There are many investment tracking apps available that can help you monitor your investment portfolio. These apps can be useful if you have multiple investment accounts and want to view your investments in one place. Some popular options include Empower (formerly Personal Capital), SigFig Wealth Management, Sharesight, and Yahoo Finance. These apps often provide real-time information, performance tracking, and asset allocation tools. It's important to consider your specific needs and priorities when choosing an investment tracking app, such as the level of detail required, the ability to sync with your accounts, and the cost of the app.

What You'll Learn

Investment tracking apps

Empower (Formerly Personal Capital)

Empower is a popular investment tracking app with over three million users and more than $1.4 trillion in assets under management as of December 31, 2023. It offers a free financial dashboard that allows you to track your net worth and create a savings plan. You can sync various investment and bank accounts, including credit cards, retirement, and taxable accounts. Empower provides easy-to-read graphs and charts to help you monitor performance, asset allocation, and fees. Additionally, it offers a Retirement Planner function to help you stay on track with your savings and retirement goals. While the app itself is free, the wealth management function comes with a fee.

SigFig Wealth Management

SigFig offers a free app that automatically syncs your investment accounts into a single dashboard, providing real-time information about your stocks, mutual funds, and ETFs. It connects with over 50 brokerages, including Schwab and Fidelity. While the basic app is free, SigFig also offers a fee-based version that provides personalized investment plans based on your risk tolerance and time horizon. This premium service charges 0.25% per year, but you can get your first $10,000 managed for free.

Sharesight

Sharesight is a portfolio tracking app that can monitor the performance of your investments using data from 60 stock exchanges. It offers a free service for up to ten holdings or one portfolio with limited reporting. For investors with more than ten holdings, a fee-based service is available, ranging from $7 to $23 per month (billed annually). Sharesight allows you to track the price and performance of stocks, ETFs, mutual funds, cryptocurrencies, real estate, private equity, and fixed-income investments globally. It also provides dividend tracking and tax reporting capabilities, making it a comprehensive solution for investment tracking.

Yahoo Finance

The Yahoo Finance app offers a simple and user-friendly design for tracking your stocks, commodities, bonds, and currencies. You can create and monitor the performance of your personal portfolio and sync it across multiple devices. It provides real-time stock and investment information, personalized alerts, and watchlists to organize your stocks by sector. The app also includes interactive charting and access to breaking news and market updates, making it a well-rounded choice for investment tracking.

WallStreetZen

WallStreetZen is a stock portfolio tracker that allows you to monitor your investments and take a holistic view of your portfolio. It offers a free Watchlist feature, which makes it easy to add your portfolio holdings and keep track of news, insider activity, analyst upgrades/downgrades, and upcoming events. WallStreetZen also provides the option to upgrade to a Premium membership for more advanced features and insights.

Ziggma

Ziggma is a portfolio tracking app that measures portfolio quality, risk, and yield. It provides Smart Alerts to notify you when it's time to place a trade. Ziggma allows you to connect an unlimited number of accounts for free and offers a comprehensive view of your portfolio. It also computes projected dividend income and provides portfolio carbon footprint information. Ziggma is a great choice for investors seeking risk-adjusted returns and automated monitoring.

These investment tracking apps offer a range of features to help you stay on top of your investments, providing valuable insights and tools for managing your financial portfolio.

A Beginner's Guide to Vanguard Mutual Funds Investing

You may want to see also

Investment tracking spreadsheets

- It shows the entire record of purchases, sells, dividends, return of capital transactions, and splits

- It can be used as a reference when making financial decisions

- It is easy to use and performs calculations automatically when data is inputted

- Information can be organized into categories to make it easier to understand the status of investments

- It can be used to keep track of assets, both locally and internationally

- It makes it easier to perform rebalancing

- Asset Allocation Spreadsheet

- Cryptocurrency Investment Tracking Spreadsheet

- Dividends Investment Tracking Spreadsheet

- Financial Portfolio Template

- Investment Portfolio Tracking Spreadsheet

- Investment Return Tracking Spreadsheet

- PAMM Investment Tracking Spreadsheet

- Property Investment Tracking Spreadsheet

- Stock Investment Tracking Spreadsheet

- Microsoft Excel can be used to keep track of the cost basis of taxes on individual lots and to calculate or map out a dividend schedule

- Google Spreadsheets can be used if the user wants the spreadsheet to automatically update with information from public finance sources

Best Public Mutual Funds: Where to Invest Smartly

You may want to see also

Investment tracking software

Empower (formerly Personal Capital)

Empower is a highly popular investment tracking app that offers a range of features such as tracking portfolio performance, fees, asset allocation, and projected future growth. It allows you to link various accounts, including investment, retirement, bank, and credit card accounts. Empower also provides an interactive graph of your asset allocation and integrates with a robust retirement tool to help you plan for the future. The app is free to use and is known for its ease of use.

Stock Rover

Stock Rover is a great option for those with more complex stock portfolios. It provides extensive data on stocks, ETFs, and mutual funds, along with numerous ways to evaluate individual investments or your portfolio as a whole. While it has a learning curve, Stock Rover offers video guides and plenty of help to make the most of its features. It requires an annual fee, but it is reasonable.

Kubera

Kubera is a newer investment app that stands out for its simplicity. It allows you to connect investment accounts, track the value of your home, and even track the value of internet domains you own. Kubera provides a net worth summary with graphs and enables you to track insurance policies and store important documents in its virtual "Safe Deposit Box." However, it does not offer investment analysis features like asset allocation or fee analysis, and it comes with a $15 monthly or $150 yearly fee.

Google Sheets

For those who prefer not to connect their financial accounts to an app, Google Sheets is a viable option. Using the Google Finance function, you can pull data on mutual funds, ETFs, and stocks, including fund or company names, prices, performance, and expense ratios. This method provides more privacy but requires manual data entry and doesn't offer automatic updates or advanced features like retirement planning tools.

Tiller

Tiller is a budgeting app that can also be used for investment tracking. It connects to your investment accounts and downloads transactions and account balances. It offers a retirement add-on to help you plan for the future. Tiller comes with a 30-day free trial, after which it costs $79 per year.

Morningstar

Morningstar is a well-known investment research platform that also offers a portfolio tracker. It provides robust investment tools and analysis, allowing you to track performance down to the penny, including dividend reinvestments. While it is free for basic portfolio tracking, it requires manual data entry and updates. For access to all of Morningstar's data and tools, there is an annual fee of $199.

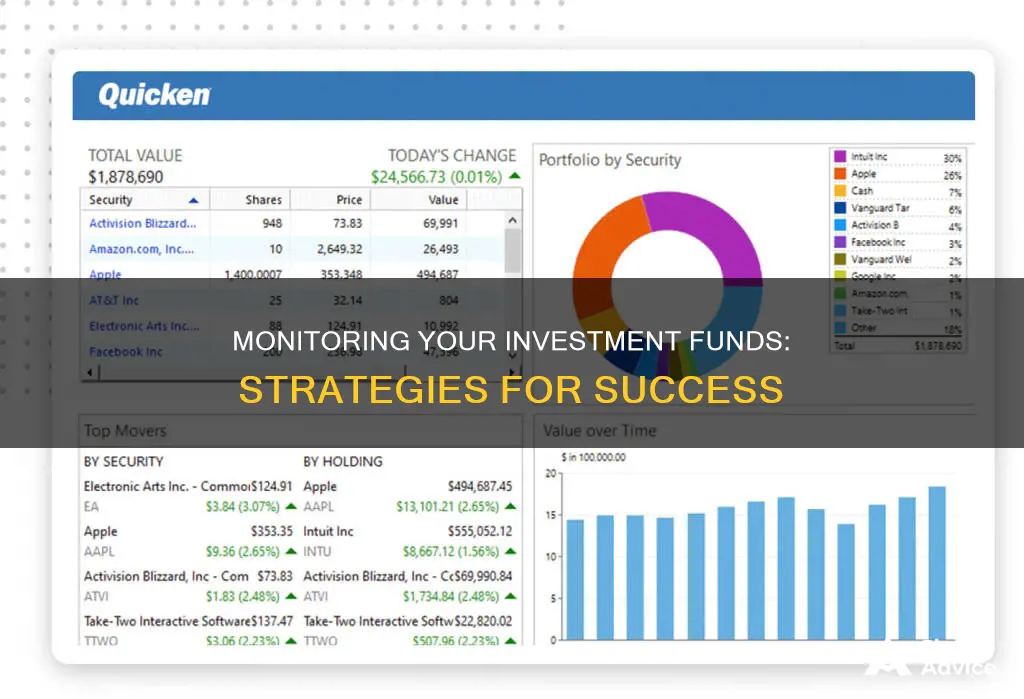

Quicken

Quicken is a long-standing budgeting and personal finance software that also offers investment tracking features. It allows you to track performance, realized and unrealized gains, and provides tools to simplify tax preparation. However, it comes with an annual fee of around $75.

Fidelity Full View

Fidelity Full View is a financial management program that integrates with other Fidelity services, such as their retirement planner. It provides portfolio performance and asset allocation tracking, along with investment-related reports. This platform is only available to Fidelity customers.

These are just a few examples of the many investment tracking software options available. Each platform has its own unique features, pricing models, and strengths, so it's important to choose one that aligns with your specific needs and financial goals.

Nippon India Multi-Asset Fund: Smart Investment Strategies

You may want to see also

Investment tracking websites

Yahoo Finance

Yahoo Finance is one of the largest business news sites in the US. Its portfolio tracker allows you to create and track the performance of your personal portfolio and sync multiple portfolios across all your devices. It provides real-time stock and investment information, along with personalised alerts and market movement updates. Yahoo Finance also offers full-screen interactive charting and multiple watchlists to organise stocks by sectors.

Sharesight

Sharesight is a portfolio tracker that can monitor the performance of your investments using data imported from 60 stock exchanges. It automatically tracks the price and performance of stocks, ETFs, and mutual funds globally. Sharesight also monitors cryptocurrencies, real estate, private equity, and fixed-income investments. The service is free for up to 10 holdings or one portfolio, with paid plans offering additional features and more holdings.

Empower (Formerly Personal Capital)

Empower is a popular investment tracking platform with over three million users. It offers investment checkup features, allowing users to track investments by account, asset class, or individual security. Empower helps assess portfolio risk levels and recommends target asset allocations to reduce the risk of loss. It also offers retirement planning tools and the option to work with a personal wealth management advisor.

SigFig Wealth Management

SigFig offers a free app that automatically pulls your investment accounts into a single dashboard, providing real-time information on stocks, mutual funds, and exchange-traded funds (ETFs). It can connect with over 50 brokerages, including Schwab and Fidelity. SigFig also offers a fee-based version that allows investors to create a personalised plan incorporating risk tolerance and time horizons.

Portfolio Visualizer

Portfolio Visualizer is a portfolio analysis and reporting tool set that enables individuals to benefit from sophisticated analytical techniques usually reserved for institutions. It offers portfolio backtesting, portfolio optimisation, and Monte-Carlo simulation tools to help users understand the impact of risk on their investments.

Other Options

Other investment tracking websites and apps include Ziggma, Quicken, Portseido, and getquin. Additionally, online brokerage accounts and robo-advisors often provide their own portfolio management tools, though they may have more limited functionality.

Smart Ways to Invest in Vanguard Star Fund with $2000

You may want to see also

Investment tracking for high-net-worth individuals

Investment tracking is essential for high-net-worth individuals (HNWIs) to monitor their financial health, make informed decisions, and set goals. Here are some strategies and tools for effective investment tracking:

Diversification

Diversification is a key strategy for HNWIs to spread risk across multiple investments. This involves allocating assets across different classes, such as stocks, bonds, real estate, and alternative investments. Sector, geographic, and investment type diversification further help reduce the impact of poor performance in any single sector, country, or investment type.

Private Equity and Real Estate

Private equity investments offer HNWIs higher returns but come with higher risks and lower liquidity. They involve investing in privately held companies, often less established ones with high growth potential. Real estate, on the other hand, provides long-term returns, portfolio diversification, and potential tax benefits. Direct real estate investment, real estate investment trusts (REITs), crowdfunding, and private real estate funds are some options for HNWIs.

Hedge Funds and Philanthropic Investments

Hedge funds offer high-risk, high-reward strategies and are usually only available to accredited investors. They employ various tactics, such as long/short equity and event-driven approaches, and often have limited liquidity. Philanthropic investments, or impact investing, allow HNWIs to support social and environmental initiatives while potentially generating financial returns.

Tracking Tools

To effectively track their investments, HNWIs can utilise various tools:

- Empower (formerly Personal Capital): A powerful and versatile app that offers free investment tracking, cash flow monitoring, budgeting, and retirement planning tools.

- PocketSmith: A personal finance software that helps with money management, cash flow forecasting, and budgeting. It offers a free plan with limited features and paid premium plans for more accurate wealth tracking and financial projections.

- Betterment: A robo-advisor app that manages investing accounts based on goals and risk tolerance. It also allows syncing bank accounts for a comprehensive view of finances.

- YNAB (You Need a Budget): A budgeting and wealth tracking tool that helps users allocate money, handle expenses, and track net worth over time. It offers a free trial and a subscription plan.

- Mint: A well-known and accessible wealth tracker that allows users to connect financial and investment accounts, track expenses and credit scores, and manage budgets. It is a simple and free tool.

- Kubera: An advanced portfolio-tracking app that offers numerous bank connections and detailed insights on international holdings. It focuses on investments and has an annual fee with no free plan.

- Tiller: A spreadsheet-based tool that syncs with financial accounts and auto-fills data into customisable templates. It offers a free trial and an annual subscription.

By utilising these strategies and tools, HNWIs can effectively track their investments, make informed decisions, and work towards their financial goals.

Investing in ICICI Prudential Bluechip Fund: A Comprehensive Guide

You may want to see also

Frequently asked questions

There are several free apps that can help you track your investment portfolio, including Empower (formerly known as Personal Capital), SigFig Wealth Management, Sharesight, Yahoo Finance, and Kubera. These apps offer various features such as performance tracking, asset allocation, and retirement planning.

When choosing an investment tracking app, look for one that offers a free version so you can try it out before committing. Additionally, consider the specific features that are important to you, such as the ability to sync all your financial accounts, retirement planning tools, and asset allocation monitoring.

Investment tracking apps provide a convenient way to monitor your investment portfolio in one place. They offer real-time information and analytics, helping you make informed decisions about your investments. Some apps also provide additional features such as retirement planning, asset allocation, and fee monitoring.

To set up an investment tracking app, you typically need to create an account and link your financial accounts, such as investment accounts, bank accounts, and credit cards. Once your accounts are linked, the app will automatically download your financial data and provide you with tools to track and analyze your investments.