The Eurozone's financial landscape is influenced by a variety of factors, including interest rates, inflation, labour markets, consumer spending, and investment activity. The Euro, introduced in 1999, was designed to promote growth, stability, and economic integration within Europe. While it has its advantages, such as encouraging investment and promoting trade, it has also faced challenges, including rigid monetary policies and accusations of bias. The impact of the Euro on financial investment is complex and multifaceted, and it continues to evolve as the European economy navigates various economic cycles and geopolitical tensions.

What You'll Learn

The impact of interest rates on savings and financial stability

Interest rates play a pivotal role in shaping the financial landscape, influencing both savings behaviour and the stability of the financial system.

Impact on Savings

The relationship between interest rates and savings is twofold. Firstly, higher interest rates make saving more attractive as individuals are incentivised by the prospect of earning higher returns on their deposits. This is particularly true for traditional savings products, such as overnight and fixed-term deposits, which have witnessed a surge in popularity during periods of elevated interest rates.

Secondly, higher interest rates increase the cost of borrowing, making it more expensive to purchase goods and services. This, in turn, can lead to reduced consumer spending and an increase in savings. Therefore, the impact of interest rates on savings is influenced by the balance between the appeal of higher returns and the increased cost of borrowing.

Impact on Financial Stability

Interest rates can have a significant impact on financial stability, affecting various sectors of the economy. Here are some key ways in which interest rates influence financial stability:

- Debt Servicing and Refinancing: Higher interest rates increase debt-servicing costs for households and businesses, making it more challenging for borrowers to manage their debt obligations. This could lead to an increased risk of default or sharp cuts in spending, amplifying macroeconomic downturns.

- Market Value of Financial Assets: Higher interest rates can result in reductions in the market value of some financial assets. If these exposures are not managed prudently, it can create risks for investors and financial institutions.

- Liquidity Risks: The use of derivatives or leveraged products can lead to liquidity risks if users cannot meet higher margin and collateral calls. This could result in the fire sale of assets and tighter credit conditions for households and businesses.

- Banking Sector Profitability: Banks' profitability is influenced by interest rates. Higher rates can increase net interest margins, benefiting banks. However, higher rates can also increase the risk of loan defaults, impacting banks' credit losses.

- Non-Bank Financial Institutions (NBFIs): NBFIs, such as insurers and pension funds, can be affected by interest rate changes. While some NBFIs are well-hedged against interest rate risk, others may face challenges, especially if they have significant derivative or repo exposures.

- Economic Activity: Interest rates can impact economic activity by influencing spending and investment decisions. Higher interest rates can reduce demand and make it less attractive to borrow, while lower rates can stimulate borrowing and investment.

In conclusion, interest rates have a significant impact on both savings behaviour and financial stability. They influence individuals' decisions to save or spend, as well as the stability and profitability of financial institutions. The complex interplay of these factors shapes the overall financial landscape.

Robinhood: Where to Invest Today

You may want to see also

The role of the European Central Bank in determining interest rates

The European Central Bank (ECB) is the central bank responsible for the monetary policy of the European Union (EU) member countries that have adopted the euro currency. This currency union is known as the Eurozone and currently includes 19 countries. The ECB's primary objective is price stability in the Eurozone, targeting 2% inflation over the medium term as a buffer against the risk of destabilising deflation.

The ECB Governing Council makes monetary policy for the Eurozone and the EU, and it is this council that determines interest rates. The council consists of six executive board members and a rotation of 15 national central bank governors. The council sets three interest rates: the interest rate on the main refinancing operations, the rate on the deposit facility, and the rate on the marginal lending facility.

The interest rate on the main refinancing operations is the rate at which commercial banks can borrow funds from the ECB against collateral on a weekly basis. The rate on the deposit facility is the rate at which banks can make overnight deposits at a pre-set rate lower than the main refinancing operations rate. Finally, the rate on the marginal lending facility is the rate at which banks can access overnight credit at a pre-set interest rate above the main refinancing operations rate.

The ECB adjusts these three main interest rates to pursue its mandate of maintaining price stability. Typically, a lower key interest rate can boost economic activity, while a higher rate is used to slow down the economy in a situation of generalised price increases. The ECB's interest rate adjustments can have a ripple effect, influencing the rates that commercial banks offer to their customers.

The ECB's interest rate decisions are based on its assessment of the inflation outlook in light of incoming economic and financial data, the dynamics of underlying inflation, and the strength of monetary policy transmission. The ECB is committed to ensuring that inflation returns to its 2% medium-term target in a timely manner and will keep policy rates sufficiently restrictive for as long as necessary to achieve this aim.

Salem's Investment: Town Secrets

You may want to see also

How inflation affects the Eurozone's financial investment

Inflation has had a significant impact on the Eurozone's financial investment landscape, affecting both households and businesses. Here are some key ways in which inflation has influenced the Eurozone's financial investment:

- Household Spending and Private Investment: High inflation rates across the Eurozone have weighed on household spending. As prices rise, consumers may become more cautious about their purchases, choosing to save more and consume less. This shift in behaviour can lead to a cooling of aggregate demand, which can impact businesses and influence their investment decisions.

- Interest Rates and Monetary Policy: The European Central Bank (ECB) has responded to inflation by adjusting monetary policy and interest rates. The ECB raised interest rates to combat inflation, with a cumulative increase of 400 basis points since July 2023, representing the fastest tightening on record. These higher interest rates impact borrowing costs for both households and businesses, potentially affecting their investment decisions and spending behaviour.

- Investment Portfolio Returns: Inflation can influence the returns on investment portfolios. During periods of high inflation, the real value of investments may be eroded, especially for assets with fixed returns, such as bonds. This can prompt investors to adjust their portfolios, seeking investments that offer better inflation protection, such as equities or real assets.

- Country-Specific Differences: Inflation rates within the Eurozone vary between countries due to specific events, trade patterns, consumption patterns, and financial systems. This variation can lead to differing investment opportunities and strategies within the Eurozone, as investors consider the unique economic conditions of each country.

- Supply Chain Disruptions: The factors contributing to inflation, such as supply chain issues and energy cost increases, can impact businesses' investment decisions. Companies may invest in supply chain resilience, seek alternative suppliers, or explore ways to improve energy efficiency to mitigate the impact of these disruptions on their operations and financial performance.

- Labour Market Dynamics: Inflation and wage growth are interconnected. As inflation rises, workers may push for higher wages to maintain their purchasing power. This can impact labour-intensive industries, particularly in the services sector, and influence businesses' investment decisions regarding expansion, hiring, and operational costs.

Penny Stocks: Why the Risk?

You may want to see also

The effect of monetary policy on investment funds

Monetary policy is a strategy employed by central banks to monitor and adjust the money circulating in an economy to achieve long-term economic growth and stability. It involves various tools such as interest rate revisions, open market operations, and changes to bank reserve requirements. The impact of monetary policy on investment funds can be understood through its effects on different asset classes.

Effect on Equities and Stocks

During periods of economic slowdown or recession, central banks typically adopt an expansionary monetary policy to stimulate the economy. This involves lowering interest rates, which makes saving less attractive, leading to increased consumer spending and business investment. As a result, stock prices and equities tend to rally, benefiting investment funds focused on these asset classes.

Effect on Bonds

Expansionary monetary policies generally lead to lower bond yields, and their inverse relationship with bond prices results in significant price gains for most fixed-income instruments. However, during contractionary monetary policies, higher interest rates negatively impact bonds as investors demand higher yields, leading to lower bond prices.

Effect on Real Estate

Real estate investments tend to perform well during periods of low-interest rates, as homeowners and investors take advantage of the reduced cost of borrowing. On the other hand, an increase in interest rates leads to higher mortgage costs, causing a decline in demand among homeowners and real estate investors.

Effect on Currencies

Monetary policy can influence the exchange rates between domestic and foreign currencies. An increase in the money supply through expansionary policies can make the domestic currency relatively cheaper compared to foreign currencies. The impact on currencies also depends on the economic outlook and the extent of monetary stimulus.

Interest Rate Risk

Investors need to consider the impact of interest rate changes on their investment portfolios. During periods of low-interest rates, investors can lock in higher rates on term deposits and savings instruments. However, when interest rates are trending lower, there is a risk of generating negative real returns if the portfolio's rate of return falls below the inflation rate.

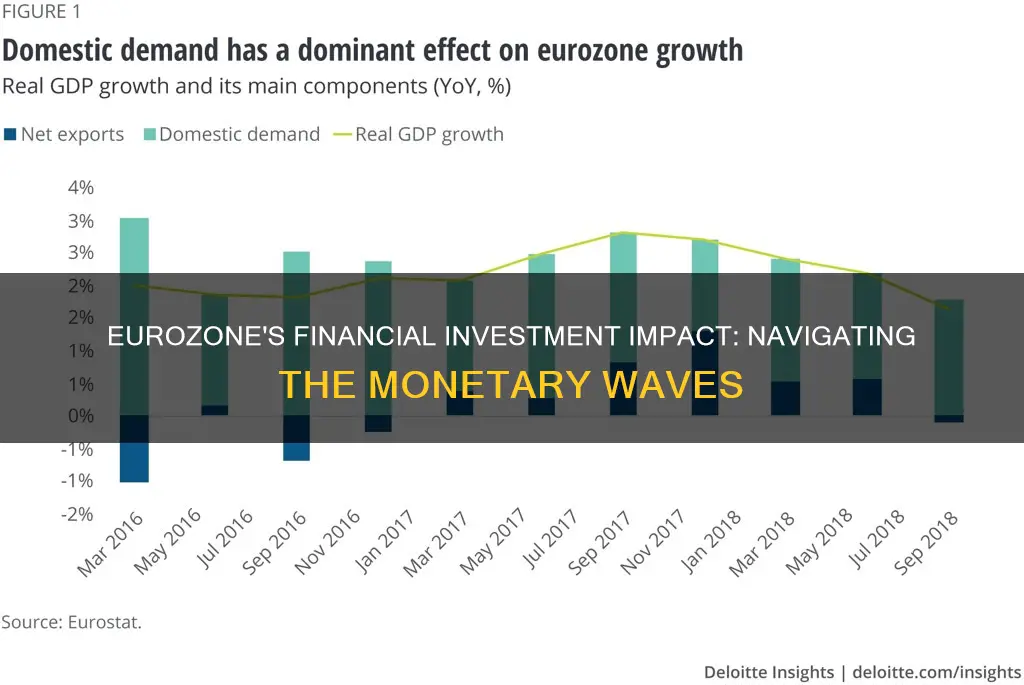

Impact of Eurozone Monetary Policy

The Eurozone's monetary policy, governed by the European Central Bank (ECB), has had significant effects on investment funds. The introduction of the euro encouraged cross-border investments within the eurozone by eliminating foreign exchange risks. However, the eurozone's single monetary policy may not always align with local economic conditions, leading to challenges in addressing inflation and unemployment in specific member states.

In recent years, the ECB has maintained a negative deposit rate and implemented bond-buying programs to support the economy during the pandemic. These policies have influenced the investment landscape, impacting areas such as green industries, tech sectors, and traditional savings products.

Glint Pay: Investing in a Golden Future

You may want to see also

The influence of exchange rates on financial investment

Exchange rates are among the most closely watched and analysed economic indicators, as they play a critical role in a nation's level of trade and the real return on an investor's portfolio. They are also subject to government manipulation. Exchange rates impact the prices of imported goods, including domestic products that rely on imported parts and raw materials. They also influence investment performance, interest rates, inflation, the job market, and the real estate sector.

A weak domestic currency makes imports more expensive and a country's exports more competitive on the global market. Conversely, a strong domestic currency may reduce the prices of foreign goods to some extent. For example, a strong US dollar makes American goods pricier abroad, which may lead foreign consumers to opt for cheaper local alternatives.

A higher-valued currency can be expected to damage a country's balance of trade, while a lower exchange rate can improve it. A country with a low inflation rate and stable political and economic conditions usually experiences a higher currency value.

Differentials in interest rates also impact exchange rates. Higher interest rates tend to attract foreign investment and increase the value of the home country's currency. Conversely, lower interest rates tend to decrease the currency's relative value.

The Euro, introduced in 1999, was designed to promote growth, stability, and economic integration in Europe. It has encouraged investment within the Eurozone by eliminating foreign exchange risk for investors. The Euro has also made it easier for European businesses to lock in the best prices from suppliers in other Eurozone countries, increasing competition between firms.

However, one of the drawbacks of the Euro is a single monetary policy that may not fit the local economic conditions of all member states. This has led to rigid monetary policies that do not address the specific needs of individual countries.

Mortgage Lenders: Your Investment Papers, Please!

You may want to see also

Frequently asked questions

The Eurozone refers to the economic region of countries within the European Union that have adopted the euro as their official currency. It was introduced to promote growth, stability, and economic integration in Europe.

The euro has both advantages and disadvantages for financial investment. On the positive side, it encourages investment by eliminating currency risks, making it easier for European businesses to lock in the best prices from suppliers in other eurozone countries, increasing competition, and allowing labour and goods to flow more easily across borders. However, the euro has also been criticised for its rigid monetary policy, which does not always fit the local economic conditions of individual countries, and there have been concerns about possible bias in favour of Germany, the largest economy in the eurozone.

The European Central Bank (ECB) controls interest rates in the Eurozone. In 2023, the Eurozone witnessed its fastest interest rate hiking cycle in history, with interest rates on deposit facilities reaching a peak of 4.00%. These hikes were implemented to combat inflation, which has surged globally in the aftermath of the pandemic. As a result, savers have benefited from higher interest rates on traditional savings products, but consumers have faced increased financial strain due to higher mortgage rates and loan interest.

The performance of stock markets in the Eurozone has lagged behind the US in recent years, and the region has been perceived as less dynamic compared to the US and East Asia due to its ageing population and slower economic growth. However, there are still investment opportunities in the Eurozone, particularly in sectors such as green industries, technology, and luxury goods. The recent shift towards a more integrated and stable financial system in the Eurozone may also have a positive impact on stock market investments.

The Eurozone has seen stable foreign direct investment (FDI) flows for decades, but there was a period of exceptionally large positive flows from about 2015, followed by high volatility and a strong retrenchment phase. The presence of multinational enterprises (MNEs) in Eurozone financial centres has contributed to the complexity of FDI flows. While FDI data remains insufficient to fully trace the ultimate investor countries and host economies, efforts are being made to improve the transparency and accuracy of FDI statistics.