INDmoney is an all-in-one app for investing in Indian stocks, US stocks, direct mutual funds, and fixed deposits. It offers a range of features to help users track and manage their investments, including a Mutual Fund Portfolio Scan, which provides a detailed analysis of a user's mutual fund portfolio. This scan allows users to compare their investment choices and performance with those of similar investors in their age group and see how their strategy aligns with their peers. Additionally, users can start building their investment portfolio with just INR 100. To get started, users need to download the INDmoney app and create a free investment account by completing their KYC (Know Your Customer).

| Characteristics | Values |

|---|---|

| How to monitor | Download the INDmoney app and create your free investment account by completing your KYC (Know Your Customer) |

| Monitor external investments | Navigate to the "Mutual Funds" section, press the dropdown arrow next to the "Overall Portfolio" tab, and click "Refresh Portfolio" |

| Monitor overall portfolio | Click on the "Portfolio Scan Story" tab |

| View | Breakdown of investments, showing fund distribution across categories like large cap, mid cap, and small cap |

| Compare | Compare investment choices and performance with those of similar investors in your age group |

| Average monthly investment | See how your average monthly investment compares to that of your age group |

| Expense ratio analysis | Find out the total expense ratio you're likely to pay over the next year, based on the current value of your portfolio |

| Sector allocation | See which sectors you're most and least invested in, and compare your sector allocation with that of other investors in your age group |

What You'll Learn

Utilise the INDmoney app to monitor your mutual fund investments

INDmoney is an all-in-one app for investing in Indian stocks, US stocks, direct mutual funds, and fixed deposits. It offers a zero-cost trading account and a free Demat account. The app allows you to set up a Systematic Investment Plan (SIP) in Indian stocks, direct mutual funds, and US stocks to diversify your portfolio and grow your net worth.

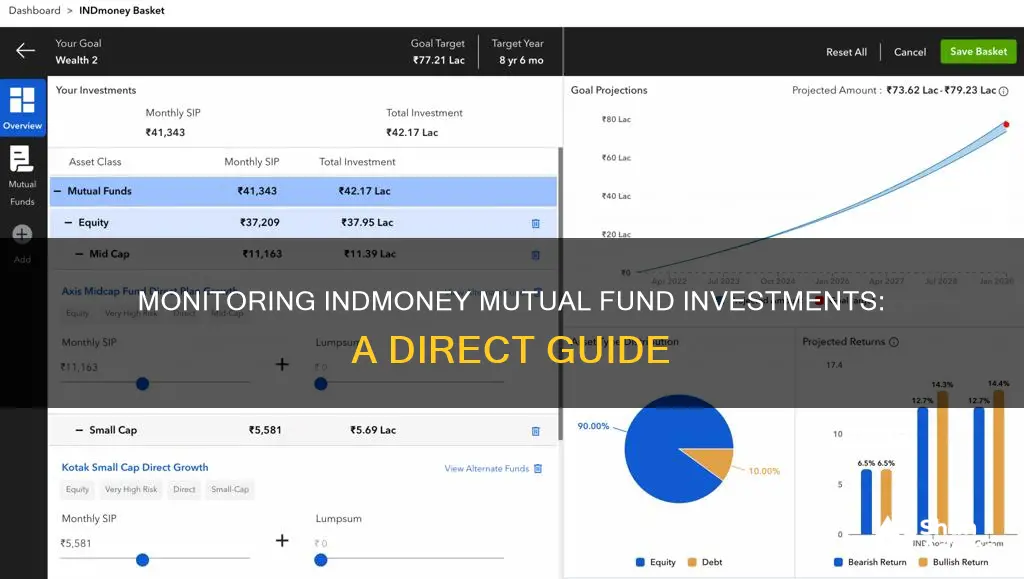

The INDmoney app provides a comprehensive view of your investments, allowing you to monitor your mutual fund portfolio and elevate your investment strategy. Here's how you can utilise the INDmoney app to monitor your mutual fund investments:

Download the INDmoney App and Create an Account:

- Visit the INDmoney website or your device's app store to download the INDmoney app.

- Install the app and open it to initiate the account creation process.

- Complete your Know Your Customer (KYC) process to create your free investment account.

Navigate to the "Mutual Funds" Section:

Once you have set up your account, navigate to the "Mutual Funds" section within the app.

Track Your External Investments:

Click on the dropdown arrow next to the "Overall Portfolio" tab and select the "Refresh Portfolio" option to sync your external mutual fund investments with the app.

Access the "Portfolio Scan Story" Tab:

After refreshing your portfolio, click on the "Portfolio Scan Story" tab to access a detailed analysis of your overall investment portfolio.

Understand Your Asset Allocation:

The "Portfolio Scan" feature provides a breakdown of your investments, showing how your funds are distributed across different categories, such as large-cap, mid-cap, and small-cap.

Compare Your Investment Choices and Performance:

You can compare your investment choices and performance with those of similar investors in your age group. This helps you understand how your investment strategy aligns with your peers.

Analyse Your Average Monthly Investment:

The Mutual Fund Portfolio Scan allows you to see how your average monthly investment compares to others in your age group. This helps you assess if you are investing more, less, or in line with your peers.

Evaluate Expense Ratios:

The app provides an expense ratio analysis, showing the total expense ratio you are likely to pay over the next year, based on the current value of your portfolio.

Sector-Wise Analysis:

With the INDmoney app, you can view which sectors you are most and least invested in and compare your sector allocation with that of other investors in your age group.

By utilising these features of the INDmoney app, you can effectively monitor and manage your mutual fund investments, making informed decisions to align your portfolio with your financial goals.

Strategies for Investing in PE Funds: A Comprehensive Guide

You may want to see also

Understand the importance of regular reviews of your mutual fund investments

Regular reviews of your mutual fund investments are crucial for several reasons. Firstly, they ensure your investments remain aligned with your financial goals, which may evolve over time. For example, your financial needs may change due to lifestyle changes, marital status, or the addition of financial dependents.

Secondly, regular reviews help assess and manage the risk levels in your portfolio. Market dynamics are unpredictable, and reviews allow you to ensure that your portfolio's risk profile aligns with your risk tolerance. This is especially important during different market phases to attain stable returns.

Thirdly, reviews enable you to optimise tax efficiency. By conducting regular reviews, you can identify opportunities to adjust your investments, potentially reducing your tax liabilities. This includes taking advantage of tax loss harvesting, which can minimise the recognition of taxable gains.

Lastly, regular reviews allow you to evaluate the performance of your investments relative to benchmarks and peers. This empowers you to make informed decisions, such as reallocating assets for better returns or switching to better-performing schemes.

The frequency of portfolio reviews may vary depending on individual needs, but it is generally recommended to perform a review every six months or at least annually. It is important to note that portfolio reviews do not always require buying or selling investments. Instead, take a holistic approach, considering factors such as changes in your risk profile, personal needs, and the long-term performance of your portfolio.

- Clarify your financial objectives: Are you saving for a particular milestone, such as buying a home or funding your child's education? Clear objectives guide the evaluation of your mutual fund investments.

- Collect portfolio data: Gather investment statements, account statements, and documents detailing your holdings, transactions, and performance.

- Examine asset allocation: Distribute your investments among different asset classes, such as equities, debt, and gold, based on your risk tolerance and financial goals.

- Evaluate fund performance: Look at key performance indicators such as returns, risk metrics (volatility), expense ratios, and the fund manager's track record.

- Review fund holdings: Ensure that the holdings within each mutual fund align with the fund's objectives and your asset allocation strategy.

- Assess portfolio characteristics: Analyze your portfolio for concentration among different asset management companies, category and sub-category weightage, and sector exposure. Ensure diversification across mutual funds, investment styles, market capitalizations, sectors, and debt quality.

- Address underperforming schemes: Identify schemes that have consistently underperformed or subjected you to inappropriate risk levels. Consider switching to better-performing schemes to earn risk-adjusted returns and effectively work towards fulfilling your financial needs.

- Consider portfolio rebalancing: If there is a significant deviation from your original asset allocation, rebalance your portfolio. For example, if your portfolio has high equity exposure but your risk tolerance has reduced or you are nearing your financial goal, consider shifting to less risky investments like debt funds.

Remember, a disciplined approach to portfolio reviews is crucial for achieving your long-term financial objectives and securing your financial future.

A Guide to Investing in Vanguard Funds

You may want to see also

Analyse the fact sheets to identify portfolio risks

To monitor your INDmoney mutual fund investment directly, you can refer to the mutual fund fact sheets. These fact sheets are mandated by the Securities and Exchange Board of India (SEBI) and are published monthly. They offer a detailed overview of the fund's performance, portfolio holdings, and fund manager backgrounds. By analysing these fact sheets, you can identify potential risks in your portfolio and make informed investment decisions. Here's how you can do it:

Understand Investment Objectives and Style

Review the fact sheet for stated strategy specifics, including investment horizons, asset styles, and benchmark tracking methodologies. Compare these against your personal investment goals and risk tolerance to gauge alignments and potential risk exposures.

Historical Performance Comparison

Contextualise the fund's performance by comparing it with other funds in the same category. Analyse return consistency, volatility, risks, and ratios across timeframes relevant to your personal investment plan. This will help you identify any historical risks or patterns that may impact your portfolio.

Spotlight Portfolio Holdings

Analyse the individual equity and debt allocations within the fund to confirm balanced and diversified holdings. Look for any concentrated bets or sector over-exposure that may introduce higher risk. Also, consider the cash balances and turnover ratios to assess the fund's overall reliability.

Key Ratios and Their Significance

Focus on key ratios such as standard deviation, which indicates the volatility of the portfolio returns. Lower fluctuations signify lower asset volatility risks and higher consistency. Additionally, consider the portfolio turnover ratio, which measures the fund's trading activity and can impact net returns.

By following these steps and analysing the fact sheets, you can identify potential risks in your INDmoney mutual fund investment. Remember to consider your personal financial goals, risk appetite, and investment horizon when interpreting the information provided in the fact sheets.

Millennium Hedge Fund: A Guide to Investing Wisely

You may want to see also

Compare scheme performance using tracking websites

When it comes to choosing a mutual fund to invest in, investors are spoilt for choice. While the three primary options of equity, debt, and hybrid funds seem simple enough, there are currently over 2000 mutual funds in India to choose from. Each category has multiple sub-categories, and there are multiple fund houses offering similar funds.

Having options is great, but too many options can make fund selection difficult. Given that investing involves a long-term commitment of your hard-earned money, choosing the right mutual fund is critical to achieving your long-term goals. This is where comparing mutual fund schemes can help you select the right ones to invest in.

Having a clear idea of how to compare mutual funds' performance and other features can help investors choose schemes that align with their investment goals and help them design an investment portfolio that minimises overall risk and maximises returns.

Compare Mutual Fund Performance Using Tracking Websites

There are several tracking websites and fintech firms that offer free mutual fund screener tools to help you compare different funds. Here are some parameters you can use to compare scheme performance:

- Returns over different periods: One of the most common criteria used to compare mutual fund schemes is their returns over different periods, typically one, three, and five years. However, it is important to note that past performance does not guarantee future results.

- Returns compared to the fund benchmark: All mutual funds are benchmarked to a particular index, and you can compare how much more or less the fund has delivered compared to that index.

- Expense ratio: The expense ratio is the annual percentage the fund house charges for managing your money. This is usually reflected in the fund's value-for-money aspect and impacts your ultimate take-home returns. SEBI sets a ceiling on how much AMCs can charge, but they can charge whatever they want as long as they don't cross that upper limit.

- Risk measurement ratios: There are several key risk measurement ratios used to compare mutual funds, including Standard Deviation, Sharpe Ratio, Sortino Ratio, Alpha, and Beta. These ratios help you understand the fund's volatility, the extra returns generated for the additional risk taken, and the extra risk undertaken to generate higher returns.

- Portfolio-level information: This can be divided into two types: those that give an overall view and those that provide a granular view. Allocation across market caps (large cap, mid cap, and small cap) and the number of securities are examples of overall views. Portfolio holdings, which show the sectors and companies the fund has invested in, provide a more detailed perspective.

When comparing mutual funds, it is important to follow a few thumb rules:

- Compare funds investing in the same asset classes: Ensure you are making an apples-to-apples comparison by defining your investment horizon. Look at equity funds for investment horizons of five years or more, hybrid funds for three to five years, and debt funds for less than three years.

- Consider additional parameters for debt funds: While there are some common factors across all fund types, debt funds have specific portfolio-related considerations, such as modified duration and credit rating of the portfolio.

Additional Considerations for Mutual Fund Selection

In addition to comparing scheme performance, there are other factors to consider when selecting a mutual fund:

- Investment goals: Define your financial goals and risk tolerance before choosing a mutual fund. For example, if you want a regular income with capital protection, you may opt for a debt fund. If you have a higher risk appetite and aim to build wealth, equities may be more suitable.

- Historical performance data: While past performance is not indicative of future results, it can help you understand how the fund has fared across different market cycles and the skill of the fund manager.

- Fee structure: Mutual fund companies charge for their services and expertise. Some funds require deft management and quick decisions on buying, selling, or holding assets. Remember that a higher fee does not necessarily mean a better fund; consider other parameters as well.

- Risk-adjusted returns: These are the returns generated by the fund against anticipated risks.

- Performance against the index: Compare the fund's performance against benchmarks like Nifty, BSE Sensex, and BSE 200. A well-managed fund won't fall too hard during a market low.

By using tracking websites and considering the above parameters, you can effectively compare the performance of different mutual fund schemes and make informed investment decisions.

BlackRock Funds: A Guide to Investing in Their Success

You may want to see also

Consult an investment advisor for expert guidance

When it comes to monitoring your INDmoney mutual fund investment, seeking the guidance of an investment advisor can be a wise decision. Here are some detailed instructions on consulting an investment advisor for expert advice:

Understanding Your Financial Goals

Before consulting an investment advisor, it's essential to have a clear understanding of your financial goals. Are you investing for the short or long term? Do you want to generate income, grow your capital, or save for retirement? Clarifying your objectives will help the advisor tailor their recommendations accordingly.

Finding a Reputable Investment Advisor

Look for a qualified and experienced investment advisor with a strong track record of success in the industry. Ensure they are registered with the appropriate regulatory bodies, such as SEBI (Securities and Exchange Board of India) and AMFI (Association of Mutual Funds in India). You can verify their credentials and check for any disciplinary history.

Providing Necessary Information

When you meet with the investment advisor, be prepared to provide detailed information about your financial situation. This includes your income, expenses, existing investments, and any debts or liabilities. The advisor will use this information to assess your risk tolerance and make suitable investment recommendations.

Discussing Investment Strategies

Investment advisors can guide you in constructing a well-diversified portfolio that aligns with your goals and risk appetite. They can offer insights into different types of mutual funds, such as equity funds, debt funds, international funds, and balanced funds. Advisors can also help you navigate the various investment strategies, such as lump-sum investments or systematic investment plans (SIPs).

Monitoring and Rebalancing Your Portfolio

The role of an investment advisor doesn't end after the initial investment. They can provide ongoing support by regularly monitoring your mutual fund portfolio's performance. Advisors can help you track important metrics, such as market capitalization, expense ratios, and fund manager performance. They can also assist in rebalancing your portfolio over time to ensure it remains aligned with your financial goals and adapts to changing market conditions.

Staying Informed and Making Adjustments

Investment advisors stay abreast of market trends, economic developments, and regulatory changes that may impact your mutual fund investments. They can provide timely advice on buying, holding, or selling specific funds. Additionally, they can guide you in adjusting your investment strategy as your financial circumstances, goals, or risk tolerance evolve over time.

Benefits of Consulting an Investment Advisor

Consulting an investment advisor offers several advantages. They provide personalized advice based on your unique financial situation and goals. Advisors can help you navigate the complex world of mutual funds, making informed decisions with your best interests in mind. They also serve as a valuable source of knowledge, offering insights that you may not have access to as an individual investor.

In conclusion, consulting an investment advisor can be a prudent step when monitoring your INDmoney mutual fund investment. Their expertise and guidance can help you make more informed decisions, potentially improving your investment outcomes. Remember to choose a reputable advisor, understand the costs involved, and maintain regular contact to ensure your investment strategy remains on track.

Smartly Invest 50 Lakhs in Mutual Funds: A Beginner's Guide

You may want to see also

Frequently asked questions

You can monitor your mutual fund investments by setting up an account on the INDmoney app. First, download the app and create a free investment account by completing your KYC (Know Your Customer) details.

Navigate to the "Mutual Funds" section, click on the dropdown arrow next to the "Overall Portfolio" tab, and select "Refresh Portfolio" to track your external investments.

The Mutual Fund Portfolio Scan provides a detailed analysis of your mutual fund portfolio, including an asset allocation report, average monthly investment, and expense ratio analysis. You can also compare your investment choices, performance, and strategy with similar investors in your age group.