax returns. Specifically, a single-member LLC is taxed as a sole proprietorship, while a multi-member LLC is taxed as a partnership.

However, LLCs have the flexibility to elect to be taxed as corporations. To do this, an LLC would need to file Form 8832, the Entity Classification Election form, with the IRS. By filing this form, the LLC is electing to be treated as an association taxable as a corporation, or a C-corporation. It's important to note that C-corporations are subject to "double taxation", where the company's net income is taxed at the corporate level, and again when the profits are distributed to shareholders as dividends.

Alternatively, LLCs can also elect to be taxed as S-corporations by filing Form 2553. S-corporations are also pass-through entities, and they offer some tax advantages over C-corporations. For example, S-corps are not subject to double taxation, and they have more flexibility when it comes to tax planning.

In summary, while LLCs are typically taxed as pass-through entities by default, they do have the option to elect to be taxed as corporations. This can provide certain benefits, such as the ability to retain more profits in the company, but it's important to carefully consider the pros and cons of different business structures and tax classifications before making a decision.

Passive Equity Investments: Leveraging Opportunities for Long-Term Growth

You may want to see also

Frequently asked questions

Setting up an LLC for investing is a safe way to build a group of investors and take advantage of the liability protection and tax benefits. Investing as an individual brings added risks to your personal finances and leaves you solely responsible for raising the money to invest.

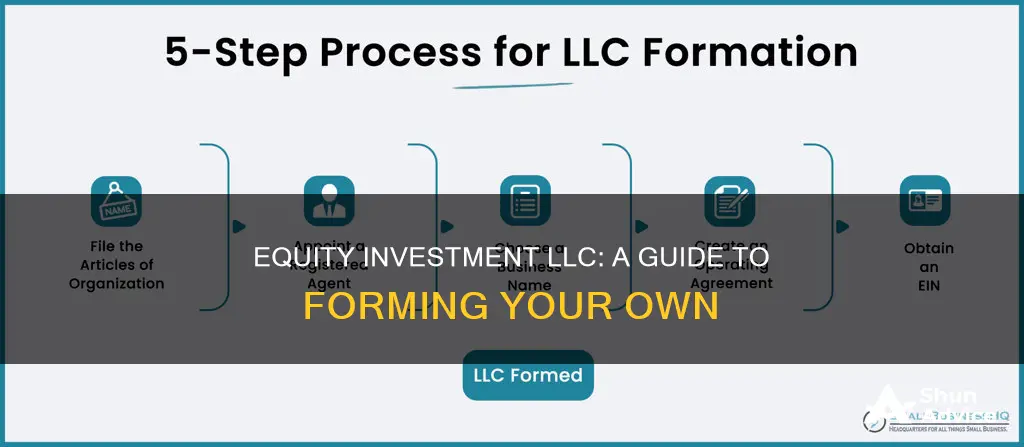

Setting up an LLC for investing is very similar to forming a regular LLC. You will need to pick a formation state, appoint a registered agent, and file formation paperwork with the state.

The main difference is that in an investment LLC operating agreement, you will need to outline guidelines for how your LLC will invest and who can invest LLC funds. In a regular LLC operating agreement, you focus on how your LLC is operated and the management structure without considering how it will invest.

LLCs can invest in property, land, metals, cryptocurrency, and even other businesses. You just can't use an LLC to invest in a retirement account.

LLCs are taxed as pass-through entities by default, but you can elect to have your investment LLC taxed as a C-corp or S-Corp.