Rebuilding an investment portfolio can be challenging, especially after experiencing investment losses. However, it is important to remember that losses are a natural part of investing, and there are several strategies to get back on track. Here are some key steps to help you rebuild your investment portfolio:

1. Reassess your investment goals and risk tolerance: Before rebuilding your portfolio, take time to re-evaluate your investment goals and the amount of risk you are willing to take. This will guide you in determining the types of investments that align with your needs and preferences.

2. Diversify your portfolio: Diversification is crucial to rebuilding your investment portfolio. This involves investing in different asset classes, such as stocks, bonds, real estate, and commodities. By diversifying, you can spread your risk and reduce the impact of losses.

3. Consider dollar-cost averaging: Dollar-cost averaging is a strategy where you invest a fixed amount at regular intervals, regardless of market conditions. This approach allows you to rebuild your portfolio gradually and take advantage of market fluctuations.

4. Seek professional advice: Consult a qualified financial advisor if you are unsure about how to rebuild your portfolio. They can provide personalised guidance based on your goals, risk tolerance, and investment preferences.

5. Monitor and adjust your portfolio: Regularly review your portfolio's performance and make adjustments as needed. Stay informed about market trends and economic conditions to make informed decisions.

6. Understand the context of the crisis: When rebuilding your portfolio after a crisis, recognise that external shocks, like the COVID-19 pandemic, tend to give way to more rapid economic recoveries compared to crises originating within the financial system.

7. Stick to your long-term savings plan: Stay invested, rebalance your portfolio, and continue investing regularly. Avoid the temptation to time the market, as it can be counter-productive and expensive.

8. Take a holistic approach: Consider your portfolio as a whole, rather than focusing on individual investments. Evaluate different investment options and broaden your investment universe if necessary.

9. Be brave and forward-thinking: Look for pockets of relative strength and identify trends that will shape investment markets in the future, such as responsible investing and the adoption of new technologies.

| Characteristics | Values |

|---|---|

| Time horizon | Short-term, medium-term, long-term |

| Risk tolerance | Aggressive, conservative |

| Investment types | Stocks, bonds, real estate, cash, commodities, ETFs, mutual funds, alternative investments |

| Diversification | Spread investments across asset classes, sectors, and geographic regions |

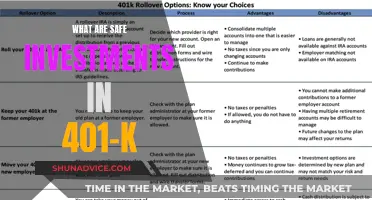

| Tax exposure | Taxable brokerage accounts, tax-advantaged retirement accounts (401(k), IRA) |

What You'll Learn

Reassess your investment goals and risk tolerance

Before rebuilding your investment portfolio, it is crucial to reassess your investment goals and risk tolerance. This involves evaluating what you aim to achieve with your investments and determining how much risk you are willing to take. Understanding your risk tolerance will help you choose investments that align with your comfort level and financial objectives. Here are some essential considerations to guide you through this process:

Evaluate Your Financial Goals

The first step is to clearly understand your short-term and long-term financial goals. Are you investing for retirement, saving for a down payment on a house, or planning for your child's education? Each goal will have a different time horizon, which is the length of time before you need to access your invested funds. For example, a long-term goal would be saving for retirement, while a short-term goal could be saving for a new car within the next year. Your goals and their respective timelines will guide your investment choices and help you decide how much risk you can take.

Assess Your Financial Situation

Consider your current financial situation, including your income, expenses, savings, and existing investments. If you have a stable income, substantial savings, and minimal debt, you may have a higher risk tolerance. In contrast, those with limited savings and high levels of debt may have a lower risk tolerance. Understanding your financial stability will help you determine the level of risk you can comfortably take on.

Understand Your Emotional Response to Risk

It is essential to be honest about how you react to market fluctuations and the possibility of losing money. Are you comfortable with market volatility, or does it cause you anxiety and sleepless nights? Your emotional response to risk is crucial because it can influence your decision-making during volatile market conditions. If you have a low risk tolerance but invest in high-risk assets, you may find yourself making impulsive decisions out of panic during a market downturn. On the other hand, if you have a high risk tolerance but invest too conservatively, you may miss out on potential growth opportunities.

Utilize Risk Tolerance Questionnaires

To gain a more objective understanding of your risk tolerance, consider completing a risk tolerance questionnaire. These questionnaires assess your attitudes towards risk, your financial situation, and your emotional response to market movements. They typically assign a numerical score or risk profile, indicating your risk tolerance level. While these questionnaires can provide a useful starting point, keep in mind that the results may be biased towards the financial products or services offered by the sponsoring company or individual.

Seek Professional Advice

If you are unsure about your risk tolerance or how to reassess your investment goals, consider consulting a financial advisor. They can provide valuable insights, help you evaluate your risk capacity, and guide you in developing a personalized investment strategy that aligns with your goals and risk tolerance. A financial advisor can also assist in navigating the complexities of the financial markets and specific investment choices.

By taking the time to reassess your investment goals and risk tolerance, you will be able to rebuild your investment portfolio with a clearer understanding of your comfort level, financial objectives, and the types of investments that are most suitable for your unique circumstances.

Savings and Investments: Two Sides of the Same Coin

You may want to see also

Diversify your portfolio

Diversifying your investment portfolio is a key strategy for managing risks and optimising returns. Diversification involves spreading your investments across different asset classes, industries, and geographic regions. This helps to reduce the impact of any single investment or sector performing poorly. Here are some ways to diversify your portfolio:

Asset Allocation

Allocate your investments across different asset classes, such as stocks, bonds, cash, and alternative investments like commodities or cryptocurrencies. Each asset class behaves differently, mitigating the impact of market volatility on your portfolio. For example, during a stock market downturn, bonds or real estate investments may provide stability and generate income.

Industry Diversification

Within each asset class, it is important to diversify across different industries. For instance, if you invest solely in the technology sector and there is a significant downturn, your entire portfolio would be at risk. By You may want to see also Dollar-cost averaging is an investment strategy that can help you rebuild your investment portfolio over time. It involves investing a fixed amount of money in a target security at regular intervals, regardless of market conditions. This strategy can be particularly useful if you are looking to rebuild your portfolio after experiencing investment losses. Here are some key considerations and benefits of dollar-cost averaging: Consistency and Discipline Dollar-cost averaging helps investors remain disciplined and consistent with their investments. By committing to a regular investment schedule, you remove the emotion and stress of trying to time the market. This strategy eliminates the need to worry about buying at the best prices and ensures you are already in the market when prices drop or rise. Lower Average Costs By investing a fixed amount at regular intervals, you will buy more shares when prices are low and fewer shares when prices are high. This approach can lower your average cost per share over time. In other words, you take advantage of market fluctuations and buy more when prices are low. Reduced Risk Dollar-cost averaging reduces the risk of investing a large sum of money at a poorly timed market peak. It also helps mitigate the impact of volatility on your portfolio. Additionally, this strategy may be less risky for less-informed investors when used to buy index funds rather than individual stocks. Long-Term Focus Dollar-cost averaging aligns with a long-term investment mindset. It reinforces the practice of investing regularly to build wealth over time. This strategy is particularly effective for investors who are committed to investing for the long term but don't have the time or inclination to closely monitor market movements. Automatic Investing Dollar-cost averaging can be set up to be automatic, taking the effort and decision-making out of your hands. This is especially useful for investors who don't want to be burdened with the research and stress of market timing. Suitability Dollar-cost averaging is suitable for beginning investors who may not have a large sum of money to invest at once. It also appeals to those who prefer a more hands-off approach, allowing them to invest regularly without worrying about market timing. However, it is important to note that this strategy may result in higher transaction costs compared to investing a lump sum once. Additionally, dollar-cost averaging assumes that prices will ultimately rise over time, so it may not be appropriate if you anticipate a persistent downward trend in the market. You may want to see also Seeking professional advice is a great way to rebuild your investment portfolio. Here are some steps to help you get started: Understand the Different Types of Investment Professionals: There are various types of investment professionals, including registered financial professionals, investment advisors, financial planners, insurance agents, accountants, and lawyers. Each has their own area of expertise and can offer different services. For example, registered financial professionals typically buy and sell securities for their customers, while investment advisors provide advice on securities. Understanding the different types of professionals can help you choose the right one for your needs. Do Your Research: Before selecting an investment professional, it's important to do your research. Check their qualifications, credentials, and disciplinary history. Use resources like FINRA's BrokerCheck to review their work history and firm information. Also, consider their investment philosophy, investment products offered, and fee structure. Ask for referrals from family and friends, but always do your own independent review as well. Articulate Your Financial Goals and Objectives: Be clear about what you want to accomplish financially and the time frame within which you hope to achieve it. Discuss your investing experience and your risk tolerance with the professional. This will help them understand your needs and make suitable recommendations. Ask Key Questions: Don't be afraid to ask questions. Inquire about their experience, qualifications, disciplinary actions, and investment strategies. Ask about their investment philosophy, the types of products and services they offer, and any potential limitations. Understanding their approach and whether it aligns with your goals is crucial. Be Wary of High-Pressure Sales Tactics: A good investment professional will not pressure you to invest quickly or make impulsive decisions. Be cautious of unsolicited communications, exaggerated claims, and offers that seem too good to be true. Take your time to consider the information and do your own research before making any commitments. Understand the Fees: Discuss the fees associated with the services provided. Ask how they get paid—through commissions, percentage of assets managed, flat fees, or other methods. Understanding the fee structure will help you evaluate the potential costs and assess the professional's independence in making recommendations. Maintain Regular Communication: Once you've selected an investment professional, stay in touch and keep them updated on any significant changes in your financial situation. This could include changes in income, time horizon, risk tolerance, or other factors that may impact your investment goals. Regular communication can help ensure your investment strategy remains aligned with your evolving needs. Do Your Homework: Even after selecting an investment professional, continue to educate yourself. If they recommend an investment, request prospectuses, regulatory filings, or research information. Understand the potential risks and rewards of the investment and discuss them with the professional. Stay informed about market trends and consider seeking advice from multiple sources to make well-informed decisions. Monitor Your Investment Portfolio: Keep a close eye on your investment portfolio's performance. Regularly review your monthly account statements, confirmations, and other relevant information. If you notice any unauthorized transactions or items you don't understand, contact your investment professional immediately. Stay proactive and don't hesitate to reach out with questions or concerns. Rebalance Your Portfolio as Needed: Over time, your investment portfolio may drift from your original asset allocation. Work with your investment professional to rebalance your portfolio and ensure it remains aligned with your risk tolerance and financial goals. This may involve buying or selling assets to restore the desired allocation. Seek Ongoing Advice: Building an investment portfolio is an ongoing process. As your financial situation evolves, continue to seek advice from your investment professional. They can help you navigate market fluctuations, adjust your investment strategy, and make informed decisions to stay on track toward your financial goals. Remember, seeking professional advice is a valuable step in rebuilding your investment portfolio. It can provide you with guidance, expertise, and peace of mind. Always do your due diligence when selecting an investment professional and remember that you are ultimately responsible for your financial decisions. You may want to see also Celebrating your successes is an important part of the process of rebuilding your investment portfolio. Here are some reasons why you should celebrate your successes: Remember, celebrating your successes is about acknowledging your hard work, resilience, and progress. It's an important part of the journey towards rebuilding your investment portfolio and achieving your financial goals. You may want to see also An investment portfolio is a collection of assets you buy or deposit money into with the aim of generating income or capital appreciation. Assets can include stocks, bonds, real estate, cash on deposit, and more. First, shake off any negative feelings about the stock market and understand that it is a long-term game. Next, review your current stocks and only continue to hold those that you believe have long-term potential. Finally, rebuild your portfolio with a positive outlook on the future of the stock market and individual issues. Here are some tips to help you optimise your investment portfolio: - Diversify your portfolio by investing in a variety of different asset classes, such as stocks, bonds, and real estate. - Reassess your investment goals and risk tolerance to ensure your portfolio is aligned with your needs and preferences. - Consider dollar-cost averaging, which involves investing a fixed amount at regular intervals, regardless of market conditions. - Monitor and adjust your portfolio regularly to ensure it stays aligned with your financial goals and risk tolerance.Saving and Investing: Strategies for Future Financial Goals

Consider dollar-cost averaging

Maximizing Savings: Strategies to Double Your Money

Seek professional advice

Maximizing Your Savings: Safe Investment Strategies for Beginners

Celebrate your successes

Adjusting Your Acorns Investment Portfolio: A Quick Guide

Frequently asked questions