A company's balance sheet is a financial statement that provides a snapshot of its finances at a specific point in time. It is divided into three sections: assets, liabilities, and shareholder equity. The shareholder equity section of a balance sheet includes the amount of money initially invested in the company, plus any retained earnings, and it represents a source of funding for the business. Equity investments are recorded as assets on the balance sheet and can be listed as either short-term or long-term investments. The two main methods for recording the value and income from these investments are the equity method and the cost method. The equity method is used when the investor company holds more than 20% but less than 50% of another company's stock, while the cost method is used when the investor company holds less than 20% and does not have significant influence over the investee company.

| Characteristics | Values |

|---|---|

| Balance Sheet Equation | Assets = Liabilities + Shareholders' Equity |

| Assets | Cash in the bank, inventory, accounts receivable, and investments |

| Liabilities | Loans, unpaid wages, taxes, and interest owed |

| Shareholders' Equity | Value of the company left if all debts are paid off |

| Long-Term Investments | Listed separately from short-term investments |

| Short-Term Investments | Investments to be sold within a year, listed as current assets |

| Quoted Investments | Listed as current assets if to be sold within a year, otherwise listed as long-term investments |

| Valuing Stocks | Report stocks at the current fair-market value, not the purchase price |

| Unrealized Gain/Loss | Change in value of investments is reported in the owner's equity section |

| Small Ownership Stake | Report the value of the investment using the cost method |

| Significant Influence | If ownership stake is ≥20%, use the equity method to calculate the value of the investment |

| Equity Method | Applicable only to equity investments, not derivative instruments or investments held by non-business entities |

| Cost Method | Used when the investor owns <20% of the entity and cannot demonstrate influence over it |

| Equity Investments | Recorded as a single amount in the asset section of the balance sheet |

What You'll Learn

- Equity investments are recorded as assets on the balance sheet

- The equity method is used when the investor company holds more than 20% but less than 50% of another company's stock

- The cost method is used when the investor makes a passive, long-term investment

- Investments are listed as assets but are separated into short-term and long-term investments

- Equity investments can include stocks, bonds, real estate and part-ownership of other businesses

Equity investments are recorded as assets on the balance sheet

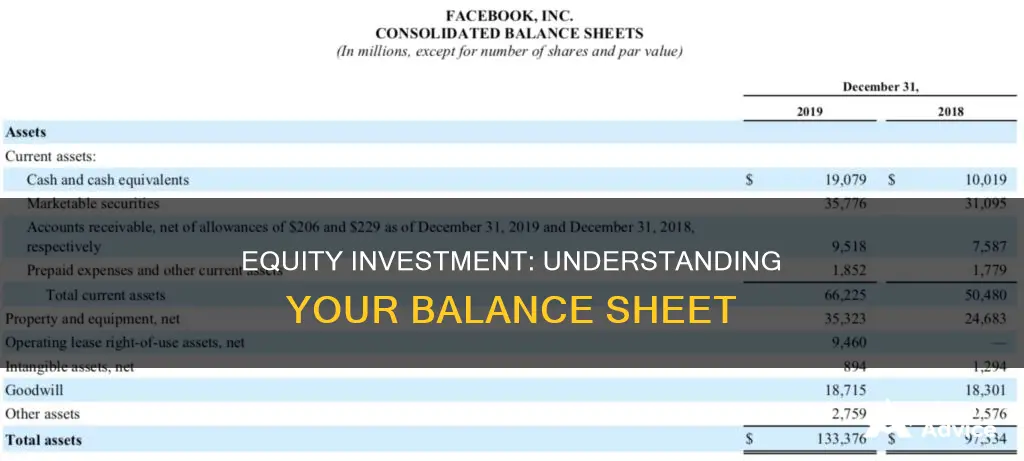

The balance sheet is an equation, with the company's total assets on one side and the company's liabilities plus the owner's equity on the other. The equation must balance out, with assets equalling liabilities plus owner's equity.

Equity investments are listed as assets on the balance sheet, but they are not all grouped together. Long-term investments are listed separately from short-term investments. Short-term investments are those that a company plans to sell within a year.

The value of equity investments is determined by their current fair-market value, rather than the amount the company paid for them. This is the case for publicly traded investments, such as stocks. For privately held companies, the value is determined using the cost method, which means they are valued at the cost of acquisition.

There are two methods for recording the value and income from long-term equity investments on a balance sheet: equity or cost. The equity method is used when the investor company holds more than 20% but less than 50% of another company's stock. In this case, the investor has significant power, influence, and control over the investee's operations. The initial investment is recorded at cost, and that value is then adjusted periodically to reflect fluctuations in the investment's income and losses.

The cost method is used when an investor makes a passive, long-term investment and does not have any influence over the investee's operations. This usually applies when the investor owns less than 20% of the company. Under the cost method, the investment is recorded at the cost of acquisition, and income from dividends is recognised when distributed and received.

Integrity Metrics: Management's Investment Guide

You may want to see also

The equity method is used when the investor company holds more than 20% but less than 50% of another company's stock

The equity method is an accounting technique used to record the profits earned by an investor company through its investment in another company. This method is used when the investor holds significant influence over the company it is investing in, usually by owning more than 20% of the company's stock.

When using the equity method, the initial investment is recorded at cost. Afterward, that value is adjusted periodically to reflect fluctuations in the investment's income and losses. When the company being invested in, known as the "investee", reports a certain income, the value of the investor's investment increases proportionally to the percentage of ownership. For example, if the investor company owns 35% of the investee, and the investee reports an income of $1.5 million, the investor's share of this profit would be $525,000. This profit is recorded on the investor's income statement, and the value of the investment is increased accordingly.

If the investee pays a dividend, the investor receiving the dividend will record the cash amount but will also record a decrease in the value of the investment on its balance sheet. Under the equity method, dividends are treated as a return on investment rather than as income.

The equity method acknowledges the substantive economic relationship between the investor and the investee. The investor records their share of the investee's earnings as revenue from investment on the income statement. This is because the investor company, by holding a significant percentage of the investee's stock, has the ability to impact the value of the investee company, which in turn benefits the investor. As a result, the change in value of that investment must be reported on the investor's income statement.

The equity method is generally used when the investor company holds between 20% to 50% of the investee's stock. If the investor company owns more than 50%, it is considered to have full control, and a different accounting method, known as the consolidation method, is used. On the other hand, if the investor company owns less than 20%, it is considered a passive minority interest, and the cost method is typically used for recording the investment.

Understanding Investments and Owners Equity: What's the Difference?

You may want to see also

The cost method is used when the investor makes a passive, long-term investment

When a company makes a passive, long-term investment in another company, it uses the cost method to record the investment on its balance sheet. This method is used when the investor does not have a significant amount of control or influence over the company they are investing in. Typically, this means that the investor owns less than 20% of the company's stock, although the level of influence is considered more important than the percentage of ownership.

Under the cost method, the stock purchased is recorded on the balance sheet as a non-current asset at the historical purchase price. This value is not modified unless shares are sold or additional shares are purchased. For example, if a company buys a 5% stake in another company for $1 million, the investment is recorded on the balance sheet at $1 million, regardless of the current share price. Any dividends received are recorded as income and can be taxed accordingly.

The cost method is a straightforward way to account for passive, long-term investments. It is important to note that the financial statements of the investor may not reflect significant changes in the operations or conditions of the company they have invested in when using this method. This is a disadvantage of the cost method compared to other methods, such as the equity method.

The cost method is commonly used for short-term stock investments and long-term investments of less than 20%. It is important to distinguish between short-term and long-term investments, as well as the level of influence the investor has over the company they are investing in, when deciding which accounting method to use.

Strategies for Investment Managers to Outperform Benchmarks

You may want to see also

Investments are listed as assets but are separated into short-term and long-term investments

Investments are listed as assets on a balance sheet, but they are separated into short-term and long-term investments. Short-term investments are those that a company plans to sell within a year, and these are listed as current assets on the balance sheet. Long-term investments are listed separately.

Short-term investments include cash, cash equivalents, accounts receivable, and inventory. Cash equivalents are very safe assets that can be readily converted into cash, such as U.S. Treasuries. Accounts receivables (AR) are the short-term obligations owed to the company by its clients. Inventory includes the company's raw materials, work-in-progress goods, and finished goods.

Long-term investments are assets that are not turned into cash easily, are expected to be turned into cash within a year, and/or have a lifespan of more than a year. They can refer to tangible assets, such as machinery, computers, buildings, and land, or intangible assets, such as goodwill, patents, or copyrights.

The equity method of accounting is used when an organisation holds a partial ownership investment in another entity and is able to influence its operating or financial decisions. This method is used when the investor company holds more than 20% but less than 50% of another company's stock. The initial investment is recorded at cost, and that value gets adjusted periodically to reflect fluctuations in the investment's income and losses.

The cost method is used when an investor makes a passive, long-term investment and does not have any influence over the investee's operations. The percentage of these investments is usually less than 20%. Under the cost method, the investment is recorded at the cost of acquisition, and income from dividends is recognised when distributed and received.

Both the equity and cost methods are accounting principles that allow the recording of the value and income from minority long-term investments on a balance sheet.

Savings and Investments: Two Sides of the Same Coin

You may want to see also

Equity investments can include stocks, bonds, real estate and part-ownership of other businesses

Equity investments are a way for companies to diversify or expand their business and earn a return. They can include stocks, bonds, real estate, and part-ownership of other businesses. When a company has excess cash, it may choose to invest outside of its own operations. This could mean purchasing a minority stake in another company, acquiring another operation entirely, or investing in debt securities.

There are two methods for recording the value and income from these long-term investments on a balance sheet: equity or cost. The equity method is used when the investor company holds more than 20% but less than 50% of another company's stock and has significant power, influence, and control over the investee's operations. In this case, the initial investment is recorded at cost, and that value is adjusted periodically to reflect fluctuations in the investment's income and losses. Dividends are not treated as income but as a return on investment.

The cost method, on the other hand, is used when an investor makes a passive, long-term investment of less than 20% and does not have any influence over the investee's operations. Here, the investment is recorded at the cost of acquisition, and income from dividends is recognized when distributed and received.

For example, if a company invests $3 million in another company, representing a 35% stake and a seat on the board of directors, the investment is recorded on the books at the acquisition cost of $3 million. If the investee company reports an income of $1.5 million, the investor's share of this profit would be $525,000 (35% x $1.5 million). The investor then reports the $525,000 profit on its income statement and increases the investment value to $3,525,000.

It is important to note that, according to ASC 323-10-45-1, an investment in common stock accounted for under the equity method should be shown as a single amount on the investor's balance sheet. Multiple equity method investments can be aggregated for the purposes of presentation on the balance sheet. Additionally, a reporting entity may combine an investment in common stock with advances or investments in senior or other securities of an investee in a single amount. However, disclosure of the types of investments is generally required.

Managing Personal Investments: Strategies for Success

You may want to see also

Frequently asked questions

Equity investments are listed as assets on a balance sheet. Long-term investments are listed separately from short-term investments. Short-term investments are those you plan to sell within a year. The value of the investment is based on the current fair-market value, not the purchase price.

The value of an equity investment is calculated by subtracting total liabilities from total assets. This figure represents the amount of money that would be returned to shareholders if all assets were liquidated and debts paid off.

The equity method is used when the investor company holds more than 20% but less than 50% of another company's stock. In this case, the investment is recorded at cost and then adjusted to reflect fluctuations in income and losses.

The cost method is used when an investor owns less than 20% of another company and does not have influence over its operations. The investment is recorded at the cost of acquisition and income from dividends is recognised when distributed and received.