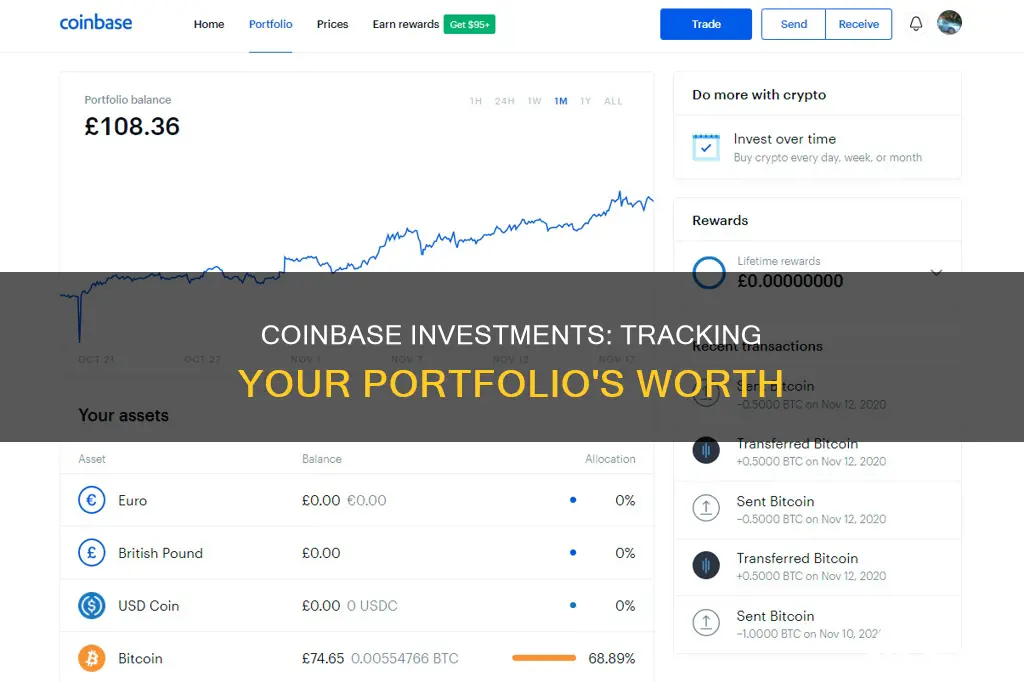

Coinbase users have expressed frustration over the platform's lack of a clear profit/loss indicator, making it challenging to track investment performance and returns. This has led to calls for a simple way to view how much one has invested in a specific cryptocurrency and the corresponding gains or losses. While Coinbase does provide transaction history and tax reports, it does not offer an intuitive way to calculate overall investment amounts and returns. Users have resorted to manual workarounds or third-party apps to address this issue, highlighting a significant gap in Coinbase's features compared to traditional stock brokerage platforms.

| Characteristics | Values |

|---|---|

| View all transactions | From the home screen, tap "My Assets" or "Total Balance". From the "My Assets" page, select the "Activity" tab. |

| View transactions by asset | From the home screen, tap "My Assets", then select the asset you’d like to view transactions for. From the asset detail page, select "Primary Balance". Scroll down to "History". |

| Download transaction report | Sign in to your Coinbase account and select "My Assets". Select the asset you’d like to view transactions for. From the asset detail page, select "Primary Balance". Scroll down to "Transactions". |

What You'll Learn

View all transactions from the home screen

To view all transactions from the home screen of your Coinbase account, start by tapping "My Assets" or "Total Balance". From the My Assets page, select the "Activity" tab. You will then see a list of transactions, starting with the most recent. To view the details of a specific transaction, simply select it. This will allow you to view all transactions from the home screen of your Coinbase account.

If you wish to view transactions by a specific asset, the process is slightly different. From the home screen, tap "My Assets", then select the asset for which you would like to view transactions. From the asset detail page, select "Primary Balance" and scroll down to "History". Here, you will be able to view all transactions related to that specific asset.

Additionally, you can download a transaction report to view your transaction history. To do so, select the menu from the home screen, scroll down to "Manage Account", and select "Taxes". From the "Documents" tab, scroll down to "Tax Reports" and choose "Custom Reports". Finally, from the drop-down menu, select "Raw Transaction Activity Report". This will allow you to download a comprehensive transaction report.

By following these steps, you can easily view all transactions or transactions related to a specific asset from the home screen of your Coinbase account.

Bitcoin Mining in India: A Guide to Getting Started

You may want to see also

View transactions by asset

To view your transactions by asset on Coinbase, you can follow these steps:

- From the home screen, tap "My Assets" or "Total Balance".

- From the "My Assets" page, select the asset you want to view transactions for.

- From the asset detail page, select "Primary Balance".

- Scroll down to "History" to view your transaction history for that specific asset.

Alternatively, you can also download a transaction report for a more detailed view of your transactions by asset:

- Sign in to your Coinbase account and select "My Assets".

- Choose the asset for which you want to view transactions.

- On the asset detail page, select "Primary Balance".

- Scroll down to "Transactions".

- Go to the "Statements" page by selecting the "Manage Account" option from your profile icon.

- On the "Statements" page, select the "Transactions" tab.

- Here, you can download predefined reports or generate custom statements with specific parameters.

It is important to note that Coinbase estimates your gains and losses based on assumptions when there is insufficient data. These estimates are provided for informational purposes and should not be considered tax advice. For tax-related queries, it is recommended to consult a tax professional.

Bitcoin: Exploring Alternative Investment Opportunities

You may want to see also

Download a transaction report

To download a transaction report on Coinbase, follow these steps:

- Sign in to your Coinbase account.

- From the home screen, select the menu and scroll down to "Manage account".

- From the options presented, select "Taxes".

- On the "Documents" tab, scroll down to "Tax reports" and select "Custom reports".

- From the drop-down menu, choose the "Raw transaction activity report".

- You can also access the "Statements" page directly by selecting the "Manage account" option from your profile icon.

- On the "Statements" page, select the "Transactions" tab.

- Here, you can download predefined reports or create a custom statement by selecting specific parameters.

You can also download a CSV file of your transaction history, which will include details such as the date and time of transactions, the fiat value of charges, the cryptocurrency used for fees, and the address from which your customer sent funds.

If you are looking for transaction history from Coinbase Pro, you can follow these steps:

- Sign in to your Coinbase account.

- Access your profile by selecting your avatar in the top right corner of the dashboard and choosing "Manage your profile" from the drop-down menu.

- From the side rail, select "Statements".

- Within the "Statements" section, navigate to "Coinbase Pro" in the top bar to access transactions made on Coinbase Pro.

- Generate a custom report by selecting the report type, portfolio, account type, and date range.

- Choose your preferred file format, such as PDF or CSV.

- Download the statement to obtain your transaction history.

Best Bitcoin Investment Sites: Where to Invest?

You may want to see also

See estimated gains and losses

Coinbase allows you to see your investment performance, including how much cash you've invested, a detailed breakdown of how your investment value was calculated, and your (assumed) returns. This data is available on the “Home” tab, where you can view your overall performance, and on the “Assets” tab, where you can see the performance of specific assets.

To view your investment performance, go to the "Home" tab and select "My Balance." A pop-up window will appear with your investment performance details. If you're selecting "My Balance" from the home page, you'll need to select it twice for the performance data to appear.

Coinbase calculates your investment performance based on your full account history. This includes the total current cash value of your holdings, the total cash value of what you've put into Coinbase (including fees), cash purchases and deposits, the value of all assets received from outside Coinbase (calculated by the market value when received), cash withdrawals and spends, and the value of all assets sent outside Coinbase (calculated by the fair market value when sent).

It's important to note that Coinbase doesn't provide tax advice. The information provided by Coinbase regarding estimated gains and losses is based on their experience reading IRS guidance and may not be applicable to your specific situation. For tax-related queries, please consult a tax professional.

Coinbase may not have all the data required to provide an accurate picture of your tax liability. This may occur if you have sent or received cryptocurrency using a wallet or exchange other than Coinbase. In such cases, Coinbase will estimate your gains and losses based on the available information.

To calculate your gains or losses, Coinbase takes the proceeds (what you received for your cryptocurrency when you sold it) and subtracts your cost basis (what you paid for it). This results in either a capital gain or a capital loss, which you can find on your Gain/Loss report.

If you have received cryptocurrency from an external address, Coinbase won't have information about your cost basis or the date you acquired the crypto. This information is crucial for determining whether your gain or loss was short-term or long-term, as they are taxed at different rates. In this case, Coinbase estimates your gains and losses using an assumed cost basis of $0 (or $1 per unit for stablecoins) and the date you received the crypto in your Coinbase account as the acquisition date.

Similarly, when you send cryptocurrency to an external address, Coinbase doesn't know who you sent it to or why (as a gift or in exchange for goods or services). Without this information, Coinbase assumes a transfer from yourself to yourself, which doesn't incur gains or losses since you still own the cryptocurrency.

To get a more complete picture of your gains or losses, you can answer a few simple questions about these transactions directly on Coinbase. Alternatively, you can use third-party tools, such as CoinTracker or Crypto Tax Calculator, to link your accounts and automatically merge your data.

The Bitcoin Bet: Family's Fortune Tied to Crypto

You may want to see also

View transaction history

To view your transaction history on Coinbase, you can either view it in your account or download a transaction report.

To view all transactions, start by tapping "My Assets" or "Total Balance" from the home screen. From the "My Assets" page, select the "Activity" tab. You will see a list of transactions with the most recent ones at the top. To view the details of a specific transaction, select it.

To view transactions by a specific asset, tap "My Assets" from the home screen, then select the asset. From the asset detail page, select "Primary Balance" and scroll down to "History".

To download a transaction report, select the menu from the home screen and scroll down to "Manage Account". From there, select "Taxes" and, from the "Documents" tab, scroll down to "Tax Reports" and select "Custom Reports". From the drop-down menu, select "Raw Transaction Activity Report".

Alternatively, you can sign in to your Coinbase account and select "My Assets". Then, choose the asset you want to view transactions for. From the asset detail page, select "Primary Balance" and scroll down to "Transactions".

You can also view your open and filled orders on Coinbase Pro. To do this, sign in to Coinbase Pro and click the "Orders" tab.

If you want to sync your Coinbase transaction history with another platform, you can connect your Coinbase account to a platform like Gilded.

A Beginner's Guide: Investing Bitcoin in the UAE

You may want to see also

Frequently asked questions

You can view your transaction history by tapping "My Assets" or "Total Balance" from the home screen. From the "My Assets" page, select the "Activity" tab to see a list of transactions, starting with the most recent.

From the home screen, tap "My Assets", then select the asset you want to view transactions for. From the asset detail page, select "Primary Balance" and scroll down to "History".

Sign in to your Coinbase account and select the "Statements" page from your profile icon. You can also access the "Statements" page directly. Select the "Transactions" tab, from which you can download various predefined reports or select your own parameters in the "Generate custom statement" field.