A balance sheet is an equation that shows a company's assets, liabilities, and owners' equity. Investments are listed as assets, but they are separated into long-term and short-term investments. Long-term investments are those that will be kept for more than a year, while short-term investments are those that will be sold within a year. The value of the investments is based on the current fair-market value rather than the purchase price. If the investments have changed in value since they were bought, the change is reported as an unrealized gain or loss in the owner's equity section. If a company owns more than 20% of another company, the equity method must be used to calculate the value of the investment. This takes into account factors such as dividend income.

| Characteristics | Values |

|---|---|

| What it shows | Investments are listed as assets |

| Investments split by | Long-term and short-term |

| Investments to be sold within a year | Current assets |

| Long-term investments | Separate account |

| Balance sheet equation | Assets = Liabilities + Owners' Equity |

| Investments included in assets | Stocks, bonds, real estate, part ownership of other businesses |

| Investments held for more than a year | Long-term |

| Investments held for less than a year | Short-term |

| Investments with no set holding period | Current assets |

| Quoted investments | Listed at current value |

| Unrealised gains/losses | Reported in owners' equity section |

| Small ownership stakes | Reported using the cost method |

| Ownership stakes of 20% or more | Reported using the equity method |

What You'll Learn

Classifying mutual funds as current or non-current assets

When classifying mutual funds as current or non-current assets on a balance sheet, several factors need to be considered. The classification of these investments can impact the perception of a company's financial health and liquidity, so it's essential to apply the appropriate accounting treatment. Here are the key factors and guidelines to consider when classifying mutual funds:

Firstly, the most common approach is to classify mutual funds based on their maturity or redemption period. If the mutual fund investment has a maturity period of one year or less from the balance sheet date (typically the reporting date or the end of the fiscal year), it is classified as a current asset. This classification reflects the short-term nature of the investment and indicates that the funds are readily convertible into cash within the next operating cycle.

On the other hand, if the mutual fund investment has a maturity period exceeding one year from the balance sheet date, it is classified as a non-current asset. This classification suggests that the funds are intended for longer-term investment purposes and are not expected to be liquidated in the short term.

Secondly, the nature of the mutual fund itself should be considered. Mutual funds can vary significantly in terms of their investment objectives, strategies, and underlying assets. Some funds may primarily invest in short-term money market instruments, while others focus on long-term growth through equity or bond investments. The classification of mutual funds should align with the overall nature of the fund, considering factors such as liquidity, stability, and expected holding period.

Thirdly, the intent and restrictions surrounding the mutual fund investment should be evaluated. If the funds are restricted or designated for a specific purpose, such as a long-term investment goal or a sinking fund, they are more likely to be classified as non-current assets. This classification reflects the fact that these funds are not readily available for general use or to meet short-term obligations. Conversely, if the mutual fund investment is unrestricted and can be easily liquidated to meet current liabilities or operational needs, it is more appropriate to classify it as a current asset.

Additionally, when classifying mutual funds, consistency and disclosure are crucial. Strive to maintain consistent classification practices across reporting periods. Any changes in classification should be appropriately disclosed and justified in the financial statements. Adequate disclosures ensure transparency and provide users of the financial statements with a clear understanding of the company's investment strategies and liquidity position.

Lastly, refer to the applicable accounting standards and regulations in your region. GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards) may provide additional guidelines or industry-specific treatments for mutual fund classification. These standards offer guidance on areas such as fair value measurements, impairment, and presentation, ensuring compliance with the relevant framework.

Best Vanguard Funds for College Students to Invest In

You may want to see also

Accounting for fluctuations in fund value

Fluctuations in the value of a mutual fund can be due to various factors, including changes in the value of the underlying securities, interest rates, and market conditions. Here are some key considerations for accounting for fluctuations in fund value:

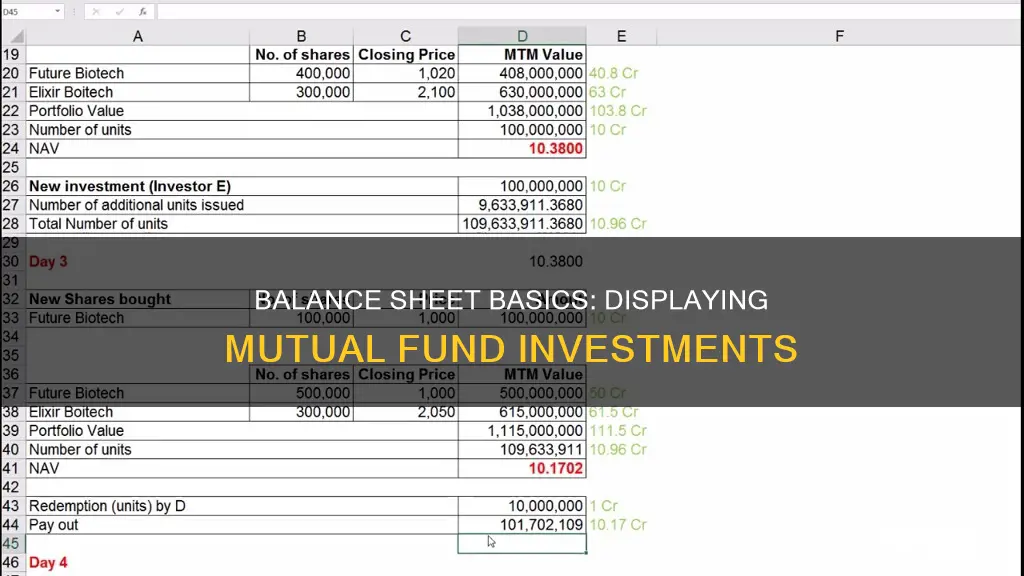

Understanding Net Asset Value (NAV)

NAV is a critical concept in determining the value of a mutual fund. It is derived by dividing the total value of the securities in the portfolio by the number of shares outstanding. Mutual fund share prices are typically bought or redeemed at the fund's NAV, which is settled at the end of each trading day. Changes in the NAV will impact the price of the mutual fund.

Tracking Fund Performance

It is essential to regularly monitor the performance of the mutual fund by reviewing its fact sheet, which provides key information such as the fund's investment objective, fund manager, latest assets under management (AUM), and total expense ratio (TER). The fact sheet also discloses the fund's performance against its benchmark, including metrics such as compound annual growth rate (CAGR), beta, standard deviation, and Sharpe ratio.

Impact of Fees and Expenses

Mutual funds charge various fees and expenses that can impact their overall returns. These include annual fees, expense ratios, sales charges or loads, redemption fees, and other account fees. It is crucial to consider these costs when evaluating the performance of a mutual fund, as they can reduce the fund's overall returns.

Capital Gains and Dividends

Mutual funds can generate returns through capital gains distributions and dividends. If the fund sells securities at a profit, it realises a capital gain, which is often passed on to investors. Additionally, mutual funds distribute dividends on stocks and interest on bonds held in their portfolio. These distributions can impact the fund's value and should be accounted for when assessing fluctuations.

Risk Assessment and Management

Mutual funds carry various investment risks, including market risk, interest rate risk, and management risk. Market risk arises from potential declines in the value of securities, while interest rate risk affects funds holding bonds and other fixed-income securities. Management risk is linked to the performance of the fund's management team, and poor investment decisions can negatively impact returns.

Periodic Evaluations

It is important to periodically review the performance of mutual fund investments. While long-term investments may not require daily monitoring, regular check-ins can help investors stay informed about the progress of their investments. This allows for timely decision-making regarding adjustments to the investment strategy or portfolio rebalancing.

Ranking Mutual Funds: Strategies for Smart Investment Choices

You may want to see also

Disclosing fund risks and valuation techniques

Understanding the Risks

Before investing in a mutual fund, it is crucial to comprehend the associated risks. Mutual funds carry various risks depending on the assets they hold. These risks include market risk, interest rate risk, and management risk. Market risk pertains to the potential decline in the value of the securities within the fund. Interest rate risk is relevant to funds holding bonds and other fixed-income securities, as rising interest rates can lead to a decrease in bond prices. Management risk is linked to the performance of the fund's management team; poor investment decisions can negatively impact returns. Therefore, investors should carefully review the fund's prospectus and assess their risk tolerance and investment objectives.

Evaluating Risk Assessment and Returns

When disclosing mutual fund investments, it is essential to refer to the fund's risk assessment. The risk assessment, typically found in the fund's fact sheet, indicates how risky the fund is. This information is crucial for investors to determine if the fund aligns with their age and other holdings. Additionally, reviewing the fund's historical performance is vital. The fact sheet usually provides returns over different periods, such as one year, three years, five years, or since inception. This information gives investors a snapshot of the fund's history and current trajectory, helping them make informed decisions.

Understanding Valuation Techniques

Valuing mutual funds involves assessing the fund's net asset value (NAV). The NAV is derived by dividing the total value of the securities in the portfolio by the number of outstanding shares. Mutual fund shares are typically bought or redeemed at the fund's NAV, which is settled at the end of each trading day. The price of a mutual fund is updated accordingly. It is worth noting that the NAV can offer a basis for comparison, but comparing mutual funds with similar names or objectives can still be challenging due to the diversity of portfolios.

Regulatory Disclosures and Timing

In many jurisdictions, such as the United States, mutual funds are required to disclose their holdings regularly. For example, the U.S. Securities and Exchange Commission (SEC) mandates that mutual funds, as regulated investment companies, report their complete lists of holdings on a quarterly basis. These disclosures are made using SEC Forms N-Q and N-CSR and are accessible on the SEC website and, in some cases, the mutual funds' official websites. The quarterly filings must be certified by the fund's principal executive and financial officers. While not mandatory, some fund managers may choose to include management discussion and analysis in their quarterly reports.

Impact of Disclosures on Liquidity and Profitability

The frequent disclosure of mutual fund holdings has been found to have varying effects on liquidity and profitability. On the one hand, increased disclosure leads to enhanced liquidity in the stocks, particularly those with high information asymmetry among investors and traders. This advantage benefits all market participants by reducing transaction costs. On the other hand, mutual funds may suffer from significant deterioration in profitability due to disclosing their stock selections. This is especially true for funds in the best-performing category based on risk-adjusted returns and those concentrating on stocks with high information asymmetry.

In conclusion, disclosing fund risks and valuation techniques is a critical aspect of showing mutual fund investments on a balance sheet. It involves understanding the associated risks, evaluating risk assessments and returns, valuing the fund through NAV calculations, complying with regulatory disclosure requirements, and being aware of the potential impacts of disclosures on liquidity and profitability.

True Beacon Hedge Fund: Investment Strategies and Opportunities

You may want to see also

Reporting fund investments at fair value

When reporting fund investments at fair value, there are several key considerations and guidelines to follow. Here are some detailed instructions and information on this topic:

Understanding Fair Value

Fair value is a critical concept in financial reporting and is defined by ASC 820, which establishes a fair value framework for US GAAP measurements. It is based on an "exit price" determined using concepts such as the unit of account, principal or most advantageous market, highest and best use for non-financial assets, and the fair value hierarchy. The fair value standard also applies to liabilities, considering the amount that would be paid to transfer them to another entity.

Mutual Fund Reporting

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. When reporting mutual fund investments, it's essential to understand the fees associated with them, as these will significantly impact overall investment returns. These fees include expense ratios, sales charges or loads, redemption fees, and other account fees. Mutual fund shares are typically bought or redeemed at the fund's net asset value (NAV) per share, which is derived by dividing the total value of the securities in the portfolio by the number of shares outstanding.

Reporting Method and Tax Implications

The reporting method for investments can impact a company's income statement and balance sheet, so accuracy is vital for tax purposes and investor relations. If a company owns more than 50% of the investment company, it must consolidate the target company's balance sheet and income statement into its existing statement. It's important to note that incorrect reporting of investments may result in tax errors, IRS fines, and Securities Exchange Commission penalties.

Fair Market Value vs. Investment Value

Fair market value is based on the market value of an asset or entity, with adjustments depending on the analysis of market transaction circumstances. It is often associated with accounting standards and is used as the basis for property tax calculations in real estate. Investment value, on the other hand, is based on independent valuation methodologies and depends on various assumptions, including cash flow estimates, tax rates, financing capabilities, and expected returns.

Guidelines for Reporting at Fair Value

The Securities and Exchange Commission (SEC) plays a crucial role in regulating how mutual funds are run, as they are essential to many Americans' retirements. The SEC adopted Rule 2a-5 under the Investment Company Act of 1940, providing a framework for boards of directors of registered investment companies to determine the fair value of fund investments. This rule allows boards to designate certain parties to perform fair value determinations under their oversight. Additionally, Rule 31a-4 outlines the record-keeping requirements associated with fair value determinations.

A Guide to Investing in Singapore's Funds

You may want to see also

Impairment considerations for mutual funds

When reporting corporate investments in stocks and mutual funds, it is important to consider the impact on your balance sheet and income statement. The reporting method can affect your tax obligations and investor relations, so accuracy is vital.

When assessing mutual funds for impairment, investors are required to evaluate their equity method investments when events or circumstances suggest that the carrying amount may be impaired. An investor records an impairment charge in earnings when the decline in value below the carrying amount is determined to be other than temporary.

- Loss in Investment Value: Recognize a loss in value of an investment that is other than a temporary decline. This could be indicated by a current fair value of an investment that is less than its carrying amount, although this does not automatically indicate a loss in value.

- Operating Losses: Continued operating losses at the investee may suggest that the investor will not recover all or part of the carrying value, indicating a decline in value that is other than temporary.

- Market Value: Consider the length of time and extent to which the market value has been less than the cost.

- Financial Condition and Prospects: Evaluate the financial health and near-term prospects of the investee, including specific events that may impact operations, such as changes in technology or discontinuance of a business segment.

- Investor Intent and Ability: Assess the investor's intent and ability to retain the investment for a sufficient period to allow for any anticipated recovery in market value.

- Recovery Period: The longer the expected period for recovery, the stronger the positive evidence needed to overcome the presumption of impairment.

- Negative and Positive Evidence: Consider a range of factors, including negative evidence that indicates a decline in value, such as a prolonged period of low fair value, deteriorating financial condition, severe losses, or adverse changes in the economic or technological environment. Positive evidence, on the other hand, may include improvements in financial performance, near-term prospects, or strengthening of the investee's geographic region and industry.

- Impairment Charge Attribution: When recording an impairment charge, attribute it to the underlying equity method memo accounts of the investment. This can be done through methods such as the specific identification method or the fair value method.

- Subsequent Accounting: After recognizing an impairment, adjust the existing basis difference and amortize any negative basis difference over the remaining asset lives.

- Impairment at Investee Level: When the investee recognizes an impairment charge, the investor generally needs to record their share of that charge, which may impact the basis differences in the impaired assets.

- Cumulative Translation Adjustment (CTA) Balance: When assessing a foreign entity investment for impairment, exclude any effects from foreign currency translation adjustments from the carrying value.

- Fair Value Determination: Fair value is determined at the reporting date for impairment purposes, regardless of whether the investor accounts for the investment on a lag.

By carefully considering these impairment factors, investors can make informed decisions and accurately report their mutual fund investments in their financial statements.

Index Funds: Solo Investing for Beginners

You may want to see also

Frequently asked questions

The balance sheet is an equation: one side shows the company's total assets, and the other side shows the company's liabilities and owners' equity. Investments are listed as assets, but they are separated into long-term and short-term investments. Investments you plan to sell within a year are shown as current assets, and long-term investments are listed separately.

If you intend to keep an investment for more than a year, it is long-term. If you plan to sell it within a year, it is short-term or a temporary asset.

You should report stocks on the balance sheet at their current fair-market value, not the price you paid for them. If the stocks have changed in value since you bought them, report the change as an unrealized gain or loss in the owner's equity section.

If you own less than 20% of a company, you can report the value of your investment as the cost you paid for it (the "cost method"). If you own more than 20% of the company, you will likely have to use the "equity method" to calculate the value of your investment, which is more complicated as you have to consider factors such as dividend income.