If you're looking to transfer funds from your Ally Invest account to your Ally Savings account, you have a few options. Firstly, you can transfer funds by logging into your online banking and selecting the Transfers option. From there, you can choose the specific accounts you want to transfer money to and from. Alternatively, you can use the Ally mobile banking app to initiate transfers between your Ally Invest and Ally Savings accounts. It's important to note that while transfers between Ally Bank and Ally Invest accounts are typically free, there may be a $30 Automated Clearing House (ACH) fee for failed transactions. Additionally, transfers from Ally Invest accounts to other firms may incur a $50 transfer fee, and closing an Ally Invest Individual Retirement Account (IRA) upon full distribution of funds may result in a $25 closing fee.

What You'll Learn

Transfer money between Ally accounts

Transferring money between Ally accounts is a straightforward process. Here is a step-by-step guide on how to transfer money between Ally accounts:

Step 1: Log in to Your Ally Account

Visit the Ally website or use the mobile banking app to log in to your account. Ensure that you have access to the account you want to transfer funds from.

Step 2: Navigate to the "Transfers" Section

Once you are logged in, find and select the "Transfers" section. From here, you will be able to manage your transfer.

Step 3: Select the Accounts

Choose the account you want to withdraw funds from and the account you want to deposit funds into. You can select from various accounts, including your Money Market Account, Savings Account, or Ally Invest account.

Step 4: Enter Transfer Details

After selecting the accounts, enter the amount you wish to transfer. You can also set the frequency of the transfer, such as a one-time or recurring transfer, and the date of the transfers.

Step 5: Review and Submit the Transfer

Before finalizing, carefully review the details of your transfer to ensure accuracy. Once you are satisfied, submit the transfer.

Additional Information:

Transfers between Ally accounts are typically instant and can be done at any time. However, transfers from an Ally Invest account to another Ally account can take anywhere from a few minutes to up to five business days, depending on the type of Ally Invest account.

It is important to note that while transfers between Ally Bank accounts are immediate, they cannot be canceled or changed once submitted. Therefore, ensure that all details are correct before submitting your transfer request.

Additionally, there are no fees for standard and expedited transfers between your Ally Bank and Ally Invest accounts or between these accounts and accounts at other institutions. However, a $30 Automated Clearing House (ACH) fee may be applicable for failed transactions.

By following these steps, you can easily transfer funds between your Ally accounts, allowing you to manage your finances effectively.

Invest Wisely: A Guide to Savings in Australia

You may want to see also

Transfer money to another bank

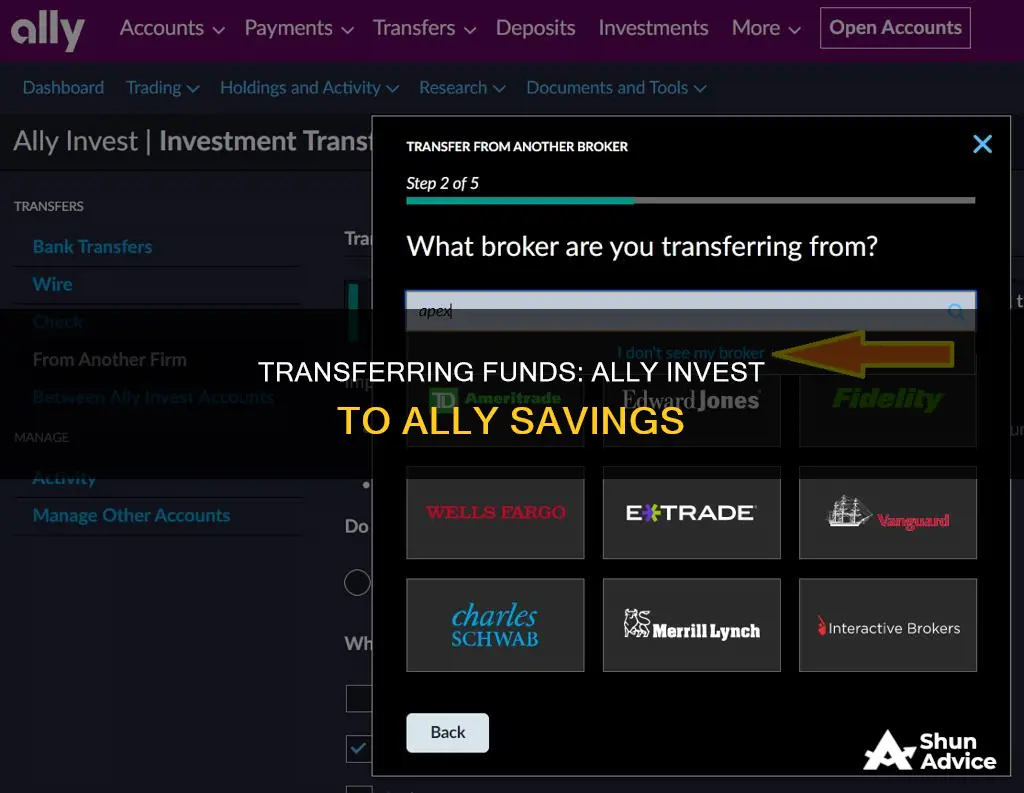

Transferring money from an Ally Invest account to an account at another bank is a straightforward process. Here is a step-by-step guide:

Step 1: Log in to Your Ally Invest Account

Visit the Ally website and log in to your Ally Invest account using your credentials. This will give you access to the various features and options available for managing your account.

Step 2: Navigate to the Transfers Section

Once you are logged in, find and select the "Transfers" section. This is typically located within the main navigation menu of your account dashboard. From there, you will be able to manage your transfer settings and initiate a new transfer.

Step 3: Link Your External Account

To transfer money to another bank, you will need to link your external account to your Ally Invest account. Click on the option to "Link Other Accounts" and provide the necessary details. This includes the account type (checking vs. savings), routing number, and account number of the external account.

Step 4: Verify Your Account Ownership

After entering the external account information, Ally will need to verify that you are the owner of the account. This verification process can be instantaneous or take up to three business days, depending on the institution and the method used for verification. In some cases, Ally may make small trial deposits into the external account and ask you to verify the amounts deposited.

Step 5: Initiate the Transfer

Once your external account has been successfully linked and verified, you can initiate the transfer. Choose the Ally Invest account you want to withdraw funds from and the external account you want to deposit the funds into. Enter the amount you wish to transfer, select the frequency (one-time or recurring), and specify the date of the transfer.

Step 6: Review and Submit the Transfer

Before finalizing the transfer, carefully review the details to ensure accuracy. Check the amount, the accounts involved, and the timing of the transfer. Once you are satisfied that all the information is correct, submit the transfer request.

Additional Considerations:

Keep in mind that standard transfers from an Ally Invest account to a non-Ally account typically take three business days to complete. Transfers are not processed on weekends or federal holidays, so allow for extra time if your transfer request falls during these periods. Additionally, certain accounts may be eligible for next-day transfers, where funds are delivered on the next business day.

Furthermore, while Ally does not charge any fees for sending or receiving transfers to and from other financial institutions, your other bank may have its own fees for incoming or outgoing transfers. It is always a good idea to check with both institutions to understand any potential fees involved.

Invest Your Savings Wisely: The Power of ETFs

You may want to see also

Account transfer fees

Ally Bank does not charge any fees to send or receive transfers from other financial institutions. However, there is a $20 fee for each outgoing domestic wire transfer. This fee is refunded if you are transferring money from your Ally Bank account to your Ally Invest account.

Transfers between your Ally Bank and Ally Invest accounts are free, as are transfers between these accounts and accounts at other institutions. However, a $30 returned Automated Clearing House (ACH) fee may apply for failed transactions.

Ally Invest charges a $50 transfer fee for each partial or full Automated Customer Account Transfer Service (ACATS) transfer of securities or cash from any Ally Invest account to another firm. Additionally, there is a $25 closing fee when an Ally Invest Individual Retirement Account (IRA) is closed upon full distribution of IRA funds. When an Ally Invest IRA is closed due to a full transfer to another firm, a total of $75 is charged ($50 transfer fee, plus $25 closing fee).

The timing of transfers depends on the type of accounts involved. Transfers from Ally Bank to Ally Invest accounts take 1-2 minutes, while transfers from Ally Invest Self-Directed to Ally Bank accounts take the same amount of time. Transfers from Ally Invest Robo Portfolio to Ally Bank accounts and from Ally Invest Personal Advice to Ally Bank accounts can take up to 5 business days since portfolio rebalancing is required.

Regular ACAT transfers (transfers from most other outside brokers) usually take 5-7 business days to show in your Ally Invest account. Non-ACAT transfers (transfers from outside banks, retirement companies, or mutual fund companies) may take several weeks to arrive by mail.

Yotta Savings: A Smart Investment Strategy for Your Money

You may want to see also

Transfer timing

When transferring money between your Ally Bank and Ally Invest accounts, it's important to consider the timing of the transaction. Here are some key points about transfer timing:

- Processing Time: Standard transfers between Ally Bank and Ally Invest accounts typically take 1 to 2 minutes. However, transfers from Ally Invest Self-Directed or Robo Portfolio to Ally Bank accounts can take up to 5 business days due to portfolio rebalancing.

- Business Days and Holidays: Transfers are processed between 8 am and 3:55 pm ET, Monday through Friday. They are not processed on weekends or federal holidays, so keep in mind that holidays may extend the transfer period.

- Standard Transfer Timing: A standard transfer from an Ally Bank account to a non-Ally Bank account typically takes 3 business days. For example, a transfer requested on Monday will be delivered by the end of the day on Thursday.

- Next-Day Transfers: Certain accounts are eligible for next-day transfers, where funds are delivered on the next business day. Ally determines eligibility for next-day transfers based on account tenure, account activity, and transfer activity.

- Account Verification: When setting up a new account for transfers, Ally may need to verify your account ownership. This process can take up to 3 business days if micro deposits are required for verification.

- ACH Transfer Timing: ACH transfers, which are used for online transfers between banks, typically take 3 business days to process. The funds are withdrawn on the first day and delivered on the third day.

- DTC Transfer Timing: DTC transfers, which are used for transferring individual stock positions between brokers, normally take 2 to 3 business days to process.

- ACAT Transfers: Regular ACAT transfers, which are transfers from most other outside brokers, usually take 5 to 7 business days to show in your Ally Invest account.

- Non-ACAT Transfers: Non-ACAT transfers, which are transfers from outside banks, retirement companies, or mutual fund companies, may take several weeks to complete.

- Wire Transfers: Wire transfers can be used for faster transactions. Depending on how quickly your bank initiates the wire, this method can take a few hours to one business day.

Savings and Investments: Strategies for Effective Money Allocation

You may want to see also

Transfer limits

Ally Bank allows you to make unlimited online transfers from an Ally Bank account to an Ally Invest account. However, there are some limits to the number of certain types of withdrawals or transfers from your savings account. You are limited to 10 per statement cycle for certain types of withdrawals or transfers from your savings account. These include online and mobile transfers, overdraft transfer services, and transfers from your Ally Bank savings or Money Market account to your other Ally Bank accounts. There is no fee for going over the limit, but Ally Bank may close your account if you exceed the limit more than occasionally.

Transfers from an Ally Bank account to a non-Ally Bank account typically take three business days. For example, a transfer requested on Monday will be delivered on Thursday. Transfers are not processed on weekends or federal holidays, and holidays may make the transfer period longer. Certain accounts are eligible for next-day transfers, meaning funds are delivered on the next business day.

Transfers between an Ally Bank account and an Ally Invest account can be made Monday through Friday from 8:00 a.m. to 3:55 p.m. EST and can take anywhere from a few minutes up to five business days, depending on the type of Ally Invest account.

Ally Bank also limits wire transfers to $25,000 for 90 days after you open your first Ally Bank account to protect you from fraud. You can request an exception if you need to wire more.

Social Security Investment Strategies: Maximizing Your Savings

You may want to see also