Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds, or a representative sample of them. Index funds are passively managed, meaning they aim to replicate the performance of a specific index rather than actively picking securities or timing the market. This makes them a low-cost, diversified investment option that is often favoured by beginners. Here's how to get started with index fund investing:

- Choose an investment platform: Select an online brokerage or investment platform that offers strong customer support, robust research and analytical tools.

- Open and fund an account: Provide personal information, set up login credentials and complete a questionnaire about your investment goals and risk tolerance. Then, deposit funds through a bank transfer.

- Select an index fund: Research different funds to understand their performance history, management fees and the indexes they track. Consider diversifying your portfolio by investing in several index funds.

- Buy shares: With your account funded, purchase shares of your chosen fund through the platform's website or app.

- Monitor and adjust: While index funds are typically long-term investments, periodically review your portfolio to ensure it aligns with your financial goals.

| Characteristics | Values |

|---|---|

| Type of fund | Mutual fund or exchange-traded fund (ETF) |

| Investment strategy | Passive |

| Investment aim | To replicate the returns of market indexes |

| Costs | Lower than actively managed funds |

| Risk | Lower than actively managed funds |

| Returns | Often higher than actively managed funds |

| Flexibility | Less flexible than actively managed funds |

| Taxation | More tax-efficient than actively managed funds |

What You'll Learn

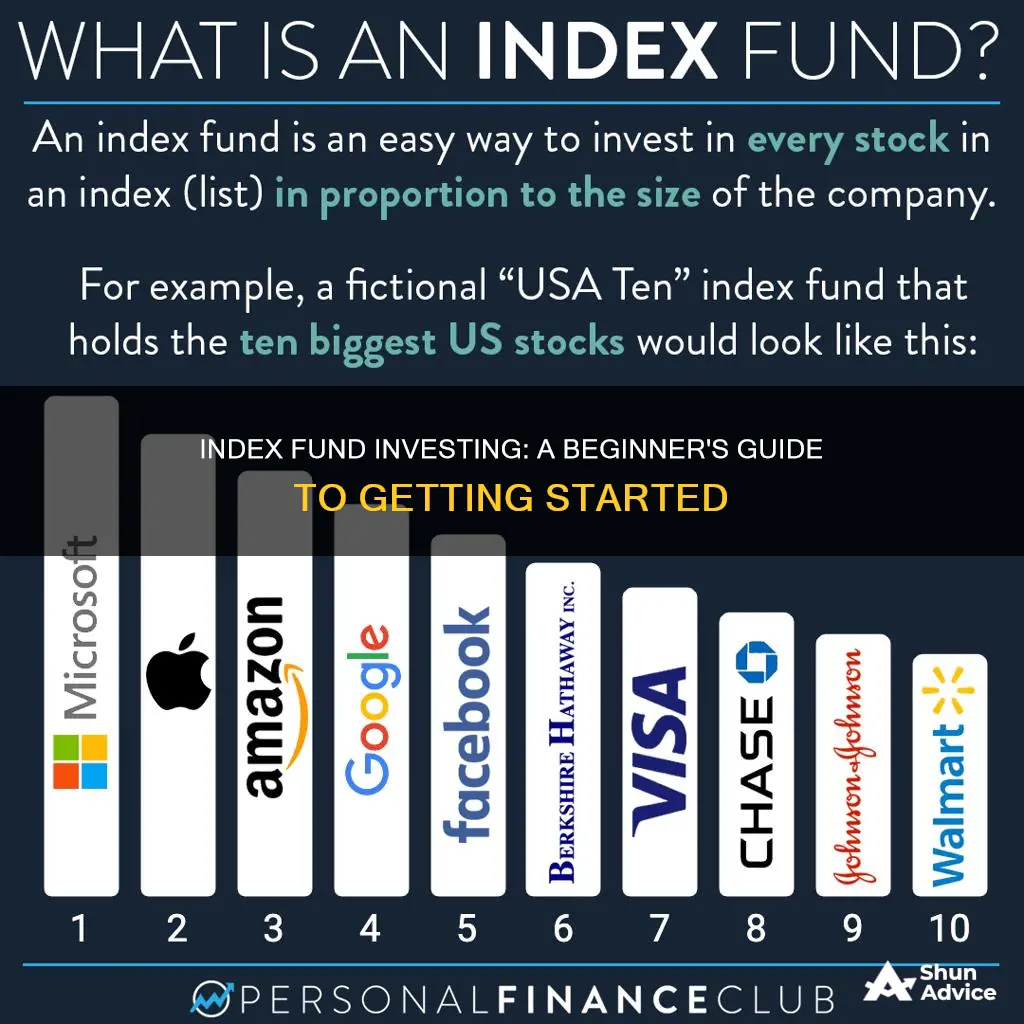

Understand the basics of index funds

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. Index funds are defined as investments that mirror the performance of benchmarks like the S&P 500 by mimicking their makeup. These passive investments are long considered an unimaginative way to invest, but they are behind a quiet revolution in U.S. equity markets, attracting a widening swath of investors.

Index funds are a low-cost, easy way to build wealth. They are a great investment for building wealth over the long term, which is one reason they are popular with retirement investors. An index fund is a group of stocks that aims to mirror the performance of an existing stock market index, such as the Standard & Poor's 500 index. An index is made up of companies that represent a part of the financial market and offers a look into the health of the economy as a whole.

An index fund will be made up of the same investments that make up the index it tracks. This way, the performance of the index fund usually closely mirrors that of the index, with no hands-on management necessary. Index funds are considered a form of "passive investing" because the fund managers aren't actively buying or selling assets to try to outperform the market; they're simply following it.

- Index funds are a passive investment strategy: Index funds involve passive investing, using a long-term strategy without actively picking securities or timing the market. They are designed to replicate the performance of financial market indexes, like the S&P 500, and are ideal for long-term investing, such as retirement accounts.

- Benefits of index funds: Index funds have several benefits, including lower costs, broad-based diversification, and lower taxes. They have lower expenses and fees than actively managed funds, and they can be more broadly diversified than individual stocks.

- Drawbacks of index funds: Index funds have some drawbacks, including a lack of flexibility and the inability to outperform the market. They are designed to mirror a specific market, so they decline in value when the market does, and they can't pivot away when the market shifts.

- How to choose an index fund: When choosing an index fund, consider the fund's performance history, management fees, and the index it tracks. Compare your options and consider factors such as the expense ratio, tracking error, and daily trading volume.

- Where to buy index funds: You can purchase an index fund directly from a mutual fund company or a brokerage, or through a brokerage account, individual retirement account (IRA), or Roth IRA.

- Monitoring your index funds: While index funds are passive investments, it's important to periodically review your portfolio to ensure it aligns with your financial goals. Check that your index fund is mirroring the performance of its underlying index and be mindful of any fees that may stack up over time.

Mutual Funds: Safer Investment, Diversified Risk

You may want to see also

Research different types of index funds

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. They are defined as investments that mirror the performance of benchmarks like the S&P 500 by mimicking their makeup. Index funds are considered passive investments, and their managers do not actively pick securities or time the market.

Broad Market Index Funds

Broad market index funds aim to capture the performance of a large segment of the investable stock market. They are an excellent investment option for long-term investors as they aim to capture the total performance of the stock market. Examples of broad market index funds include the Vanguard Total Stock Market Index Fund and the Schwab U.S. Broad Market Index Fund.

Market Capitalization Index Funds

Market capitalization index funds invest based on specific market capitalization ranges. A company's market cap is equal to the total value of its outstanding shares, and companies can be divided based on these values. Examples of market capitalization index funds include the Vanguard 500 Index Fund and the iShares Russell 2000 ETF.

Equal Weight Index Funds

Equal weight index funds aim to counteract the overweighting or underweighting of a market capitalization-weighted index. In these funds, each holding in the fund makes up roughly the same percentage of fund assets. For example, if a fund has 100 holdings, each one will account for about 1% of the portfolio. Popular equal weight index funds include the Invesco S&P 500 Equal Weight ETF and the Direxion Nasdaq-100 Equal Weighted Index Shares.

Fixed Income/Debt Index Funds

Fixed-income or debt index funds invest in bonds rather than stocks. They track bond indices in the same way that stock funds track stock market indices, allowing them to charge low expense ratios compared to actively managed funds. Examples of fixed-income index funds include the Vanguard Long-Term Bond ETF and the iShares 1-5 Year Investment Grade Corporate Bond ETF.

Sector-Based Index Funds

Sector-based index funds focus on a specific sector or industry, such as technology, healthcare, or financials. These funds are a great fit for investors who have a specific view on a certain area of the economy. Examples of sector-based index funds include the Consumer Discretionary Select Sector SPDR Fund and the Vanguard Communication Services Index Fund.

International Index Funds

International index funds provide exposure to geographic areas outside of the investor's home country, such as Europe or the Asia-Pacific region. These funds are a simple way to gain access to economies and companies in other parts of the world. Examples of international index funds include the Vanguard FTSE Emerging Markets ETF and the iShares Core MSCI Total International Stock ETF.

Socially Responsible Index Funds

Socially responsible index funds, also known as ESG (environmental, social, and governance) funds, focus on investing in companies with high ESG standards. These funds exclude companies involved in industries such as adult entertainment, alcohol, tobacco, conventional weapons, and fossil fuels. Examples of socially responsible index funds include the Vanguard ESG U.S. Stock ETF and the iShares Global Clean Energy ETF.

Mutual Fund Stocktrak: A Guide to Investing

You may want to see also

Choose an investment platform

You can purchase an index fund directly from a mutual fund company or a brokerage. The same goes for exchange-traded funds (ETFs). These are like mini mutual funds that trade like stocks throughout the day.

When choosing where to buy an index fund, consider the following:

- Fund selection: Do you want to purchase index funds from various fund families? The big mutual fund companies carry some of their competitors’ funds. However, the selection may be more limited than what’s available in a discount broker’s lineup.

- Convenience: Find a single provider who can accommodate all your needs. For example, if you’re just going to invest in mutual funds (or even a mix of funds and stocks), a mutual fund company may be able to serve as your investment hub. But if you require sophisticated stock research and screening tools, a discount broker that also sells the index funds you want may be better.

- Trading costs: If the commission or transaction fee isn’t waived, consider how much a broker or fund company charges to buy or sell the index fund. Mutual fund commissions are higher than stock trading ones (about $20 or more). Compare that with less than $10 a trade for stocks and ETFs.

- Impact investing: Want your investment to make a difference outside your portfolio? Some funds target companies with a focus on environmental or social justice causes.

- Commission-free options: Do they offer no-transaction-fee mutual funds or commission-free ETFs?

In order to purchase shares of an index fund, you'll need to open an investment account. A brokerage account, individual retirement account (IRA) or Roth IRA will all work. You can then buy the fund in the account.

When you go to purchase the fund, you may be able to select a fixed dollar amount to spend or choose a number of shares. The share price of the index fund, and your investing budget, will likely determine how much you're willing to spend. For instance, if you have $1,000 you'd like to invest in an index fund, and the fund you're looking at is selling for $100 a share, you'd be able to purchase 10 shares.

Banks' CD Fund Investment Strategies: Where Does Your Money Go?

You may want to see also

Open and fund an account

Once you've chosen an investment platform, you'll need to open an account. This typically involves providing personal information, setting up login credentials, and completing a questionnaire about your investment goals and risk tolerance.

After that, you'll need to deposit funds. This can usually be done through a bank transfer.

If you're investing in index funds through an online stockbroker, you'll need to open an account with them. There are at least 40 online brokers available in Australia as of 2024.

- Brokerage fees: This is the fee you pay every time you buy or sell stocks or ETF units. If you plan to invest regularly in your index fund, you'll want to find a broker with lower commission/brokerage fees.

- ETF screeners: Some brokers offer search tools to help you find ETFs based on specific criteria.

- Dividend reinvestment: If you decide you want any index fund dividends reinvested back into the fund automatically, make sure your broker offers this option.

- Access to the Australian Securities Exchange (ASX): If you plan to invest in a local index fund, you'll want a broker that offers access to the ASX.

- Inactivity fees: Some brokers charge inactivity fees if you don't make a certain number of trades per year.

You can also purchase an index fund directly from a mutual fund company or a brokerage. The same goes for exchange-traded funds (ETFs). These are like mini mutual funds that trade like stocks throughout the day.

When choosing where to buy an index fund, consider:

- Fund selection: Do you want to purchase index funds from various fund families? The big mutual fund companies carry some of their competitors' funds, but the selection may be more limited than what's available from a discount broker.

- Convenience: Find a single provider who can accommodate all your needs. For example, if you're just going to invest in mutual funds (or even a mix of funds and stocks), a mutual fund company may be able to serve as your investment hub. But if you require sophisticated stock research and screening tools, a discount broker that also sells the index funds you want may be better.

- Trading costs: If the commission or transaction fee isn't waived, consider how much a broker or fund company charges to buy or sell the index fund. Mutual fund commissions are typically higher than stock trading commissions, about $20 or more. Compare that with less than $10 a trade for stocks and ETFs.

- Impact investing: Some funds target companies with a focus on environmental or social justice causes.

- Commission-free options: Do they offer no-transaction-fee mutual funds or commission-free ETFs?

In order to purchase shares of an index fund, you'll need to open an investment account. A brokerage account, individual retirement account (IRA), or Roth IRA will all work. You can then buy the fund in the account.

When you go to purchase the fund, you may be able to select a fixed dollar amount to spend or choose a number of shares. The share price of the index fund, and your investing budget, will likely determine how much you're willing to spend.

For example, if you have $1,000 you'd like to invest in an index fund, and the fund you're looking at is selling for $100 a share, you'd be able to purchase 10 shares.

Smart Strategies for Investing in Mutual Funds for Your Child

You may want to see also

Monitor and adjust your portfolio

Index funds are a passive investment strategy, meaning they don't require the active decision-making and constant monitoring that other funds do. However, it is still important to periodically review your portfolio to ensure it aligns with your financial goals.

- Performance vs. the underlying index: Your index fund should mirror the performance of the underlying index it tracks. While you shouldn't expect identical returns due to factors like investment costs and taxes, keep an eye out for red flags, such as if the fund's performance lags the index by more than the expense ratio.

- Fees: One of the benefits of index funds is their low cost compared to actively managed funds. However, fees can vary among index funds, so be mindful of the management costs and expense ratios charged by your fund. If fees start to stack up over time, it may be worth considering alternative funds with lower costs.

- Diversification: Index funds are a great way to achieve diversification across various sectors and asset classes. When monitoring your portfolio, ensure that you have a well-diversified mix of funds that aligns with your risk tolerance and financial goals. Consider your desired level of exposure to specific markets and sectors, and adjust your fund allocations accordingly.

- Reinvesting dividends: Some index funds pay dividends. Decide whether you want to reinvest these dividends back into the fund or have them paid into your account. Reinvesting dividends can help your investments grow over time.

- Buy-and-hold strategy: Index funds are typically considered a long-term investment strategy. While you may be tempted to buy or sell based on short-term market fluctuations, it's generally advisable to take a buy-and-hold approach with index funds, riding out any short-term downturns in the market.

- Tax implications: Be mindful of the tax implications of your index fund investments, especially if they are held outside of tax-advantaged accounts. Consult with a tax professional to understand how your index fund investments may impact your tax liability.

- Seek professional advice: If you're unsure how to adjust your portfolio or need help defining your financial goals, consider seeking advice from a financial advisor. They can guide you in selecting funds that align with your risk tolerance, investment horizon, and overall financial objectives.

CEF Funds: Where the Rich Invest Their Money

You may want to see also

Frequently asked questions

An index fund is a group of stocks or bonds that aims to mirror the performance of an existing stock market index, such as the S&P 500. Index funds are passively managed, meaning they don't require active decision-making to buy or sell investments.

To start investing in index funds, you'll need to open an investment account, such as a brokerage account, individual retirement account (IRA), or Roth IRA. Then, you can purchase shares of an index fund through a mutual fund company or a brokerage. When choosing an index fund, consider factors such as company size, geography, business sector, and asset type.

Index funds offer a low-cost, diversified, and passive investment strategy. They typically have lower fees than actively managed funds and can provide broad market exposure across various sectors and asset classes. Index funds also tend to have better returns than actively managed funds over the long term.

As with any investment, there is a risk of losing money in an index fund. Index funds may not be suitable for short-term investments as they are designed for long-term growth. Additionally, they may not provide the opportunity to outperform the market, as they aim to mirror the performance of a specific index.

The minimum investment required to start investing in index funds can vary. Some funds have no minimum investment requirement, while others may require a few thousand dollars. It is important to consider your financial situation and risk tolerance before investing.