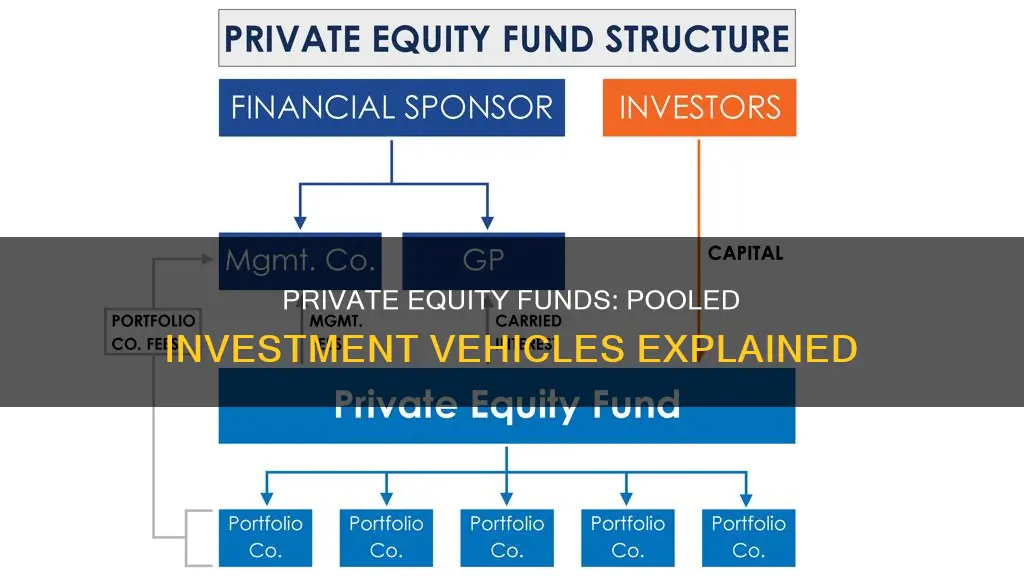

A private equity fund is a type of private fund that is managed by a private equity firm, which may be required to register with the SEC as an investment advisor. Private equity funds are a type of pooled investment vehicle, where the adviser pools together the money invested in the fund by all investors and uses that money to make investments on behalf of the fund. The fund manager charges a fee for this service. Private equity funds are not registered with the SEC and are therefore not subject to regular public disclosure requirements.

What You'll Learn

Private equity funds are a type of pooled investment vehicle

Private equity funds are managed by private equity firms, which may be required to register with the SEC as investment advisers. Private equity funds pursue a variety of investment strategies, such as buyout, growth equity, and venture capital.

A typical investment strategy undertaken by private equity funds is to take a controlling interest in a portfolio company and actively engage in the management and direction of the business to increase its value. Other private equity funds may specialize in making minority investments in fast-growing companies or startups.

Private equity funds are not registered with the SEC and are therefore not subject to regular public disclosure requirements. They are considered private investment vehicles, which are not available to the general public. Investors in private equity funds must meet certain income or net worth thresholds to participate in the investment offering.

Private equity funds are often open only to accredited investors and qualified clients, including institutional investors such as insurance companies, university endowments, and pension funds, as well as high-income and high-net-worth individuals. The initial investment amount for a private equity investment is typically very high.

Investing in a private equity fund can provide benefits such as increased negotiating power, professional management, and diversification. However, there are also management fees associated with private equity funds, which can eat into the returns.

Overall, private equity funds offer a unique opportunity for qualified investors to access a broader range of investments and pursue various investment strategies under the management of private equity firms.

Invesco Funds: A Guide to Getting Started with Investing

You may want to see also

Pooled investment vehicles are created and led by sponsors

In return for their services, investors are required to pay the fund manager a management fee, usually charged as a percentage of the pooled investment vehicle's gross asset value. While these fees can eat into the returns, they are generally worth it for the expertise and time offered by the portfolio managers.

Pooled investment vehicles offer several advantages to investors. Firstly, they increase the range of investment opportunities available as larger investment funds have better negotiating power when purchasing assets due to reduced competition. Secondly, pooled investment vehicles enable investors to gain access to a broader range of investments than they would as individual investors. This allows for greater diversification across various industries, businesses, geographies, and asset classes. Lastly, investing in a pooled investment vehicle can save individuals a lot of time as the tedious process of conducting thorough due diligence on investment opportunities falls on the investment manager of the fund.

Some examples of pooled investment vehicles include mutual funds, exchange-traded funds (ETFs), and real estate investment trusts (REITs). Mutual funds, for instance, can be actively or passively managed. Actively managed mutual funds involve portfolio managers taking a hands-on approach and attempting to outperform the market, while passively managed funds aim to replicate the performance of a particular index.

Global Funds: Where Are They Invested?

You may want to see also

Private equity funds are not registered with the SEC

Private equity funds are a type of pooled investment vehicle. They are funds that are created to pool money from multiple investors, who are often referred to as limited partners. Each investor makes an investment in the fund by purchasing an interest in the fund entity, and the adviser uses that money to make investments on behalf of the fund.

To avoid registering as an investment company, private equity funds must meet certain criteria outlined in the Investment Company Act. There are two main exclusions that private equity funds can qualify for:

- 3(c)(1) Fund: This exclusion applies if the fund has no more than 100 beneficial owners (or 250 beneficial owners in the case of a qualifying venture capital fund) and meets other criteria outlined in Section 3(c)(1) of the Investment Company Act.

- 3(c)(7) Fund: This exclusion applies if the fund is limited to investors who are qualified purchasers and meets the criteria outlined in Section 3(c)(7) of the Investment Company Act.

In addition to these exclusions, private equity funds are also exempt from registering their offerings with the SEC under the Securities Act of 1933. This is because private equity funds rely on exemptions such as Rule 506(b) or Rule 506(c) of Regulation D, which allow them to sell their interests to investors without registering with the SEC.

While private equity funds are not required to register with the SEC, their advisers may be subject to registration requirements under the Investment Advisers Act of 1940. Private fund advisers are generally considered investment advisers and must register with the SEC unless they fit within an exemption. Some common exemptions for private fund advisers include the private fund adviser exemption and the venture capital fund adviser exemption.

Overall, while private equity funds are not registered with the SEC, they are still subject to certain federal securities laws and regulations, and their advisers may be required to register depending on their specific circumstances.

A Beginner's Guide to REIT Funds in India

You may want to see also

Private equity funds are advised by an adviser

Private equity funds are a type of pooled investment vehicle. They are advised by an adviser, or private equity firm, which pools together the money invested by all investors in the fund. The adviser then uses this money to make investments on behalf of the fund.

The adviser of a private equity fund is typically a private equity firm. This firm acts as a manager, making investment decisions on behalf of the fund. Private equity funds are not registered with the SEC and are therefore not subject to regular public disclosure requirements. However, if the adviser is registered with the SEC, information about them is available to the public.

Private equity funds are typically only open to accredited investors and qualified clients, including institutional investors such as insurance companies, university endowments, and pension funds, as well as high-income and high-net-worth individuals. The initial investment amount for a private equity investment is often very high.

Private equity funds usually focus on long-term investment opportunities in assets that take time to sell, with an investment time horizon of 10 or more years. This long-term investment horizon means that an investment in a private equity fund is often illiquid, and investors may need to hold their investment for several years before seeing any returns.

Advisers may manage multiple funds that are jointly invested in multiple portfolio companies. In this case, the adviser has a legal obligation to act in the best interests of each of the funds it manages and must allocate expenses accordingly.

As with any investment, there are certain risks associated with private equity funds. For example, private equity firms may have interests that conflict with the funds they manage and, by extension, the investors in those funds. Advisers must make a full disclosure of all conflicts of interest and obtain informed consent from investors.

Best Debt Funds to Invest in Amid Rising Rates

You may want to see also

Private equity funds are open only to accredited investors

Private equity funds are a type of pooled investment vehicle. They are typically open only to accredited investors and qualified clients. These include institutional investors, such as insurance companies, university endowments, and pension funds, as well as high-income and high-net-worth individuals.

Accredited investors are those who meet certain standards outlined in Rule 501(a) of Regulation D. For example, individuals may qualify by having an annual income exceeding $200,000 (single) or $300,000 (with a spouse or spousal equivalent) in each of the two most recent years. Another criterion is having a net worth of over $1 million, excluding the primary residence, whether single or with a spouse or spousal equivalent. Certain financial professional credentials can also be a qualifying factor.

Accredited investors are allowed to invest in businesses conducting common types of exempt offerings. Qualifying as an accredited investor determines whether an investor can gain access to private equity funds.

Private equity funds are managed by private equity firms, which may be required to register with the SEC as investment advisers. However, the funds themselves are not registered with the SEC and are therefore not subject to regular public disclosure requirements.

Private equity funds are characterised by their long-term investment horizon, which is typically 10 or more years. This means that investments are often illiquid, and investors may need to hold their investments for several years before realising any returns.

Private equity funds usually focus on long-term investment opportunities in assets that take time to sell. A common investment strategy is to take a controlling interest in an operating company or business and actively manage and direct the company to increase its value.

Private equity funds are also associated with high initial investment amounts. Even if an investor is not directly invested in a private equity fund, they may be indirectly invested through participation in a pension plan or ownership of an insurance policy.

Diversified Investment: Mutual Fund Strategy for Beginners

You may want to see also

Frequently asked questions

A pooled investment vehicle is an entity where money from multiple investors is pooled together to buy shares or units of an investment product/company. Each investor makes an investment in the fund and the adviser uses that money to make investments on behalf of the fund.

Examples of pooled investment vehicles include mutual funds, exchange-traded funds (ETFs), pension funds, and hedge funds.

A private equity fund is a type of private fund that is managed by a private equity firm, which may be registered with the SEC as an investment adviser. Private equity funds typically focus on long-term investment opportunities with an investment time horizon of 10 or more years.

Yes, a private equity fund is a type of pooled investment vehicle. Private equity funds pool money from investors and use it to make investments in operating companies or businesses, often taking a controlling interest.

Pooled investment vehicles offer several advantages such as negotiating power, professional management, and diversification of investments. Additionally, larger investment funds have better negotiating power when purchasing assets.