An increase in government spending can have a range of effects on investment. Firstly, it can lead to a rise in aggregate demand, resulting in higher growth in the short term but potentially causing inflation. Higher government spending can impact the supply side of the economy, depending on where it is targeted. For instance, investment in infrastructure can boost productivity and long-term economic growth, while spending on welfare benefits may reduce inequality but could also crowd out more productive private sector investment.

Economists hold differing views on the impact of government spending. Some argue that it stimulates the economy through a multiplier effect, where each dollar spent by the government is spent and re-spent multiple times throughout the economy, increasing GDP. On the other hand, others suggest that government spending may crowd out private sector activity and investment, reducing overall economic growth.

The impact of increased government spending on investment also depends on how it is financed. If financed by higher taxes, the increase in tax burden may counterbalance the rise in spending, resulting in no net change in aggregate demand. Additionally, higher government spending can lead to higher interest rates, which may reduce interest-sensitive investment.

Overall, the effects of increased government spending on investment are complex and depend on various factors, including the specific areas of spending, the method of financing, and the state of the economy.

| Characteristics | Values |

|---|---|

| Effect on aggregate demand | Increase |

| Effect on growth | Positive in the short-term |

| Effect on inflation | Positive |

| Effect on supply-side | Depends on the area of spending |

| Effect on productivity | Positive if spent on infrastructure |

| Effect on inequality | Positive if spent on welfare benefits |

| Effect on incentives to work | Negative if spent on welfare benefits |

| Effect on labour market efficiency | Positive if spent on welfare benefits |

| Effect on interest rates | Positive |

| Effect on private sector spending | Negative (crowding out) |

| Effect on private sector investment | Negative (crowding out) |

| Effect on efficiency | Negative |

| Effect on cost of borrowing | Positive |

| Effect on GDP | Positive |

What You'll Learn

Impact on interest rates

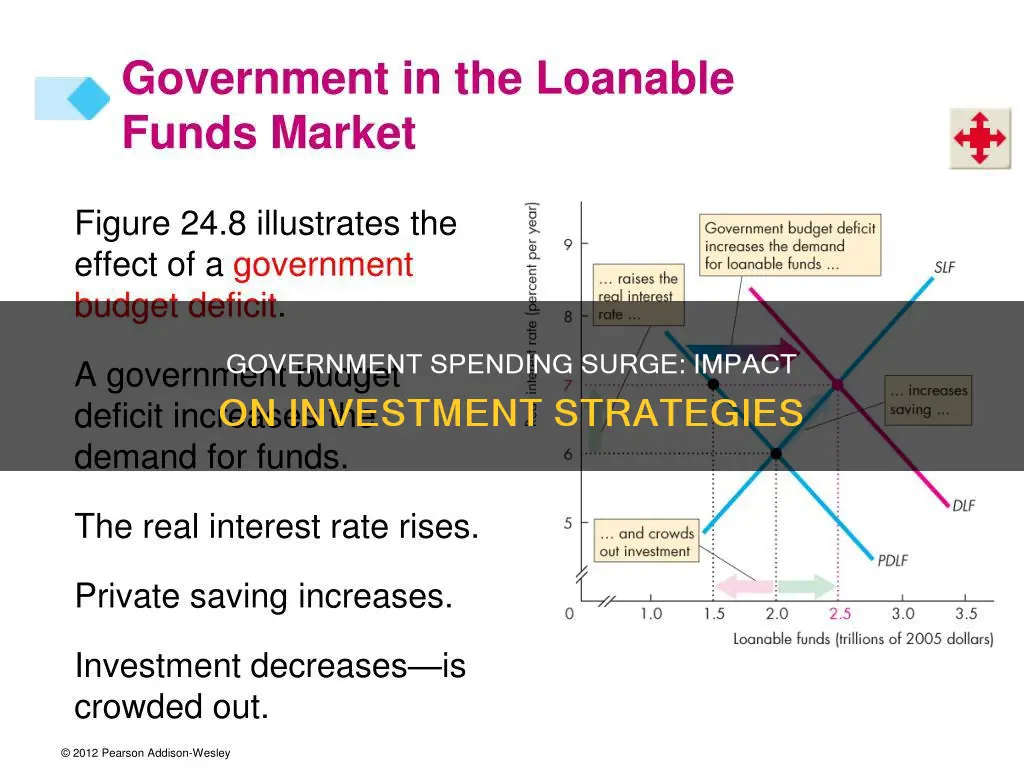

An increase in government spending will likely lead to a rise in interest rates. This is because the government needs to obtain more revenue to fund this spending, which it does through raising taxes and/or borrowing by selling Treasury securities. This can cause a rise in interest rates and borrowing costs, reducing the demand for borrowing and spending in the private sector. This is known as the crowding-out effect.

However, it is important to note that the relationship between government spending and interest rates is complex and subject to various factors. Some empirical evidence suggests that government spending can have a zero or negative effect on interest rates. For example, some studies have shown that an increase in government spending can lead to a fall in interest rates on Treasury bills and corporate bonds. This may be due to the increased income and supply of credit associated with higher government spending, which can offset the increased demand for credit.

Additionally, the impact of government spending on interest rates can depend on the specific type of spending. For instance, one study found that an increase in US Department of Defense contracts was associated with a decline in auto loan and home equity loan rates. This may be because these contracts increase expected future income and wealth, reducing the default risk for borrowers.

Furthermore, the impact of government spending on interest rates can also depend on the state of the economy. If the economy is operating below capacity, government spending may not crowd out private sector spending and could even increase demand by generating employment. On the other hand, if the economy is close to full capacity, higher government spending may lead to inflationary pressures and have a more significant crowding-out effect.

In summary, while an increase in government spending typically leads to higher interest rates due to the crowding-out effect, the relationship between government spending and interest rates is complex and subject to various factors, including the type of spending, the state of the economy, and the interaction between demand and supply of credit.

Art That Pays: Unveiling the Secrets to Smart Investing

You may want to see also

Effect on private sector spending

The effect of an increase in government spending on private sector spending depends on several factors, including the state of the economy, the type of government spending, and the way it is financed.

Crowding Out Effect

The crowding out effect is an economic theory that suggests an increase in public sector spending can reduce or even eliminate private sector spending. This occurs when the government demands more loanable funds, causing interest rates to rise, and subsequently reducing investment spending. The government obtains the necessary funds for increased spending by raising taxes or borrowing through the sale of Treasury securities. Higher taxes can result in reduced income and spending by individuals and businesses. Additionally, Treasury sales can increase interest rates and borrowing costs, further diminishing borrowing demand and spending.

Impact on Private Investment

An increase in government spending can impact private investment in two ways: crowding out and crowding in. Crowding out occurs when higher government spending leads to a fall in private sector savings and investment. This happens when private sector savers invest in government bonds, leaving fewer savings for private sector investment. Additionally, higher government borrowing tends to push up interest rates, which can reduce private investment. On the other hand, crowding in occurs when higher government spending encourages firms to invest due to increased economic growth and more profitable investment opportunities.

State of the Economy

The impact of increased government spending also depends on whether the economy is operating at or below full capacity. If the economy is close to full capacity or full employment, an increase in government spending can result in competition with the private sector for scarce resources, leading to a redistribution of production. In this scenario, the stimulus effect of increased government spending may be offset by the crowding out effect. Conversely, if the economy is below capacity with surplus resources, an increase in government spending and deficit does not result in direct competition with the private sector, and the stimulus program is likely to be more effective.

Type of Government Spending

The type of government spending also influences private sector spending. Spending on infrastructure, such as roads and railways, can boost efficiency and long-term economic growth. Similarly, investment in education and training can increase labour productivity and enable higher long-term economic growth. However, spending on welfare benefits and pensions may crowd out more productive private sector investment, although it can help reduce inequality and improve the efficiency of the labour market.

Financing of Government Spending

The way government spending is financed also plays a role in its impact on private sector spending. If government spending is financed by higher taxes, the increase in spending may be counterbalanced by tax rises, resulting in no net increase in aggregate demand. However, if the economy is in a recession, a rise in taxes may not significantly reduce spending as consumers may already have reduced their expenditure. Additionally, increased government spending may create a multiplier effect, where the unemployed gain jobs and spend more, further increasing aggregate demand.

Retirement Community Investment: A Guide to Smart Financial Planning for Your Golden Years

You may want to see also

Effect on economic growth

The impact of an increase in government spending on economic growth is a highly debated topic. While some argue that it can stimulate the economy, others suggest that it may crowd out private-sector activity and investment.

One view, supported by the concept of the "government spending multiplier", posits that government purchases cause a chain reaction of spending. For example, when the government buys goods and services, the recipients of that money will save some and spend the rest, perpetuating a cycle of spending that boosts the economy. This theory suggests that the "government spending multiplier" is greater than 1, indicating that every $1 spent by the government leads to an increase in gross domestic product (GDP) of more than $1.

On the other hand, the opposing view suggests that government spending may "crowd out" economic activity in the private sector. This can occur when government spending hires workers who could have been employed in the private sector, or when government debt leads to increased interest rates and reduced private investment. In this case, the "government spending multiplier" is less than 1, implying that a $1 increase in government spending leads to a less than $1 increase in GDP due to the negative impact on private investment.

Empirical evidence on the impact of government spending on economic growth is mixed. Some studies have found a positive correlation between government investment and GDP growth, while others have observed a negative correlation or no correlation at all. For instance, a study by Robert Barro and Charles Redlick estimated that the multiplier from government defense spending is 1.0 during high unemployment but falls below 1.0 at lower unemployment rates, with non-defense spending potentially having an even smaller multiplier effect. Another study by Valerie A. Ramey estimated a spending multiplier range of 0.6 to 1.1, indicating that government spending may even decrease economic growth due to inefficient money allocation.

The impact of government spending on economic growth also depends on where the spending is targeted. Spending on infrastructure, such as roads and railways, can boost long-term economic growth by removing supply bottlenecks and increasing efficiency. Similarly, investments in education and training can enhance labour productivity and enable higher long-term economic growth. However, spending on welfare benefits and pensions may not have a direct impact on boosting productivity, but it can help reduce inequality and improve the functioning of the labour market.

Additionally, the effects of government spending on economic growth can vary based on the state of the economy. During a recession, government spending can act as an expansionary fiscal policy, boosting economic growth by increasing aggregate demand. In contrast, when the economy is close to full capacity, higher government spending may lead to inflationary pressures with little increase in real GDP.

In conclusion, the effect of increased government spending on economic growth is complex and subject to various factors, including the type of spending, the state of the economy, and the interaction between government and private-sector activity. While government spending can potentially stimulate economic growth, it may also crowd out private investment and lead to inefficient allocation of resources. Therefore, policymakers should carefully consider the potential consequences and utilize the best available literature to make informed decisions regarding government spending initiatives.

Invest Wisely: Strategies for Success

You may want to see also

Impact on inflation

An increase in government spending can be one of the factors that lead to inflation. Inflation is defined by the Federal Reserve as an increase in prices for goods and services over time. It is usually expressed as a percentage change in a specific measure, such as the Consumer Price Index (CPI), over a period of time. Inflation can have a negative impact on investments by reducing their returns after accounting for the decreased purchasing power of a dollar.

There are two types of inflation: cost-push inflation and demand-pull inflation. Cost-push inflation occurs when the cost of production rises, which can happen due to rising prices of raw materials, intermediate goods, or labor. Demand-pull inflation, on the other hand, is caused by increases in consumer demand. While demand-pull inflation can be a sign of economic growth, it can also be harmful if it is triggered by new government policies that provide consumers with too much money, such as subsidies, easy access to credit, or transfer payments.

The impact of government spending on inflation is complex and depends on various factors. Some studies suggest that government spending has little to no effect on inflation. However, others argue that it can contribute to inflation, especially when it increases household income and consumer demand. For example, the historic government assistance provided during the COVID-19 pandemic, such as the American Rescue Plan and the CARES Act, was followed by near-historic spikes in inflation. This suggests that the injection of trillions of dollars into the economy played a significant role in the price hikes.

However, it is important to note that inflation is influenced by multiple factors, and the post-pandemic inflation spike was also attributed to supply chain disruptions, pent-up demand after the pandemic, and interruptions in the oil supply due to boycotts of Russian oil and gas. Additionally, the specific allocation of government spending can have varying effects on inflation. For instance, spending on welfare benefits and pensions may not boost productivity but can help reduce inequality. On the other hand, investment in infrastructure can lead to increased productivity and long-term economic growth.

In summary, while increased government spending can be a contributing factor to inflation, especially when it boosts consumer demand, it is not the sole determinant. The impact of government spending on inflation also depends on how the spending is financed and the state of the economy. Other factors, such as interest rates, monetary policy, supply chain issues, and fluctuations in demand, also play a significant role in influencing inflationary trends.

Retirement Planning: Navigating the Advisor Conundrum

You may want to see also

Effect on labour market

An increase in government spending can have a significant impact on the labour market, and the effects can vary depending on several factors. Firstly, it is important to consider the specific area of government spending that is increased. For instance, increased spending on infrastructure development can lead to improved productivity and long-term aggregate supply growth. On the other hand, increased spending on welfare benefits and pensions can help reduce inequality but may also crowd out more productive private sector investment. While welfare benefits can ensure a minimum income for the unemployed and prevent absolute poverty, there is a potential trade-off between higher benefits and reduced work incentives.

Secondly, the impact on the labour market can depend on how the government spending is financed. If it is financed through higher taxes, the resulting increase in tax burden on citizens may counterbalance the positive effects of higher government spending. This can lead to reduced private sector spending and investment, a phenomenon known as "crowding out." Additionally, higher taxes may lead to reduced savings in the economy, resulting in increased interest rates and decreased investment in areas such as home building and productive capacity.

Thirdly, the state of the economy also plays a crucial role in determining the effects of increased government spending on the labour market. If the economy is close to full capacity, higher government spending may contribute to inflationary pressures without a significant increase in real GDP. In contrast, if the economy is in a recession, government borrowing from the private sector can act as an expansionary fiscal policy, stimulating economic growth.

Furthermore, the efficiency of government spending is another factor to consider. Some economists argue that government spending has the potential to be more inefficient than private sector spending due to poor information, lack of incentives, and misallocation of resources. This inefficiency can lead to a less productive economy as government spending replaces private-sector spending.

Lastly, the impact of increased government spending on the labour market can be influenced by the specific economic context and the behaviour of other variables. For example, an increase in government demand can lead to higher output and hours worked but may also result in slightly lower real wages and labour productivity. Additionally, higher government spending on labour-intensive industries can affect the equilibrium in the labour market, influencing wage demands and labour market conditions.

Invest: Picking the Right Neighborhood

You may want to see also

Frequently asked questions

An increase in government spending can affect investment in a number of ways. Firstly, it can lead to a rise in aggregate demand (AD), which may result in higher growth in the short term but also potentially lead to inflation. Secondly, higher government spending can impact the supply-side of the economy, depending on where the additional spending is directed. For instance, investment in infrastructure can lead to increased productivity and long-term aggregate supply, while increased spending on welfare benefits may reduce inequality but could also crowd out more productive private sector investment. Thirdly, government spending can influence interest rates. Most macroeconomic models predict that government spending will cause interest rates to rise, which may crowd out investment. However, empirical evidence, particularly from the US, suggests that interest rates may remain unchanged or even fall temporarily following an increase in government spending. Lastly, government spending can impact investment by affecting company profits. Higher public spending can reduce company profits, leading to a reduction in private investment and economic growth.

The "crowding out" effect refers to the idea that government spending may "crowd out" or reduce economic activity in the private sector. For example, if the government hires workers who would otherwise be employed in the private sector, it can lead to a decline in private sector investment. Similarly, if the government finances its spending by issuing debt, it can lead to higher interest rates and a subsequent reduction in private investment.

Most macroeconomic models predict that an increase in government spending will lead to higher interest rates. However, empirical evidence, particularly from the US, suggests that interest rates may remain unchanged or even fall temporarily. This is because the increased demand for credit associated with higher government spending is offset by an increase in the supply of credit due to higher aggregate income.

An increase in government spending typically leads to a rise in aggregate demand (AD), which can stimulate economic growth, especially in the short term. However, if the economy is already operating at full capacity, higher government spending may not result in a significant increase in AD and could instead lead to inflationary pressures.

Government spending can affect productivity and long-term economic growth, depending on where the additional spending is directed. For example, investment in infrastructure, education, and research and development can boost productivity and support long-term economic growth. On the other hand, spending on welfare benefits and pensions may not have a direct impact on boosting productivity but can help reduce inequality.