The UK's decision to leave the EU in 2016 has had a significant impact on investment in the country. Brexit has reduced the UK's trade openness, foreign direct investment inflows, and immigration growth. New border frictions and higher transport costs have created barriers to trade, and foreign direct investment inflows are unlikely to return to pre-Brexit levels. The UK's withdrawal from the EU has also led to a decrease in productivity and investment by UK firms. Reports indicate that foreign investment in the UK is expected to decrease by 37% post-Brexit. The loss of access to the EU Single Market and Customs Union, as well as the resulting regulatory divergence, have made it harder for companies to invest across borders. Overall, the uncertainty created by Brexit is likely to have an unfavourable impact on the foreign direct investment landscape in the UK.

| Characteristics | Values |

|---|---|

| Foreign investment | Anticipated to decrease by 37% |

| Foreign investment in financial services | Likely to be impacted due to limited mention in the Trade and Cooperation Agreement (TCA) |

| Trade | Slower recovery from the pandemic shock compared to other European countries |

| Trade | More than 6% below its Q1 2017 level |

| Foreign direct investment (FDI) | Unlikely to return to levels reached in the 1990s and 2000s |

| FDI inflows as a share of GDP | Plummeted to its lowest level since the 1980s |

| Immigration | No longer one of the most open economies to immigrants |

| Immigration | Net outflow of EU-born residents since 2018 |

| Immigration | No compensatory increase in non-EU immigration |

| Workforce | Reduced size and diversity |

| Productivity | Decreased by about 2% to 5% |

What You'll Learn

Foreign direct investment (FDI) inflows

In 2018, the net value of FDI into the UK was £49.3 billion, a sharp decline from £80.6 billion in 2017. This decrease in FDI inflows can be partly attributed to a fall in investment from the EU, which went from £24 billion in 2017 to a net disinvestment of -£12 billion in 2018. This means that in 2018, the value of inward investments withdrawn from the UK by EU companies exceeded the value of new investments from EU companies.

The UK's FDI inflows as a share of GDP have also seen a notable drop since Brexit. In 2016, the value of the UK's inward FDI was 10% of GDP, but this fell to 4% in 2017 and 2% in 2018. The average over the last decade has been 3%.

Brexit has also impacted the UK's position in global FDI rankings. In 2018, the UK accounted for 5% of world inward FDI flows, down from 7% in 2017 and 10% in 2016. The UK's ranking among world recipients of inward FDI flows has fluctuated, dropping from second in 2016 to seventh in 2018.

The effects of Brexit on FDI inflows are complex and multifaceted. On the one hand, the UK continues to attract FDI due to factors such as its stable legal system and educated workforce. On the other hand, the fall in the value of the pound following Brexit has made it easier for foreign companies to acquire UK companies at a lower cost.

Overall, Brexit has had a noticeable impact on FDI inflows into the UK, with a decline in both the value and share of FDI inflows. The UK's position in global FDI rankings has also been affected, with the country dropping several places since the referendum. The long-term effects of this reduction in FDI inflows remain to be seen but could potentially damage the UK economy by limiting competition for domestic firms and hindering innovation.

Retirement Savings: Navigating the Investment Maze

You may want to see also

Trade and investment

Brexit has negatively impacted the UK's trade and investment performance. The reintroduction of significant barriers to trade with the EU, the UK's largest trading partner, has resulted in a decline in overall trade volumes, particularly in goods imports and exports. The UK's 'trade intensity' (trade as a proportion of GDP) has decreased significantly, underperforming other advanced economies.

Brexit-related factors, such as additional paperwork and the UK being a relatively small market for individual EU exporters, have likely contributed to the reduction in trade with the EU. Furthermore, global supply bottlenecks and changes in reporting trade flows may also have played a role.

The impact on services trade is less clear, with the pandemic influencing sectors like travel and transport. However, there is evidence that the UK's strong position in high-value sectors like consultancy, where remote service delivery has been normalised due to the pandemic, has helped maintain services trade.

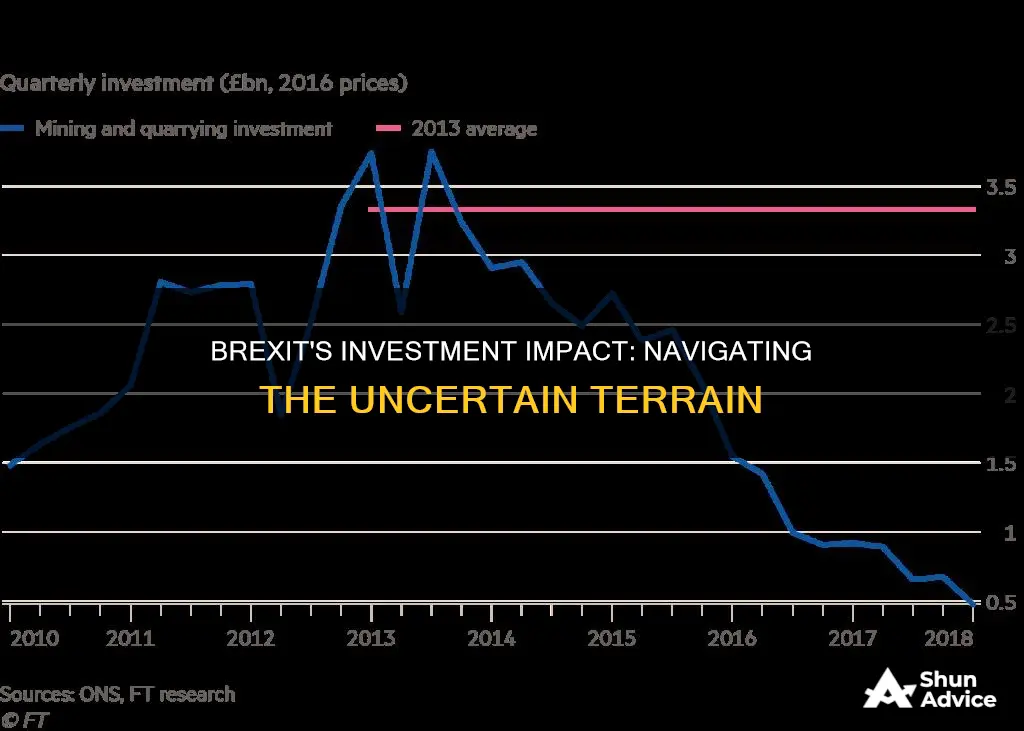

The uncertainty surrounding Brexit has also negatively affected investment in the UK. According to a 2018 analysis by Stanford University and Nottingham University economists, uncertainty around Brexit reduced investment by businesses by approximately 6 percentage points. The anticipation of Brexit has gradually reduced investment by about 11% over three years since the referendum, according to Nicholas Bloom et al. The UK has experienced a decline in foreign direct investment (FDI) inflows, with average FDI inflows as a share of GDP plummeting to their lowest level since the 1980s between 2017 and 2020.

The UK's attractiveness as a destination for FDI has been impacted by Brexit, as companies may no longer view the country as a gateway to other EU markets. However, there are differing views on the long-term economic prospects, with some experts arguing that the UK's economy will remain robust and attractive for FDI.

Overall, the impact of Brexit on trade and investment has been negative, with a reduction in trade intensity and investment levels, contributing to a decline in the UK's economic performance.

Investing in People: Avoid the Wrong Ones

You may want to see also

Financial services

The UK's departure from the EU has impacted the financial services industry in several ways. Firstly, the loss of passporting rights has made it more difficult for UK-based financial institutions to sell their products and services in the EU without obtaining additional licenses and regulatory approvals. This has led to an exodus of financial firms from the UK, with an estimated 7,000 jobs moving from the UK to the EU. The relocation of companies has also resulted in a brain drain of talent, affecting the competitiveness of the UK's financial sector.

Secondly, regulatory uncertainty following Brexit has created challenges for UK financial institutions. The UK will need to renegotiate and replicate decades' worth of EU regulations and trade deals, a process that will take significant time and resources. There is also uncertainty about whether new UK financial regulations will be beneficial to the sector.

Thirdly, Brexit has disrupted the UK's trade relationships with the EU and non-EU countries. The UK's ability to conduct financial services trade with non-EU countries through deals with the EU has been impacted, and the country now faces the challenge of negotiating new trade agreements independently. While the UK has pursued new trade deals, there are concerns about their effectiveness in strengthening the country's trading position internationally.

Despite these challenges, the UK's financial services sector has proven resilient. The sector remains a vital driver of the UK economy, and London continues to be a hotspot for fintech innovation. Additionally, new trade agreements and policies aimed at recruiting top talent indicate a potentially brighter outlook for the industry. However, it is difficult to determine if the financial services industry would have been stronger had the UK remained in the EU.

Retirement Redefined: Exploring the Post-Banking Lives of Investment Veterans

You may want to see also

Regulatory divergence

Brexit has resulted in regulatory divergence between the UK and the EU, with the UK now having the freedom to change its rules and regulations independently of the EU. This has created uncertainty for businesses, particularly those with strong links to the EU, and has impacted investment decisions.

The UK's regulatory divergence from the EU has taken several forms, including active divergence, where the UK changes its rules, passive divergence, where the EU changes its rules and the UK does not follow, and delayed divergence, where either side postpones an upcoming case of divergence. This divergence has affected a range of sectors, including financial services, transportation, and digital assets.

The impact of regulatory divergence on investment is complex. On the one hand, it may create opportunities for the UK to develop more favourable regulations for businesses, potentially attracting investment. On the other hand, it may also increase costs and complexities for businesses operating in both the UK and EU markets, leading to reduced investment.

The UK's decision to leave the EU has generated uncertainty for businesses, which has impacted their investment decisions. This uncertainty is particularly high for firms with strong links to the EU, as they face the challenge of navigating two sets of regulations and the potential for further divergence in the future. As a result, some companies may choose to reduce their investment in the UK or focus their investments on other markets with more stable and predictable regulatory environments.

Overall, while regulatory divergence may create some opportunities for the UK to attract investment, it is also likely to increase costs and complexities for businesses, particularly those with strong links to the EU. This could lead to reduced investment in the UK and a negative impact on the country's economy. The full effects of regulatory divergence remain to be seen and will depend on the UK government's future regulatory decisions and the ongoing relationship between the UK and the EU.

Investing in Your Future: Exploring the Dividends of OpenStudy

You may want to see also

MNCs' export platform attractiveness

MNCs Export Platform Attractiveness

One of the key considerations for MNCs when assessing the attractiveness of a market is the ease of access to regional markets, especially within the EU. Pre-Brexit, the UK offered a convenient gateway to the EU single market, with its free movement of goods, services, capital, and people. This made the UK an ideal location for MNCs to establish their European headquarters and use it as a launchpad for serving the wider European market.

However, post-Brexit, the situation has changed significantly. The UK is no longer part of the EU single market or customs union, and this has important implications for MNCs. Tariffs and non-tariff barriers to trade have been introduced, adding costs and complexity to doing business. The free movement of people has ended, impacting the ability to hire and transfer talent across borders.

Despite these challenges, the UK still offers a number of advantages that could enhance its attractiveness as an export platform for MNCs. For one, the UK has a large and sophisticated services sector, particularly in areas such as finance, legal, and consulting, which are important enablers for businesses. English is the primary language, and the country has a strong rule of law and transparent business environment, all of which reduce operational risks.

In addition, the UK government has been actively pursuing trade deals with other countries, both individually and through agreements with blocs like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). These new trade deals could open up preferential access to markets beyond the EU, which may be particularly attractive to MNCs with a global footprint.

The impact of Brexit on MNCs' export platform attractiveness is nuanced and depends on a variety of factors, including the industry, the specific business model, and the importance of the EU market to the company. Some MNCs may decide to diversify their operations and establish a presence in multiple European countries to mitigate risks and take advantage of opportunities in different markets. Ultimately, each company will need to carefully assess the impact of Brexit on their specific business and make strategic decisions accordingly.

Overall, while Brexit has introduced challenges for MNCs considering the UK as an export platform, it has not diminished the country's attractiveness entirely. The UK still offers a number of advantages that could make it a compelling location for MNCs, especially those looking to access markets beyond the EU or take advantage of the country's strong services sector and business-friendly environment.

Smart Ways to Invest $200 Today

You may want to see also

Frequently asked questions

Brexit is expected to reduce foreign investment in the UK by 37%. This is due to the UK becoming a distinct market from the EU, making it a less attractive export platform for multinational companies.

Brexit has gradually reduced investment by about 11% and decreased productivity by about 2% to 5% in the three years since the referendum.

The financial services industry, one of the largest recipients of foreign direct investment in the UK, is expected to be impacted by Brexit due to restrictions on 'single passport' privileges and limited access rights for UK market participants.

Brexit has reduced the UK's trade openness, with new border frictions and higher transport costs posing new barriers to trade.

The effects of reduced trade openness, a less diverse workforce, and lower foreign direct investment (FDI) inflows could do lasting damage to the UK economy, hindering innovation and productivity growth.