A proof of funds letter is a document that demonstrates an individual or entity's ability to pay for a specific transaction, usually a large one. It is often required for buying a house, especially if the buyer is taking out a mortgage. The letter is used to prove to the seller that the buyer has the financial capacity to cover the purchase costs of the home, such as the down payment, escrow and closing costs. It is also required in other financial transactions, such as loan applications, immigration applications, business transactions, and investment opportunities. The letter should include the bank's name and address, an official bank statement, the balance of funds in the buyer's accounts, and the signature of an authorised bank employee.

| Characteristics | Values |

|---|---|

| Purpose | Demonstrate that an individual or entity has the liquid assets to cover a specific expenditure |

| Required for | Buying a home, obtaining a mortgage, making a cash down payment, immigration applications, loan applications, investment opportunities, business transactions, creating a trust, contract bidding, private sales, business licensing, franchise opportunities, auction participation, escrow transactions |

| Format | Bank's name and address, official bank statement, balance of funds in the checking and savings accounts, balance of total funds, signature of authorized bank personnel, verification of the date of the proof of funds letter |

| Other names | POF letter |

What You'll Learn

Requesting a proof of funds letter from your bank

Consolidate your funds

If you have money in multiple accounts, it is recommended to consolidate your funds into a single account. This makes it easier to provide proof of funds and reduces the likelihood of your home loan being denied by the seller. You can usually make transfers online, but you may need to visit different banks to get checks and transfer money. It is also important to keep careful records of these transactions, as your lender will want to see statements showing when the funds were moved.

Submit a request to the bank

You can typically request a proof of funds letter in person at a branch or through an online form. Your lender may also be able to fill out a request form on your behalf. The bank will usually provide the letter within a few days to a week.

Provide the letter to the seller

Once you receive the proof of funds letter, provide copies to your lender and the seller. Keep another copy of the letter in a safe place, as you would with any other important financial document.

It's important to note that a proof of funds letter is different from a preapproval letter. A preapproval letter states that a lender will provide you with a loan, while a proof of funds letter confirms that you have the necessary funds available to cover the costs associated with the purchase. In the context of buying a home, a proof of funds letter demonstrates that you have the cash to cover expenses like the down payment, escrow, and closing costs.

Investing in 1confirmation: Strategies for Crypto Venture Capital

You may want to see also

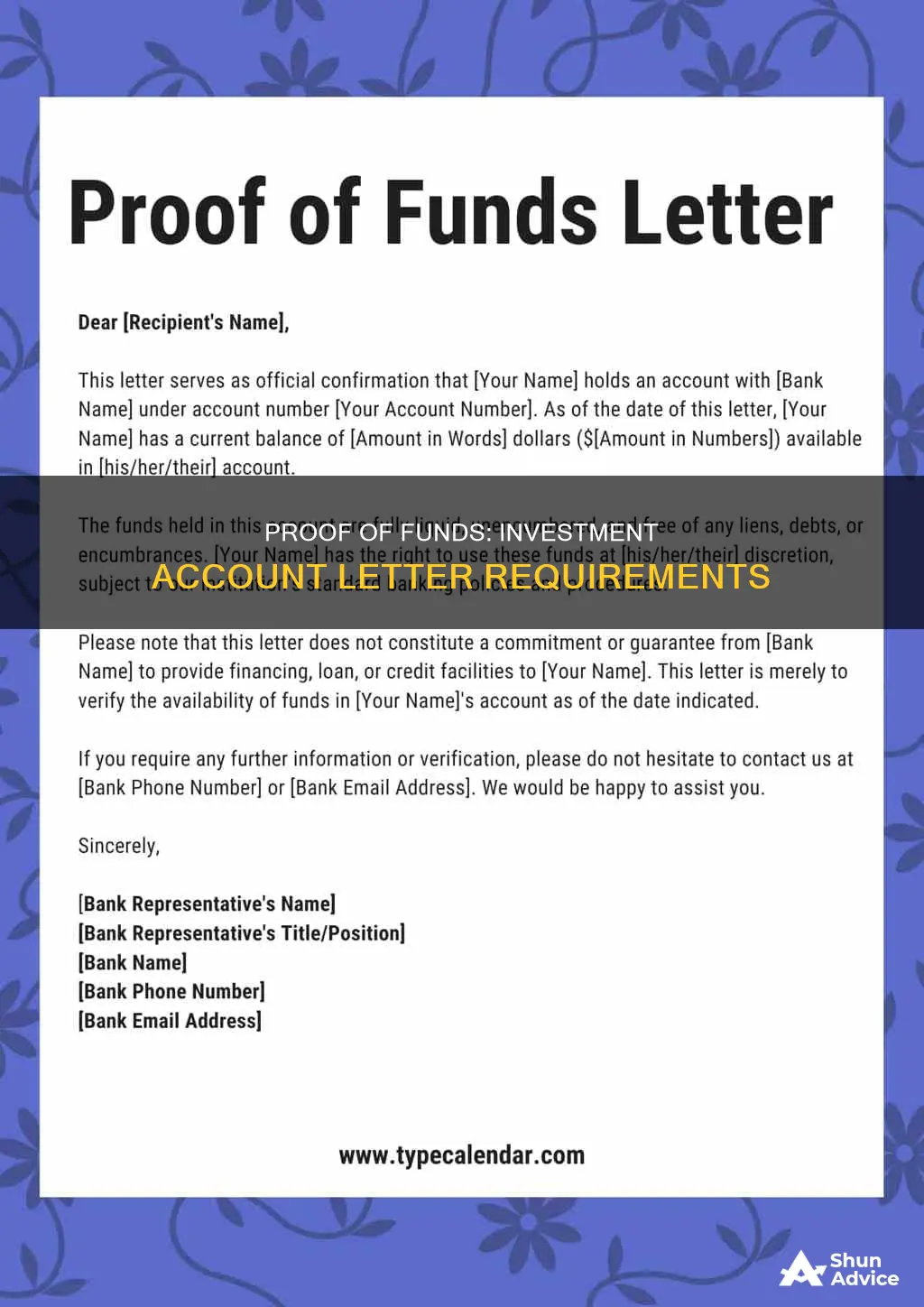

What to include in a proof of funds letter

A proof of funds letter is a formal document that demonstrates an individual's ability to cover a specific expenditure. When buying a home, this means proving that you have enough money to pay for the down payment and closing costs. Here is what you should include in a proof of funds letter:

- Bank's name and address: Include the name and address of the bank that is providing the proof of funds letter.

- Official bank statement: Provide an official bank statement that details the exact amount of available funds. This can be printed at a branch or obtained as an online statement.

- Money market account details: Include the details of any money market accounts and their balances.

- Balance of funds in checking and savings accounts: List the balance of funds in your checking and savings accounts.

- Total balance of funds: Include the total balance of all your accounts.

- Bank-certified financial statement: Provide a financial statement that has been certified by the bank.

- Signature of an authorized bank employee or notary: The letter should be signed by an authorized employee of the bank or a notary public.

- Verification of the date: Verify the date that the funds were in your account or the date of the letter.

Keep in mind that the funds must be liquid, meaning that they are easily accessible and can be withdrawn from savings or checking accounts. Investments such as stocks, bonds, mutual funds, and life insurance do not qualify as proof of funds.

A Guide to Investing in No-Load Mutual Funds

You may want to see also

How to get proof of funds from your bank

A proof of funds letter is a document that demonstrates an individual or entity's ability to pay for a specific transaction, usually a large one. It is often required for purchasing a home, applying for a loan, or investing in opportunities. This letter is typically addressed to the seller and includes the following:

- Bank's name and address

- Official bank statement

- Balance of funds in the checking and savings accounts

- Balance of total funds

- Signature of an authorized bank employee or notary

- Verification of the date the funds were in your account

- Consolidate your funds: If you have money in multiple accounts, consider consolidating them into a single checking or savings account. This simplifies the process and makes it easier for the seller to verify your funds. It also ensures that the total amount of your liquid assets is clearly presented.

- Submit a request to your bank: You can usually submit a request for a proof of funds letter in person at a branch or through an online form. The bank will likely ask for specific information, such as your account numbers and the purpose of the letter.

- Wait for the letter: It typically takes a few days to a week to receive the proof of funds letter from your bank.

- Provide the letter to the seller or requester: Once you receive the letter, provide copies to the seller or any other parties who require it, such as a lender. Keep your original copy in a safe and secure place.

It is important to note that the proof of funds must usually refer to liquid assets, primarily cash. Certain investments, such as retirement accounts, mutual funds, and life insurance, do not qualify as proof of funds. Additionally, protect your sensitive financial information and only provide the proof of funds letter to trusted individuals or entities.

Satori Fund: A Guide to Investing in This Unique Opportunity

You may want to see also

Why homebuyers need a proof of funds letter

A proof of funds letter is a document that demonstrates a homebuyer's ability to pay for a property. It is essential for homebuyers to provide this letter to show that they have enough liquid cash or assets to purchase a home. Here are some reasons why homebuyers need a proof of funds letter:

Prove the legitimacy of the offer

The proof of funds letter serves as evidence that the buyer has the financial capacity to purchase the property. It shows the seller that the buyer's offer is legitimate and can be considered. Without this letter, the seller may not even consider the buyer's offer.

Stand out in a competitive market

In a multiple-bid situation, a proof of funds letter can give a homebuyer an advantage over other potential buyers. It demonstrates that the buyer is prepared with the necessary funds, making their offer more attractive and competitive.

Protect the seller

The letter also protects the seller from accepting an offer from a buyer who may not have the financial means to complete the transaction. It provides assurance that the buyer can afford the down payment and closing costs, reducing the risk of the sale falling through due to insufficient funds.

Provide assurance in an all-cash offer

When a buyer is making an all-cash offer on a property, a proof of funds letter is crucial. It ensures that the seller can confidently accept the offer, knowing that the buyer has the financial means to complete the purchase without relying on a loan.

Comply with requirements

In certain situations, such as short sales, banks may have strict rules that require buyers to provide a proof of funds letter. This helps to protect the bank's interests and ensures that the buyer is financially capable of completing the transaction.

To obtain a proof of funds letter, homebuyers can request one from their bank or financial institution. This letter, along with a pre-approval letter, provides assurance to the seller and lender that the buyer is serious and capable of purchasing the property.

Smartly Investing 100K in Mutual Funds at 35

You may want to see also

When you might need a proof of funds letter

A proof of funds letter is a document that demonstrates how much money a person or entity has available. It is often required when purchasing a home, to prove to the seller that you can cover the purchase costs of a home.

Buying Property with Cash

If you are buying a home with cash, you will need to prove that you have the necessary funds to do so. A proof of funds letter will demonstrate that you have the cash available to cover the full cost of the property.

Obtaining a Mortgage

When applying for a mortgage, your lender may require a proof of funds letter to ensure that you have enough money to cover the remainder of the cost of the home. This includes costs such as the down payment, escrow, and closing costs.

Making a Cash Down Payment

If you are making a down payment in cash, you may be asked to provide a proof of funds letter to show that you have the funds available and that they are not a loan.

Multiple-Bid Situation

When making an offer on a home, providing a proof of funds letter can give you an advantage over other potential buyers. If you can show that you have the funds available for a down payment and closing costs, your offer may be more competitive and more likely to be considered by the seller.

It is important to note that a proof of funds letter is different from a preapproval letter. A preapproval letter states that a lender will provide you with a loan, while a proof of funds letter demonstrates that you have the funds available to cover the costs associated with the purchase.

Vanguard Funds: Best Investment Options for Your Portfolio

You may want to see also

Frequently asked questions

A proof of funds letter is a document that demonstrates an individual's ability to cover the cost of a high-value transaction, such as purchasing a home. It is often required by the seller to ensure that the buyer has the financial capacity to follow through with the purchase.

Only liquid assets qualify as proof of funds. This includes money in checking and savings accounts, money from investment or retirement accounts (provided they are liquidated), gift funds or grants, and money from a bridge loan or pending sale. Non-liquid assets, such as mutual funds, life insurance, shares, and bonds, do not qualify.

You can request a proof of funds letter from your bank. Some banks allow you to make the request online, while others may require you to visit a branch in person. Alternatively, your lender may be able to fill out a request form on your behalf.

A proof of funds letter should include the name and address of your bank, an official bank statement, the balance of funds in your checking and savings accounts, the total balance of funds, and the signature of an authorized bank employee. If you are consolidating funds from multiple accounts, you will need to provide this information for each account.

A proof of funds letter is typically required for large transactions or business situations. Common scenarios include real estate transactions, investment opportunities, loan applications, immigration applications, business transactions, contract bidding, private sales, business licensing, franchise opportunities, auction participation, and escrow transactions.